- SUI could be gearing up for a breakout as weak hands exit the market.

- If this happens, a shift in rankings among the top 20 might follow.

Sui [SUI] has made a significant impact in the past 30 trading days by surpassing Litecoin [LTC] in market cap. Its growing user base has certainly fueled this upward trend.

However, a recent weekly pullback of over 3% has landed SUI on the top losers chart.

This divergence prompted analysts at AMBCrypto to examine whether the recent pullback was a deliberate attempt to shake out weak hands, setting the stage for a stronger push that could close SUI near $2.40.

If so, a rebound could cost NEAR its position as the 17th biggest crypto by market cap; otherwise, Litecoin appears poised to reclaim its spot.

SUI hits a transactional milestone

Interestingly, SUI has demonstrated strong upward potential over the past two months. Despite the bearish cycles, the bulls have managed to prevent any retracement, maintaining the last support level at $0.53.

Trading at $2.06 at press time, SUI has shown impressive gains in a short timeframe. This surge was marked by a significant peak, with the RSI reaching overextension.

However, despite this concern, the token has maintained its upward trajectory, experiencing only minor hiccups, strategically smoothed out by bullish support.

This momentum is bolstered by the network’s design, which aims to address traditional blockchain shortcomings by enabling faster transactions without congesting the network.

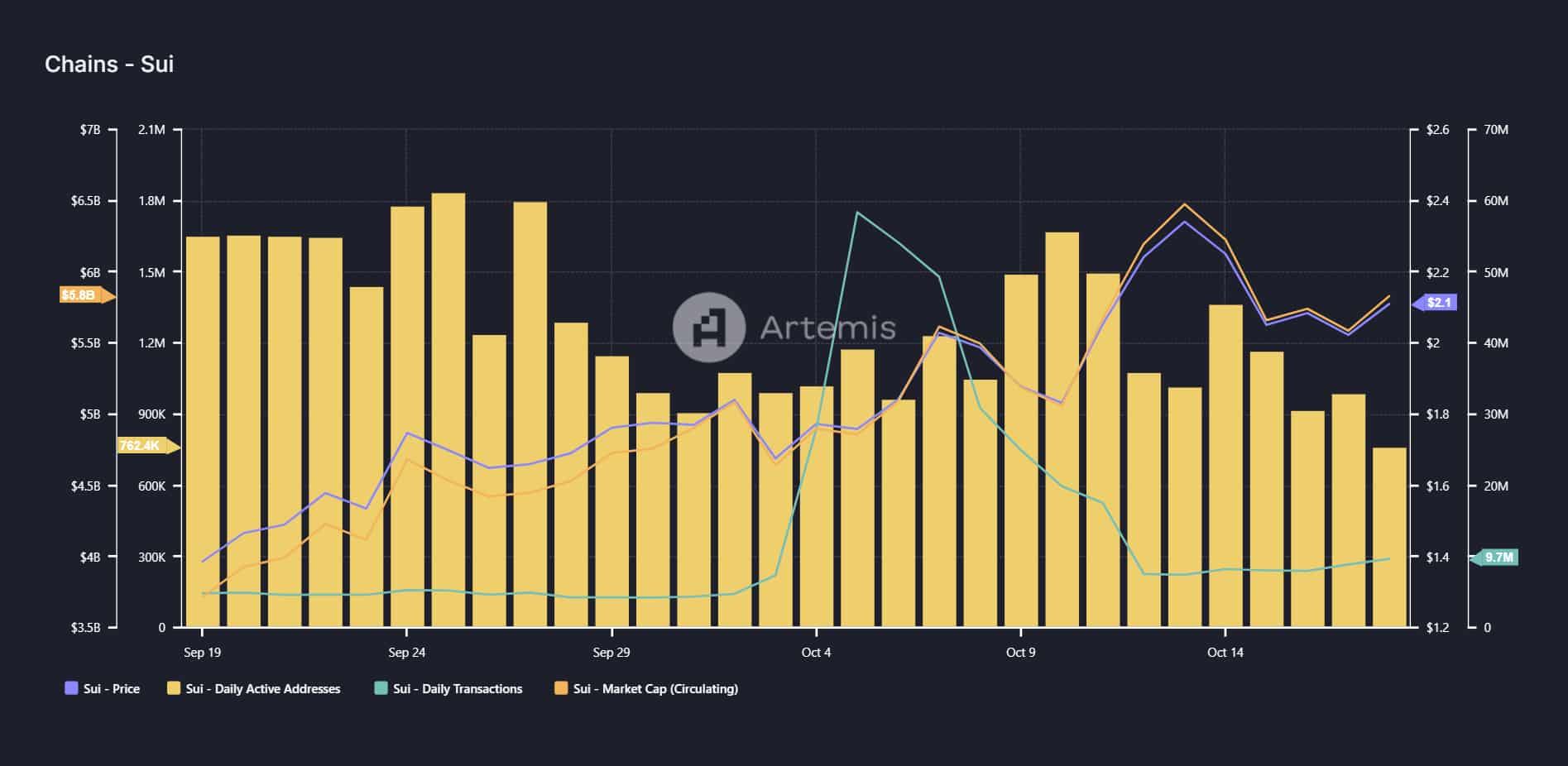

Achieving 270K TPS, SUI has resonated well with crypto users, boasting a remarkable $6 billion in transactional volume.

This success propelled SUI to an ATH of $2.40 just a week ago.

However, as this price range indicated a potential top, many wallets began offloading their holdings, leading to a significant drop in daily transactions, which fell by half to $20 million.

Source: Artemis Terminal

This trend suggests that the surge has shifted many stakeholders into profit, prompting weak hands to exit.

Yet, for a rebound to materialize, it is crucial for new buyers to target the local low at $2 as a potential dip, anticipating a rally that could offer substantial returns.

If this trend holds, SUI could experience an intense rebound, potentially leading to a new ATH. In such a scenario, its market cap might trigger a shift in rankings within the top 20.

Intense rivalry ahead

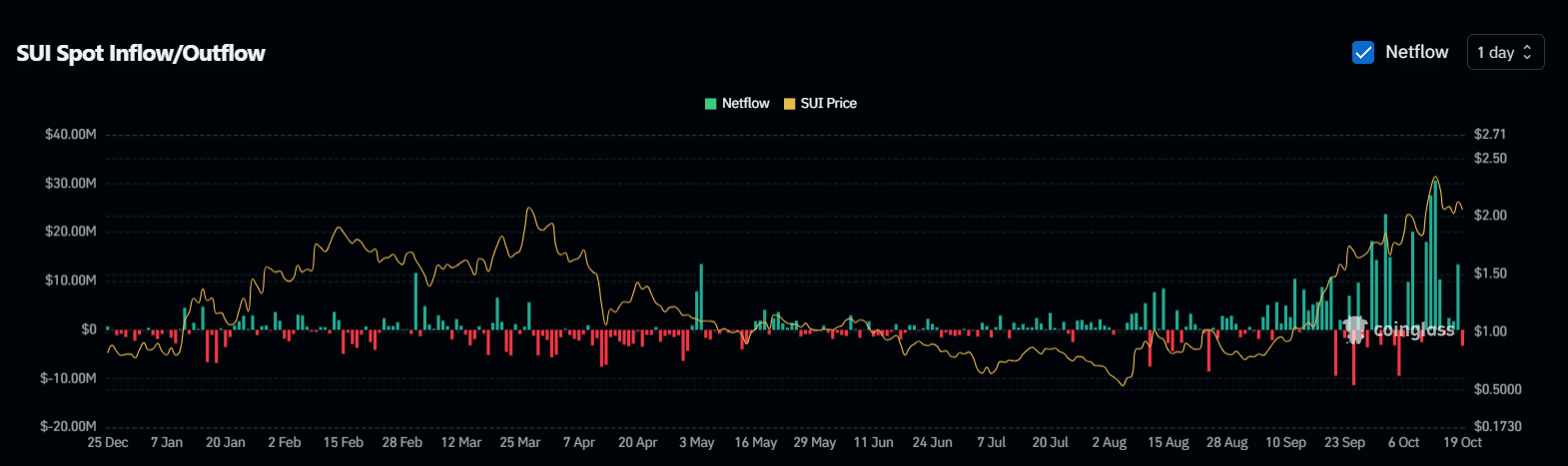

Surprisingly, despite the surge SUI experienced over the past 60 days, spot traders continued to offload their holdings, bringing daily volume down to $30 million.

However, the price has stabilized, suggesting potential accumulation by stakeholders, which is crucial for a rebound.

Source: Coinglass

The recent weekly pullback has brought SUI close to the $2.05 mark, making it essential for holders to view this as the ideal entry point. The recent red wick indicates that many may be adopting this strategy.

Read Sui’s [SUI] Price Prediction 2024-25

If this trend holds, SUI could be gearing up for a significant correction near $2, as a recent MACD crossover has turned bearish, hinting that prices may drift lower unless spot traders ramp up their buying activity.

If this renewed interest materializes around the $2 mark, a robust rebound could follow. However, to surpass NEAR, the rebound must drive SUI back to around $2.40.