- POL’s active addresses and total holders recorded exponential growth

- POL’s transition has attracted many users, with some analysts eyeing a flip too

The past few months have seen many in the crypto market eagerly anticipate the upgrade of Polygon’s MATIC to POL. As reported previously by AMBCrypto, the MATIC to POL migration officially went live on 4 September 2024.

This transition meant that MATIC was upgraded to POL as the network token for Polygon. Simply put, every transaction that takes place on Polygon PoS now uses POL as the native gas token.

Now, this transition may have given Polygon’s token a new life after a sustained downside on the charts. Prior to the migration, MATIC was on a southbound trajectory, dropping by 10.75% on the weekly charts and by 7.38% on the monthly charts.

However, since the transition, the altcoin has made moderate gains. In fact, at press time, POL was trading at $0.3773 after a 1.45% hike in 24 hours. Also, its market cap rose by 3.44% to $2.1 billion over the same period.

Undoubtedly, current market conditions have shown favourability towards POL, indicating the significance of the upgrade. For instance, Santiment’s analysis revealed a hike in network growth and a surge in total holders too.

Assessing the prevailing market sentiment

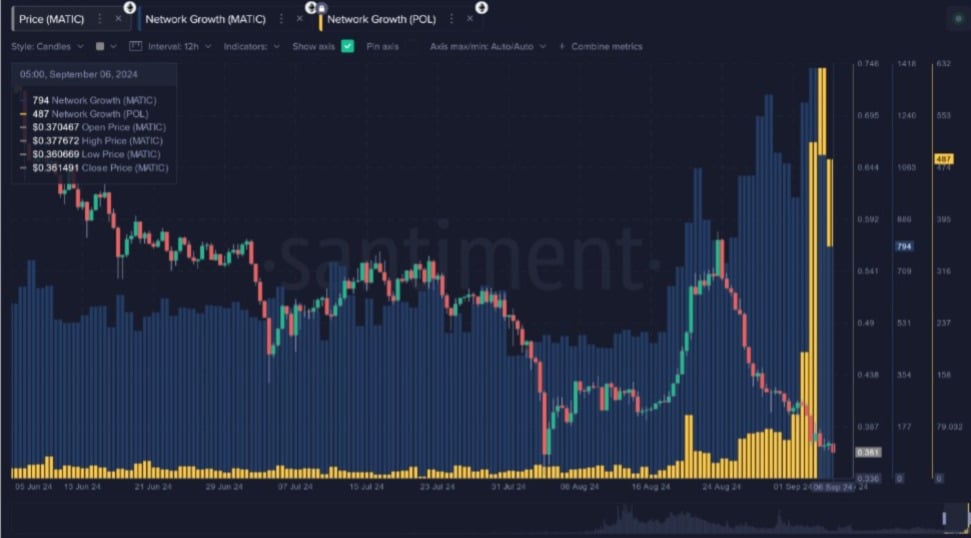

According to Santiment’s analysis of Polygon’s ecosystem, POL has seen exponential growth on the network front. New daily addresses created, at the time of writing, were 487, positioning the altcoin to bypass MATIC’s figures in 2 weeks.

Source: Santiment

Additionally, since 15 August, thousands of MATIC wallets liquidated their wallets to facilitate the swap. In the same period, over 1826 POL wallets were created – Representing a 64% rise on the charts.

Source: Santiment

Equally, the markets have seen POL supply held by 1 million plus wallets fall from 98% to 92% in 2 weeks. This usually happens when small and mid-sized traders jump into a new asset with haste. The trend will slow down after Binance lists its pairs. As reported previously by AMBCrypto, Binance will delist MATIC pairs starting 10 September.

Another reason leading to increased interest in the altcoin is the current price volatility. Over the past few weeks, altcoins have seen some extreme volatility.

Finally, traders are attracted to POL for long-term benefits. For instance, the token allows multi-chain staking while giving users enhanced control in governance.

What do POL charts indicate?

As highlighted by Santiment, POL has seen some market favourability over the past 3 days since the migration.

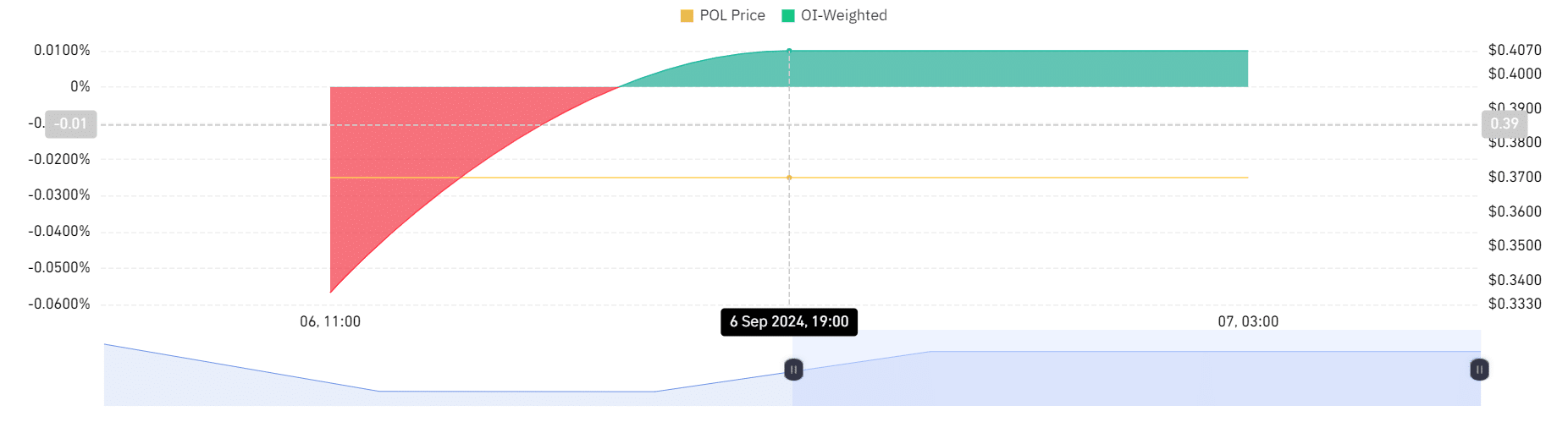

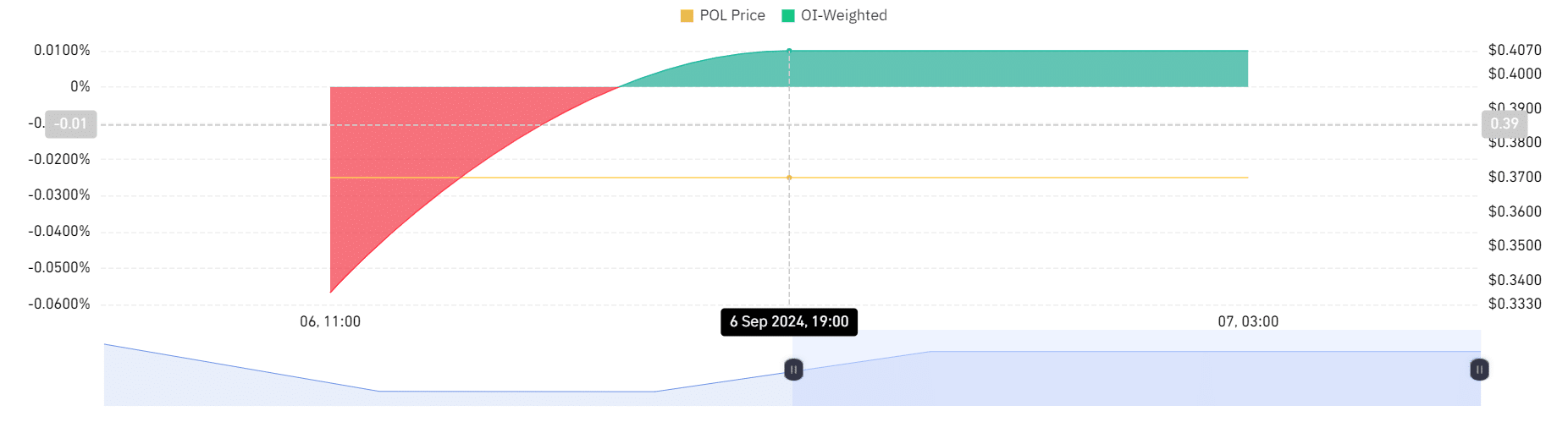

Source: Coinglass

For starters, the OI-weighted funding rate has remained positive for the past 2 days, only reporting a negative value on a single day.

Here, the positive OI-weighted funding rate suggests increased demand for long positions. This also means investors are betting on prices to record further gains – A sign of positive market sentiment.

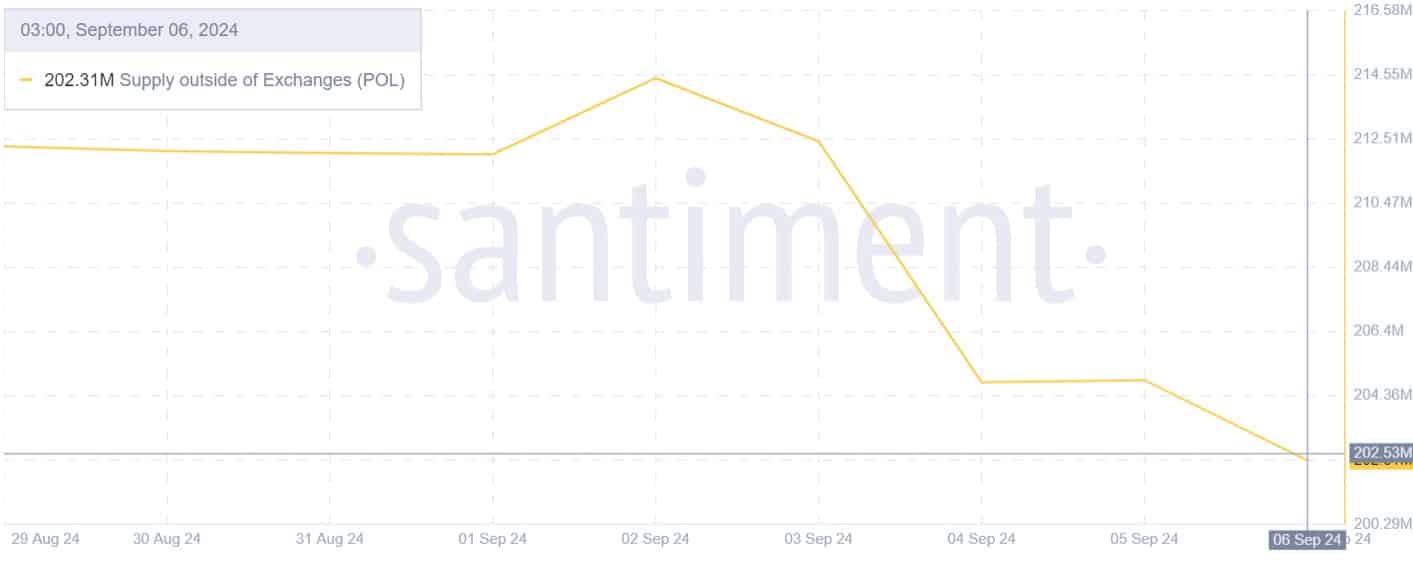

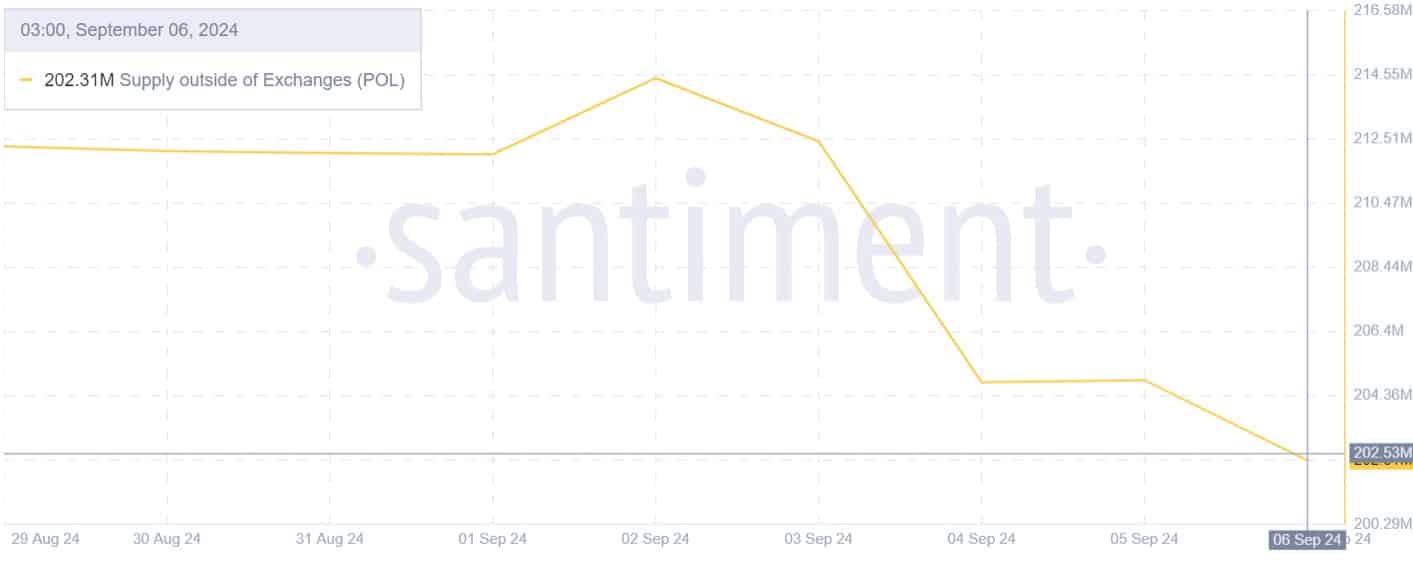

Source: Santiment

Additionally, POL’s supply outside of exchanges has fallen from $214 million to $202 million since the migration. This market behavior suggests investors are taking the long-term view and are less likely to sell in the short term. Such an approach signals investor’s confidence in the altcoin’s future prospects.

Therefore, with favorable market conditions, the altcoin may be well positioned to break out from the $0.38 resistance level and hit $0.4 in the short term.