- UK High Court classified Tether (USDT) as property, setting a legal precedent

- Bill before British parliament expands the definition of ‘property’ to include digital assets like NFTs and cryptocurrencies

The landscape of cryptocurrency adoption is shifting with every passing day, with Chainalysis’s Global Crypto Adoption Index’s latest report testifying to the same. According to the same, while India and Nigeria lead globally, the United Kingdom lags behind at 12th among the top 20 countries.

However, recent advancements in the UK’s regulatory framework could mean the tide is turning for the better.

A landmark ruling

A recent ruling by a British High Court has designated stablecoin Tether (USDT) as property. This is a historic first under English law for cryptocurrency classification following a comprehensive trial.

In his ruling on 12 September, Deputy Judge Richard Farnhill of the High Court of Justice remarked,

“USDT attract property rights under English law.”

He added,

“It [USDT] is neither a chose in action nor a chose in possession, but rather a distinct form of property not premised on an underlying legal right. It can be the subject of tracing and can constitute trust property in the same way as other property.”

Judge Farnhill highlighted a well-established precedent affirming that cryptocurrencies qualify as property. In doing so, he referenced a 2019 judgment from the same court which was not contested at trial.

Is there more to it?

This view is in line with the Law Commission of England and Wales’s 2023 report which categorized digital assets as property.

Here, it’s worth pointing out that the aforementioned ruling coincided with a U.K government bill, introduced just a day prior. It aims to define non-fungible tokens (NFTs), cryptocurrencies, and carbon credits as “things” and “personal property” under existing property laws.

The bill proposes an expansion of the traditional definition of “property,” which previously encompassed “things in possession” and “things in action.” If passed, it will introduce a third category of “thing,” specifically designed to include digital assets that confer personal rights.

This change aims to explicitly recognize and incorporate digital assets into the property framework. This is a sign of growing significance in the asset class and the need for legal clarity in their treatment.

USDT legal status questioned?

For those unaware, recently, the legal status of USDT also emerged as a key issue in a case where fraud victim Fabrizio D’Aloia’s stolen cryptos, including USDT, were laundered through crypto mixers and exchanges.

D’Aloia failed to prove that his stolen USDT reached the Thai exchange BitKub.

While Judge Farnhill acknowledged the fraud, he ruled that the use of crypto mixers prevented tracing the USDT to BitKub’s wallet. This led to the dismissal of D’Aloia’s breach of trust claims.

USDT emerges the winner

In the meantime, Tether has emerged as a dominant force in the stablecoin sector.

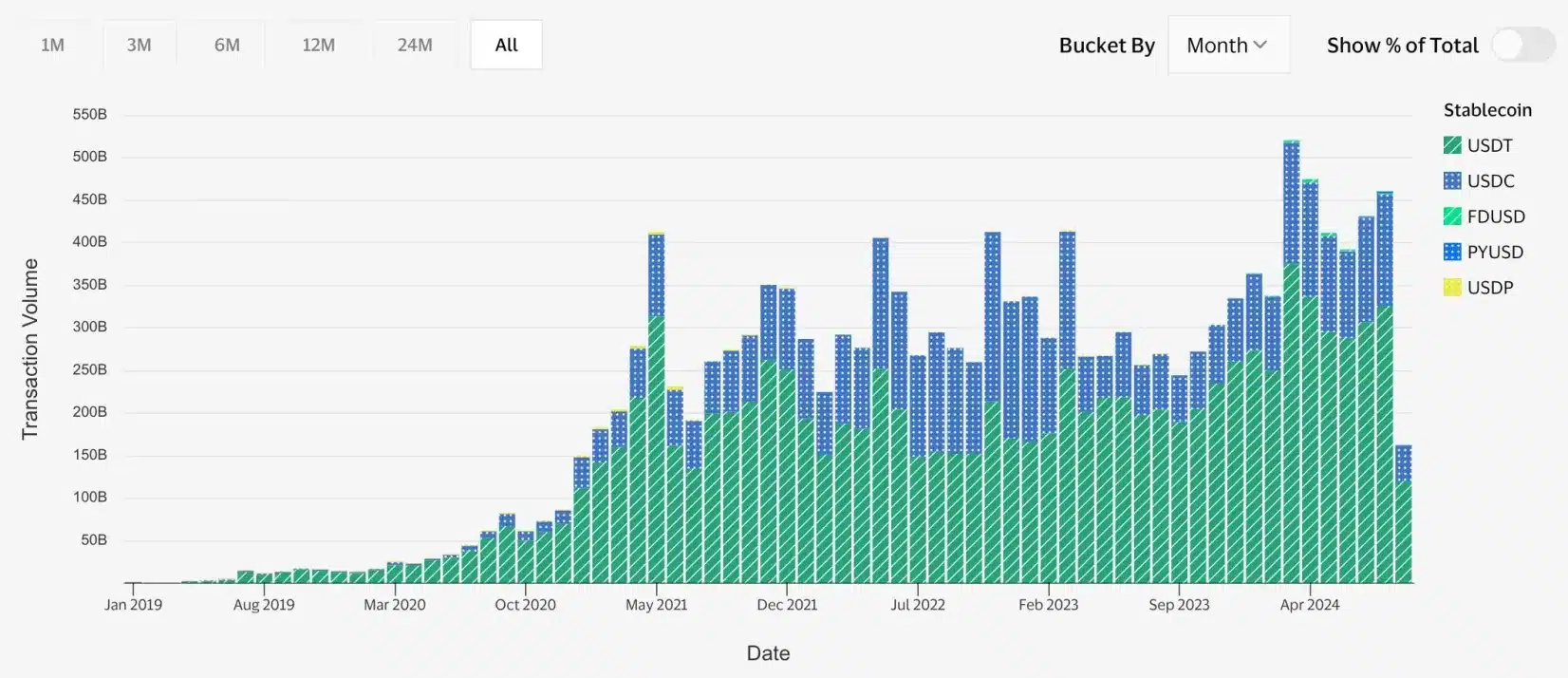

According to Visa on-chain analytics, USDT has significantly outpaced Circle’s USDC in transaction volume, reinforcing its leading position in the market.

Source: Visa On-chain Analytics

As expected, USDT has significantly contributed to the recent expansion of the stablecoin market.

Beginning 2024 with a market capitalization of $91.69 billion, Tether has seen steady growth since. In fact, it reached a market cap of over $117.84 billion in August.