- Number of addresses holding over 1 BTC has fallen since the start of the year

- Metrics revealed that investors might have been selling to earn profits

After a comfortable uptrend, Bitcoin [BTC] saw a price drop on the charts and started to consolidate under $70,000. Meanwhile, it would seem that big-pocketed players reduced their holdings in 2024 too.

Does this mean they have been losing confidence in BTC? Or were they reducing their positions to earn profits?

Are whales selling Bitcoin?

Here, it’s worth noting that while BTC’s value dropped, its price was still hovering close its all-time high at press time. With Bitcoin performing as it is, IntoTheBlock shared a tweet revealing an interesting development. According to the same, 1,013,120 addresses held more than 1 BTC. This number fell from 1,024,437 since the start of the year.

At first glance, this might suggest that whales may be losing confidence in the king coin. However, the reality might be different. The whales might have chosen to sell their assets in order to earn profits. Especially as BTC’s price was considerably high on the charts.

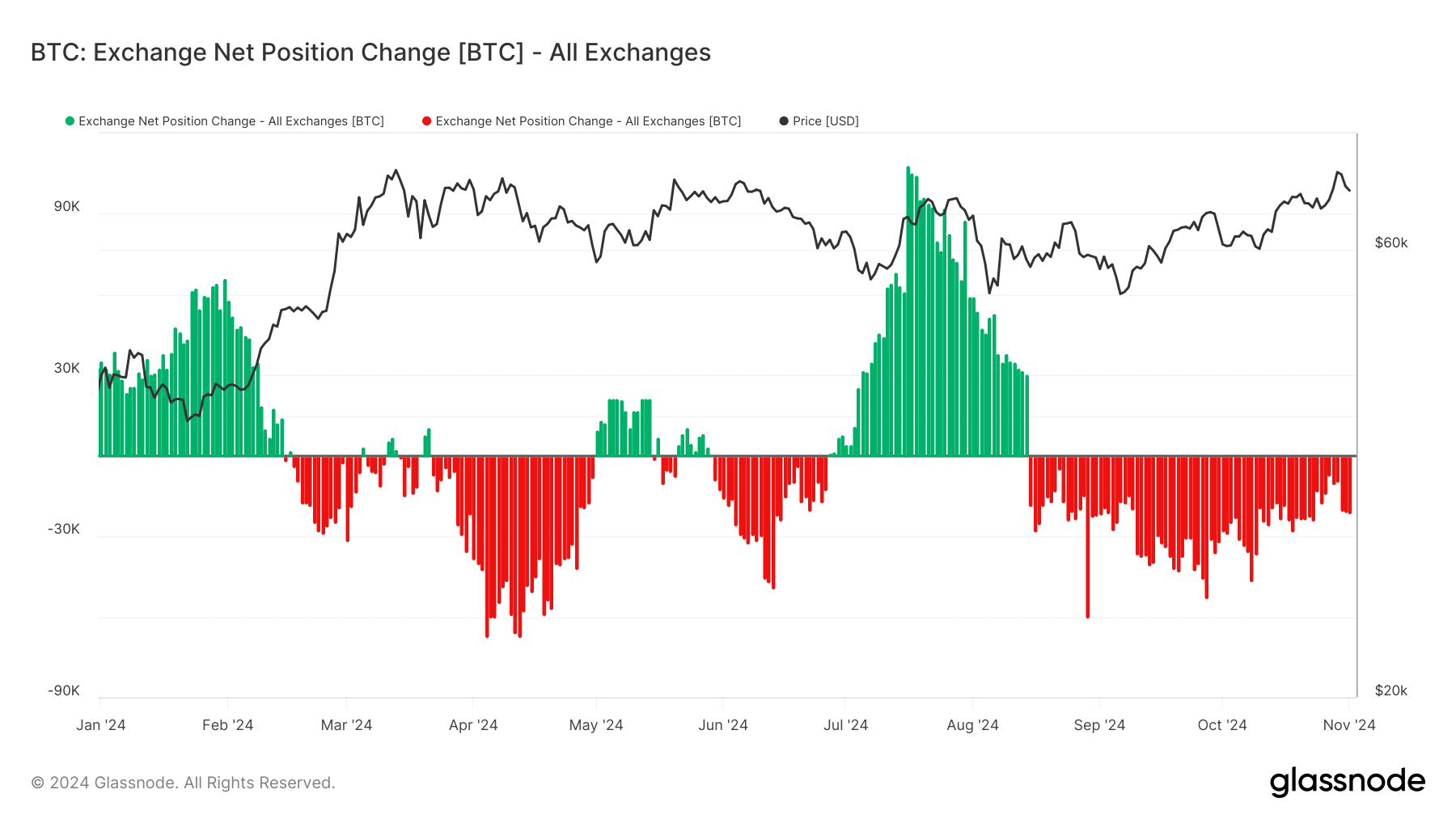

To check the same, AMBCrypto assessed the crypto’s on-chain data. As per AMBCrypto’s analysis of Glassnode’s data, Bitcoin’s net position change remained in the negative zone over the past few months. A major reason behind this could be BTC’s price rise during the same period. Generally, when prices approach ATHs, investors often choose to sell their holdings in order to take profits.

Source: Glassnode

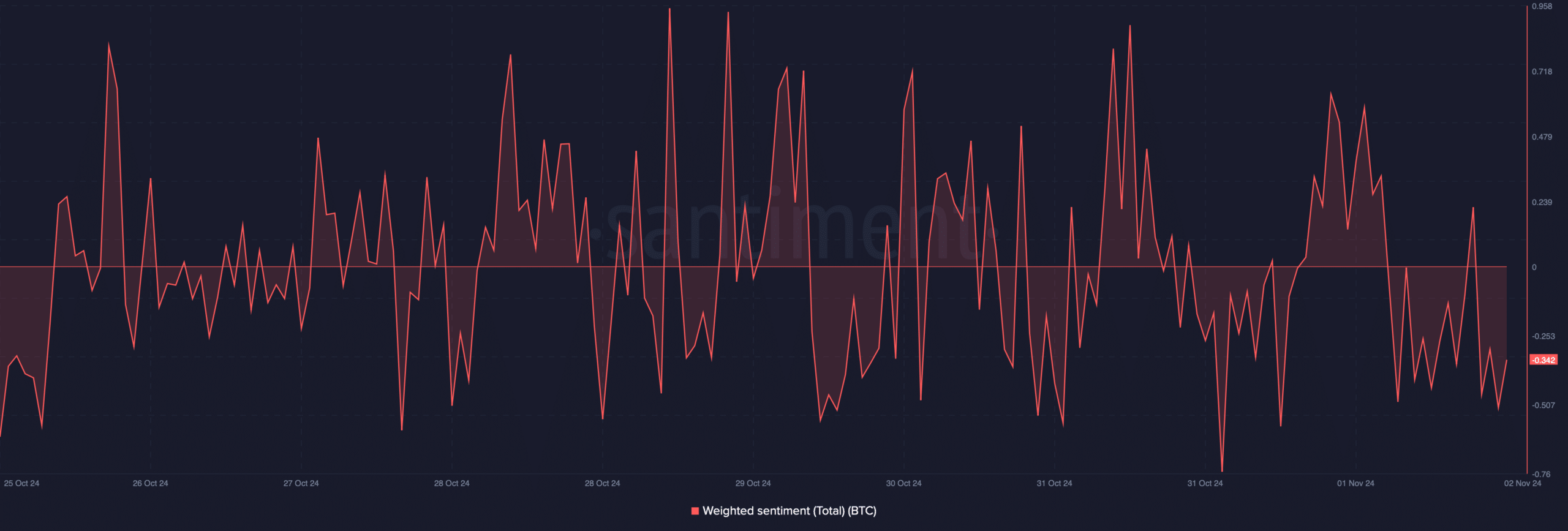

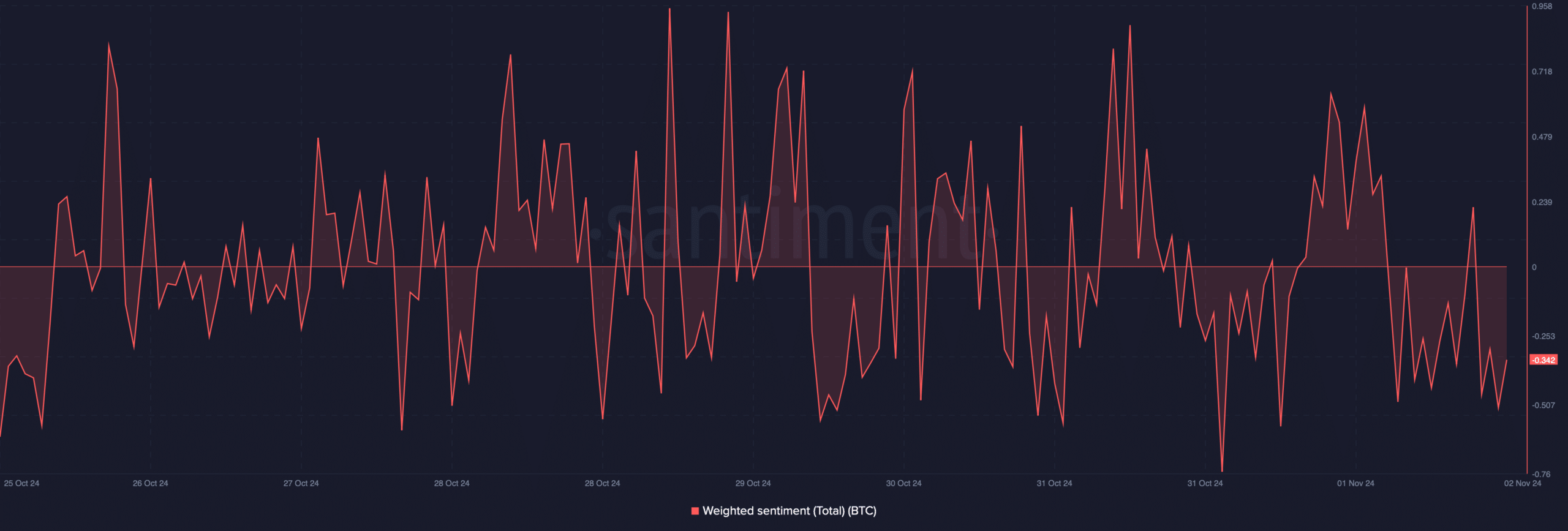

AMBCrypto then checked Bitcoin’s social metrics to find out whether confidence in the coin has actually been dwindling. According to our analysis, BTC’s weighted sentiment kept moving in the positive and negative zones frequently over the past week.

This meant that there was not a particular sentiment that was dominant in the market. Therefore, the possibility of whales selling to earn profits seemed high.

Source: Santiment

Mapping BTC’s future

Since the big-pocketed plates were taking profits and reducing their holdings, AMBCrypto then assessed how this might affect the crypto’s price.

As per our analysis of CryptoQuant’s data, Bitcoin’s aSORP was red. This indicated that more investors have been selling at a profit. In the middle of a bull market, it can hint at a market top.

Source: CryptoQuant

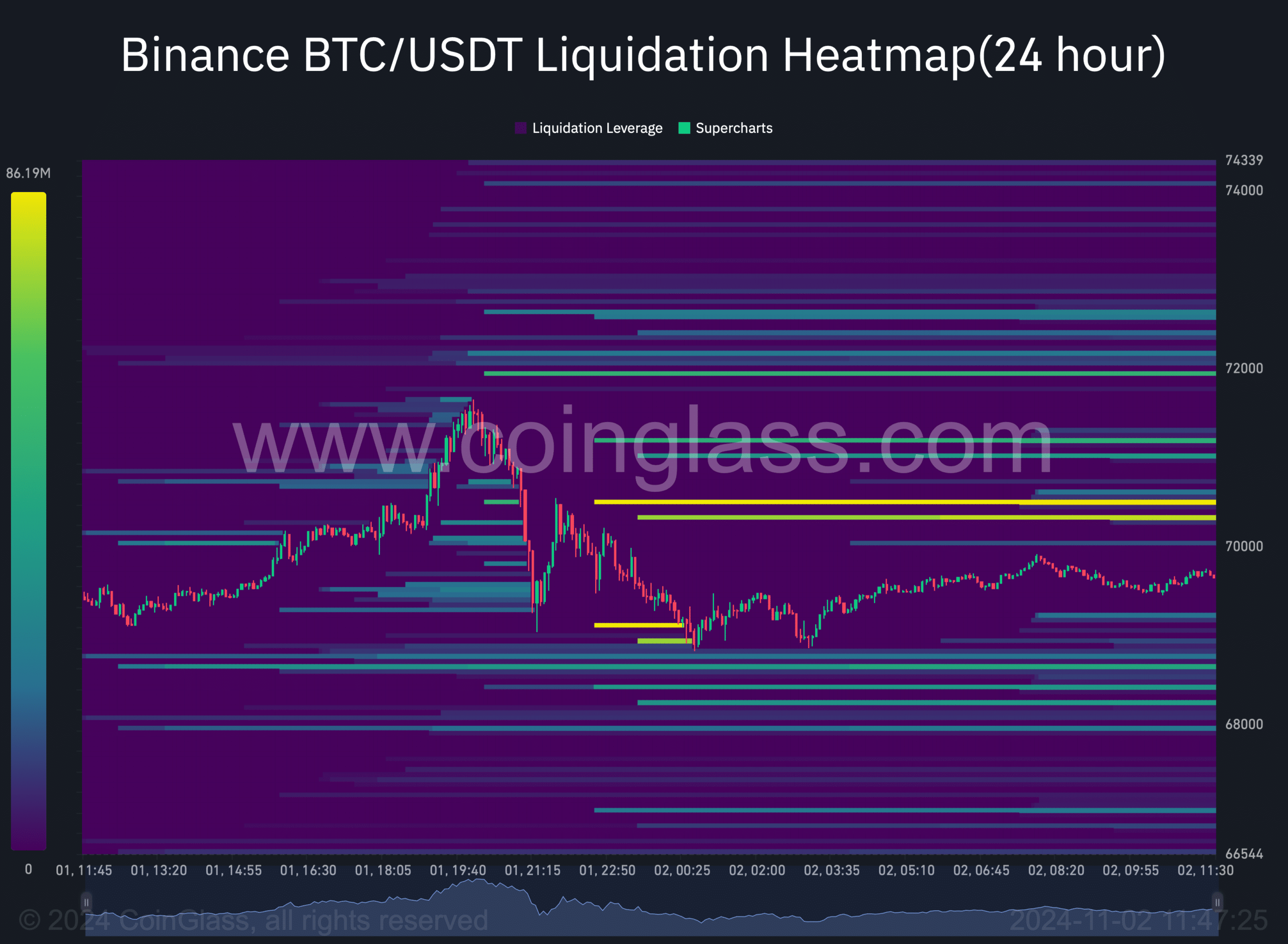

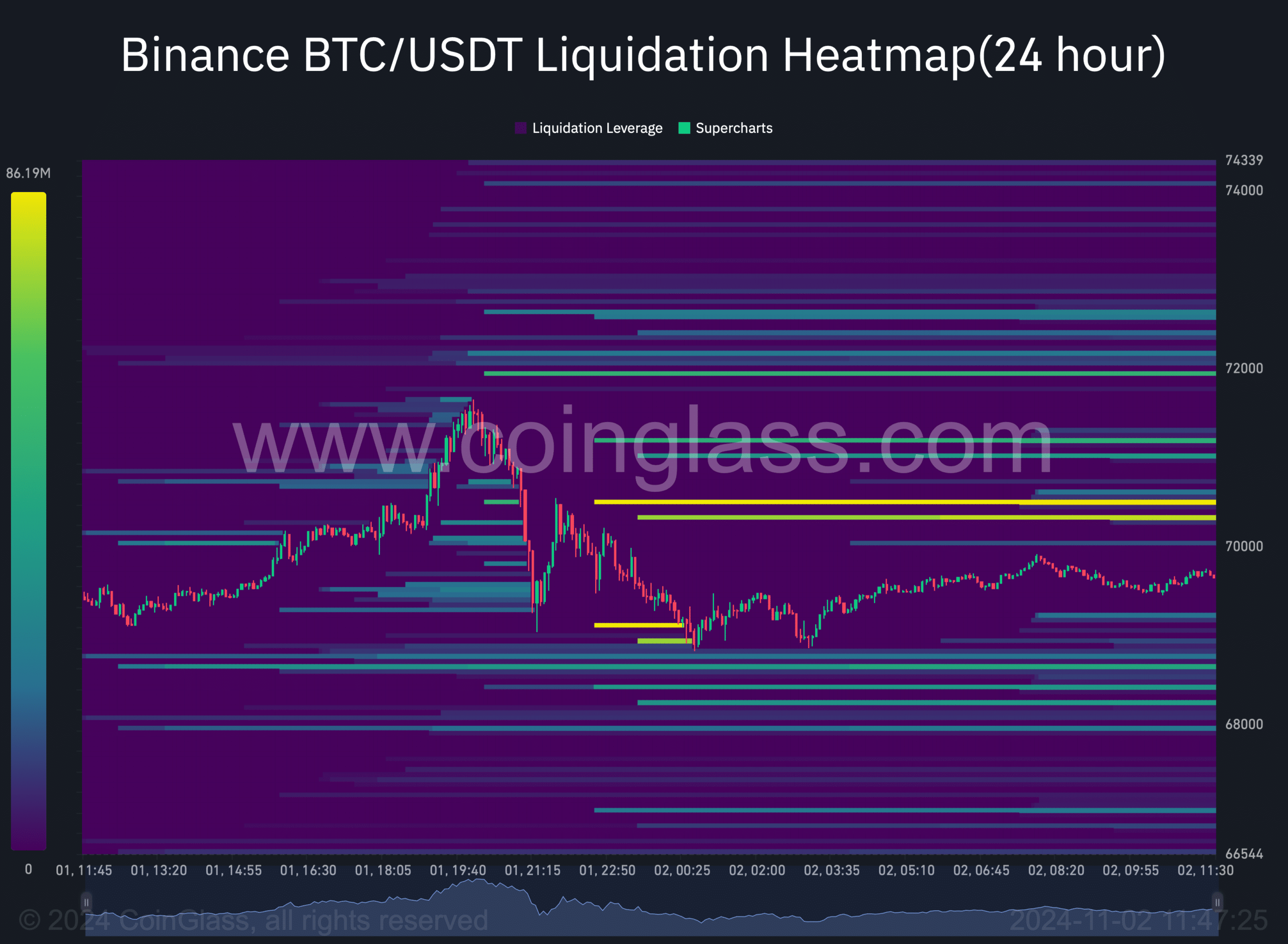

Coinglass’s liquidation heatmap also revealed that in case of a price drop, BTC’s value might decline to $68.6k. This was the case as liquidations will rise sharply, which can possibly act as a support from where bulls would have an opportunity to bounce back.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Nonetheless, AMBCrypto reported that BTC’s NVT ratio dropped over the last few days – A finding that hinted at a price hike.

Source: Coinglass