Opens in new window

Opens in new windowAfter years of impressive growth, Chinaâs economy is now worth $18 trillion and its apparel market is the second largest in the world. In 2025, the IMF projects Chinaâs economy will grow by 4.5 percent, outpacing global GDP growth of around 3 percent.

While still higher than global GDP growth, Chinaâs projected growth rate reflects a deceleration from the previous decade, which averaged around 7 percent growth per year from 2013 to 2019. The economic slowdown is expected to continue in the medium term, with the IMF forecasting GDP growth to fall to 3.3 percent by 2029, due to aging consumers and slower productivity growth.

The slowdown is affecting retail sales. Apparel sales increased only 1.3 percent in the first half of 2024 compared to the same period a year prior. This growth is about half that of 2019 levels (at around 3 percent).

Additionally, leading macroeconomic indicators of consumer spending point towards a muted 2025. Consumer confidence and residential property transactions have neared all-time lows, while Chinese debt-to-GDP ratio increased to a historic high of 288 percent at the end of 2023.

3 points

â Â projected decrease in percentage points in Chinaâs annual GDP growth rate from 2019 to 2029 by the IMF

36 points

â Â decrease in Chinese consumer confidence index points from January 2022 to July 2024

There are headwinds in both the non-luxury and luxury segments in China

In the non-luxury segment, domestic brands have been taking share:

- Domestic brands grew their share versus international brands by 6 percentage points between 2013 and 2023. As of 2023, over 50 percent of Chinese consumers preferred domestic brands, a 35 percentage point increase from 2011.

- Even market leaders such as Uniqlo have recently cited challenges in China, such as lower consumer appetite and a need for more localised products.

- Foreign sports and outdoor brands continue to thrive while focusing on localisation and a strong association with quality. Lululemon and Amer Sports, owner of Arcâteryx, saw double-digit growth in China in the first quarter of 2024.

In the luxury segment, consumer shifts are driving a slowdown:

- Despite brands such as Prada Group and Hermès posting double-digit growth in Asia (excl. Japan) in the first half of 2024, China luxury growth slowed to an estimated negative 3 percent from 12 percent in 2023.

- Chinaâs recent consumer and government condemnation of wealth flaunting, or âluxury shame,â is driving demand for âquieterâ and more affordable products, such small leather goods, while brands such as Ralph Lauren have a bullish outlook.

- Government stimulus measures are expected to support luxury demand, but this may not translate to domestic sales. Chinese luxury spend abroad is projected to increase 12 to 17 percentage points from 2023 to 2025, though as of May 2024, spending by Chinese shoppers was still below 2019 levels in key luxury markets.

Fashion executives see growth prospects in other Asian countries

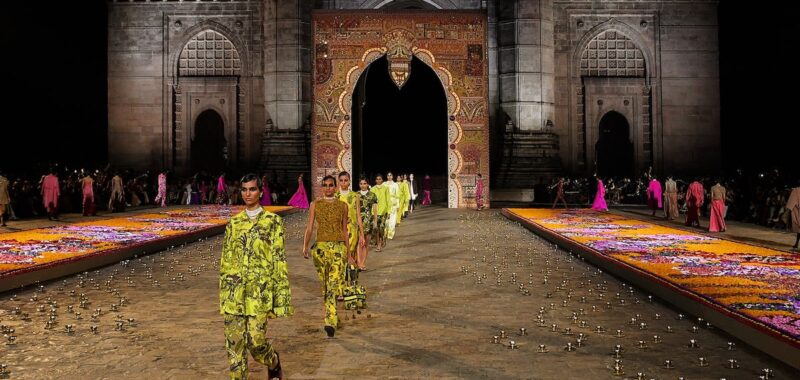

Fashion executive sentiment on Asia is overwhelmingly positive about growth prospects in India and both mature and emerging APAC countries. One in five respondents in the BoF-McKinsey State of Fashion 2025 Executive Survey mentioned India as a focus market for 2025.

Among luxury executives, overall sentiment for mature APAC regions, such as Japan and Korea, is even higher (+63 percent), with one in four fashion executives mentioning Japan as a focus market in the year ahead.

APAC emerging countries, such as Indonesia and Thailand, are also gaining prominence on the global fashion stage, due to growing fashion hubs like Bangkok and the rise of Southeast Asian global influencers. While many of these emerging markets across Asia remain small in scale for now, executives are convinced of their growth prospects going forward. 58 percent of executives believe other APAC emerging regions will offer promising prospects in 2025.

Indiaâs fashion market will be in focus

India is expected to become the fourth largest economy in 2025, growing at 7 percent year on year, outpacing all other economies. This puts India on track to become the worldâs third-largest consumer market by 2027.

In the non-luxury segment, strong growth is fuelled by the middle class and digitisation:

- There are 430 million people in Indiaâs middle class â greater than the middle classes of the US and Western Europe combined. It is expected to reach 1 billion by 2050, largely from tier-two and -three cities.

- Indian fashion customers are increasingly trend-focused. Digitisation is accelerating this shift, as is the large share of young consumers in the country. People under the age of 35 make up 66 percent of Indiaâs population, amounting to over 808 million people.

In luxury, high growth is fuelled by demographic and structural tailwinds:

- Indiaâs population of ultra-high-net-worth individuals (UHNWI), with over $30 million in assets, is expected to grow 50 percent from 2023 to 2028, making it the fastest-growing UHNWI population in the world.

- Aspirational customers, who make up about half of global luxury sales, are expected to grow from 60 million in 2023 to 100 million in 2027.

- As of October 2023, international purchases over INR 700,000 ($8,400) are taxed at 20 percent, encouraging domestic spending.

- New luxury malls and department stores, such as the Jio World Plaza and Galeries Lafayette, are increasing luxury real estate in tier-one cities.

Fashion brands looking to succeed in India need to consider its unique obstacles and nuances

Infrastructure challenges

High-quality retail real estate remains limited, especially in tier-two and tier-three cities, impacting physical expansion, especially for luxury brands. Last-mile delivery also remains difficult, requiring international companies to make significant investments to offer seamless customer experiences.

Partner selection and operating model

While brands such as Uniqlo have found success entering India on their own, finding the right local partner continues to be instrumental for international brands operating in India. A local partner can define the right operating model and go-to-market strategy, accounting for complex regional nuances.

Local consumer dynamics

Indian culture heavily influences fashion and can vary widely by region. Indian shoppers tend to spend more on jewellery (44 percent vs 13 percent global average) and less on apparel (40 percent vs 52 percent). Local brands with expertise in traditional wear tend to dominate in apparel, increasingly so with the rise of local fast-fashion players. In 2023, nine of the top 20 apparel brands were domestic. That said, increasing openness to Western silhouettes is making markets such as the sizeable wedding industry attractive to international brands.

Regulatory requirements

Regulatory requirements, such as local sourcing rules, plus high regional taxes, continue to act as barriers in the market. However, some new policy changes for foreign brands allow 100 percent foreign direct investment in single-brand retail and selling via e-commerce prior to having physical locations.

Japanâs fashion market will be propelled by international and domestic luxury spend

Japanâs luxury fashion market, estimated at $20-25 billion at the end of 2023, was up 25 to 30 percent year on year at constant exchange rates for the first half of 2024. Players including LVMH, Richemont and Hermès saw double-digit sales growth in the country, surpassing pre-pandemic levels. Even fashion brands that saw overall sales decline during the second quarter of 2024, such as Kering (-11 percent) and Ferragamo (-13 percent), delivered healthy topline growth in Japan of around 27 percent and 10 percent, respectively.

A core driver of this strength is the yenâs depreciation, with the currency hitting a 38-year low against the dollar in July 2024. This attracted luxury shoppers from around the world, fuelling record-high duty-free sales in department stores.

Unlike other markets, Japanâs tourism has made a complete recovery from the pandemic. The country had 17.7 million visitors in the first half of 2024, a 66 percent increase from 2023 and 7 percent from 2019, with 25 percent from South Korea, 17 percent from China, 17 percent from Taiwan and 8 percent from the US.

The Japanese luxury market is expected to grow between 8 percent and 12 percent in 2025, maintaining its position as a top luxury shopping destination in the years to come. Brands such as Hermès are opening more stores in Japan after seeing double-digit growth, while emerging brands including Gemmyo, Ganni and Studio Nicholson opened their first stores in the country in the last year.

In the near term, positive price dynamics will continue to fuel inbound tourism, though this trend will rely on the trajectory of the yen and the Bank of Japanâs monetary policy. The Japan Tourism Agency expects annual tourism spend to reach around $100 billion by 2030, far surpassing 2023â²s record of $36 billion.

Domestic demand is also robust, with Japanese customers making up a significant portion of luxury sales. The country remains one of the worldâs largest economies and is home to the second-largest number of UHNWIs in Asia, a group expected to grow by more than 12 percent from 2023 to 2028.

How should executives respond to these shifts?

Curate a localised go-to-market approach that resonates with customers and culture

Tailor international brand product portfolios and supply chains to better serve local markets, as fashion tastes and trend dynamics significantly differ between Asian and Western markets (and within Asian countries themselves):

- Cater to local consumer preferences by creating special collections, altering product dimensions and adjusting pricing architecture. However, brands will need to ensure that styles do not diverge too far from their international offerings, otherwise they risk diluting global brand image.

- Evaluate opportunities to localise elements of the supply chain to increase agility and speed-to-market to compete with local players. This will be particularly relevant in India, where local brands have strong market share. High apparel import taxes and difficulties in last-mile delivery can also be challenging for international brands without strong local capabilities.

- Adapt marketing messaging and partner with local influencers to reach consumers in relevant channels. To achieve the right balance between global and local elements, companies should consider building local teams in focus markets, particularly in branding, marketing and communications functions where strategies can vary considerably by region.

Develop strong omnichannel propositions, leveraging both owned and third-party channels

Invest in developing integrated in-store and online propositions, adjusting for nuances in Asian markets:

- In China, consider direct-to-consumer and owned online propositions. Owned online channels have gained significant traction since 2020 due to declining offline traffic and rising customer acquisition costs in e-commerce marketplaces. Additionally, Chinese consumers value shopping direct-to-consumer for the personalisation it can offer â 69 percent of Chinese consumers value personalisation, according to a McKinsey survey.

- In India, partner with local online marketplaces. Limited real estate availability and last-mile logistics, especially in tier-two and -three cities, make partnering with local online marketplaces key to reaching consumers. E-commerce retailers like Flipkart-owned Myntra have become a key partner to international brands in India. H&M, for example, sells on the platform in India, while in all other markets it only sells through owned channels.

- In Japan, offer hyper-personalised retail services where appropriate. This approach is key to enticing local customers, particularly in luxury, where concierge-style strategies known as gaisho target VIP shoppers. Department store groups such as Daimaru Matsuzakaya report gaisho sales increased 7 percent in the first half of 2023 to account for nearly one third of all sales.

This article first appeared in The State of Fashion 2025, an in-depth report on the global fashion industry, co-published by BoF and McKinsey & Company.