- PEPE struggling with weak demand, despite flashing bullish signs courtesy of a price-RSI divergence

- Memecoin now failing to attract participation from whales too

Popular memecoin PEPE recently saw some bullish relief come its way after days of trending south. However, Its price action still demonstrated a lack of bullish momentum. Is there a reason why the market bulls are still on the sidelines right now?

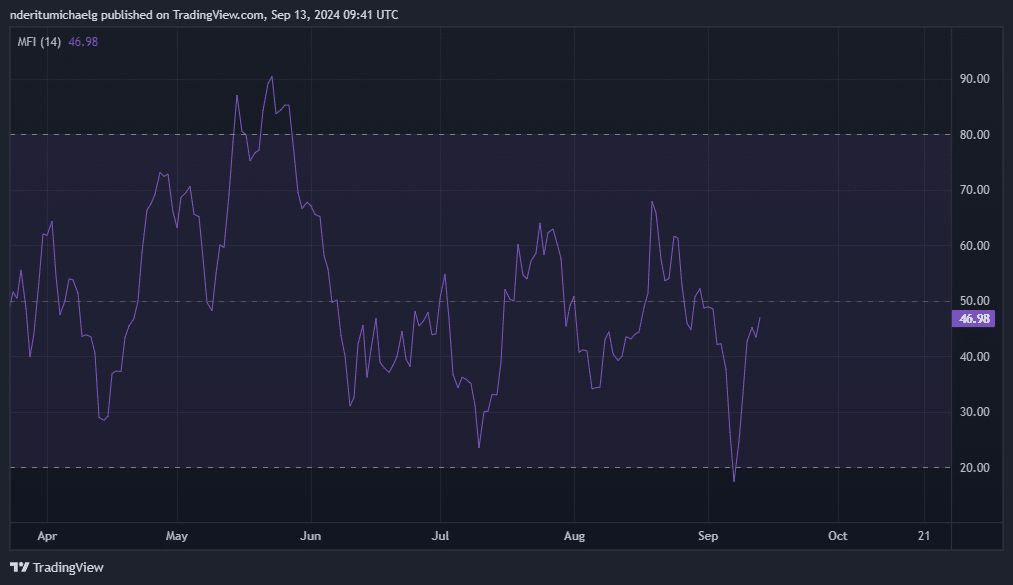

PEPE’s price action flashed a major bullish sign on the charts. Its price hit lower lows between mid-August and the end of the first week of September. Meanwhile, the RSI achieved lower highs, resulting in a bullish divergence. This is usually a bullish sign for any asset.

Source: TradingView

As a consequence, a PEPE swing low can be expected, followed by a significant rally. Especially in light of the fact that the price recently dropped closer to its 4-month low – A zone where it previously saw strong demand.

Is PEPE’s demand falling?

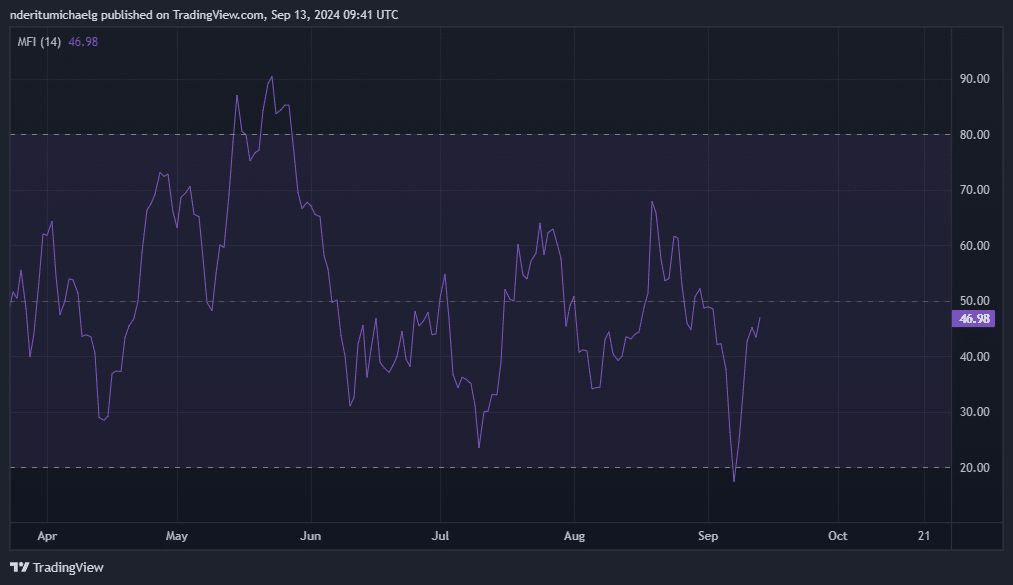

There was some accumulation which resulted in a bit of an uptick. This was evidenced by the Money Flow indicator, with the same bouncing back from the oversold zone towards the start of the week.

Source: TradingView

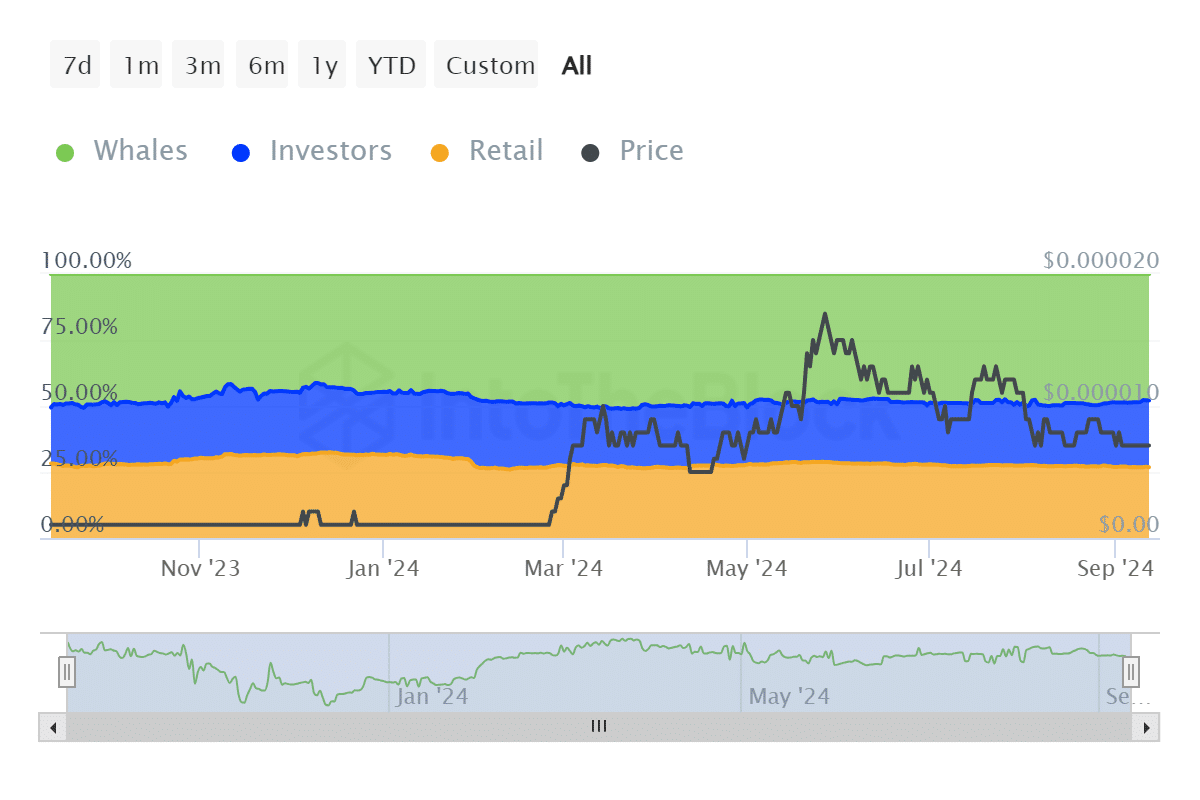

Demand has been relatively weak, despite this accumulation. In fact, an on-chain assessment revealed a lack of proper participation by whales. IntoTheBlock’s data also revealed that whales have trimmed their PEPE holdings since the start of September.

Whales held 203.27 trillion PEPE on 1 September. Their holdings have since dropped to 200.24 trillion PEPE. This may explain why the memecoin has been struggling to gain bullish traction.

Source: IntoTheBlock

The historical concentration data also revealed that retail holdings dropped slightly from 112.52 trillion PEPE to 112.08 trillion PEPE. The only positive gain was seen in the investor category which grew from 102.22 trillion PEPE to 105.75 trillion PEPE over the same period.

Simply said, there may still be some interest in PEPE. Nevertheless, the lack of demand from whales and retail buyers means that PEPE memecoin is losing ground in the short-term.

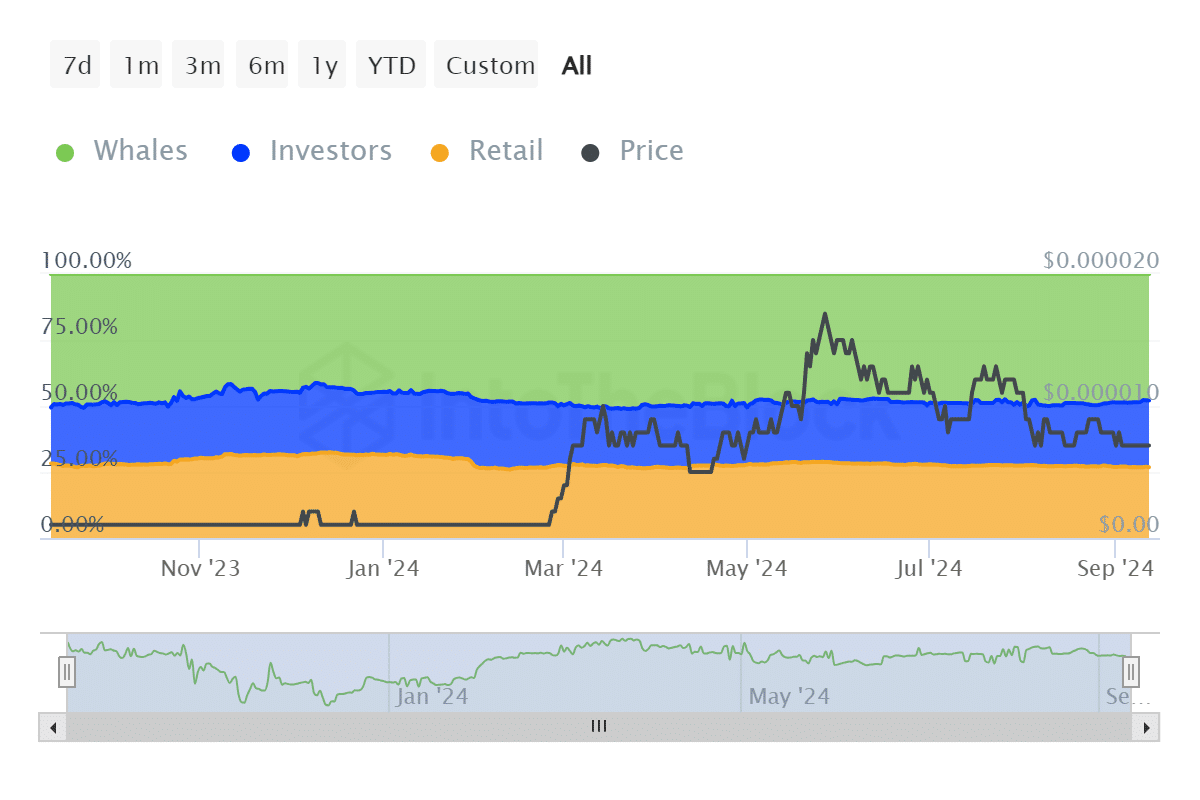

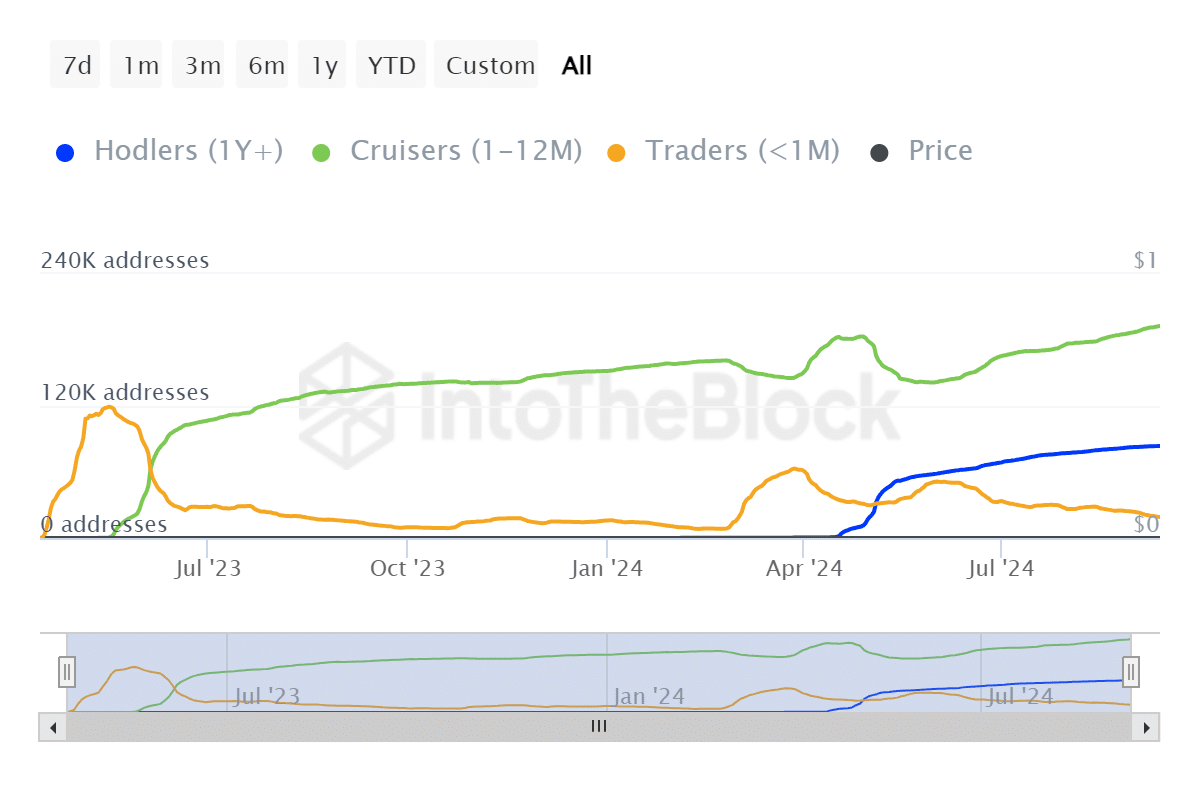

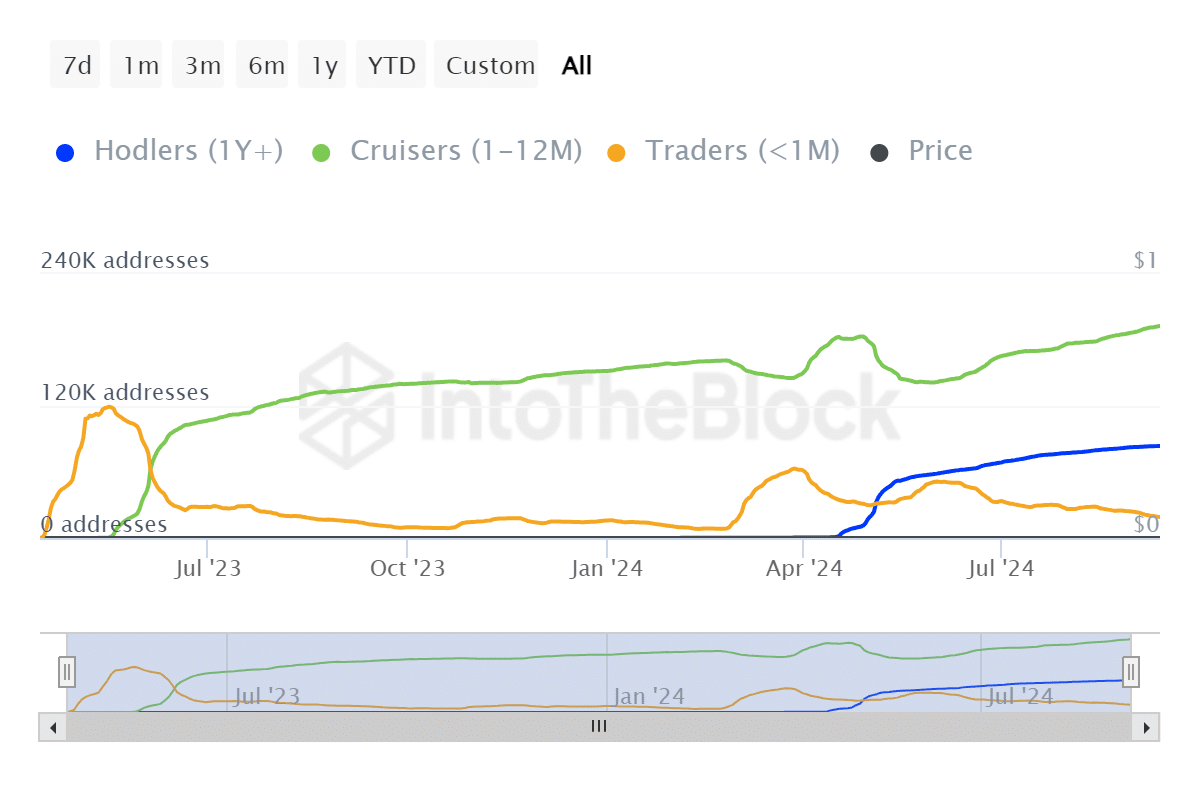

What about its long term position though? Well, another metric – PEPE addresses by time held – revealed that holders are close to their historic peak at 83,710 addresses. Short-term swing traders (cruisers) are also at their highest at around 192,790 addresses.

Source: IntoTheBlock

Meanwhile, traders have dropped considerably since June, to levels seen before PEPE’s February rally. This means PEPE has been shaking off weak hands. Hence, we may see a surge in the number of traders if PEPE records a surge in volatility. For now, however, the memecoin will be subjected to weak demand.