- Trump’s World Liberty had purchased a significant 177,928 LINK tokens worth $4.7 million.

- LINK’s Long/Short Ratio stood at 1.03, indicating strong bullish sentiment among traders.

Chainlink [LINK] is gaining significant attention from the crypto community and is poised for a massive upside rally. Bullish price action and a recent investment by Donald Trump’s World Liberty could explain this positive outlook.

Despite his inauguration, the current market sentiment seems to be facing a price correction as investors engage in profit booking.

On the 20th of January 2024, the blockchain-based transaction tracker Lookonchain posted on X (formerly Twitter) that Trump’s World Liberty had purchased a significant 177,928 LINK tokens worth $4.7 million.

Traders’ rising interest

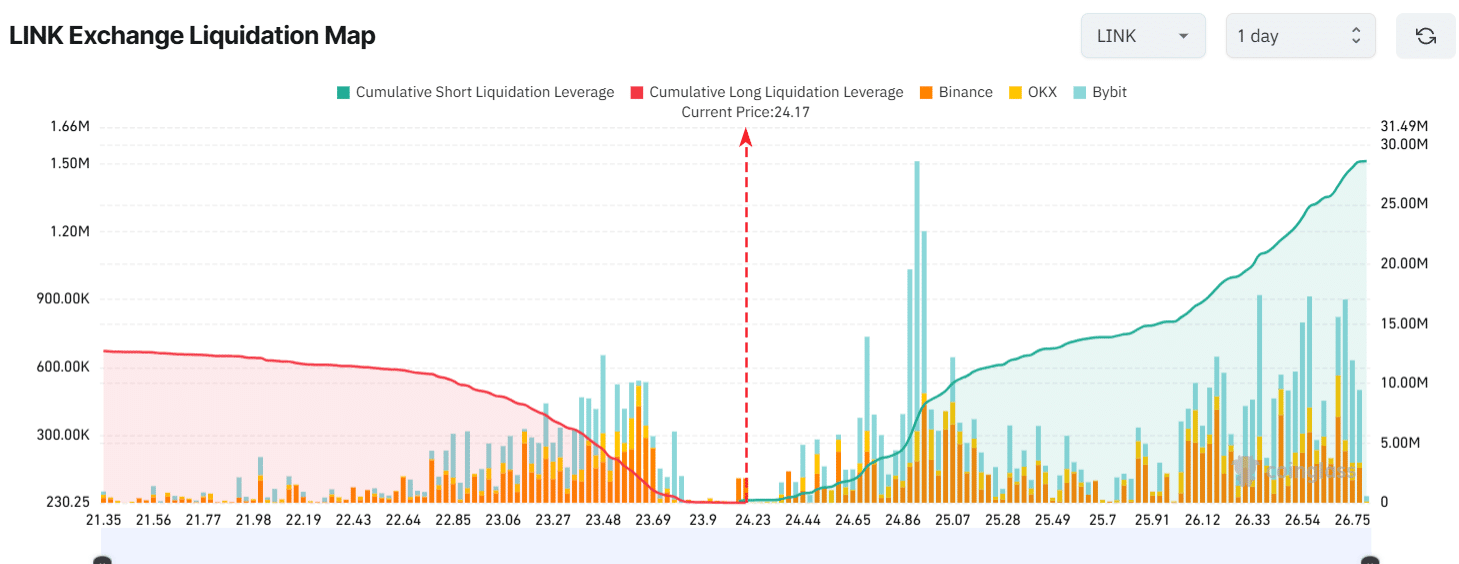

Considering the notable investment, traders are also making bets on LINK, as revealed by the on-chain analytics firm Coinglass. The Long/Short Ratio currently stands at 1.03. This indicates a strong bullish sentiment among traders.

Additionally, data further reveals that 53% of top traders currently hold long positions, while 47% hold short positions.

In addition to this data, traders are over-leveraged, with positions ranging from $23.98 on the lower side to $25 on the upper side.

Source: Coinglass

LINK technical analysis and key levels

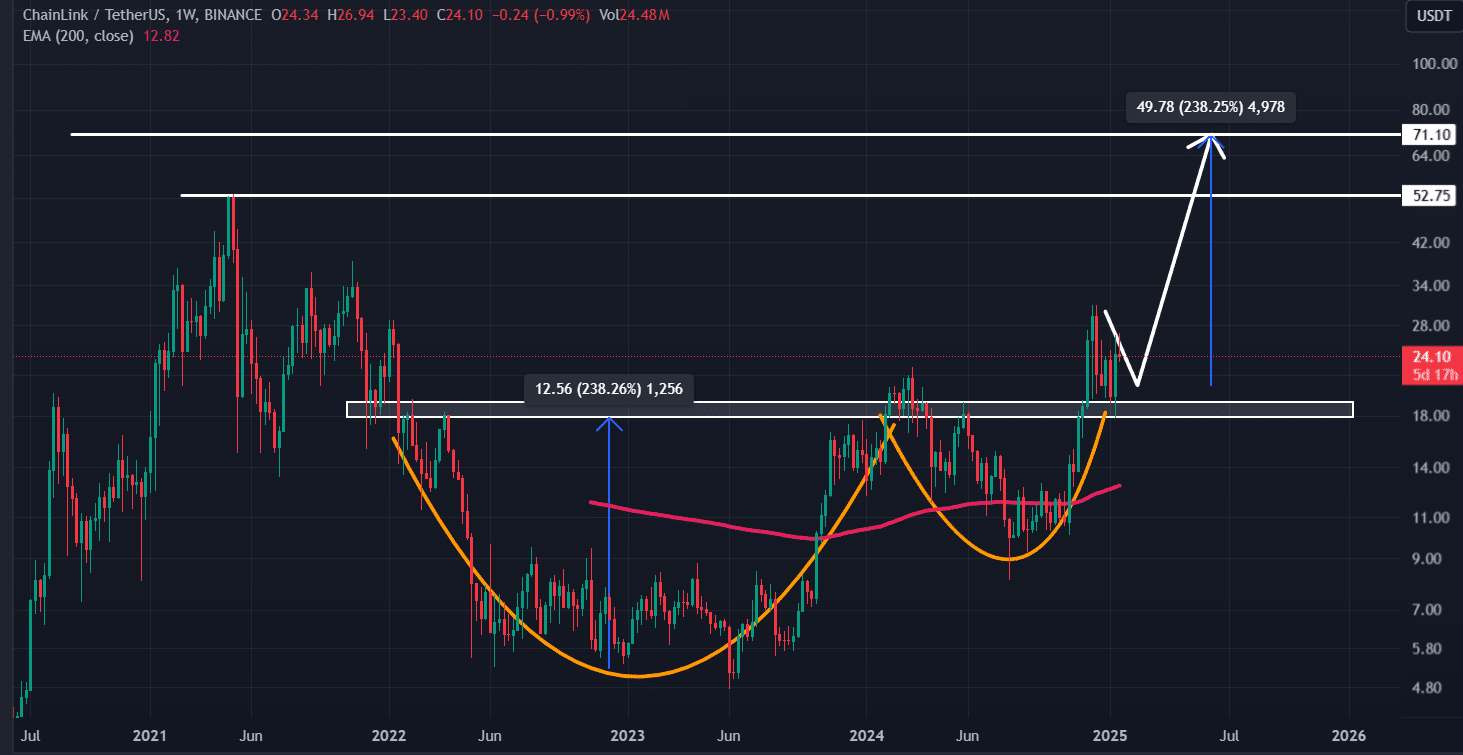

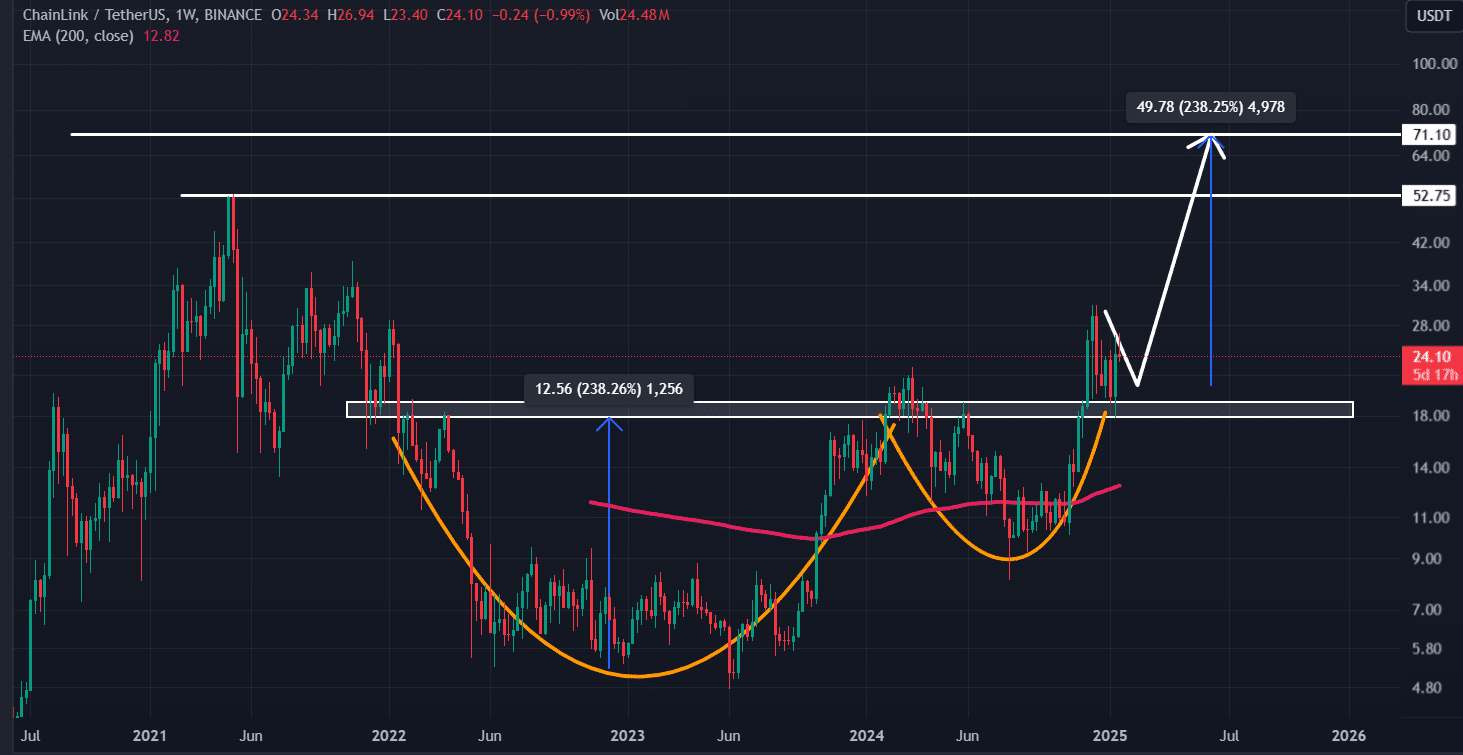

According to expert technical analysis, LINK appeared bullish. On the weekly timeframe, it successfully retested the breakout level of a bullish cup-and-handle price action pattern.

It is now poised for significant upside momentum.

Source: TradingView

Based on historical price movements, if LINK closes a daily candle above $26.70, it could rally by 175% to reach $75 in the future.

However, this target is still far off. Current market sentiment and Donald Trump’s arrival as President of the United States could play a significant role in achieving it.

RSI bullish reversal indication

On the positive side, LINK’s Relative Strength Index (RSI) is below the overbought zone. This indicates that the asset has sufficient room to rally significantly in the coming days.

When combining on-chain metrics with LINK’s price action and Trump’s World Liberty’s recent investment, the outlook is bullish. It appears that the bulls are back and could support the altcoin in reaching its predicted level.

Is your portfolio green? Check the Chainlink Profit Calculator

At press time, LINK was trading near $23.90 and has registered a price drop of 2.55% in the past 24 hours.

Despite this, traders and investors have shown strong confidence, leading to a 29% increase in trading volume during the same period.