- PEPE has fallen by about 18.2% in the last 3 days alone

- Metrics seemed indecisive about memecoin’s short-term price action

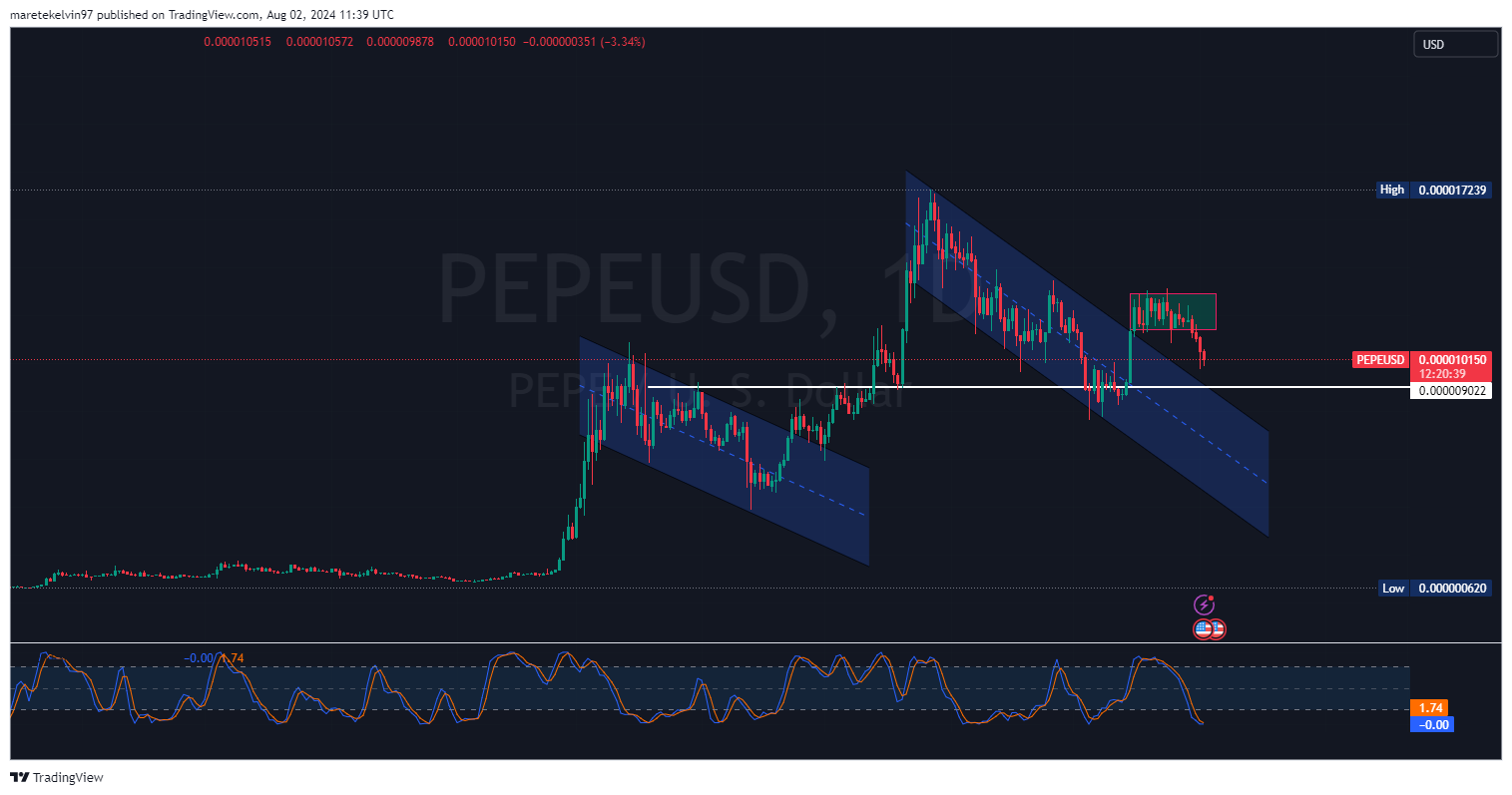

PEPE has seen significant volatility recently. In fact, its price has dipped by approximately 18.2% in the last 3 days alone, bringing it closer to the critical support level of $0.000009022. This, following a period of consolidation that ended on 30 July.

The memecoin’s price action over the last few days has been on a visible decline. This, contrary to the period of sideways movement that preceded it. This observation is critical as PEPE seemed to break down from its consolidation phase a few days ago. Arresting this breakdown over the next few days will be key for the altcoin’s price action now.

However, at the time of writing, the token’s price was nearing the key support level of $0.000009022. If this level is breached, it could signal a further depreciation in value for PEPE.

Source: PEPE/USD, TradingView

AMBCrypto’s analysis of Coinglass data highlighted significant fluctuations on the charts. Specifically, the data revealed periods of heavy inflows and outflows.

At press time, there seemed to be an increase in outflows, correlating with the aforementioned price fall on the charts. This can be interpreted as a sign that more investors are selling off their holdings, most probably due to the fear of further dips.

Source: Coinglass

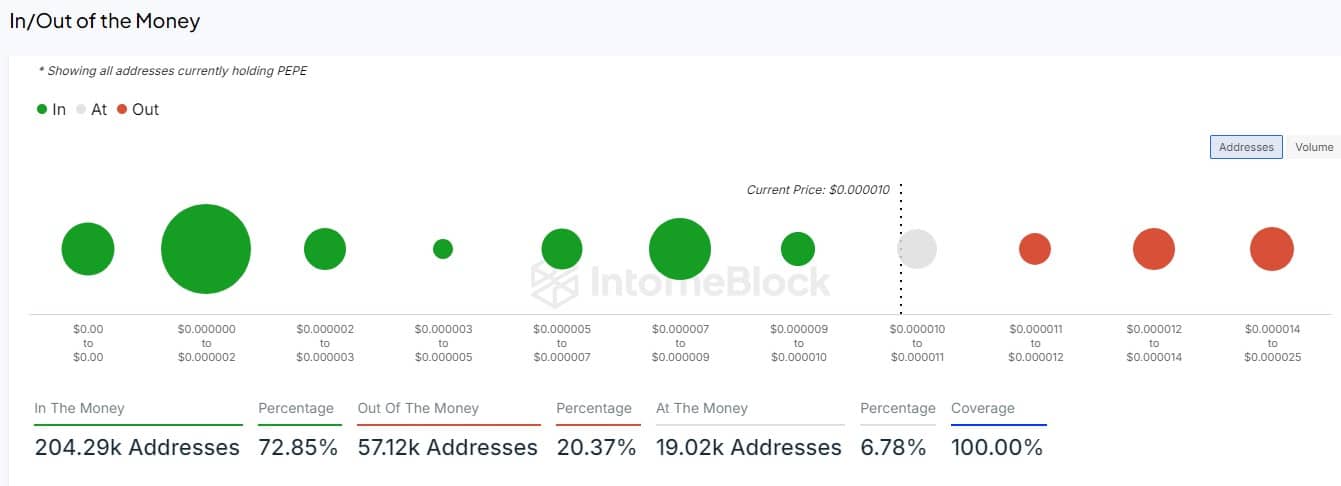

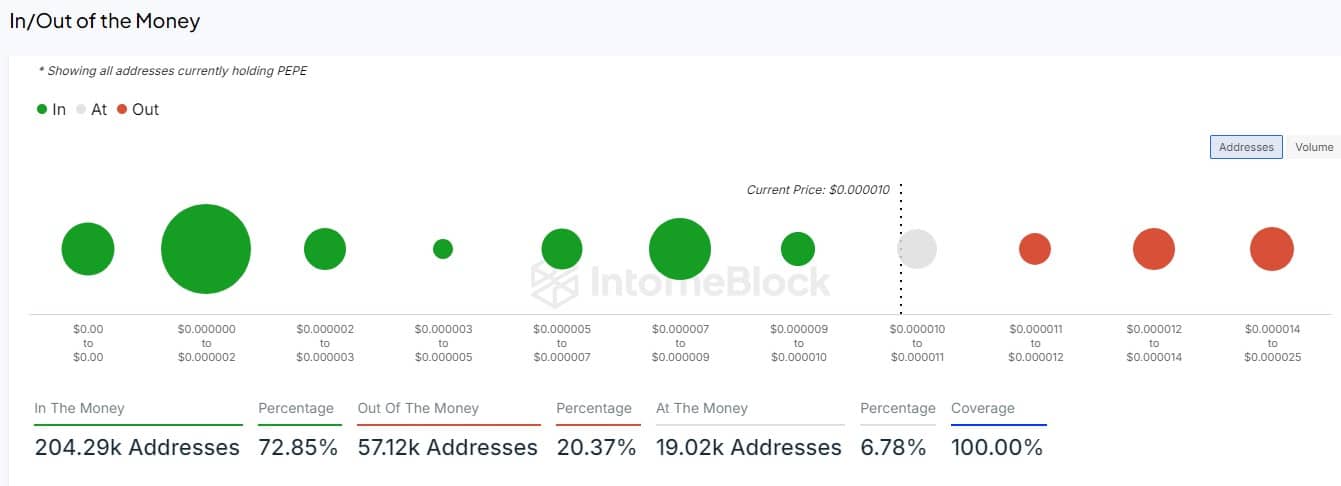

Additionally, AMBCrypto further analyzed the in/out of the money data from IntoTheBlock. The data indicated that 72.85% of PEPE addresses are currently at profit, with a majority of the profitable addresses buying in at lower prices than the press time level.

On the contrary, the 23.37% of the investors currently at a loss cannot be written off and might precipitate greater selling pressure. This could further fuel its ongoing bearish run.

Source: IntoTheBlock

PEPE’s latest bout of price depreciation has brought it close to a critical level on the charts. If the price holds above this level, then a reversal could be on the cards for the memecoin.

However, if bearish momentum sustains itself and the price manages to break down below the support level, PEPE may dip even further.