- Sei broke resistance at $0.635, supported by strong RSI and increasing social volume.

- Positive funding rate and high long liquidations pointed to continued bullish sentiment.

Sei [SEI] has achieved a major milestone with its daily active addresses surpassing 280k, marking a new all-time high.

The surge in user activity, combined with the addition of three million unique users in the past three months, indicates growing momentum within the SEI ecosystem.

At press time, the coin was trading at $0.6727 after dipping 1.91% in the past 24 hours. Also, the project’s increasing network activity suggests a positive outlook for future growth.

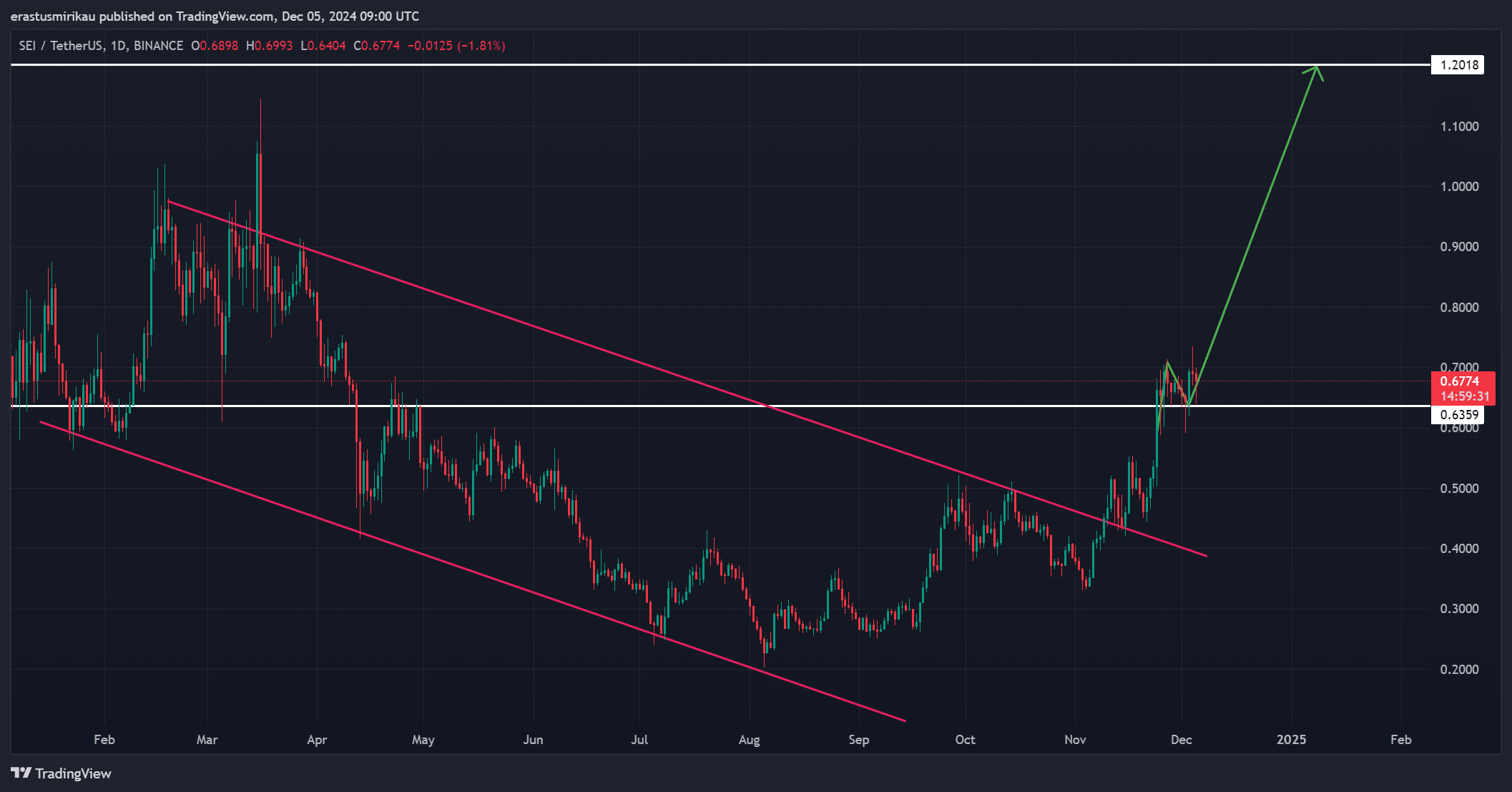

SEI price action: A breakout to watch

At press time, SEI was trading at $0.635, reflecting a strong bullish trend after successfully breaking out of a descending channel. This move has cleared a key resistance level, which was tested and retested at $0.635.

If the price maintains above this level, the next possible target could be $1.20, signaling a potential 90% upside.

This breakout indicates increased buying interest and a shift in market sentiment. However, traders should monitor whether the price sustains above this critical level.

Source: TradingView

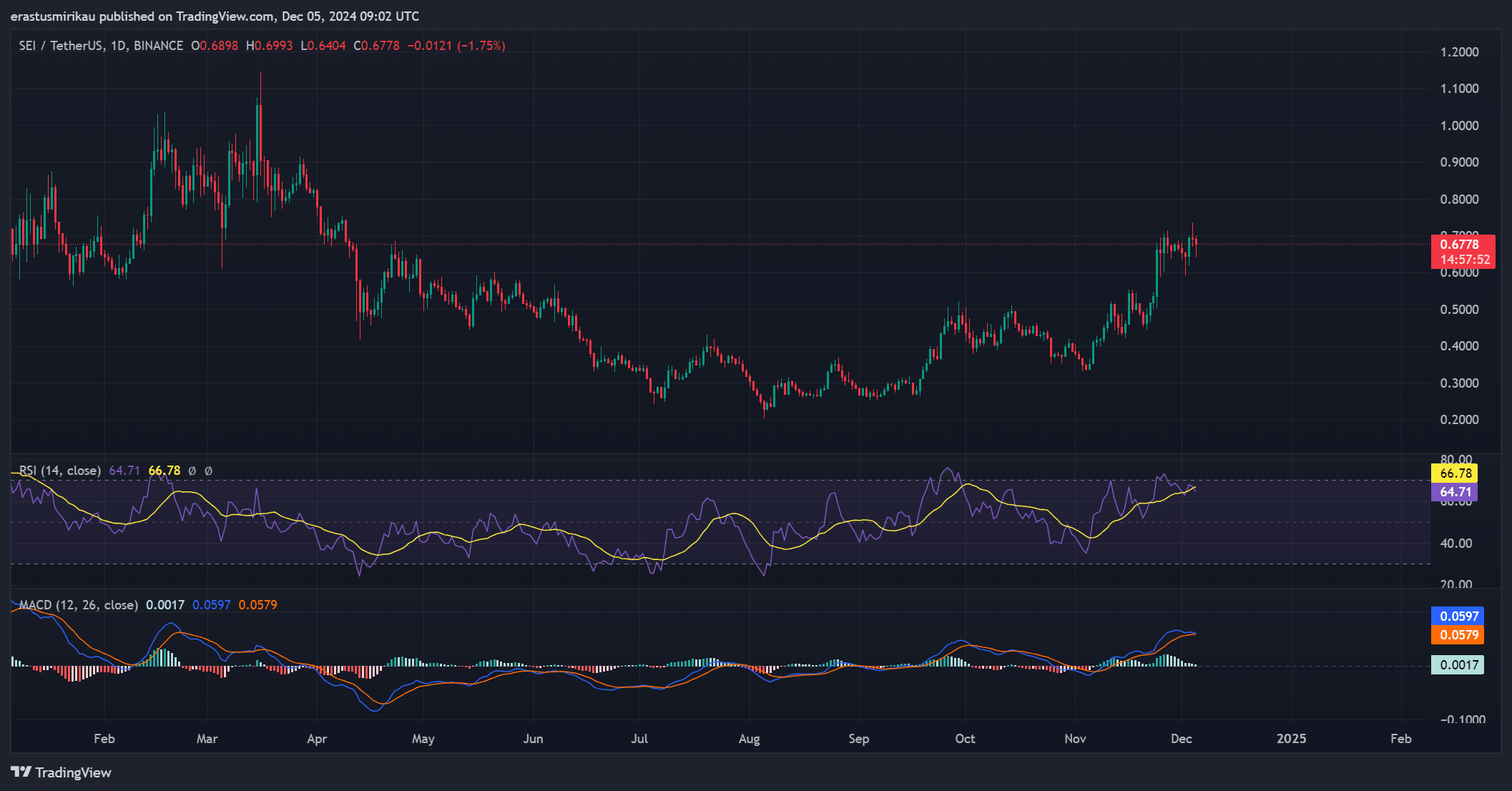

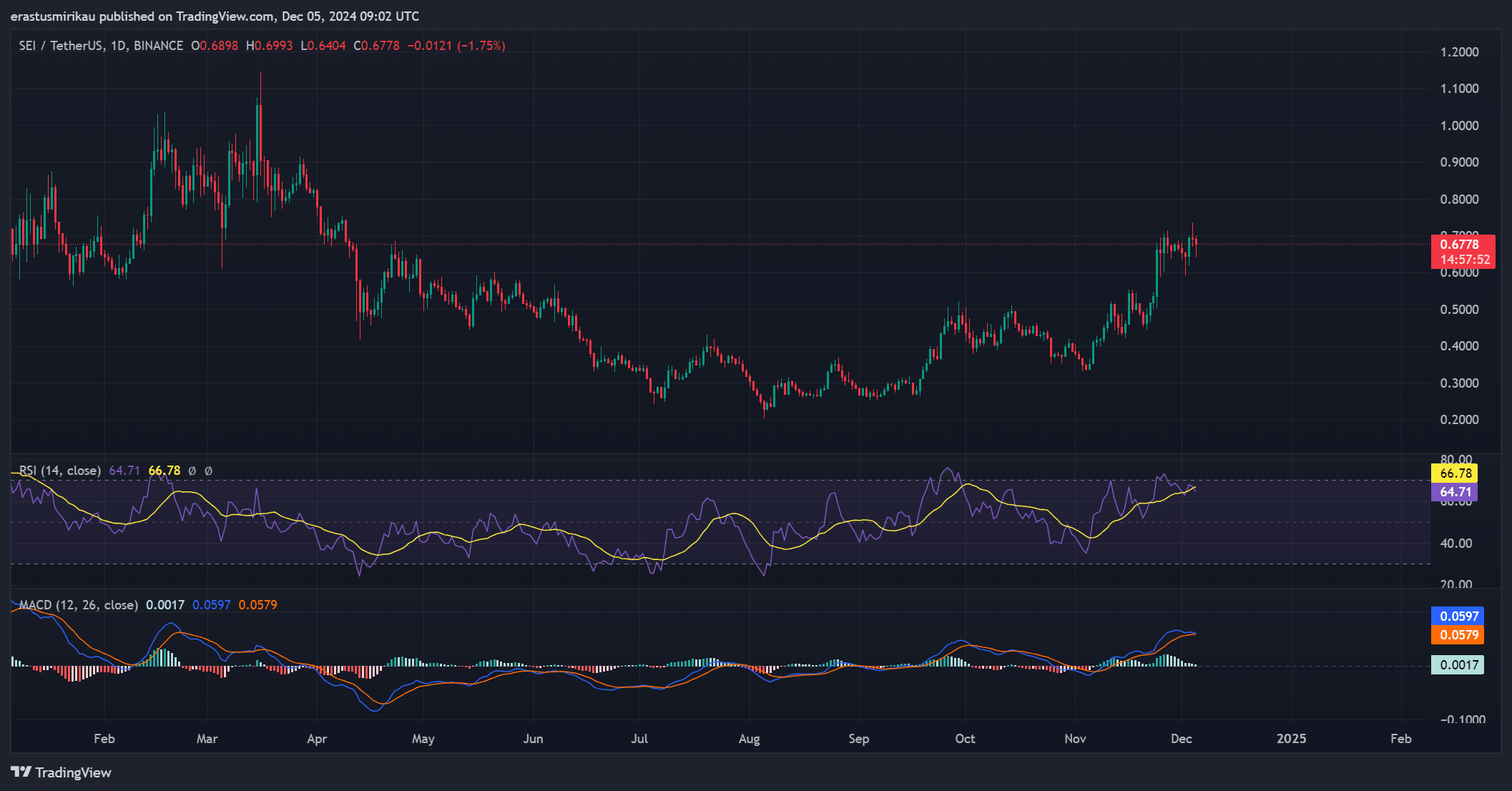

Technical indicators show a bullish outlook for Sei. The RSI currently sits at 64.71, suggesting that the asset is nearing overbought conditions but still has room for further gains.

Additionally, the MACD at 0.0017 supports the upward momentum, confirming that buying pressure is outweighing selling at the moment. These indicators point toward a possible continuation of the bullish trend, but traders should stay cautious of any sharp reversals.

Source: TradingView

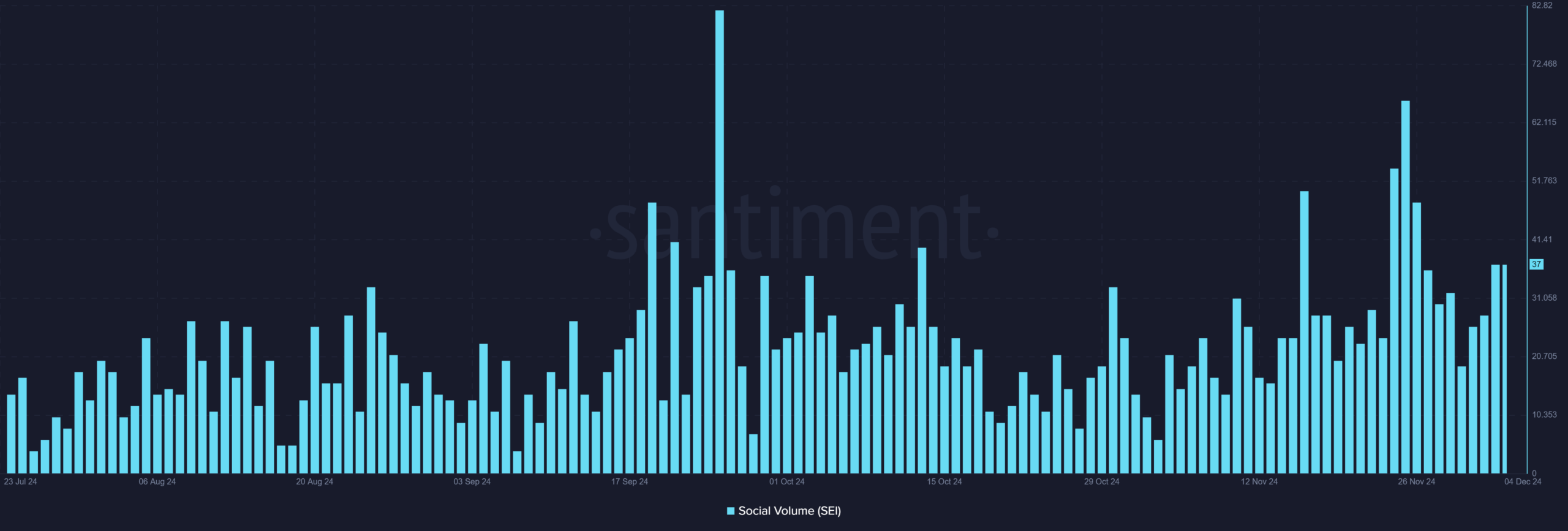

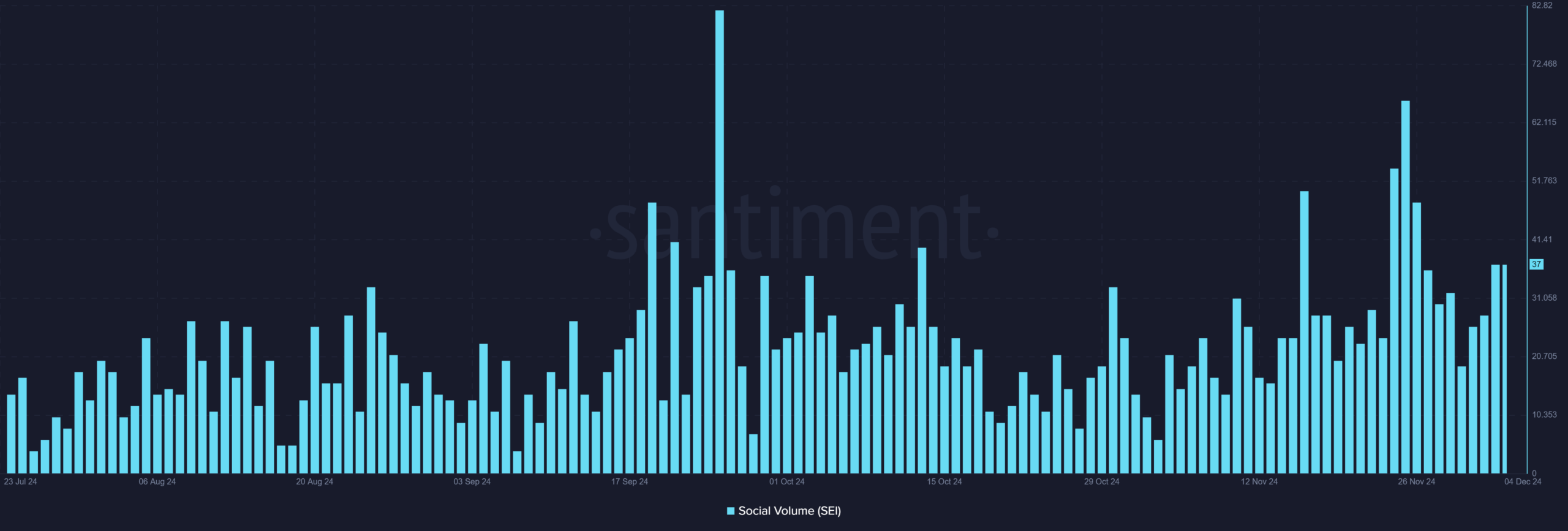

Is the rise in social volume a bullish signal?

Social volume has slightly increased from 28 to 37 in just one day, indicating growing interest in the project. Although this increase is modest, it’s important to note that social volume often correlates with market movements.

As the project attracts more attention, this could lead to greater price action. Consequently, this rise in engagement might signal heightened investor sentiment, potentially driving further bullish momentum in the near term.

Source: Santiment

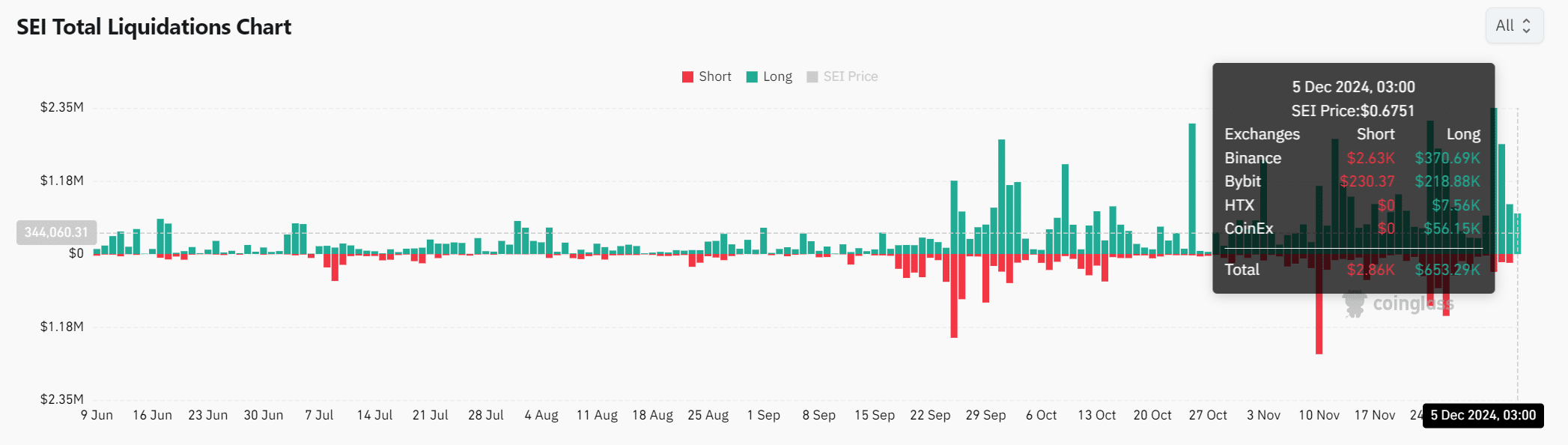

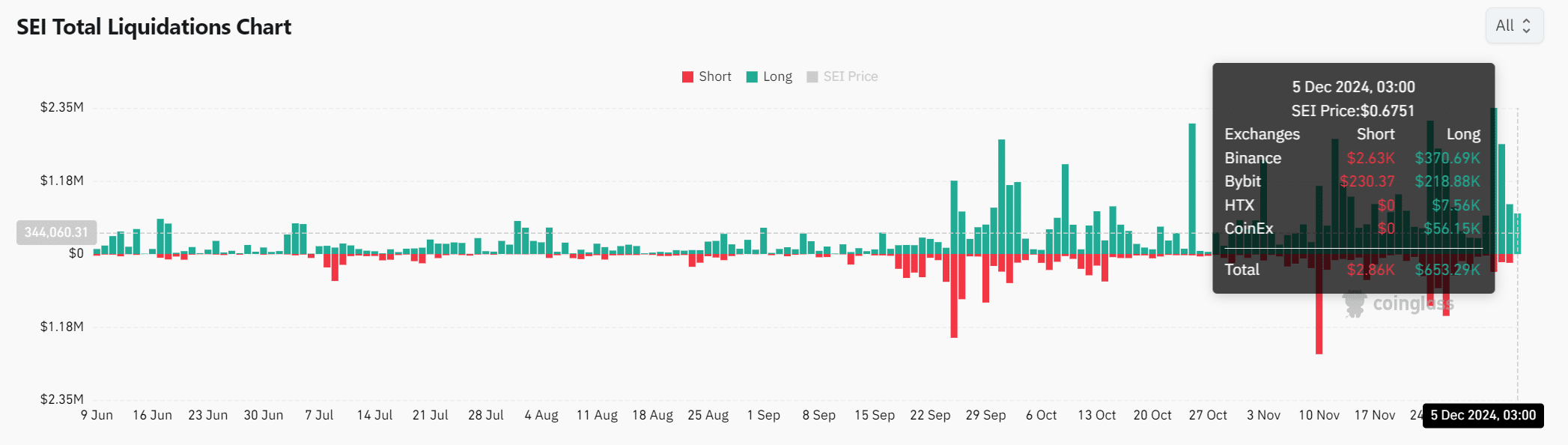

What does the liquidation data reveal about market sentiment?

When examining liquidation data, we see that short liquidations are at a relatively low $2.86k, while long liquidations are much higher at $653.29k.

This imbalance suggests that long positions are being squeezed, which could either be a sign of bullish strength or impending correction.

Therefore, traders should monitor this closely, as liquidation spikes often precede significant price shifts.

Source: Coinglass

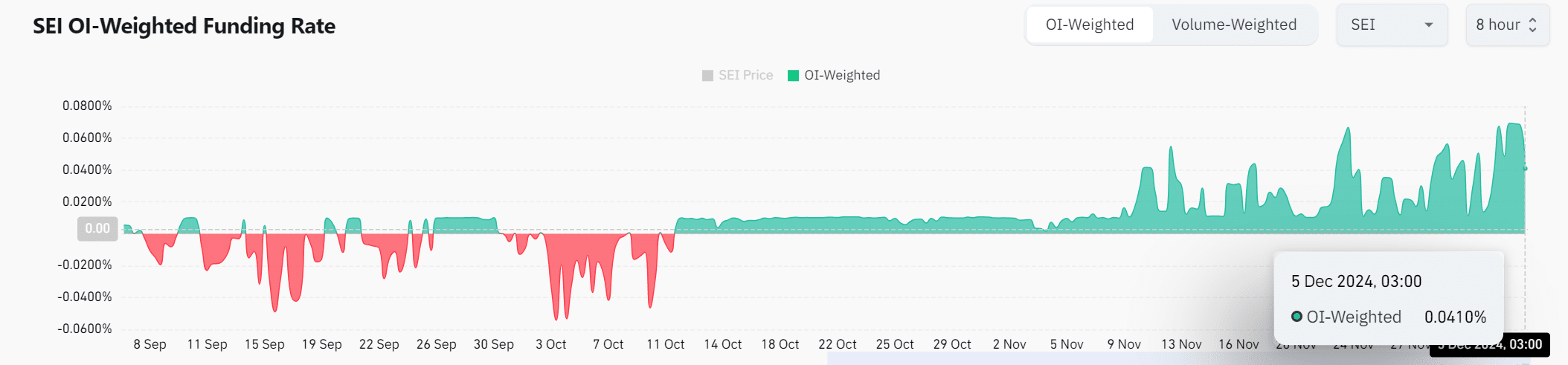

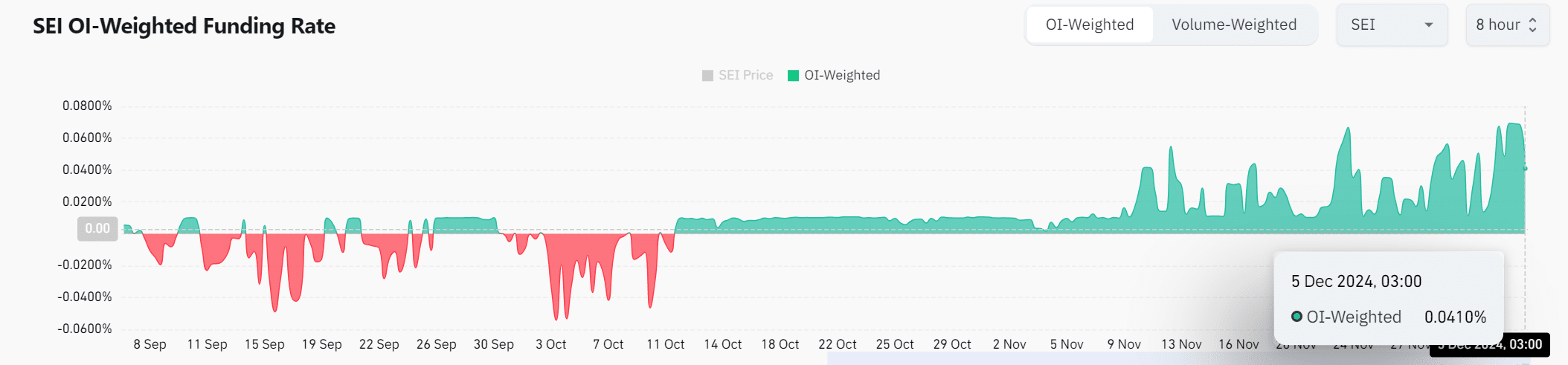

How does the funding rate influence the market?

The funding rate stood at 0.0410%, reflecting a slightly positive outlook for the token. This suggests that long positions dominate the market, further supporting bullish sentiment. However, this could change quickly if market conditions fluctuate.

Source: Coinglass

Read Sei’s [SEI] Price Prediction 2024–2025

Can Sei sustain its momentum?

The recent price action, increase in social volume, and positive funding rate indicate strong market confidence.

The breakout from its descending channel, along with an uptick in the network activity, suggests that Sei is likely to maintain its upward momentum. Consequently, Sei has positioned itself for sustained growth in the competitive blockchain space.