- ETH stalled on the charts as memecoins gained momentum throughout the week

- A strong catalyst may be needed to spark a short squeeze

As the crypto market rallied, propelled by Bitcoin [BTC] nearing its previous ATH, Ethereum [ETH] enjoyed weekly gains of nearly 10%. At the time of writing, the altcoin was trading at $2.6k.

This reflected a common trading strategy, one where high-cap altcoins thrive when BTC hits a key resistance, prompting retail investors to shift their capital in a bid to mitigate risk.

However, unlike previous cycles, ETH has continued to consolidate over the last three days. All while BTC posted daily gains exceeding 2% over the same timeframe.

Simply put, there has been an underlying shift in the market dynamics.

Memecoins have reaped the most benefits

Over the last seven days, memecoins have surged dramatically on the price charts, with three of the top five gainers being meme tokens.

Notably, DOGE led the pack with impressive 30% weekly gains – A sign that investors are showing confidence in high-risk assets that offer quick, outsized returns.

According to AMBCrypto, as traders increasingly saw upside potential in memecoins, interest in ETH waned, leading to its consolidation on the charts.

However, another AMBCrypto report suggested that DOGE’s uptick could be a sign of an overheated market. One which may soon face a correction.

Hence, the question – Could this potential pullback attract capital back into ETH, setting the stage for a short squeeze?

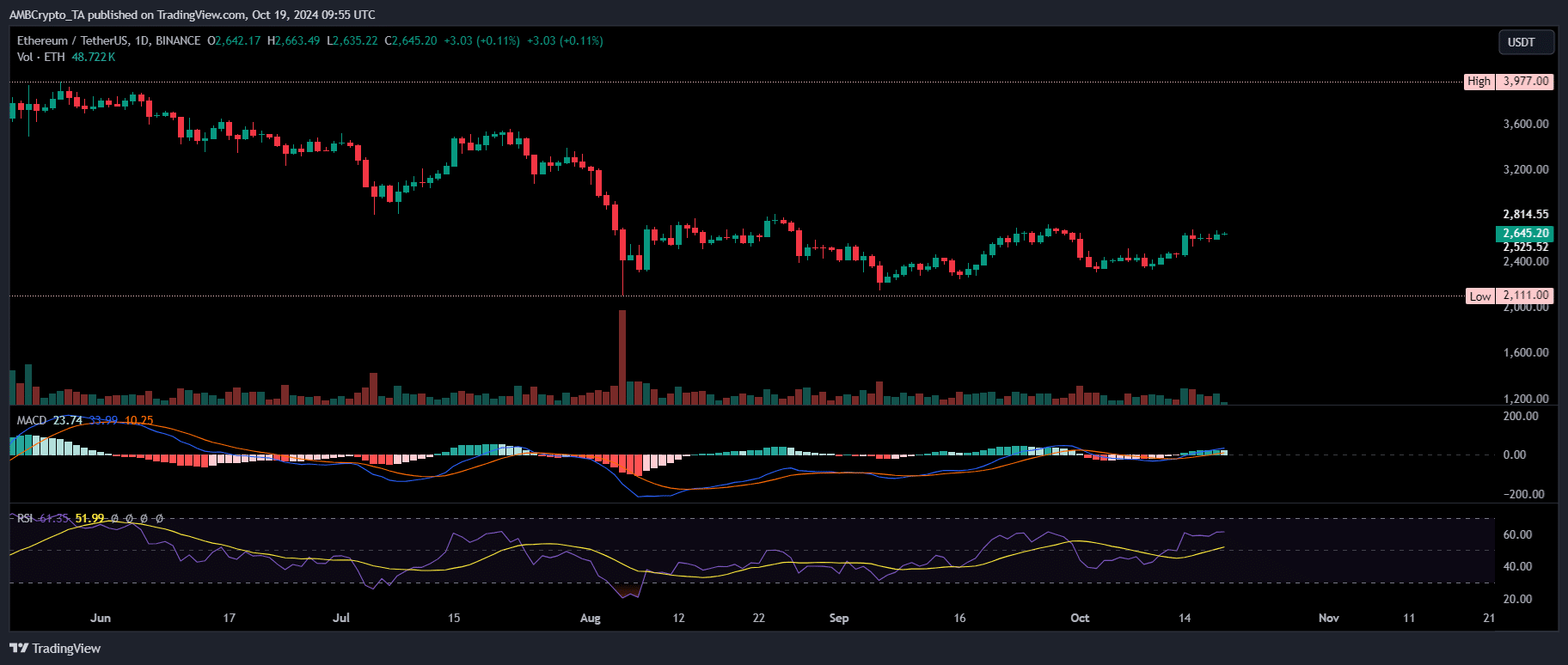

Source: TradingView

At the time of writing, the MACD lines were nearing a crossover. It it turns out as planned, it could further confirm ETH’s expected move over the weekend.

On the contrary, the RSI projected an overbought condition, with 74% of the price action over the last two weeks trending upwards – Raising the possibility of a trend reversal soon.

Taken together, one can argue that ETH has been losing ground across key metrics, with selling pressure increasing as traders continue to ride the memecoin wave.

If this trend persists and isn’t countered by a shift in momentum, it could trigger a liquidation of long positions, forcing holders to sell.

Such a situation would limit ETH’s ability to gain momentum when BTC peaks. This is typically an indicator of the onset of altcoin season.

ETH holders are targeting the dip

Typically, when retail investors offload their holdings, it signals a market top as they cash in on their gains.

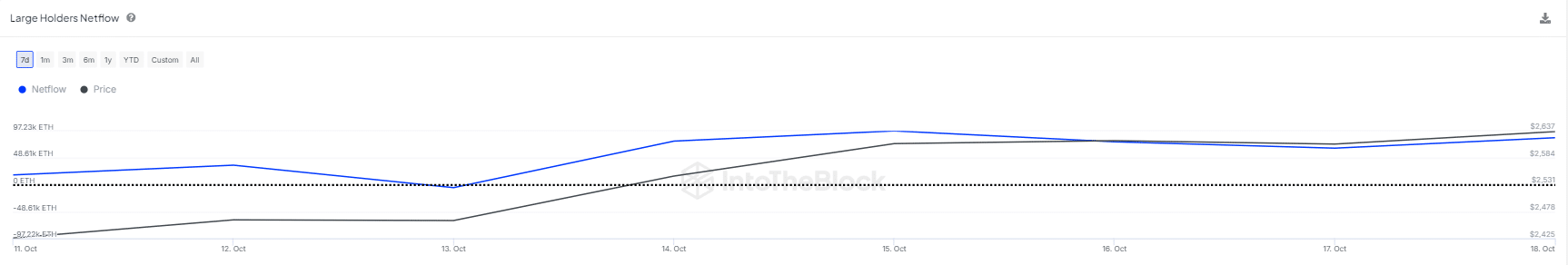

On the contrary, large holders entering an accumulation phase at a local low can establish a market bottom, viewing it as a potential dip to buy.

Over the past three days, as ETH’s rally stalled, large holders strategically bought ETH at bargain prices. They anticipated that BTC’s rally would continue, and more investors would seek refuge in altcoins.

Source: IntoTheBlock

Consequently, a significant amount of ETH tokens were withdrawn from exchanges, catalyzing a 10% weekly surge despite the prevailing market fear.

Read Ethereum [ETH] Price Prediction 2024-2025

In short, ETH is at a critical juncture, influenced by various factors shaping its future trajectory.

If memecoins continue to draw liquidity away from BTC traders, the potential for a short squeeze may hinge on large holder activity. This might make ETH more vulnerable to uneven concentration and sudden price swings.