- TON’s user base drops sharply, but past trends suggest potential for another explosive surge.

- With 91% of tokens in large holders’ control, TON faces centralization concerns amidst bearish indicators.

TON network has experienced a sharp decline in daily active users, dropping from over 5 million at its peak to 1.58 million, according to data from IntoTheBlock.

This significant decrease has raised questions about whether the previous hype is fading or if a new surge is on the horizon.

The history of TON’s daily active addresses shows a series of rapid increases, generally tied to specific events or broader market excitement. In the initial phase from late October to mid-December, user activity remained relatively stable, with no major spikes.

However, the period from late December to mid-March witnessed a gradual uptick, indicating growing user interest.

Source: IntoTheBlock

Between mid-March and late April, daily active addresses spiked sharply, possibly driven by price increases and heightened market interest. The period from May to early July saw fluctuations, characterized by short-lived peaks.

Another substantial rise was observed between late August and early October, marking the highest levels of the year.

Yet, user activity has recently declined, settling at 1.58 million—though it remains higher than early levels.

Price trends and concentration

TON was trading at $5.26 at press time, reflecting a -0.34% decline over the last 24 hours and a 2.11% increase in the past week. The trading volume stands at $299.64 million, while the total market cap is approximately $13.32 billion.

Notably, 91% of the token’s supply is held by large holders, pointing to a high level of centralization.

With 73% of holders at a loss and only 15% in profit, market sentiment remains cautious. The low price correlation with Bitcoin (at 0.12) indicates that TON’s movements are less influenced by Bitcoin’s price trends.

Over the past week, transactions exceeding $100,000 totaled $42.01 billion, yet net exchange outflows reached $8.81 million, suggesting more TON leaving exchanges than entering.

On-chain metrics remain mostly bearish

On-chain indicators for TON show a mostly bearish sentiment. Three bearish signals include: “In the Money” (-0.14), indicating low profitability among holders; concentration (-0.04), suggesting centralization; and large transactions (-0.23), pointing to decreased big-money movements.

The sole bullish indicator is net network growth (+2.97%), hinting at potential user expansion despite current downturns.

Read Toncoin’s [TON] Price Prediction 2024–2025

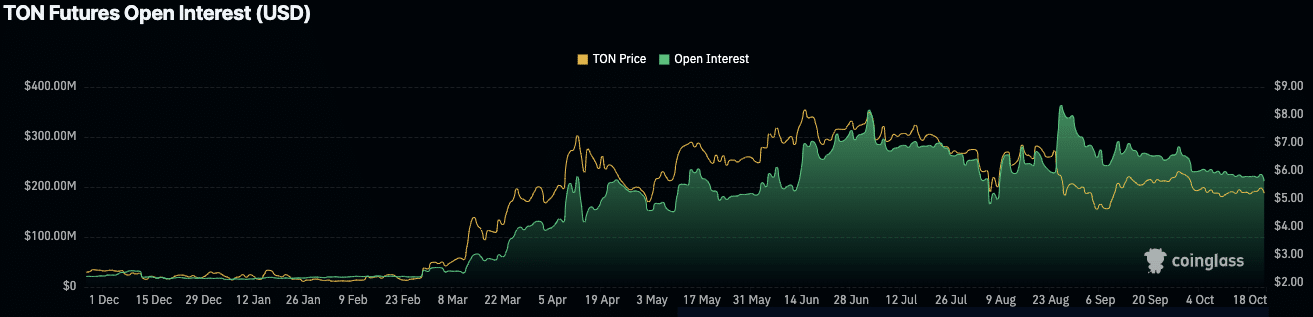

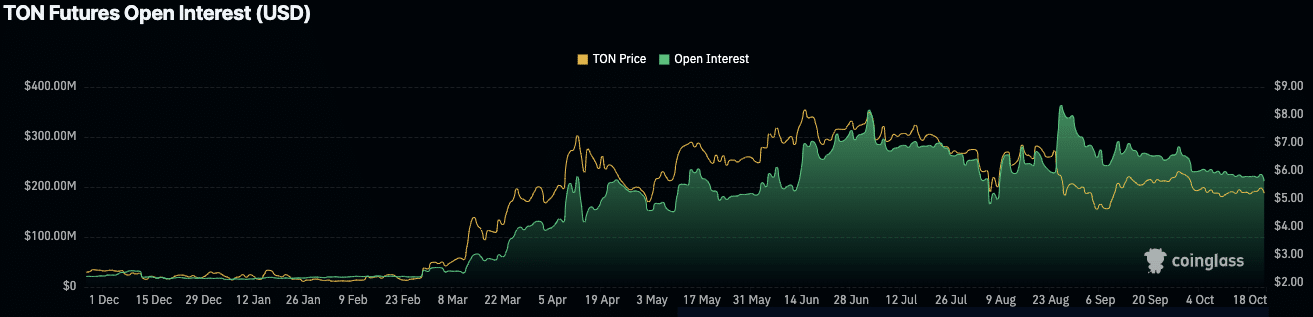

Futures open interest has also seen ups and downs, according to Coinglass data. It reached its highest level above $300 million in early August, but has since dropped to $214.18 million, a 1.99% decrease in recent trading activity.

Source: Coinglass

While current metrics suggest a cooling phase, past patterns show that TON’s user base can rapidly expand during periods of renewed interest or market events.