- Stablecoins outperformed the overall market in April and posted a 4.7% growth.

- USDT, FDUSD, and Ethena’s USDe shined, but USDC stalled.

Stablecoins defied the broader market retracement in April and surged higher, hitting a 7-month of consecutive growth.

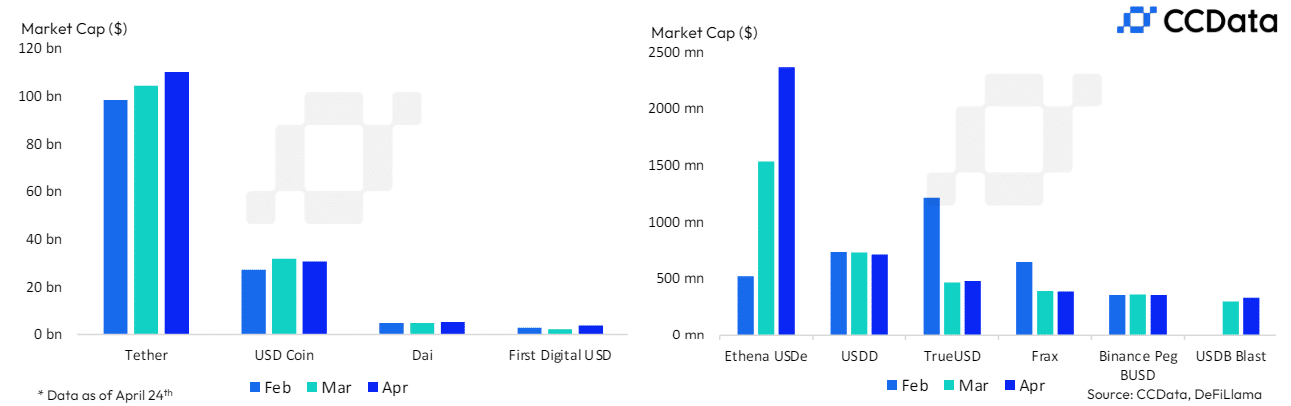

The sector increased by 4.76%, lifting its market cap to $158 billion, per the CCData report. On YTD (Year-to-Date) basis, stablecoins have added $27.1 billion.

This massive growth tipped stablecoin market dominance to increase to 6.30% from March’s reading of 5.43%. The surge amidst overall market drawdown was the first of its kind, as the report noted;

“This recorded the first increase in stablecoins dominance as markets retraced in April due to higher-than-forecasted inflation data in the US and escalation in geopolitical tensions last month.”

Interestingly, April’s growth was led by US-based Tether’s USDC and Hong Kong-domiciled First Digital Labs’ FDUSD.

USDT and FDUSDT dominate market share

Tether’s USDT market cap increased by 5.58% to $110 billion, a new record high for USDT, reinforcing its market dominance of 70%.

However, FDUSD was the outlier among USD-denominated stablecoins. As of 24th April, its market cap increased by 77.6% to $3.88 billion, according to the report.

Source: CCData

AMBCrypto’s evaluation of DeFiLlama data confirmed FDUSD’s explosive monthly growth. At the time of writing, the FDUSD market cap jumped to the $4 billion mark – a whopping 79.4% monthly increase.

Additionally, Ethena’s USDe also made an impressive mark, jumping over 74% to hit $2.36 billion and top five overall based on market cap.

However, Circle’s USDC missed the fun. Its market share shrank by 3.97% to $30.7 billion. USDC’s stalling in April was unique, as the report highlighted,

“The market capitalization of USD Coin (USDC) fell for the first time in five months”

On the trading volume front, USDT was the most preferred stablecoin across CEXs (centralized exchanges).

Stablecoin trading volume on CEXs almost doubled (a 98.9% surge) in March, hitting $2.15 trillion. This happened amidst wild volatility, as Bitcoin hit a new all-time high of $73.7K. Out of the $2.15 trillion volume, USDT controlled 77.5% of the market share.

Once again, FDUSD grabbed the second spot in terms of CEX volumes with a 14.6% market share. USDC followed closely at the third spot with a 7.14% market dominance.

Gold moves and crypto summer

Away from USD-denominated stablecoins, the gold-backed duopoly of Tether Gold [XAUT] and Pax Gold [PAXG] traded at premiums in April.

The two gold-backed assets saw their market cap jump by over 4% on what the report linked to Gold’s new record high and Middle East tensions,

“Tether Gold (XAUT) and Pax Gold (PAXG) rose 4.20% and 4.77% to $573mn and $425mn, respectively, as Gold surpassed its previous all-time high price amidst the geopolitical tensions in the Middle East.”

On a positive note, it looks like the sector isn’t done with growth yet. On 25th April, Stripe announced the resumption of global crypto payments, starting this summer with stablecoins.

If international markets overwhelmingly receive the crypto pay, stablecoins could record more growth.