- OP token was up 19% in the last 30 days but has shed 53% since the start of the year.

- Optimism concluded its fifth airdrop last week, with roughly 10 million OP distributed.

Optimism [OP] has been a standout Ethereum-compatible Layer 2 scaling solution since the launch of its public mainnet in December 2021. On DeFiLlama’s dashboard, it ranks as the fourth-largest L2 chain, with a total of $688 million locked into its smart contracts at the time of writing.

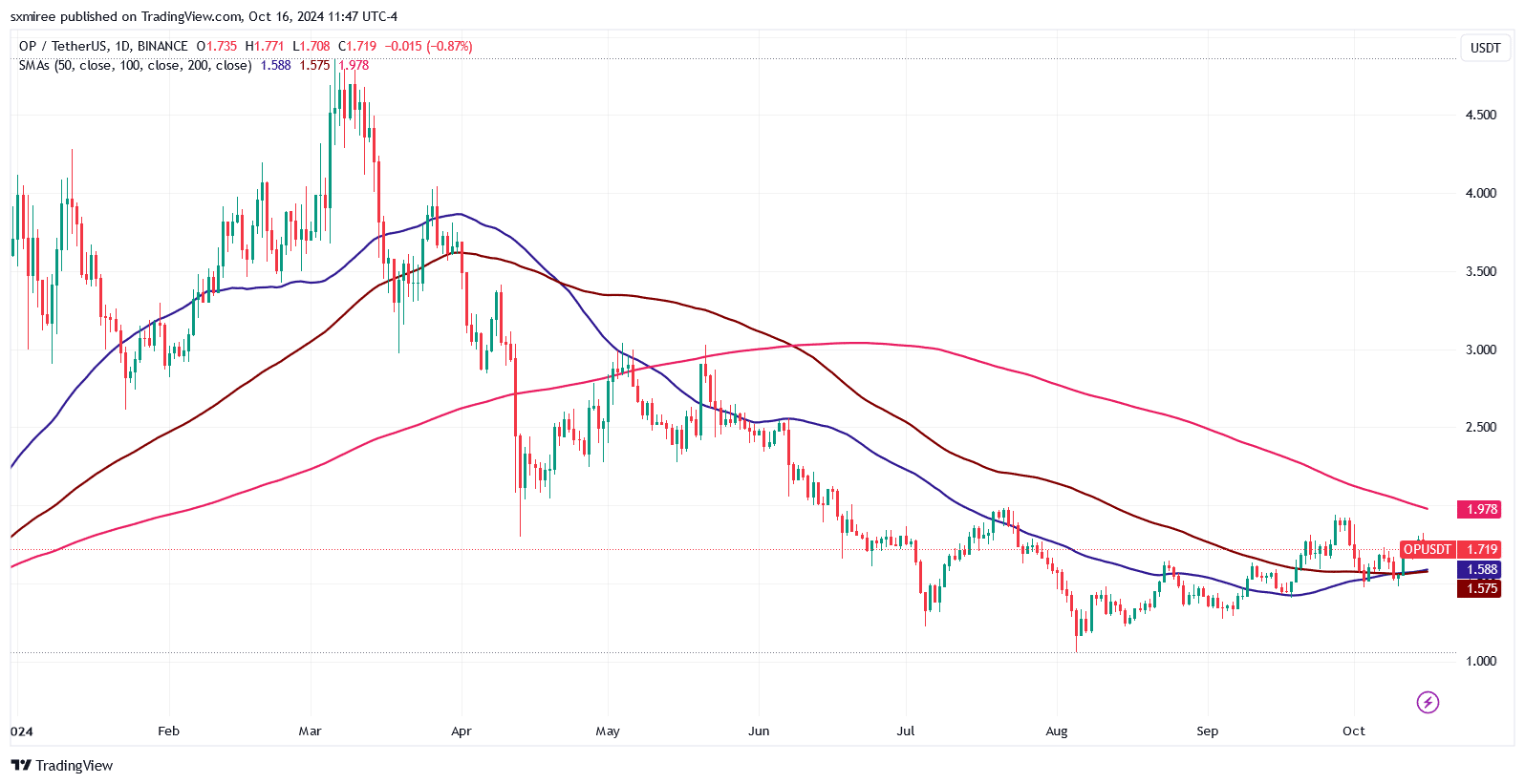

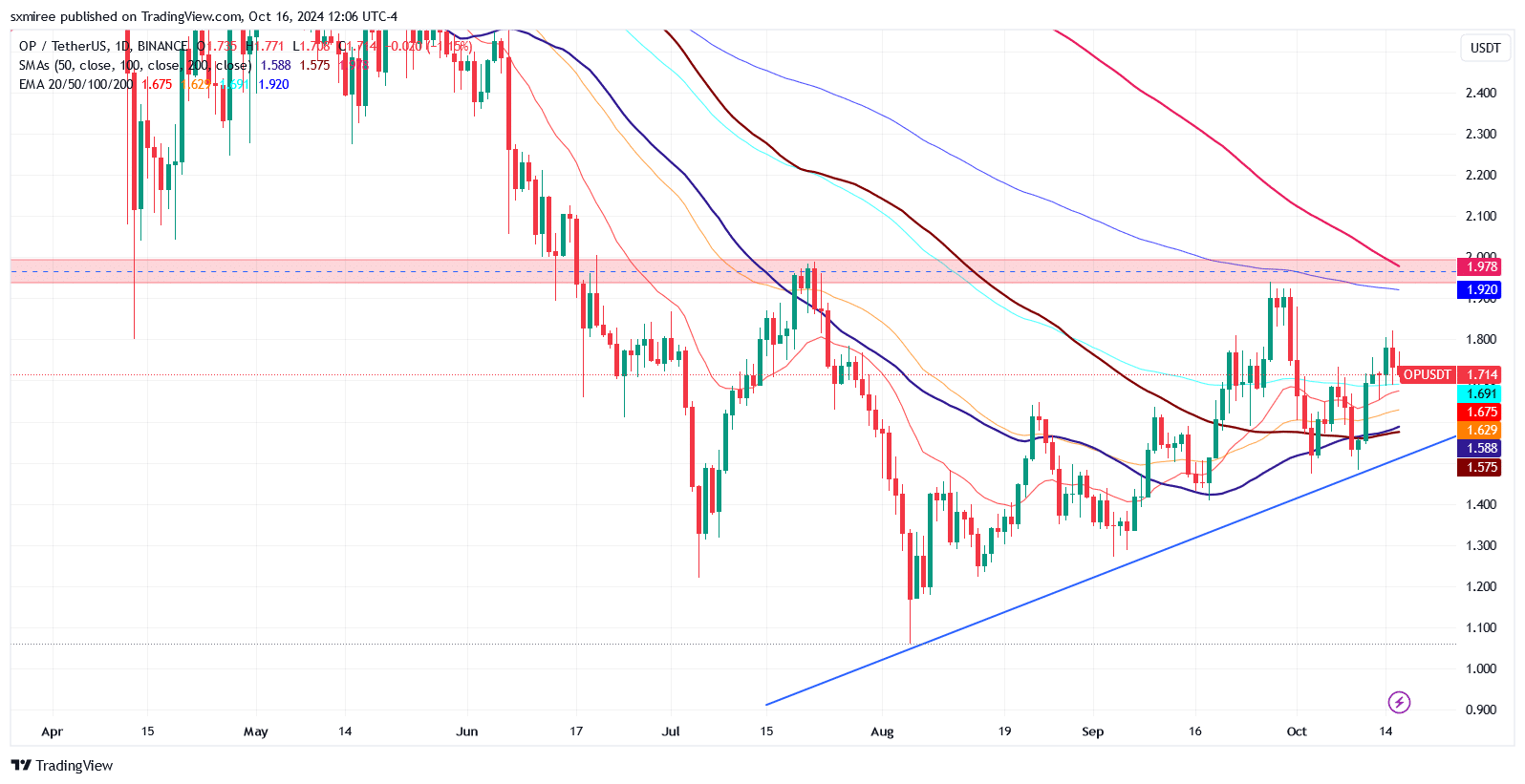

However, its eponymous governance token has displayed lackluster performance in the spot market. OP price has been in an extended consolidation phase in the last four months.

In the daily timeframe, the short-term Simple Moving Averages (SMA) and Exponential Moving Averages (EMA) consistently remained below their respective 200-day MAs, signaling prolonged bearish momentum.

Source: TradingView

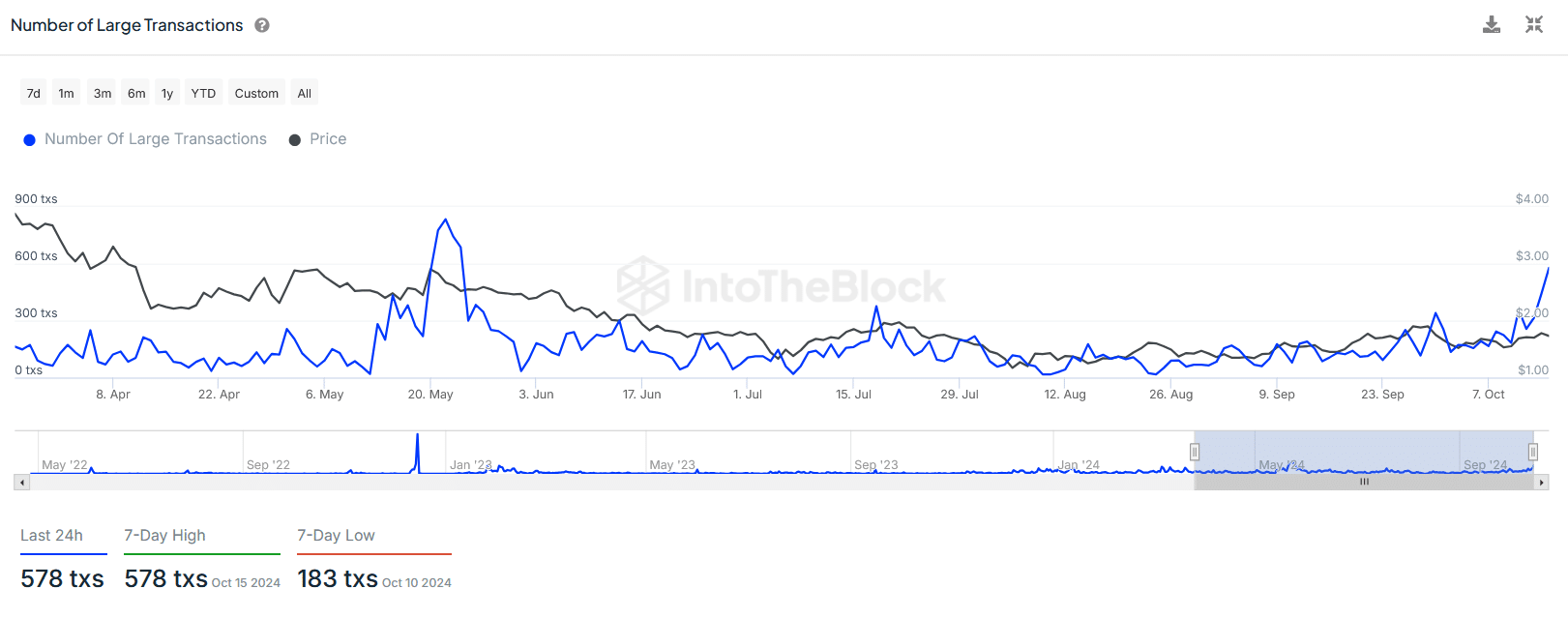

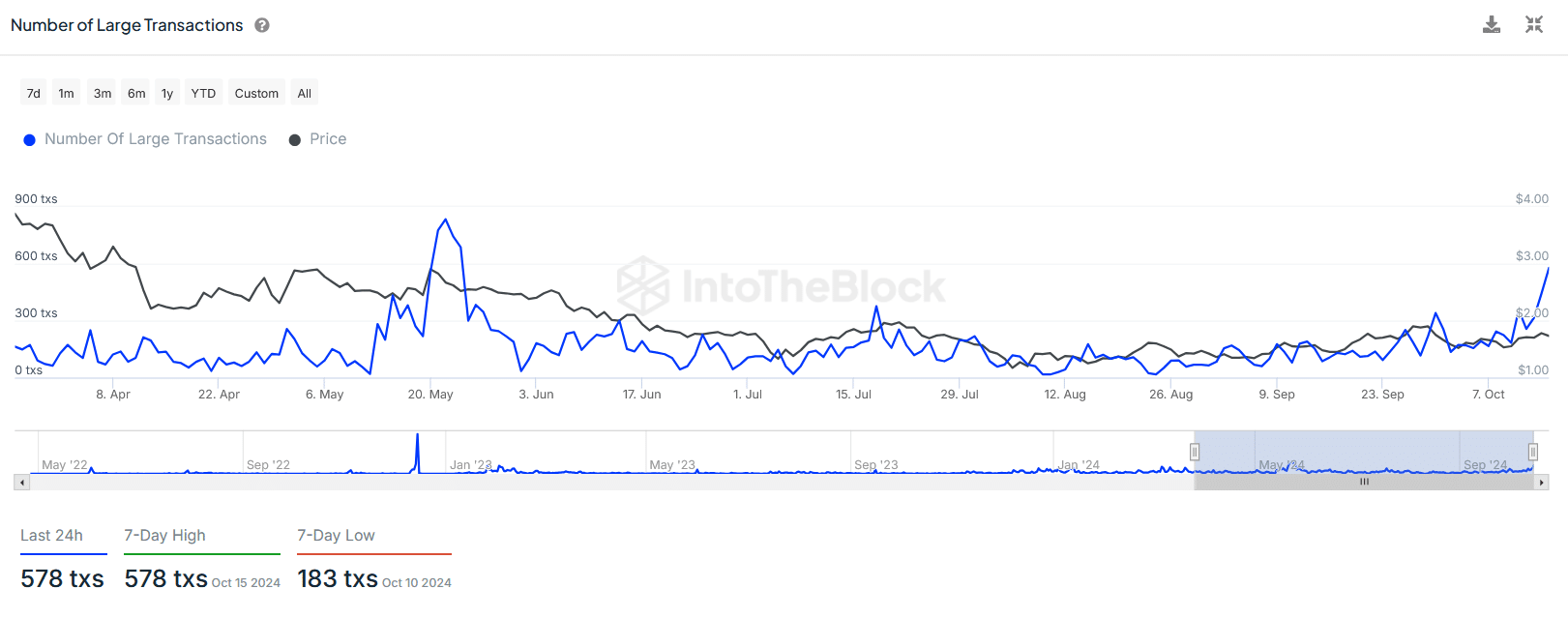

Notwithstanding this weakening price action, on-chain activity has picked up in recent days. The number of large transactions on Optimism spiked to a near five-month high on October 15 according to IntoTheBlock.

Source: IntoTheBlock

This uptick in high-value activity suggests that deep-pocketed holders may be positioning ahead of upcoming events, possibly anticipating market shifts in OP price.

Optimism’s recent airdrop and upcoming token unlock

Last week, Optimism concluded its fifth airdrop, which saw 10.3 million OP tokens distributed to approximately 54,700 addresses. Optimism launched with a supply of 4.294 billion OP tokens and had a rocky start as the mainnet experienced degraded performance, overwhelmed by high demand in the first airdrop.

During this initial airdrop in June 2022, the Optimism Foundation distributed 200.1 million OP tokens to 248,699 addresses. The second airdrop drew more participation, with over 308,000 eligible addresses receiving 11.7 million OP tokens cumulatively.

Token unlocks monitoring tool Tokenomist shows Optimism is set for a major token unlock scheduled for 31st October. Approximately 31.34 million tokens, representing 2.5% of OP’s circulating supply, will be released in allocations to investors and core contributors.

Can OP break out of its downtrend?

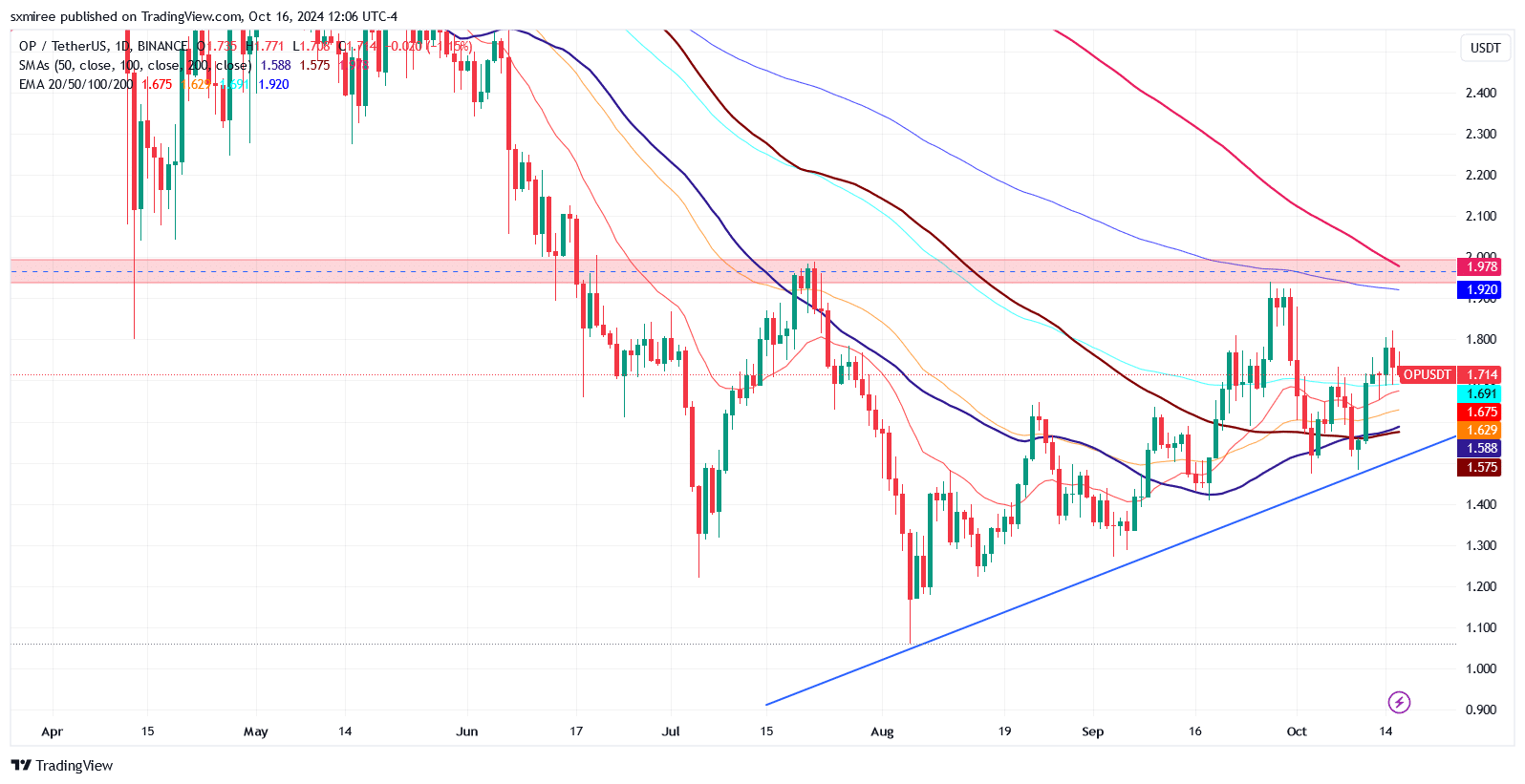

Optimism was trading at $1.72 above a rising lower trendline support at the time of writing. The setup presents an opportunity for OP bulls to challenge the resistance between $1.93 and $1.98 which coincide with the 200-day EMA and SMA respectively.

To confirm a breakout from current range, OP/USDT needs to definitively breach the $2.00 psychological hurdle and flip it into support.

Source: TradingView

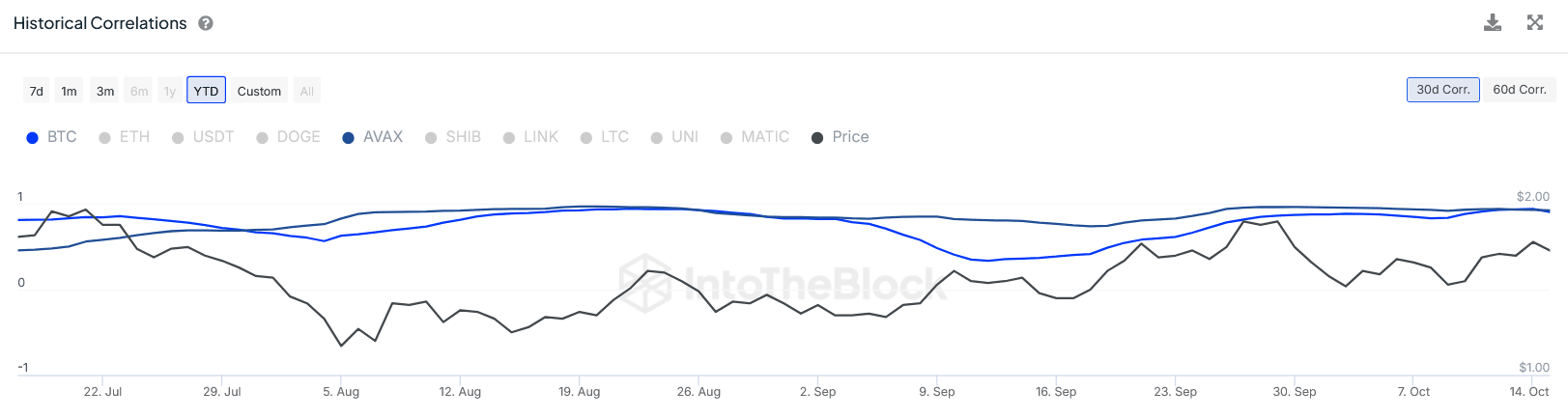

Interestingly, OP’s price has shown the strongest 30-day and 60-day correlation with Avalanche (AVAX). The correlation with AVAX has remained fairly steady in contrast to the correlation with Bitcoin (BTC), which has fluctuated.

Source: IntoTheBlock

Realistic or not, here’s OP market cap in BTC’s terms

Both Optimism and Avalanche are Ethereum-compatible blockchain platforms designed to address scalability limitations. However, they differ in their underlying architectures.

Optimism is powered by Optimistic rollups, which bundle volumes of transaction data into a single transaction on the underlying Ethereum mainnet. Avalanche, on the other hand, is a standalone L1 blockchain with its consensus mechanism.