- TON DEX platforms experience a surge in transactions, with STON.Fi capturing 90% of market activity.

- Toncoin has tapped a key support zone, suggesting potential further price increases if historical trends repeat.

Toncoin [TON], a Layer 1 smart contract platform specialized in financial applications, has been showing an interesting trend in its blockchain activity.

Originally developed by Telegram’s co-founder Nikolai Durov as the “Telegram Open Network,” it has since been rebranded under the TON Foundation as “The Open Network.”

TON is experiencing rising interest, particularly in its decentralized exchanges (DEXes), which has coincided with a stabilization in the price of its native token Toncoin.

Toncoin has seen a modest price increase, rising by 2.2% over the past week and was trading at $5.62 at press time. However, beyond its price movements, a CryptoQuant analyst recently highlighted a significant surge in activity on TON-based DEXes.

TON fundamentals signal bullishness

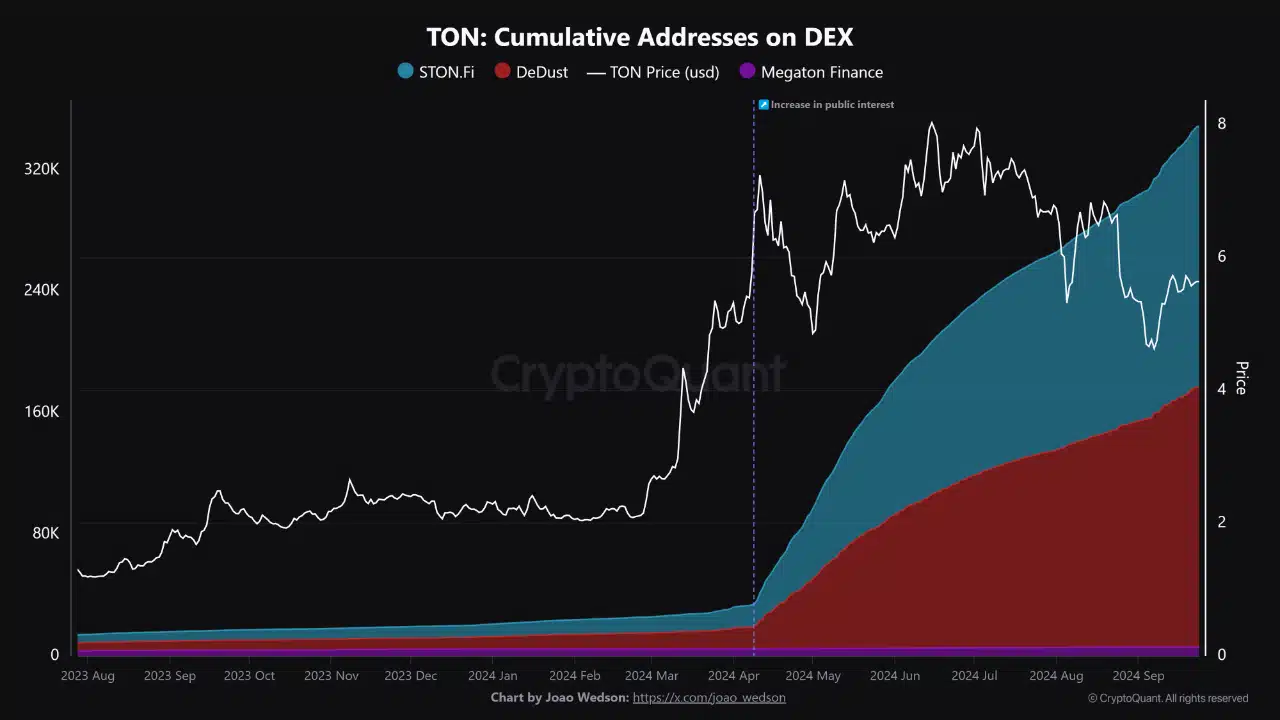

According to the CryptoQuant analyst, the number of addresses and transactions on these DEXes have skyrocketed, demonstrating growing interest from investors.

Source: CryptoQuant

Interestingly, this spike in activity seems to have occurred after Toncoin’s price stabilized, suggesting that while early adopters were already well-positioned, many traders might have arrived too late to benefit from speculative gains.

Despite the stabilization in Toncoin’s price, the surge in new addresses and increased DEX activity indicates sustained interest in decentralized trading within the TON ecosystem.

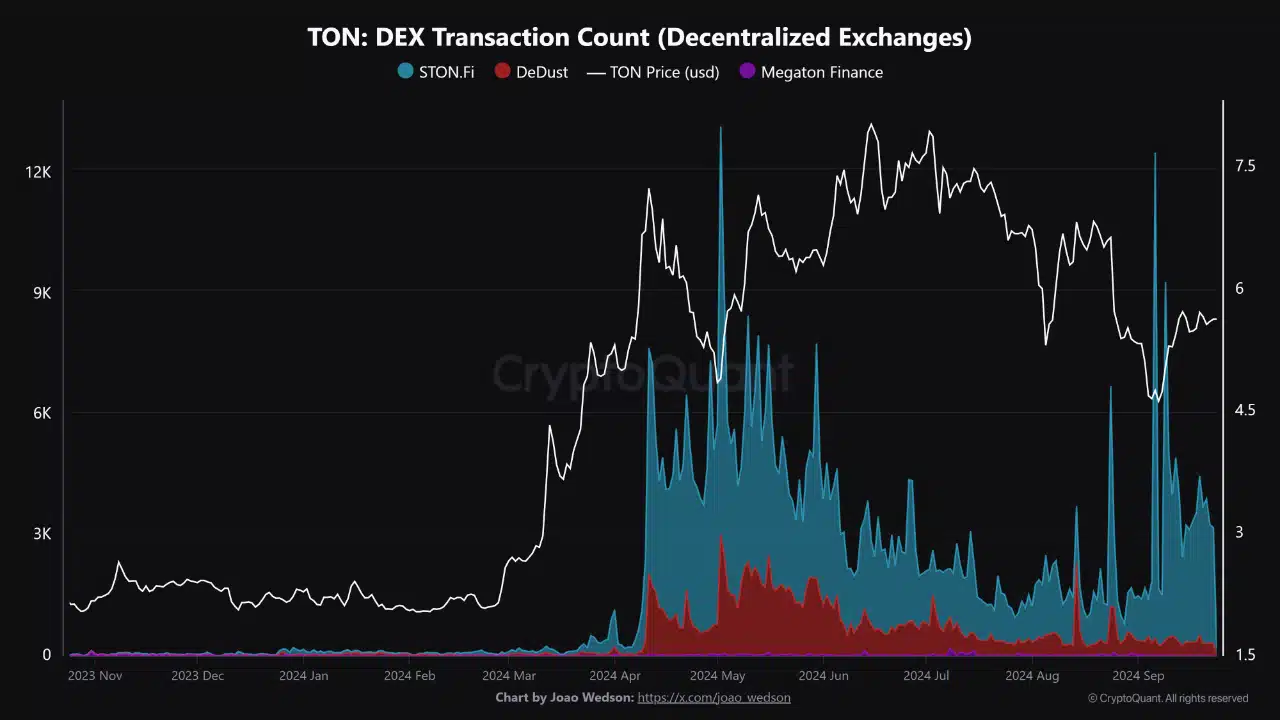

Among the various platforms, the analyst revealed that STON.Fi stands out as the clear leader, capturing 90% of all DEX transactions on the TON network.

Source: CryptoQuant

This has positioned STON.Fi as the “most competitive” decentralized exchange in the TON ecosystem, driven by strong community engagement and a solid infrastructure.

In contrast, other platforms like DeDust have been losing market relevance, while Megaton Finance has struggled to gain significant traction over time.

Notably, the increased activity on TON’s DEXs suggests that the platform is gaining momentum as a hub for decentralized finance (DeFi).

With STON.Fi leading the charge, the TON network could potentially see more growth in its decentralized trading ecosystem as it attracts more users and liquidity.

The growing user base on these DEXs, coupled with the broader adoption of decentralized trading on TON, reflects an expanding community that’s increasingly engaging with the network’s financial applications.

Price support and technical momentum

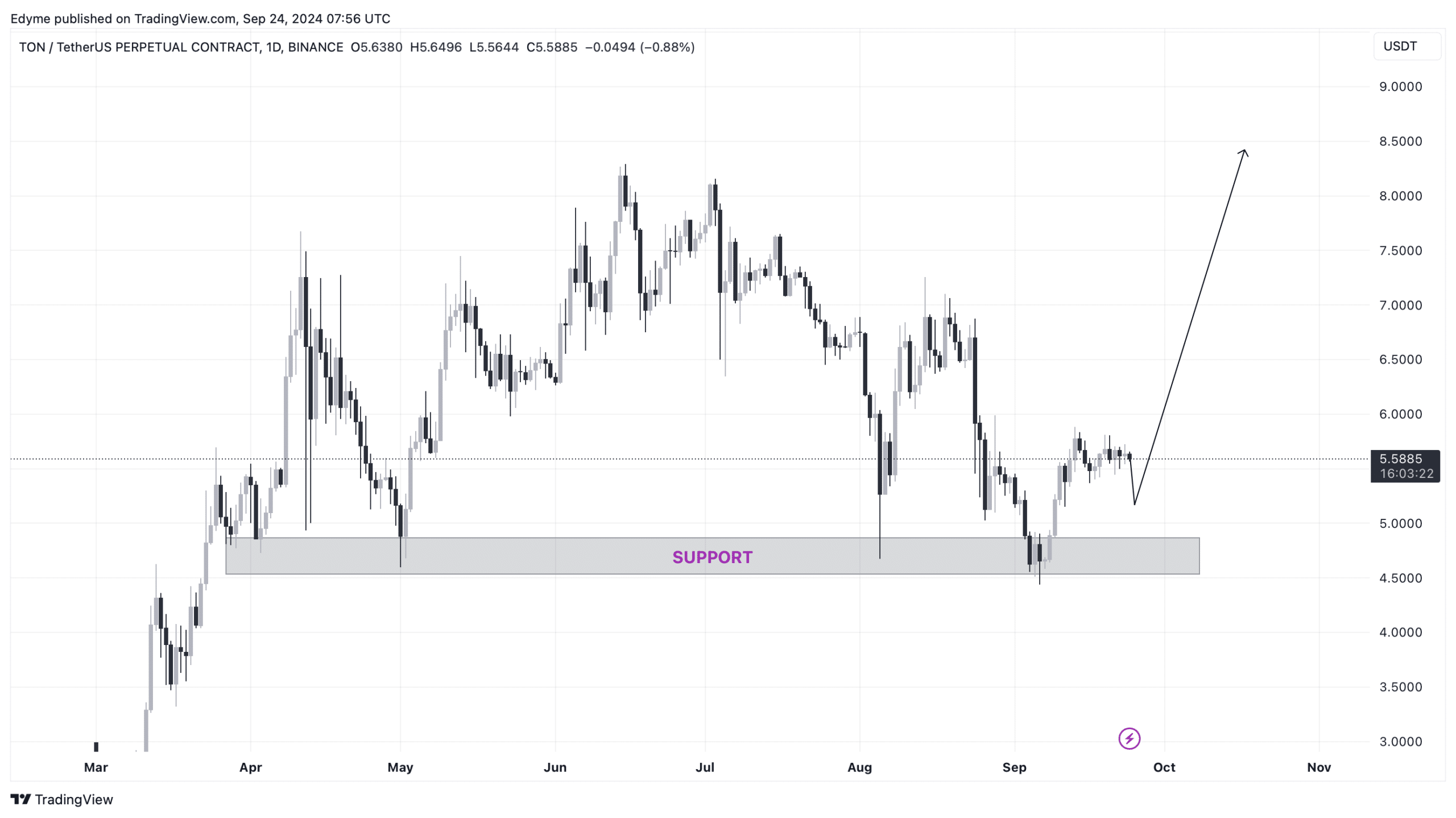

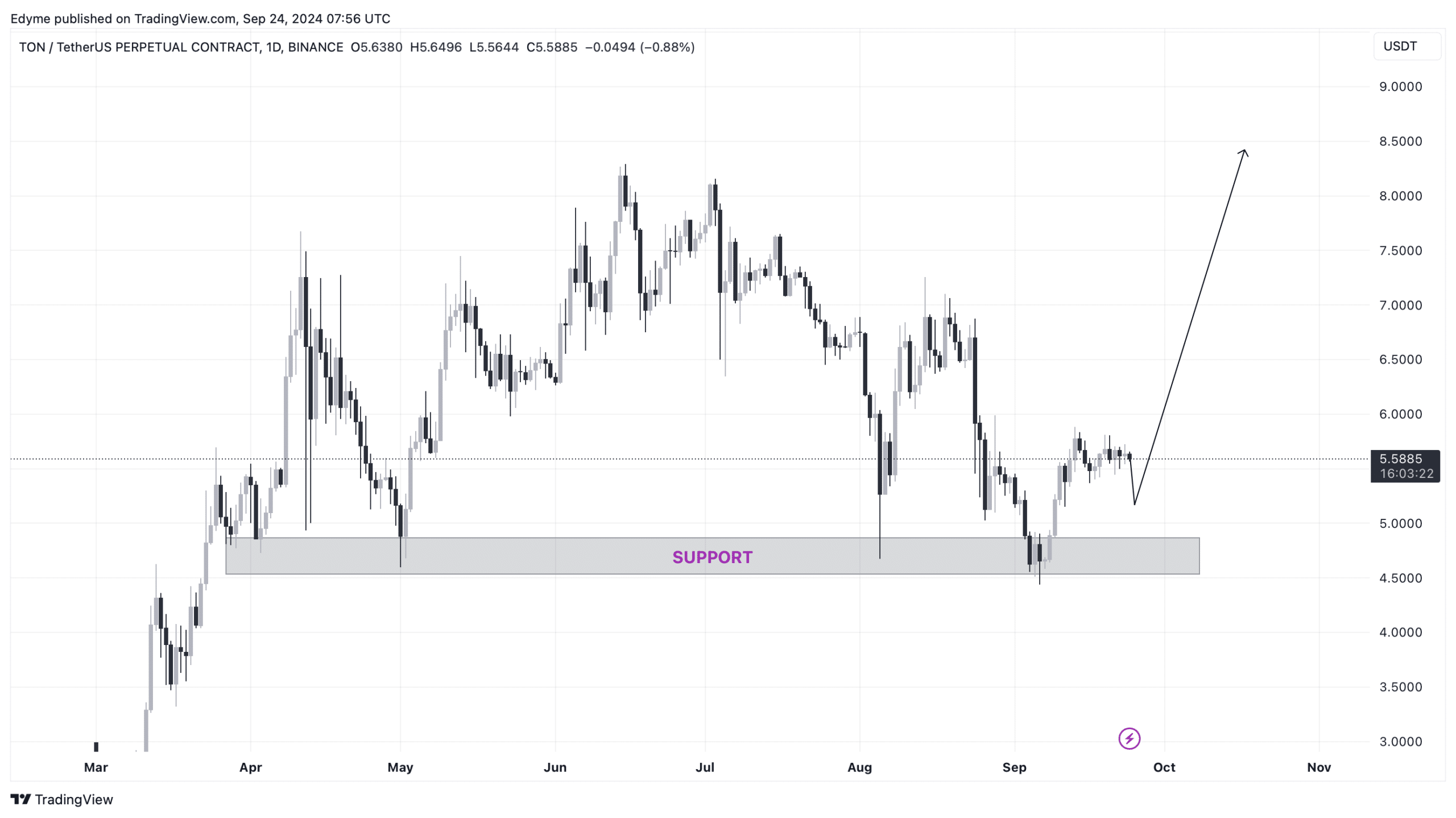

On the technical front, Toncoin’s price chart indicates a potentially bullish outlook. The asset has recently tapped into a key support zone, which historically has triggered price reversals.

Source: TradingView

This support zone, identified at the $4.5 level, has proven to be a critical point for Toncoin, with previous instances of price rebounds observed when TON approached this zone.

As Toncoin once again reaches this support level, there’s growing speculation that the asset could see further upward price movements, especially if historical chart patterns repeat.

Read Toncoin’s [TON] Price Prediction 2024-25

If Toncoin continues to find support at this key level, it could attract additional buying pressure from both retail and institutional investors.

The combination of rising activity on TON’s decentralized exchanges and strong technical support could further propel the asset’s bullish momentum.