- Bullish structure and changing momentum could guide TON prices higher

- Metrics noted heightened profit-taking activity when the price hit $6.8 – A key resistance

Toncoin [TON] faced rejection from the $6.8 resistance zone last weekend, but the bulls showed resilience. At press time, they were fighting to establish an uptrend, with the evidence at hand suggesting that they might succeed.

Source: TON/USDT on TradingView

The 1-day chart revealed a bullish structure, despite the retracement to $4.72 earlier in August. The OBV climbed significantly higher over the past ten days, supporting the idea of high demand.

Additionally, the RSI showed that the momentum was on the verge of shifting bullishly.

Social sentiment could spur further gains for TON

The breach of the $6.8 resistance on Wednesday, 14 August was critical. It flipped the daily market structure bullishly and breached the range that Toncoin had traded within from early June to late July.

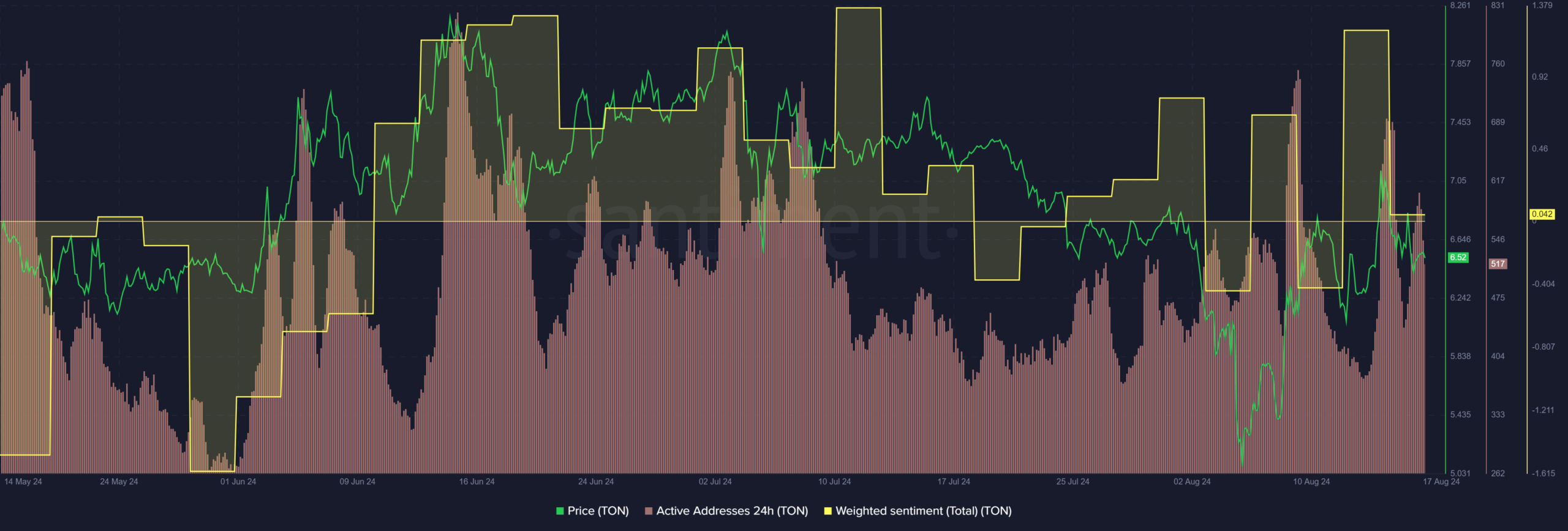

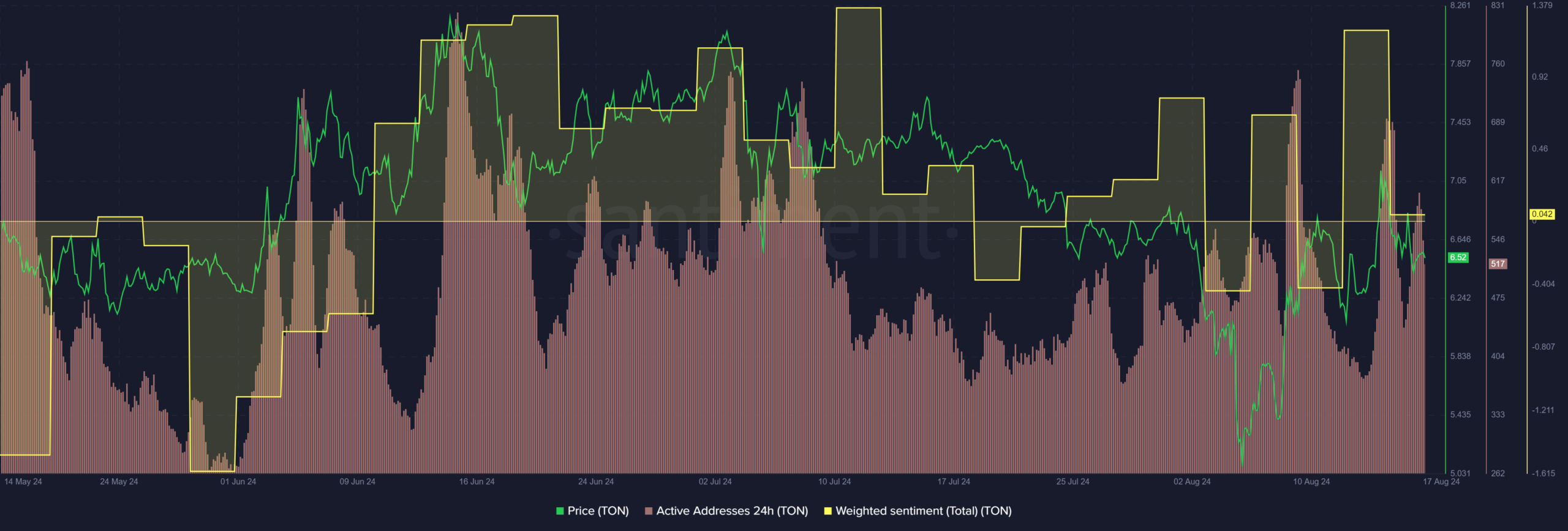

Source: Santiment

This bullish structure break was accompanied by strongly bullish online engagement.

That’s not all though as the daily active addresses metric has slowly trended upwards since mid-July. Together, the two metrics pointed to a good chance of sustained demand and adoption.

Does the recent distribution phase mark the beginning of a bearish reversal?

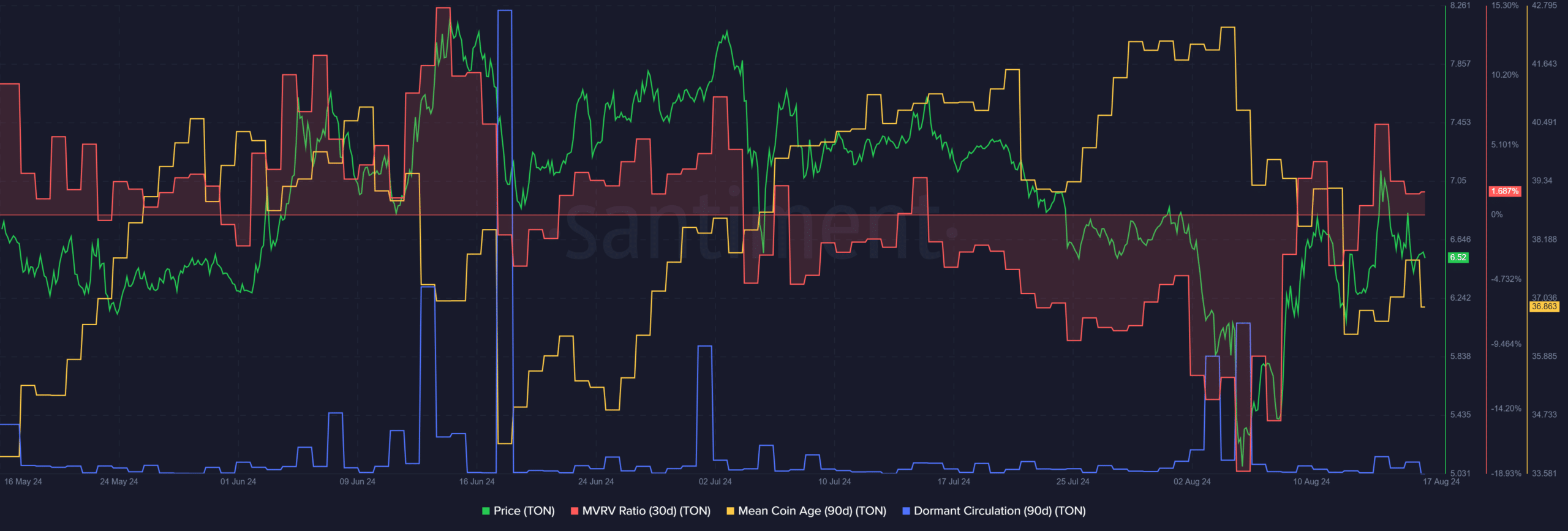

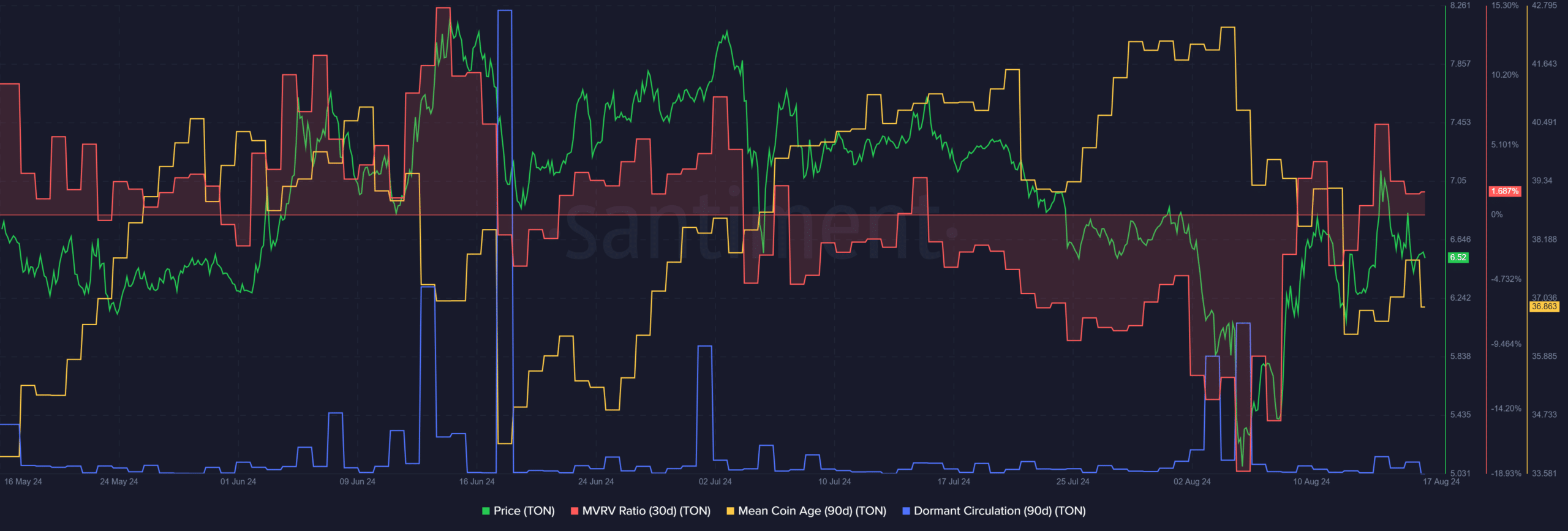

Source: Santiment

Since 4 August, the mean coin age has trended south. After the $4.27 retest, Toncoin has trended upwards over the past ten days. Typically, a rising price and a falling mean coin age indicate profit-taking activity.

The 30-day MVRV was positive too, showing that this profit-taking activity has room to continue. The falling mean coin age represented a distribution phase, while the MVRV did not signal a buying opportunity yet.

While it looked worrisome, the dormant circulation has been flat in recent days. This might alleviate some of the fears that TON is undergoing distribution.

Is your portfolio green? Check the Toncoin Profit Calculator

Overall, the technical and on-chain metrics suggested the token has more room for bullish growth.

In fact, IntoTheBlock data showed a +0.75 30-day correlation between TON and Bitcoin’s [BTC] price movements. Hence, TON bulls should be wary of volatility or a short-term trend shift in Bitcoin.