- VeChain broke out of a descending channel, approaching the $0.05 resistance level at press time.

- Growing volume and Open Interest indicated potential upside as VET eyed a key resistance level.

VeChain [VET] has seen a bullish surge recently, with the token trading at $0.02225 as of press time, reflecting a 2.14% increase in the last 24 hours.

The token has attracted much attention due to its potential to break through the key resistance level of $0.05, a milestone that could lead to further price appreciation.

With a 24-hour trading volume of $18.85 million and Open Interest growing by 3.48%, market participants are closely watching the token’s next move, particularly whether VET can potentially double in value.

Bullish breakout and technical indicators

VeChain has recently broken out of a descending channel that had defined its price movement over the past few months. The breakout has been accompanied by an increase in both volume and price momentum.

Source: TradingView

VET’s price has surged past key technical indicators, including its 9-day Exponential Moving Average (EMA) of $0.02170, signaling a potential shift in market sentiment towards bullishness.

The press time resistance level at $0.05 remained a key focal point for traders. If VET manages to surpass this level, it could trigger further buying pressure and open the door for more significant gains.

However, short-term caution is warranted as the RSI, on the 1-hour chart, was sitting at 50.68, indicating neutral momentum.

The slight pullback from recent highs suggested consolidation before any potential move higher.

Source: TradingView

Also, the MACD line crossed slightly below the signal line at the time of writing, suggesting a potential short-term slowdown in momentum.

However, the histogram showed minimal divergence, implying the trend could remain sideways in the near term.

VET surges in volume

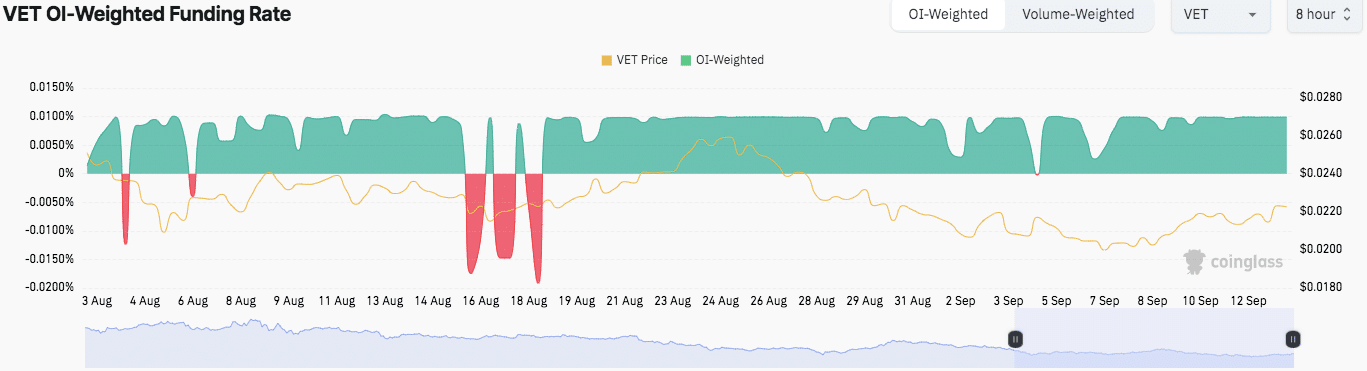

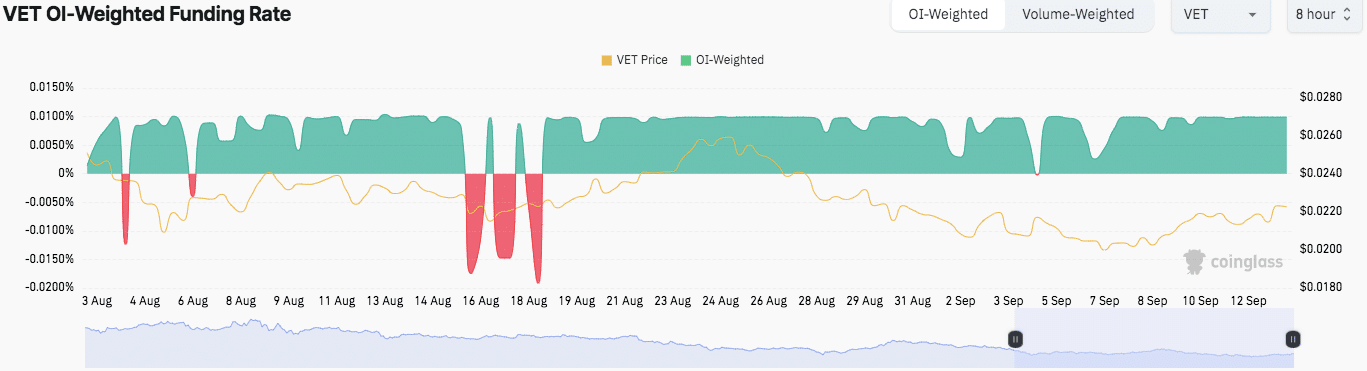

The Open Interest (OI)-Weighted Funding Rate for VET has stayed positive at 0.0099% at press time, indicating that long positions were paying funding fees to short positions.

This positive Funding Rate suggested that traders remained optimistic about the coin’s prospects, although brief dips into negative territory in mid-August signaled short-term bearish sentiment at the time.

Source: Coinglass

VeChain has witnessed a 26.58% increase in trading volume to $18.21 million, while its Open Interest in Futures contracts rose to $28.70 million, reflecting growing market participation.

Read VeChain’s [VET] Price Prediction 2024–2025

According to DefiLlama, VET’s Total Value Locked (TVL) was $80.26 billion at the time of writing, reinforcing its position as a solid player in the blockchain ecosystem.

These indicators suggested a growing interest in the token, but the market remains cautious as traders await confirmation of a breakout above the critical $0.05 resistance level.