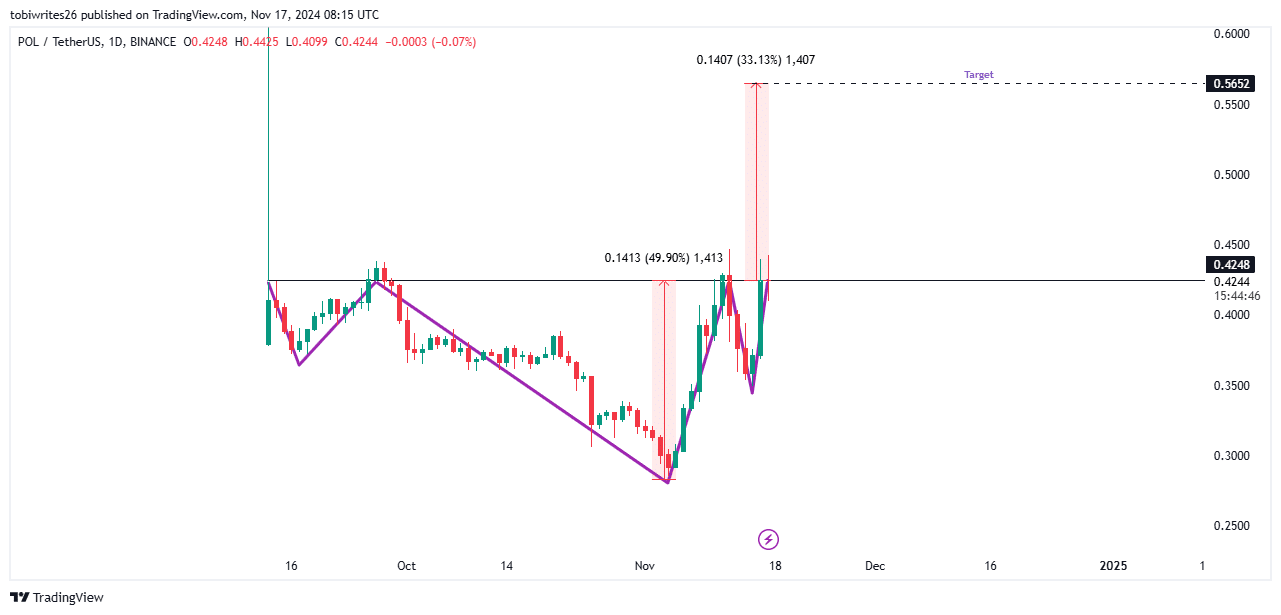

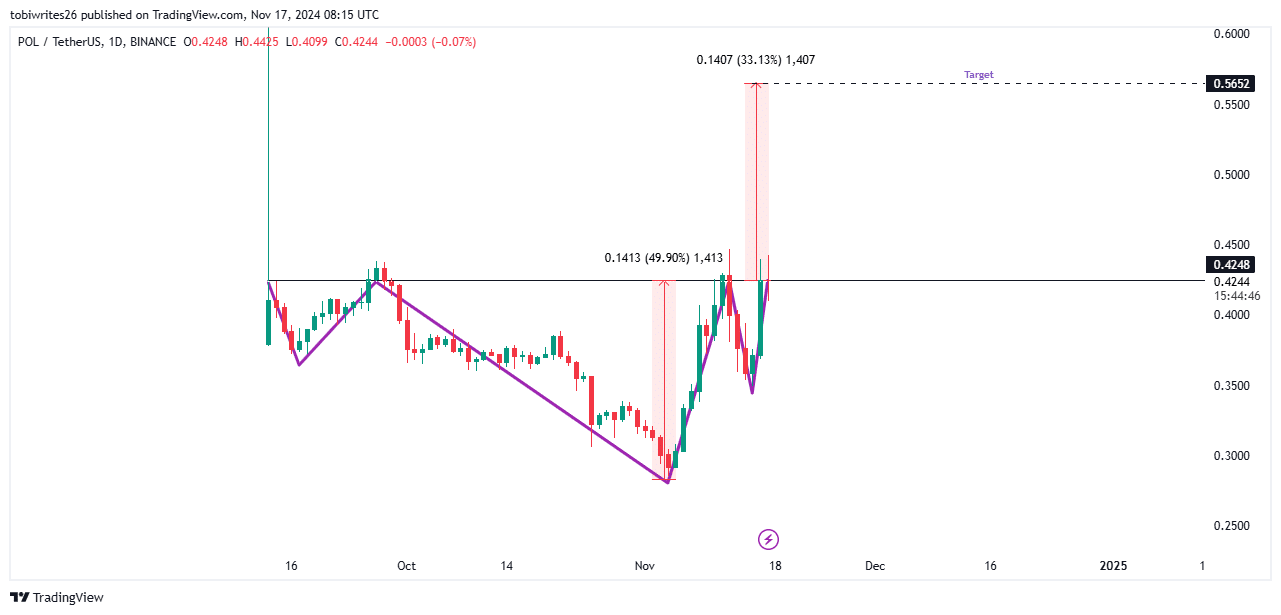

- POL has formed a classic inverse head-and-shoulders pattern.

- This bullish outlook is supported by multiple on-chain metrics and technical indicators.

Polygon’s [POL] performance has been impressive. On the monthly timeframe, it has surged 13.93%, while daily gains stood at 5.41%.

If the bullish setup materializes as expected, these gains could extend significantly, bringing POL closer to the $5.6 target.

33% gain with head and shoulders pattern

POL is well-positioned for a potential 33% gain, as the formation of a head-and-shoulders pattern suggested an impending upward movement. This pattern has historically acted as a significant catalyst for price rallies.

For the bullish scenario to materialize, POL must first breach the neckline (resistance level) at 0.4282 and trade above it. Once this key level is surpassed, the asset is likely to continue its ascent.

Source: TradingView

With a successful breakout, POL could target $0.5652, representing a potential 33.13% gain. At this level, price revaluation will occur, which could either lead to further upward momentum or a potential pullback.

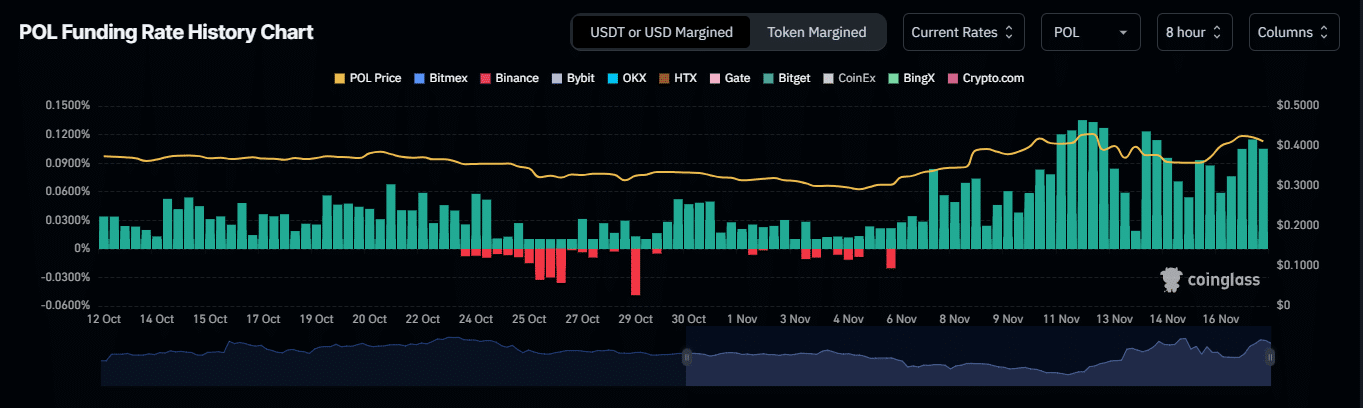

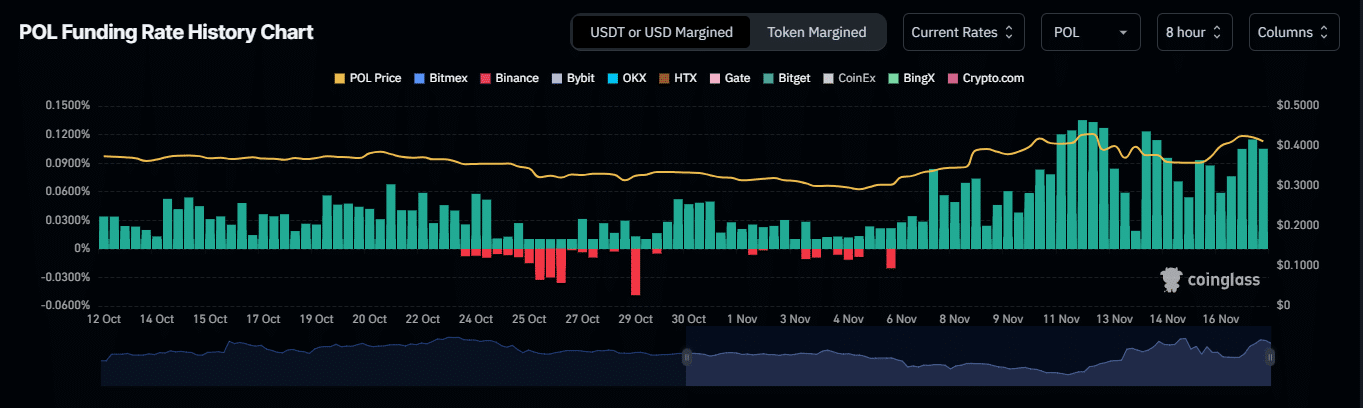

Bullish sentiment for POL

As of writing, the positive Funding Rate of POL showed strong buying activity and pointed to an impending rally. According to Coinglass, the press time Funding Rate was 0.0205%.

The Funding Rate measures the cost of maintaining a balance between an asset’s spot and Futures prices. In this case, the fact that longs are paying shorts indicates that the market sentiment is bullish.

Source: Coinglass

Additionally, Open Interest has risen by 7.30%, reaching $96.62 million, signaling that the market is leaning towards the bulls, as they hold the majority of unsettled contracts.

Market volume has surged by 98.12%, reaching $606.64 million, further reinforcing the bullish trend. With the price of POL trending upwards, these on-chain metrics suggest a positive outlook for the asset.

Strong bullish sentiment

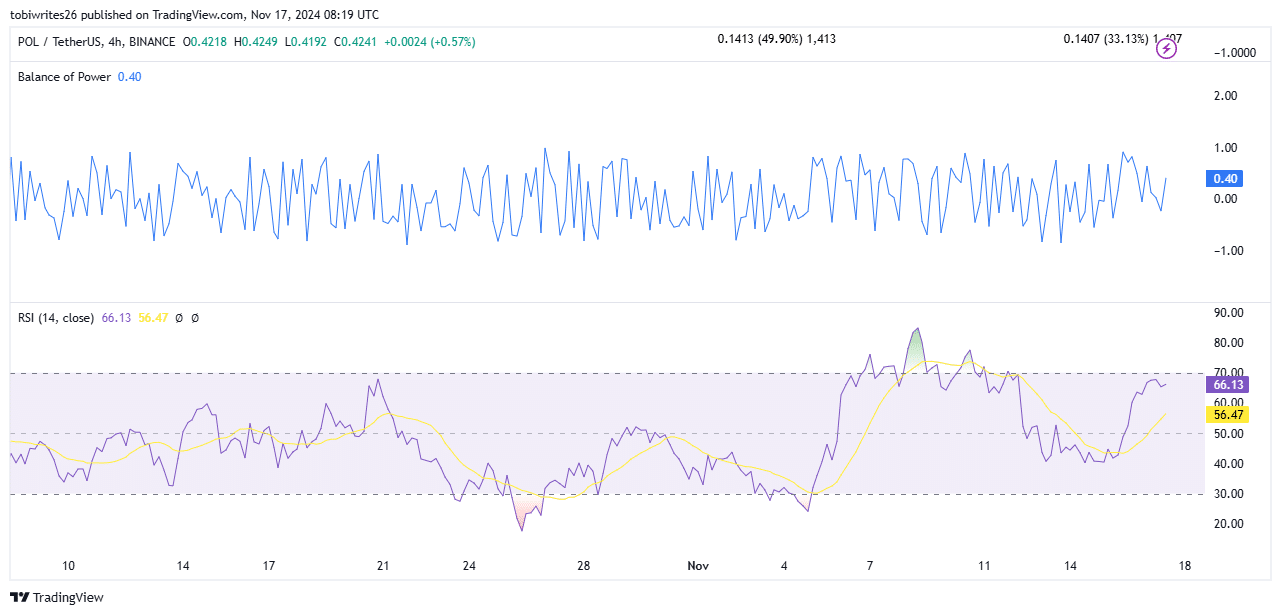

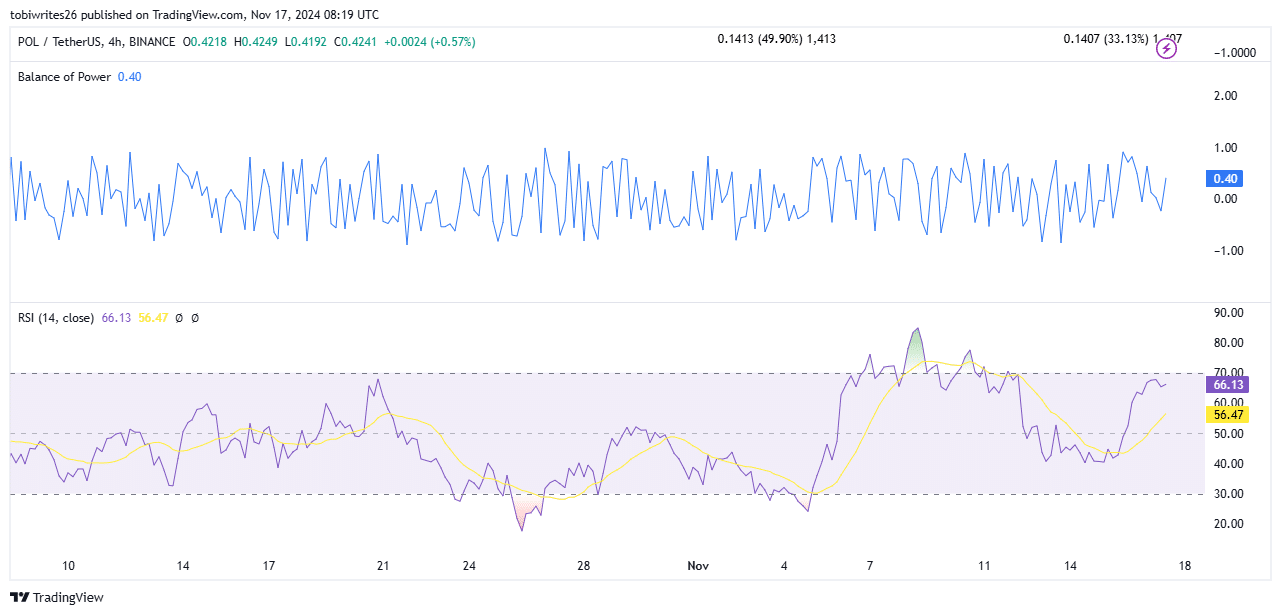

Technical indicators are strengthening the bullish case for POL, with both the Balance of Power (BoP) and Relative Strength Index (RSI) reflecting positive upward momentum.

The Balance of Power (BoP) measures the dominance of buyers versus sellers. At press time, the BoP reading was 0.41, indicating that buyers were in control and setting the stage for potential price gains.

Read Polygon’s [POL] Price Prediction 2024–2025

The RSI was also in bullish territory, with a reading of 66.13. Thus, there was still room for further upside, as the asset was not yet overbought and may continue its upward trend.

Source: Trading View

If these technical indicators, along with on-chain metrics, continue to show positive momentum, POL is likely to see further market gains.