- Uniswap’s large transactions surged by 200% in just 24 hours.

- Exchange inflows dropped steadily over the last three days as the altcoin’s price plunged by 9% in less than 48 hours.

Uniswap’s [UNI] market activity is sending mixed signals, leaving market participants scratching their heads on its potential trajectory in the near future.

On the one hand, the altcoin’s whale activity spiked, as evident from its large transactions shooting up by an impressive 200% within the last 24 hours alone.

On the contrary, UNI exchange inflows have been shrinking for three consecutive days. To complicate matters further, Uniswap’s price has taken a sharp nosedive, losing 9% in value in less than 48 hours.

What does this conflicting data mean for the altcoin’s future? Let’s break it down.

Uniswap whale activity skyrockets, but why?

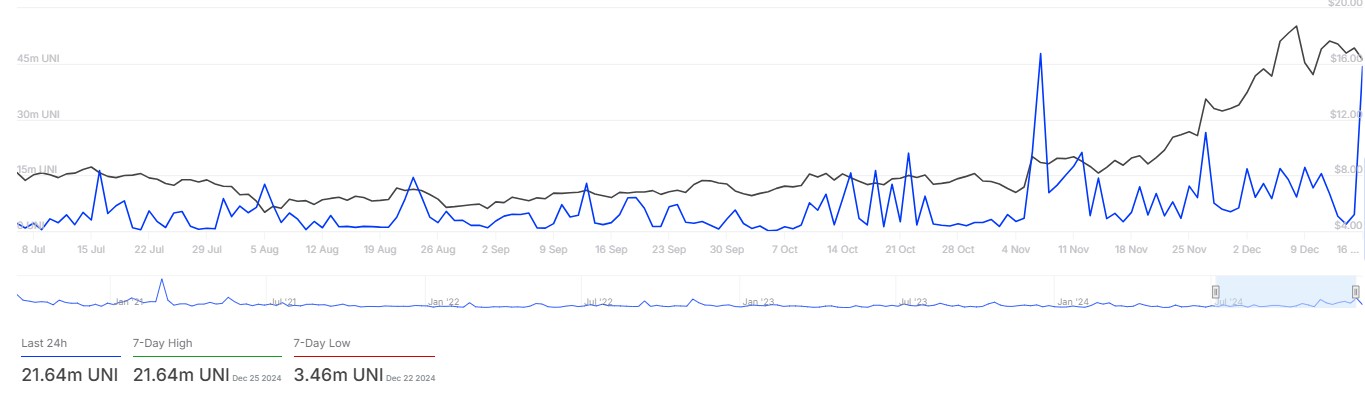

Historically, large transactions mirror whale activity, and Uniswap large transactions have seen a dramatic surge according to the IntoTheBlock data.

The altcoin’s 200% increase in large transactions over the last 24 hours indicated that the market’s big players are making huge moves.

This kind of activity can stir excitement since it often foreshadows strategic market positioning.

Yet, it cannot be determined whether whales are actually accumulating the Uniswap tokens for a bullish play or preparing to offload the holdings.

Source: IntoTheBlock

The lack of clarity leaves the market guessing, with market participants treading carefully through uncertainties.

Shrinking exchange inflows add to the mystery

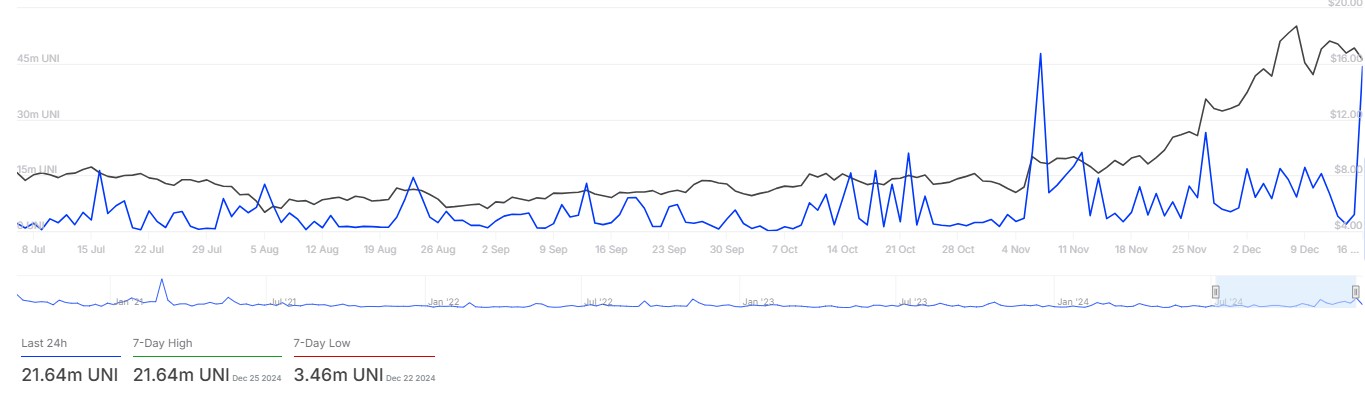

While whale activity is heating up, exchange inflows are cooling down. According to data from CryptoQuant, the amount of tokens flowing to exchanges in the last three days has been on a drastic drop.

In general, this downtrend is a sign that traders are holding, not preparing to sell their assets.

However, a reduction in inflows could also suggest waning retail interest.

This arising contrast between rising whale activity and falling inflows creates a puzzling scenario on whether whales seeing opportunities that retail traders are missing, or is something bigger on the cards.

Source: CryptoQuant

Uniswap price plunges despite market activity

Adding to the complexity, the price of Uniswap has dived by 9% in less than 48 hours. This steep dive suggests bears are in force.

Hence, the question arises — are whales supporting this market or using its relative weakness?

Source: TradingView

However, on the longer time-frames, Uniswap’s price action indicated a bullish trend. This suggested that the altcoin may be on a short correction before the ultimate rally.

Technically, its prices may drop to test the $12 key support level- a resistance level that turned support on the recent bullish rally.

Read Uniswap’s [UNI] Price Prediction 2025–2026

AMBCrypto’s deep analysis of Coinglass’ liquidation data may provide the much anticipated answers. With about 818K worth of UNI to be liquidated if the price drops further to around $12 key price level.

The altcoin may drop further to $12 before a potential rally from the whales’ increasing buying pressure.

Source: Coinglass