- SOL bulls prepare for another run as bears run out of steam.

- Bitcoin dominance slides, paving the way for altcoin season hopes, but can SOL capitalize?

Solana [SOL] has been one of the top performing cryptocurrencies in the last 12 months. Few top coins have come close to its gains and ability to achieve a strong bounce back after every major dip. But will a similar outcome play out this time?

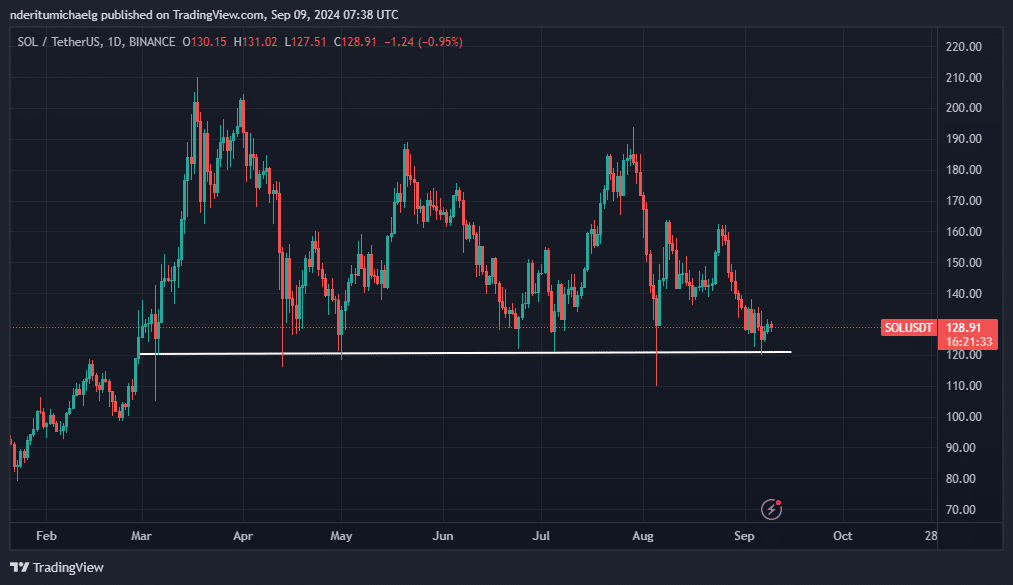

SOL bears have maintained dominance since the last week of August as market sentiment dipped. This has consequently pushed SOL into an important price level, around $120, which has historically acted as support at least for the last 6 months.

Source: TradingView

Moreover, SOL price recently demonstrated consolidation above the same level in the first week of September. Sell pressure has notably tapered out which suggests that there could be some accumulation taking place.

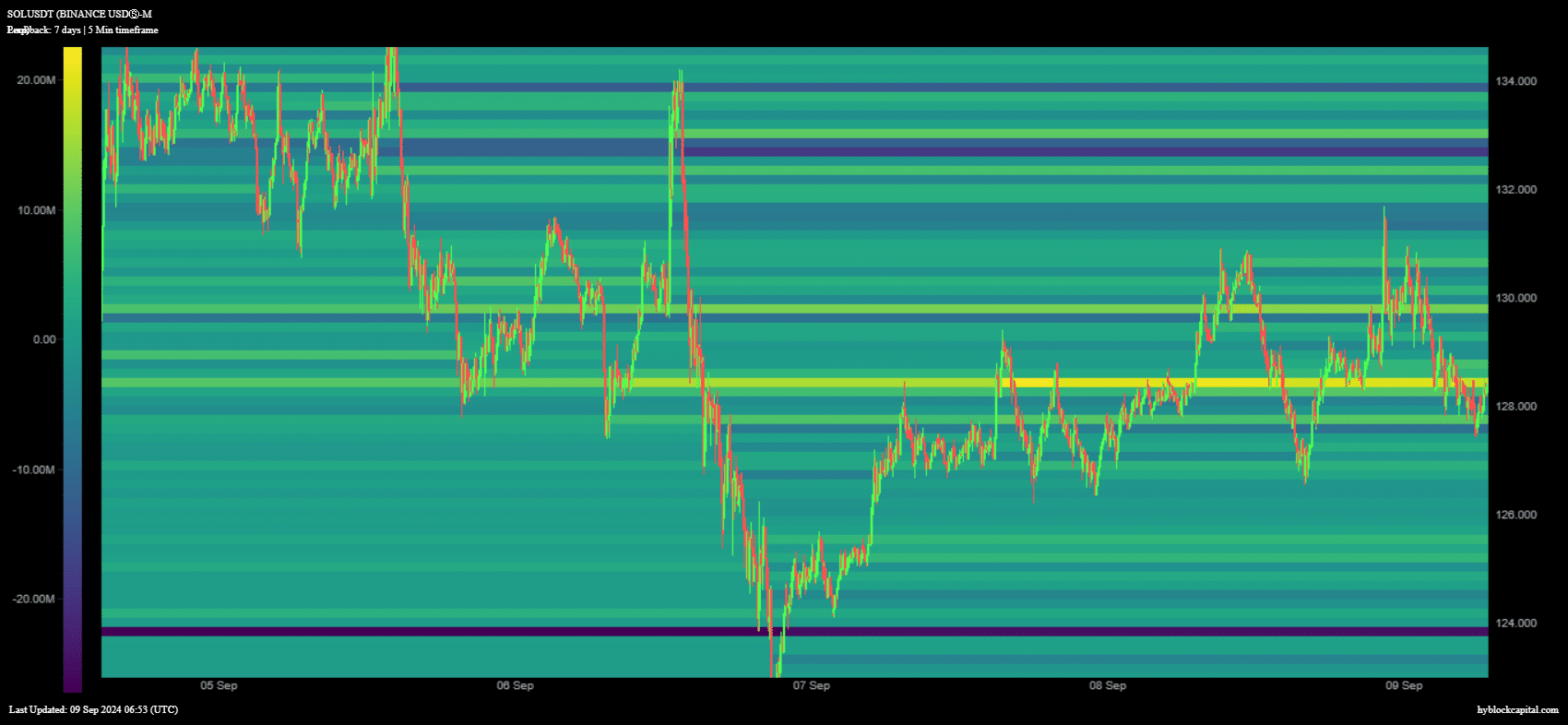

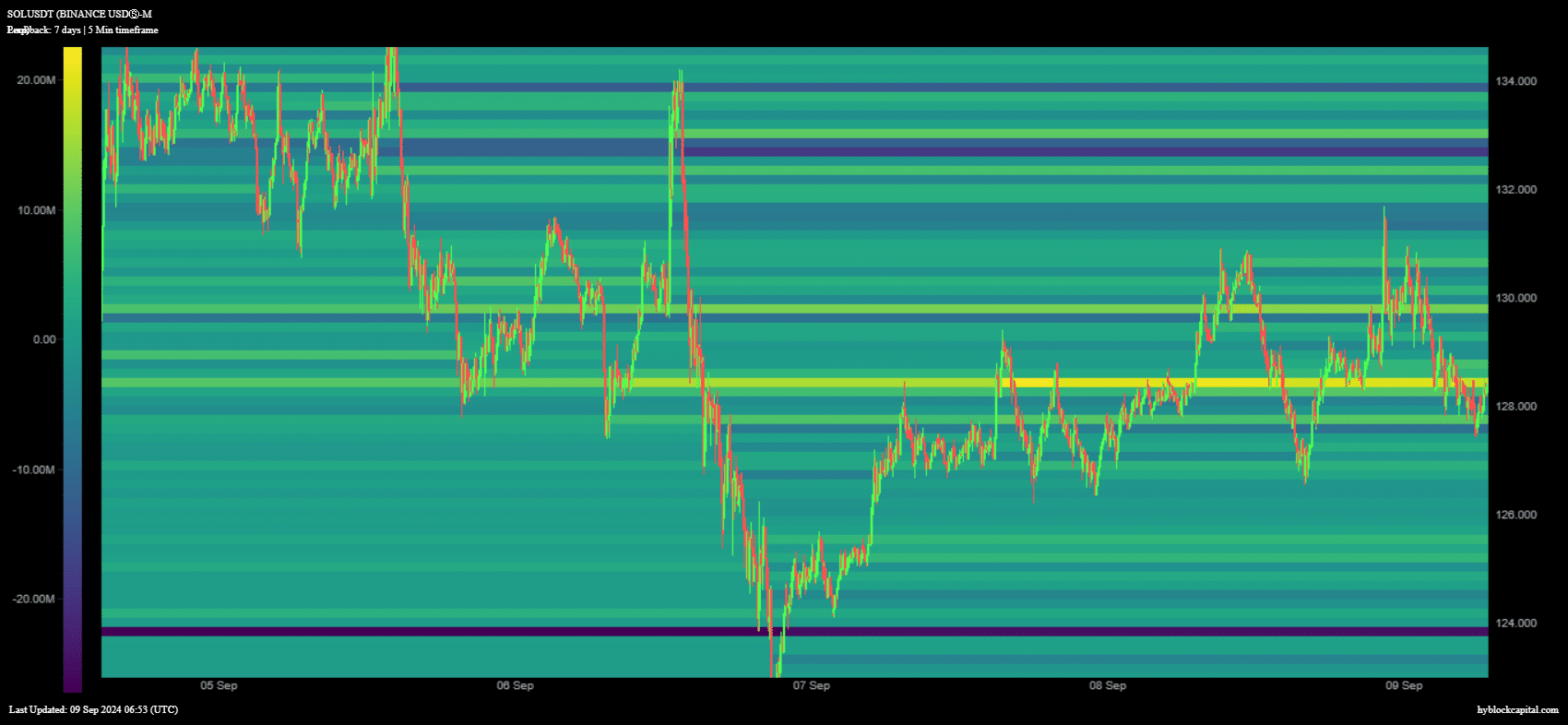

Our assessment of SOL demand revealed a spike in the number of net longs to over 18 million NLs at the $128 price level. A sign that market sentiment is shifting in favor of the bulls.

Nevertheless, this also highlights risk of heavy liquidations which may see price dip lower. A leverage shakedown may have already happened 2 days ago when price dropped below $128, all the way to the support band.

Source: HyblockCapital

Can SOL bounce back strong as altseason trends?

Aside from the observed consolidation, SOL may also enjoy a flood of liquidity now that altcoin season is trending. Bitcoin dominance trended lower in the last five days, indicating growing focus on altcoins.

SOL has been one of the most attractive altcoins so far this year, which puts it in the crosshairs of investors looking for the best opportunities.

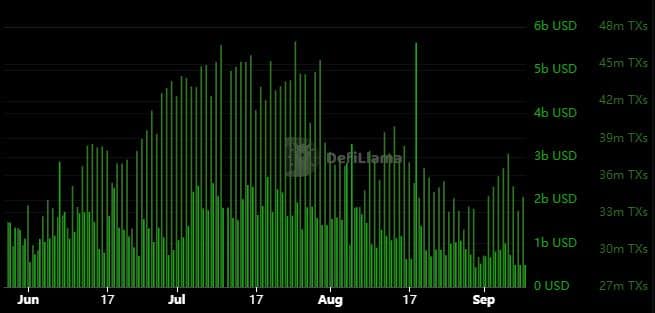

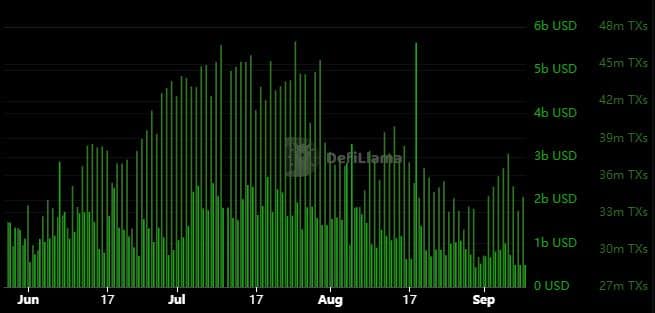

Solana transactions and on-chain volumes have been declining since the last week of August. However, on-chain data reveals a bit of a surge in on-chain activity. Especially with transaction growth towards the end of last week.

Source: DeFiLlama

There was also a slight volume uptick during the same period. SOL Price demonstrated bearish weakness during the same period, which could indicate that there was a spike in accumulation.

If altseason kicks off, then the Solana network may experience a resurgence of activity. This should translate to a spike in transaction activity, as well as more demand for SOL within the network’s DeFi ecosystem.

Realistic or not, here’s SOL’s market cap in BTC’s terms

Such an outcome could pave the way for a strong recovery just as has been the case with SOL in the last few months. A recovery rally may pull off at least a 15% to 20% upside from the current position, to the next major resistance level.

This means price may rally above $160 in the next few days in the event of a strong bullish move.