- BNB has entered a supply zone, which often acts as a catalyst for potential declines.

- However, several indicators suggest that BNB may navigate this challenge successfully.

In the past week, Binance Coin [BNB] has shown steady growth, with a modest increase of 2.68%. In the last 24 hours alone, it has gained 1.14% as it moved into the supply zone.

While trader sentiment remains bullish, BNB must contend with significant obstacles that could hinder its rally.

BNB faces obstacles on the chart

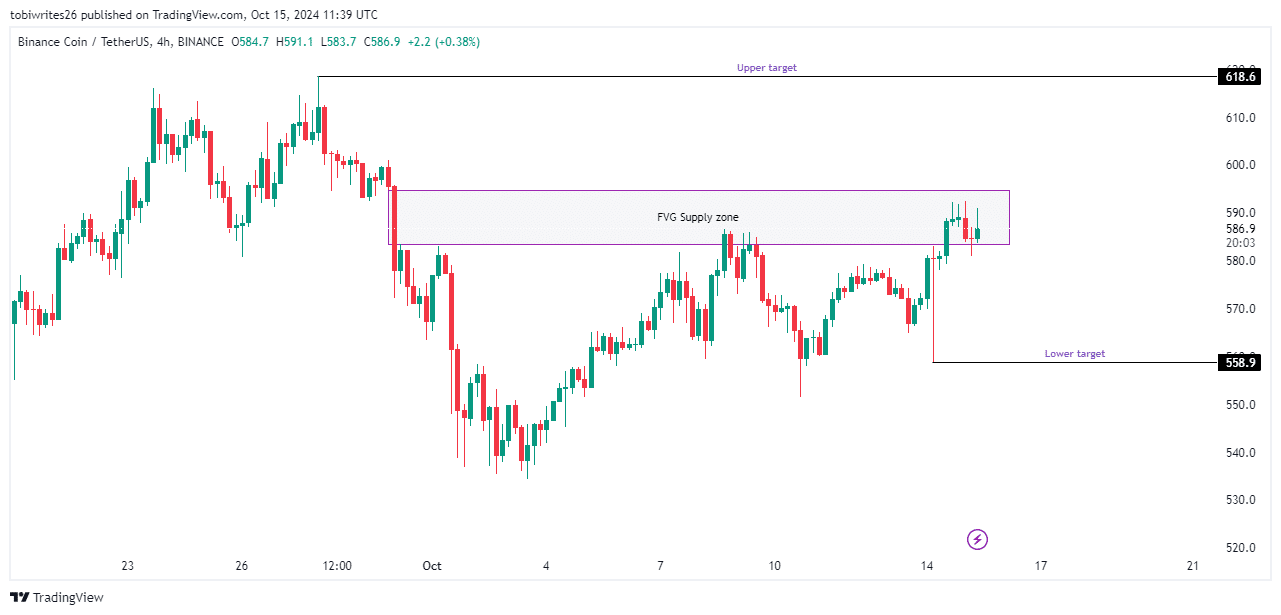

AMBCrypto’s analysis shows that BNB has entered a significant fair value gap (FVG) supply zone identified on the 4-hour chart, ranging from $580 to $590. This zone is likely to restrict upward price movement.

Typically, an FVG supply zone serves as a catalyst for downward pressure, which can lead to losses for investors.

The last time BNB traded within this zone, it experienced a 6.02% decline over two days, reaching a low of $551.50.

If the market moves lower again, BNB may fall to around $558.90. However, if bullish momentum takes over, it could rise to approximately $618.60.

Source: Trading View

AMBCrypto reports that trading activity in the market is currently supporting a potential upward movement.

Short traders record major losses

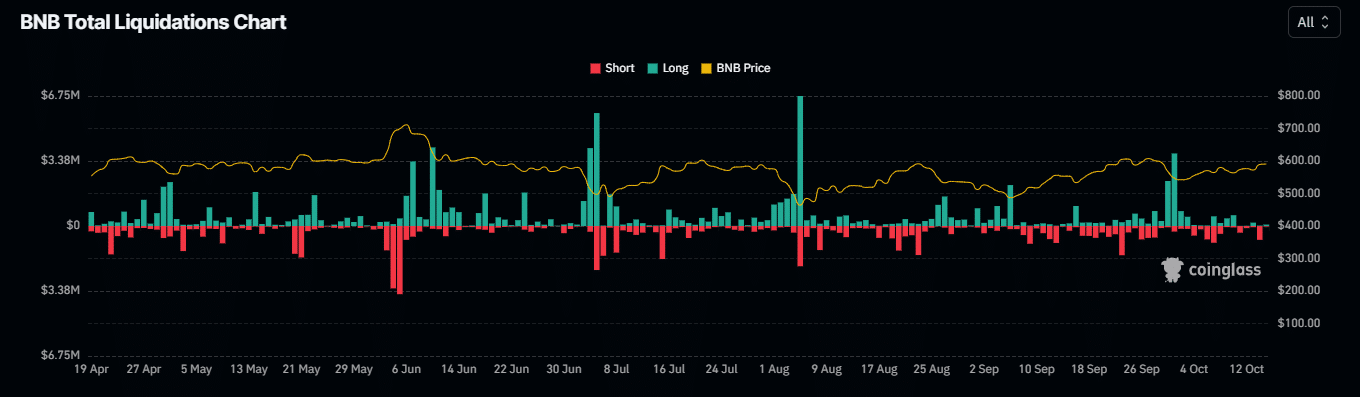

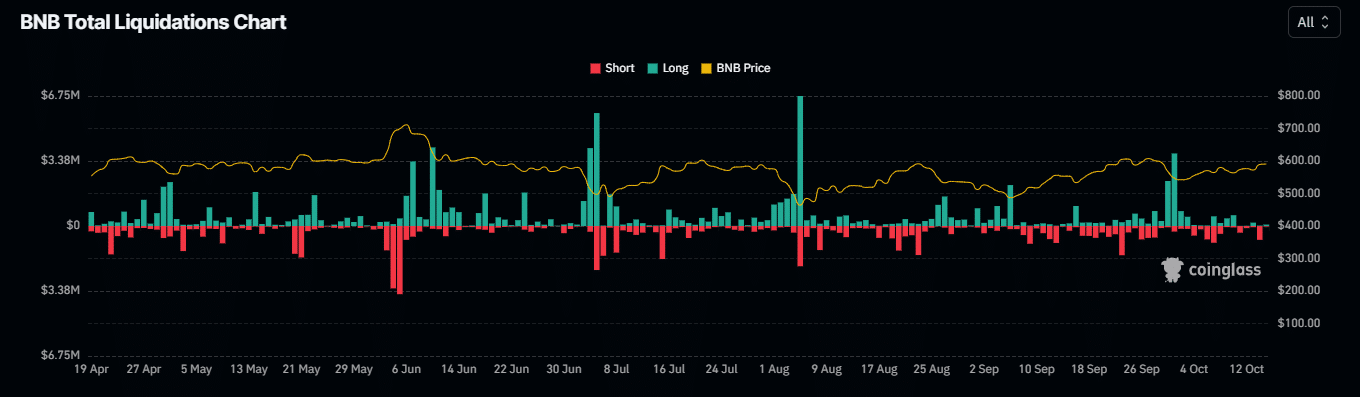

The market is currently seeing a significant imbalance in liquidations, with short traders bearing the brunt of losses.

At the time of writing, short traders have been liquidated to the tune of $463.05k, compared to $94.89k in long liquidations.

This imbalance suggests a bullish market, as more short positions are being closed, signaling upward price momentum for BNB.

Additionally, the Funding Rate has remained positive. A positive Funding Rate means long traders are paying short traders, reflecting strong buying demand and indicating that the market expects further price gains.

Source: Coinglass

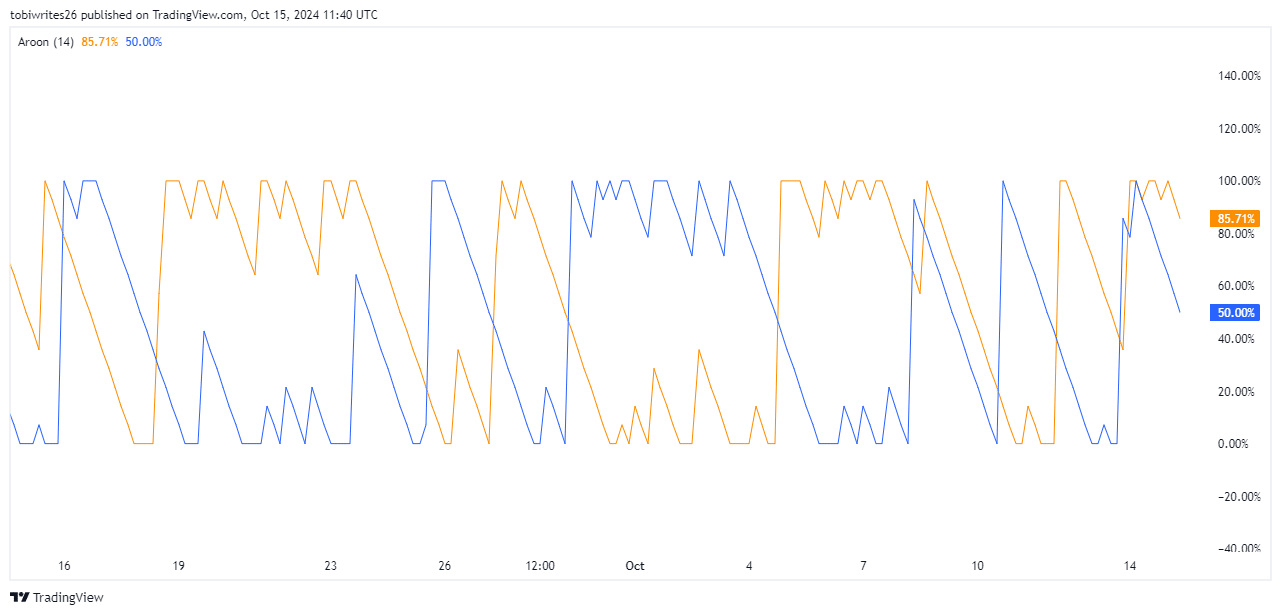

The Aroon Indicator also supports this bullish sentiment. The Aroon Up line, which measures the time since the last price high, is currently above the Aroon Down line, showing a reading of 85.71% to 50.00%.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

This indicates that a bullish trend is in play.

Source: Trading View

If this bullish momentum continues, BNB is likely to move higher, with further upward trends expected in subsequent market session.