- WIF experiences significant growth due to a confirmed breakout from a descending channel, suggesting bullish momentum.

- Open Interest and trading volume surge, pointing to potential sustained price gains in the short term.

dogwifhat [WIF], a rising memecoin in the cryptocurrency market, has been making waves lately, responding positively to the gradual rebound seen across the overall crypto market.

Over the past week, WIF has shown a surge of 42%, outpacing many other digital assets.

The bullish sentiment seems to continue, with WIF climbing by another 5.4% in the last 24 hours, bringing its current trading price to $2.43.

Amid this price performance, Captain Faibik, a well-known crypto analyst on X, recently shed some light on WIF’s price action.

Faibik’s analysis hinted at a potentially strong future for WIF, attributing its current performance to significant technical signals that could indicate further growth.

WIF technical breakout and its implications

In a recent post, Captain Faibik analyzed the technical chart for WIF, suggesting that the memecoin may be on the verge of a continued upward trend.

Faibik emphasized that WIF has experienced a confirmed upside breakout from a descending channel on the daily timeframe.

He stated,

“WIF Descending Channel Upside Breakout is Confirmed on the Daily timeframe Chart… Send it to the New All-Time High.”

Thus, WIF could be set for further upward momentum, with an all-time high on the horizon.

Source: Captain Faibik/X

For context, a descending channel is formed when an asset’s price moves lower between two parallel trendlines, characterized by a series of lower highs and lower lows.

The breakout occurs when the asset’s price surpasses the upper trendline, breaking free from the downward movement.

The breakout not only demonstrates that buyers are gaining control but also indicates increased momentum, potentially paving the way for significant price appreciation.

Potential uptrend continuation?

Beyond the technical outlook, it is worth looking at WIF fundamentals to know whether the current uptrend is sustainable.

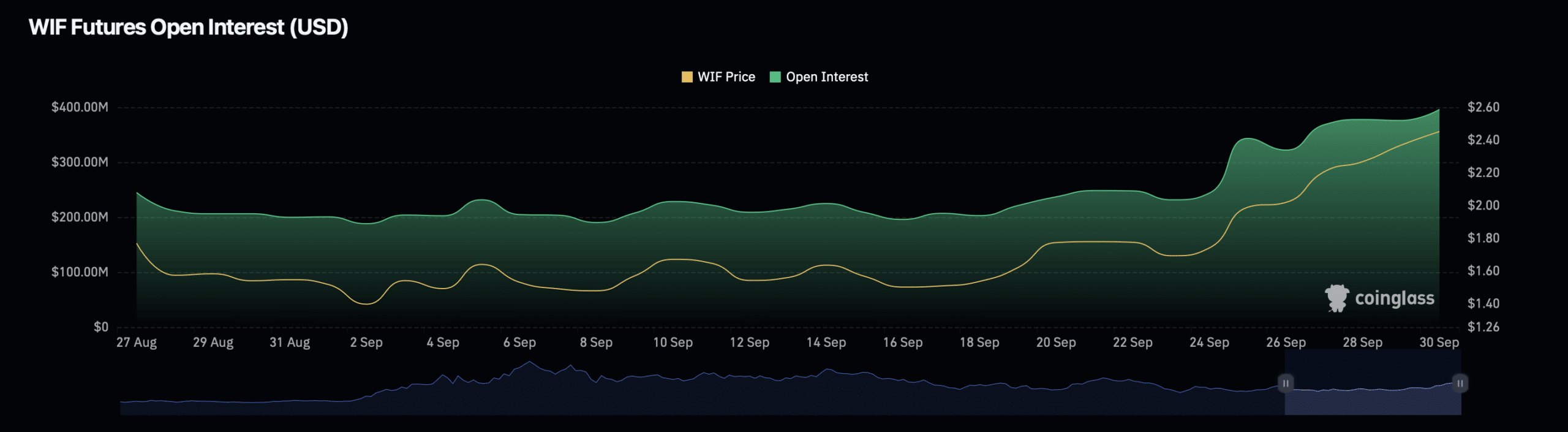

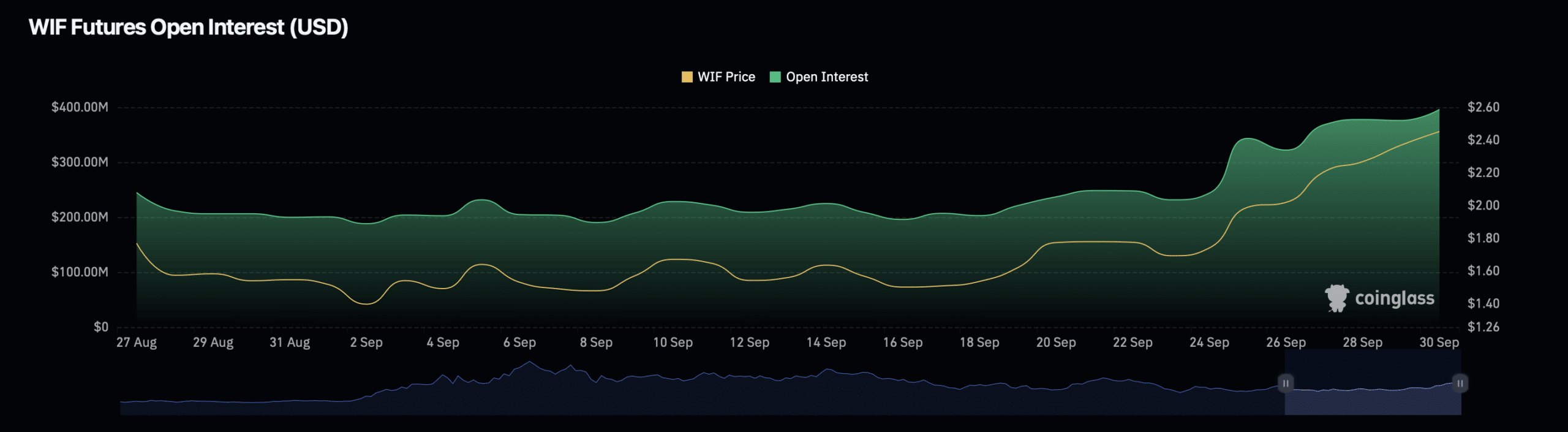

A key metric in this analysis is WIF’s Open Interest, which provides insight into the number of open positions in the Futures market for the asset.

According to data from Coinglass, WIF’s Open Interest has increased by nearly 4%, reaching a press time valuation of $389.70 million.

Additionally, the Open Interest volume has seen a substantial surge, rising by 43.78% to a valuation of $1.78 billion.

Source: Coinglass

This rise in Open Interest and volume indicates growing market activity and interest in WIF.

Typically, increasing Open Interest is associated with more capital flowing into the asset’s derivatives market, often signaling heightened expectations for price movement.

Read dogwifhat’s [WIF] Price Prediction 2024–2025

When Open Interest increases along with a rising price, it often suggests that traders are placing bullish bets on the asset, expecting the price to continue its upward trajectory.

Moreover, a growing Open Interest volume may highlight an increase in market liquidity, enhancing the trading opportunities for WIF. Such liquidity can attract more traders, further fueling the asset’s price movement.