- Despite the strong gains recently, the stubborn resistance zone was not broken.

- A continued drop below the nearby support level would be a sign that bears were gaining control.

Shiba Inu [SHIB] was one of the leading memecoins during the recent uptrend that swept across the crypto markets. It gained close to 40% in 36 hours on the 26th and 27th of September.

The Shibarium Network was also in a healthy spot. The Total Value Locked (TVL) rose massively in recent days to cross the $4 million milestone for the first time.

An increase in new addresses was also seen on the network, which could lead to an uptick in demand and popularity.

SHIB bulls unable to scale the long-term resistance

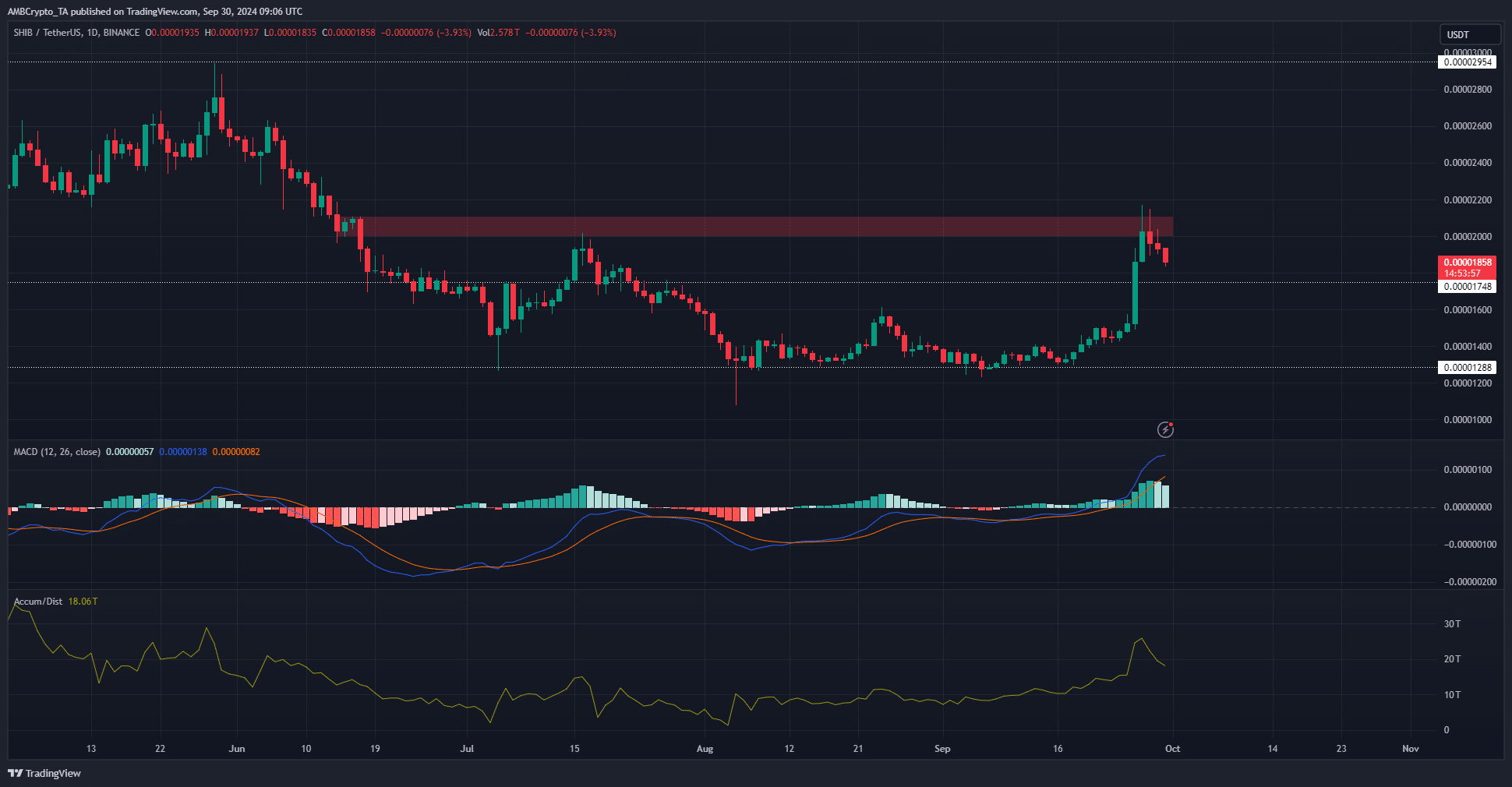

Source: SHIB/USDT on TradingView

A bearish order block was highlighted at the $0.00002-$0.000022 region that has been in play since June. This area was retested in July, and then again a few days ago.

The bulls could not achieve a breakout on either occasion.

While the price dropped 14.7% in three days from the recent local high, it might not be too worrisome for investors with a high time horizon.

The accumulation/distribution chart was still in an uptrend and close to challenging the May highs.

The MACD also underlined strong bullish momentum. The strong buying in recent weeks meant that it was possible for the bulls to halt the price dip at the $0.0000175 support level.

Shiba Inu price prediction bearish in the near term

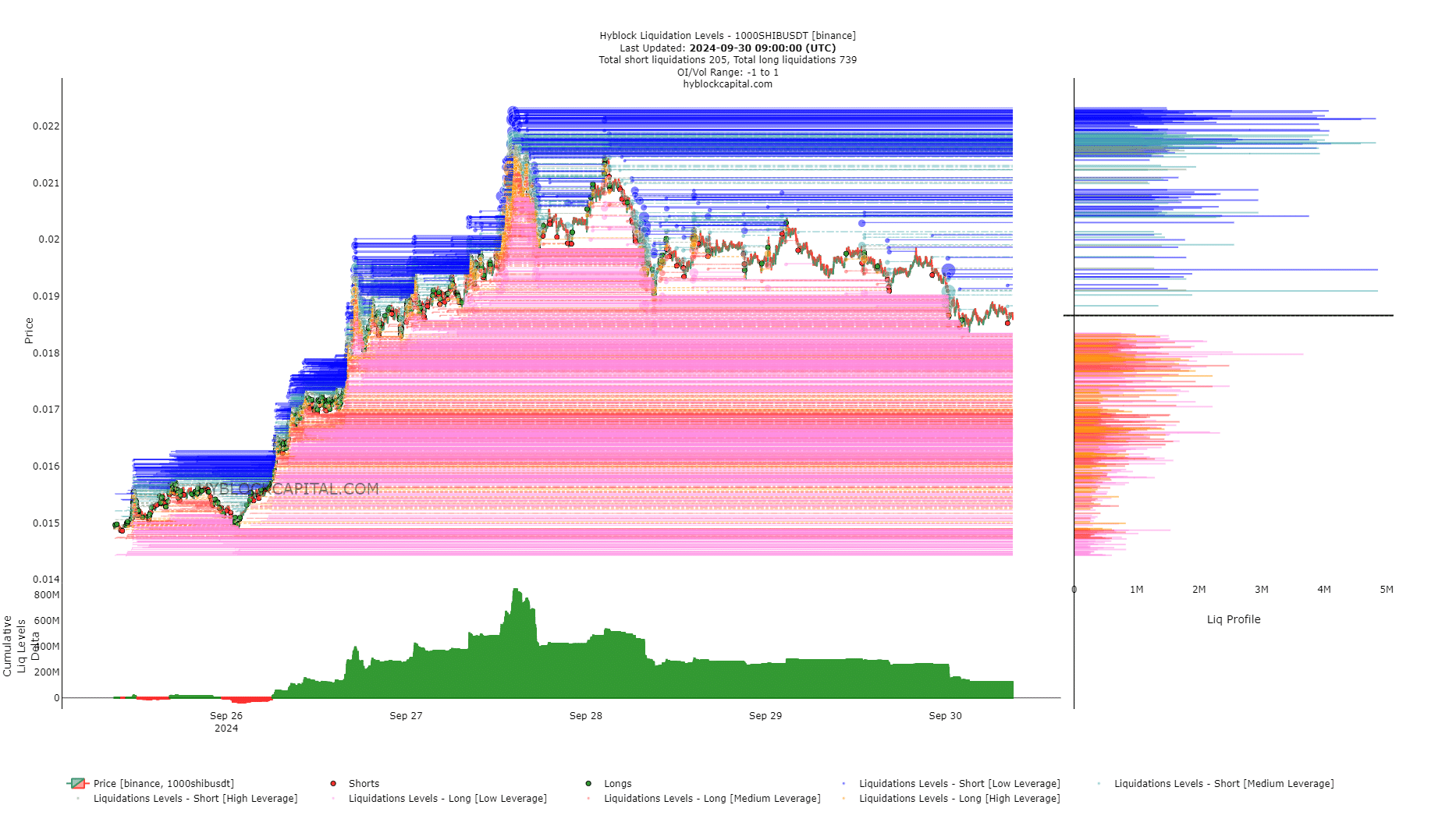

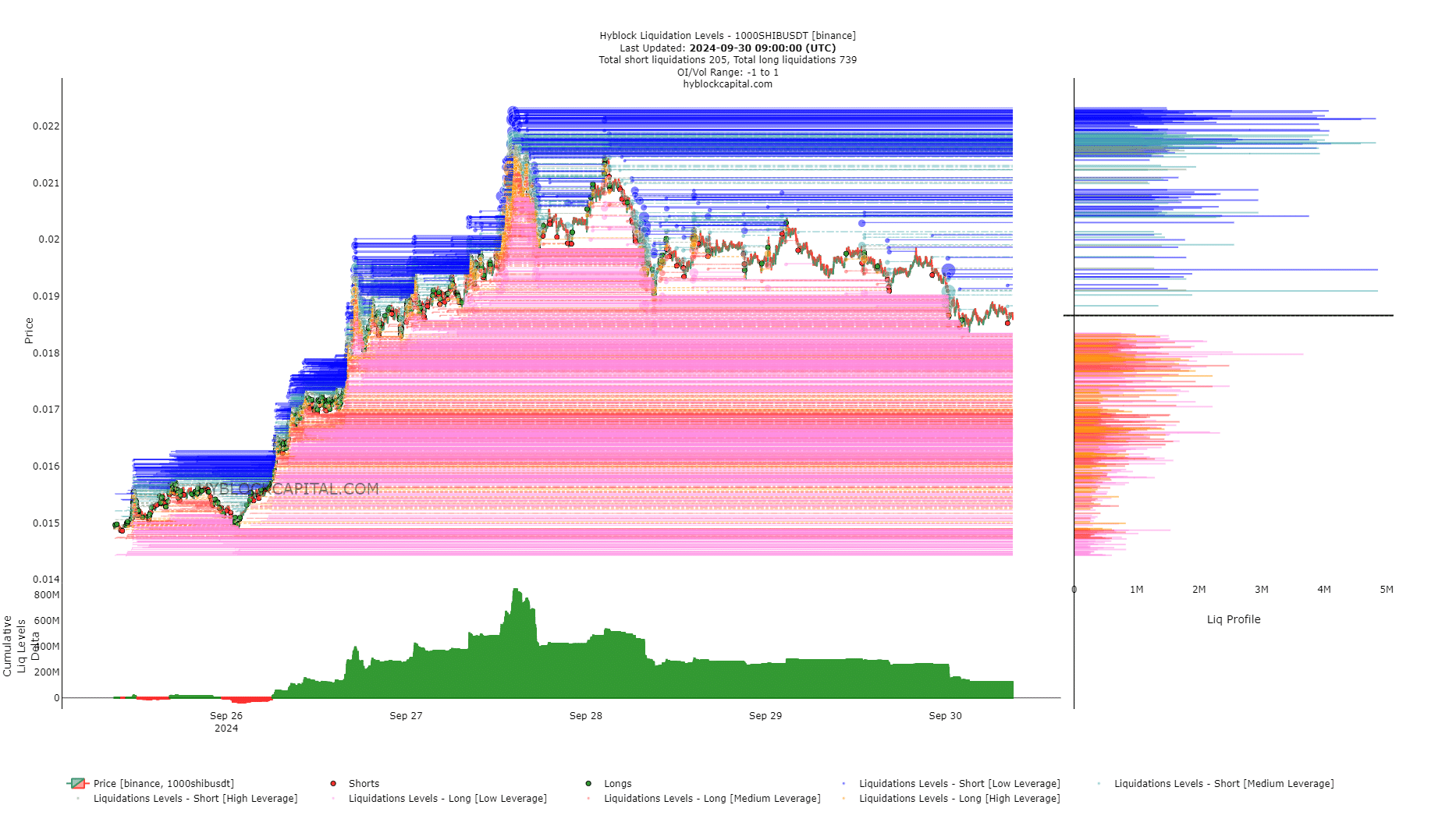

Source: Hyblock

The cumulative liq levels delta had been positive a couple of days back. The concentration of long liquidations around $0.000019 attracted prices lower.

At press time, the delta was not highly in favor of either party.

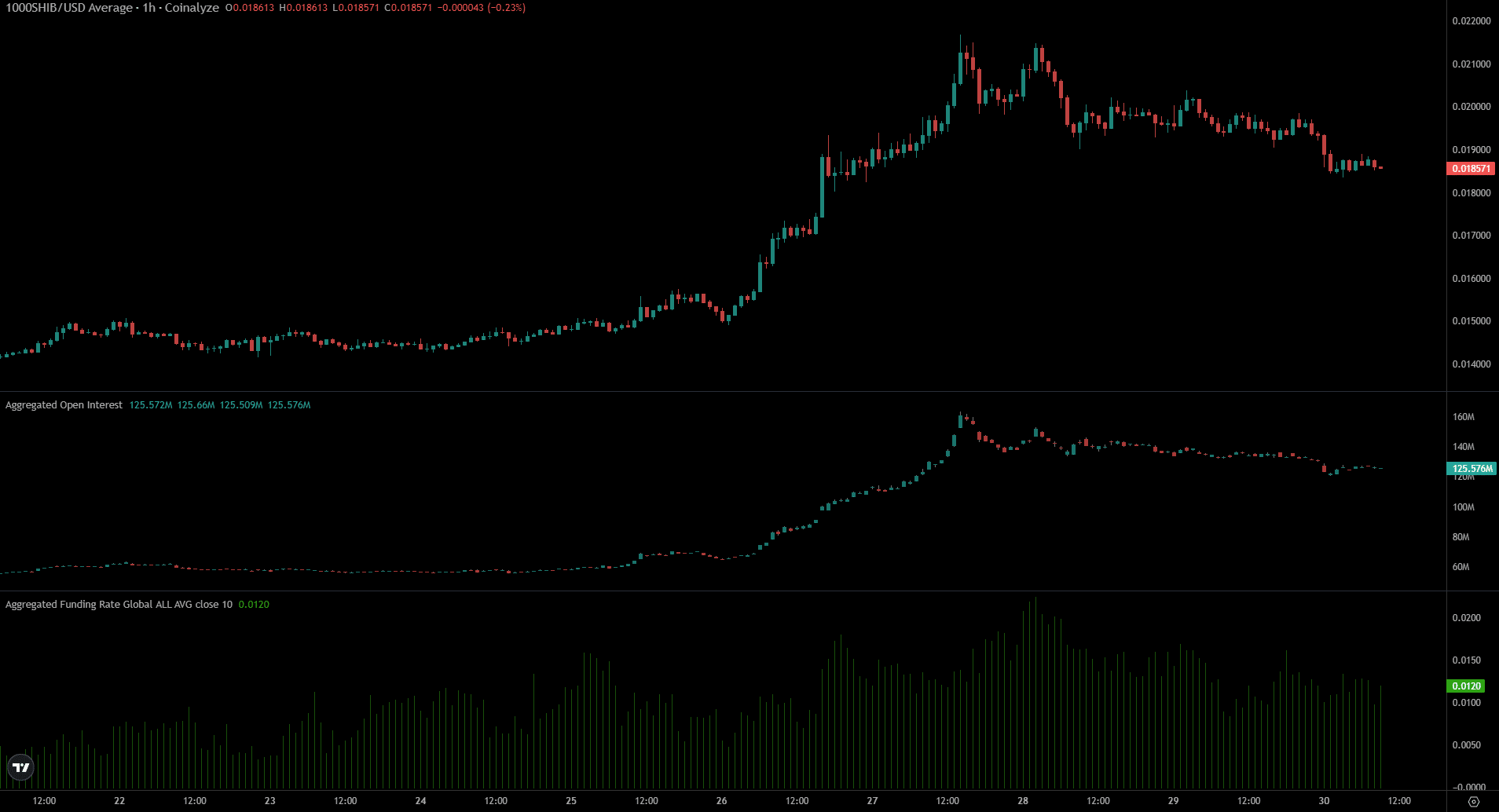

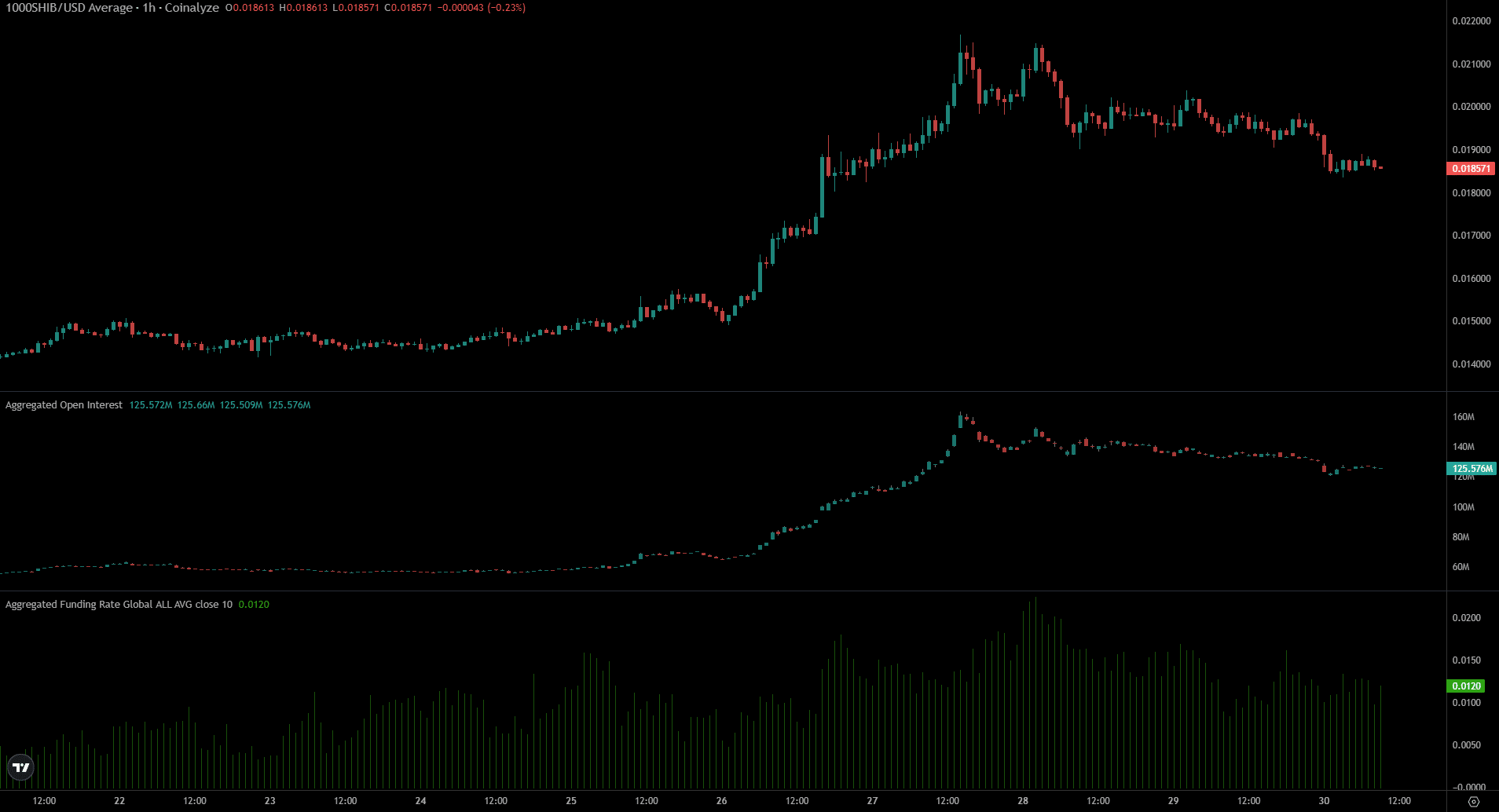

Source: Coinalyze

The Open Interest has been dwindling alongside the meme coin prices in the past three days, showing bullish sentiment was muted. However, the Funding Rate remained positive to show bulls were in the majority.

Realistic or not, here’s SHIB’s market cap in BTC’s terms

The Shiba Inu price prediction is bullish in the long term, provided the $0.00002 resistance zone is flipped to support in the coming weeks.

A sustained price drop below $0.0000175 would indicate bears were dominant once more.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion