- TURBO has a strong bullish outlook, provided it can defend $0.01

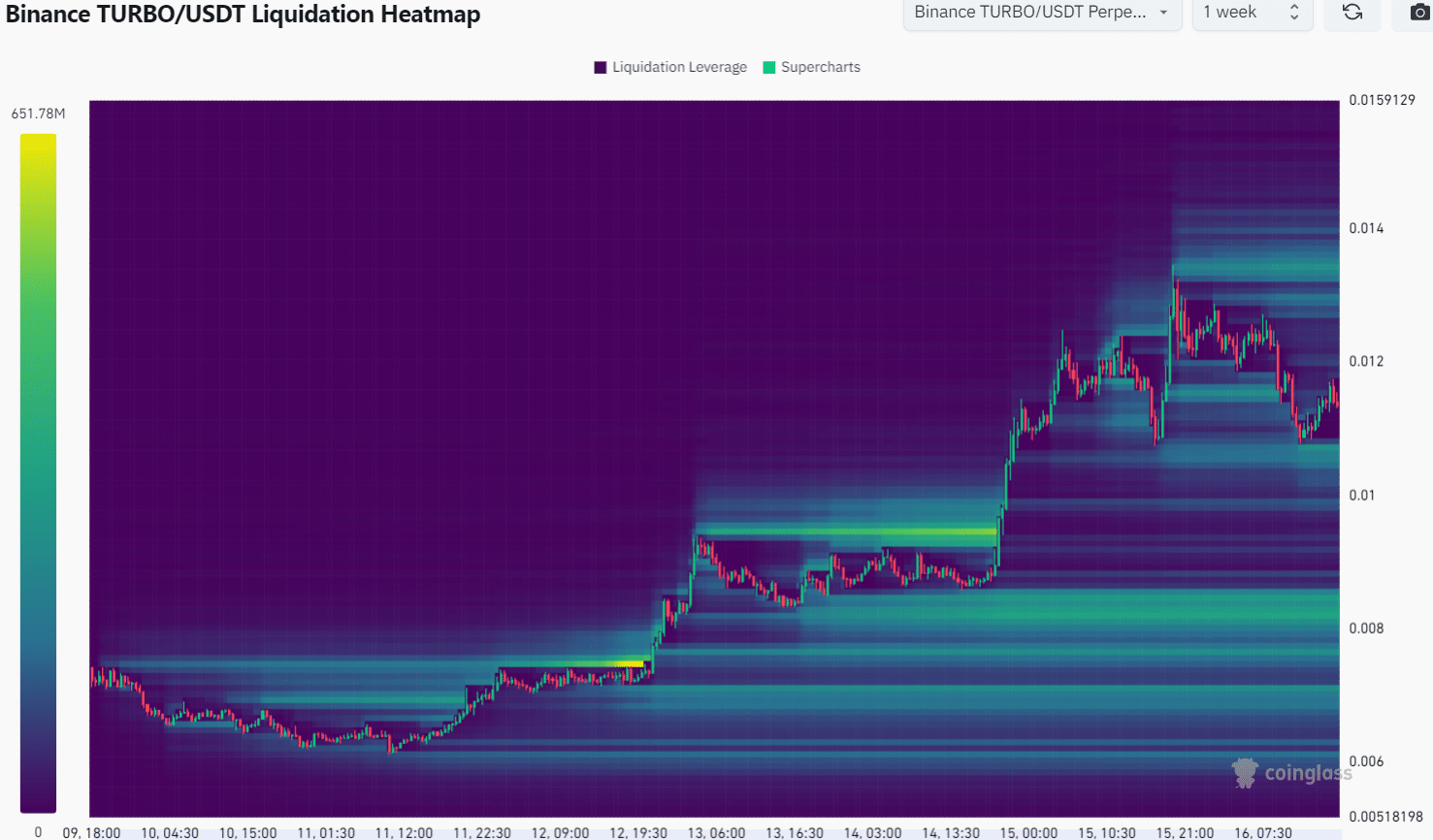

- Liquidation heatmap appeared to have confluence with the Fibonacci support levels

Turbo [TURBO] bulls have been on a mission and the memecoin lived up to its name with rapid gains in recent days. Since 3 October, the token has gained by 140%. TURBO accomplished a near 120% rally within four days, before the volatility on Tuesday disrupted its bullish plans.

As things stand, the token’s rejection from $0.013 is likely just a temporary setback. If the price dips lower than the $0.01 level, swing traders might have to flip their bias bearishly.

Uptrend showed some signs of weakness

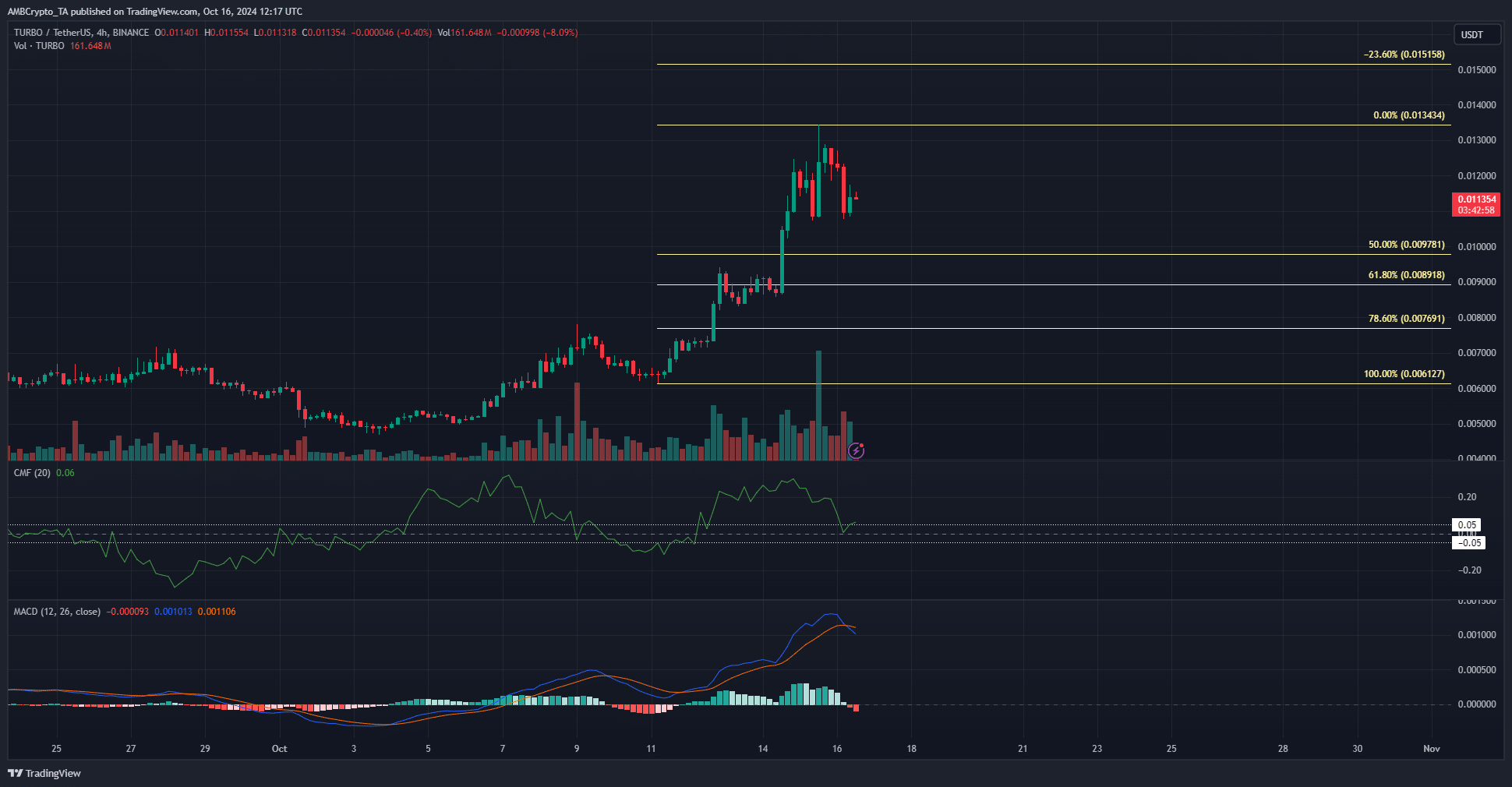

Source: TURBO/USDT on TradingView

The CMF on the 4-hour chart was well above +0.05 in recent days. The rejection from the psychological $0.01 level on Tuesday changed this, dragging the indicator to its press time value of +0.06. This seemed to be a sign of sizeable inflows, but they did slow down in comparison.

The MACD formed a bearish crossover above zero – An early sign of a price drop. The size of the incoming dip is unclear though. The Fibonacci levels were plotted based on past week’s rally from $0.0061 to $0.0134.

The 50% level at $0.0097, if retested, is likely to provide a bullish reaction. The $0.089 level could also offer a buying opportunity for swing traders. A deeper drop would shift the market structure bearishly on higher timeframes and could delay a potential recovery.

TURBO price prediction from the liquidation heatmap

Source: Coinglass

Momentum and buying pressure have not swayed wholly in favor of the sellers yet either. The short-term liquidation heatmap underlined the $0.0104-$0.0106 zone as a liquidity pool of interest.

Realistic or not, here’s TURBO’s market cap in BTC’s terms

A sweep of this area could be followed by a continuation of the aforementioned rapid gains. Traders should be wary of buying too early, as the $0.0083 level is also a magnetic zone. This could drag the crypto’s value lower this week.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion