- Pepe in profit drops below 400 trillion.

- PEPE has declined by over 9% in the last 48 hours.

Pepe [PEPE] was experiencing significant growth a few weeks ago, but it was now losing steam.

Its supply in profit has been decreasing over the last few weeks, and several key metrics indicate a lack of activity that could signal a forthcoming rebound.

More Pepe goes underwater

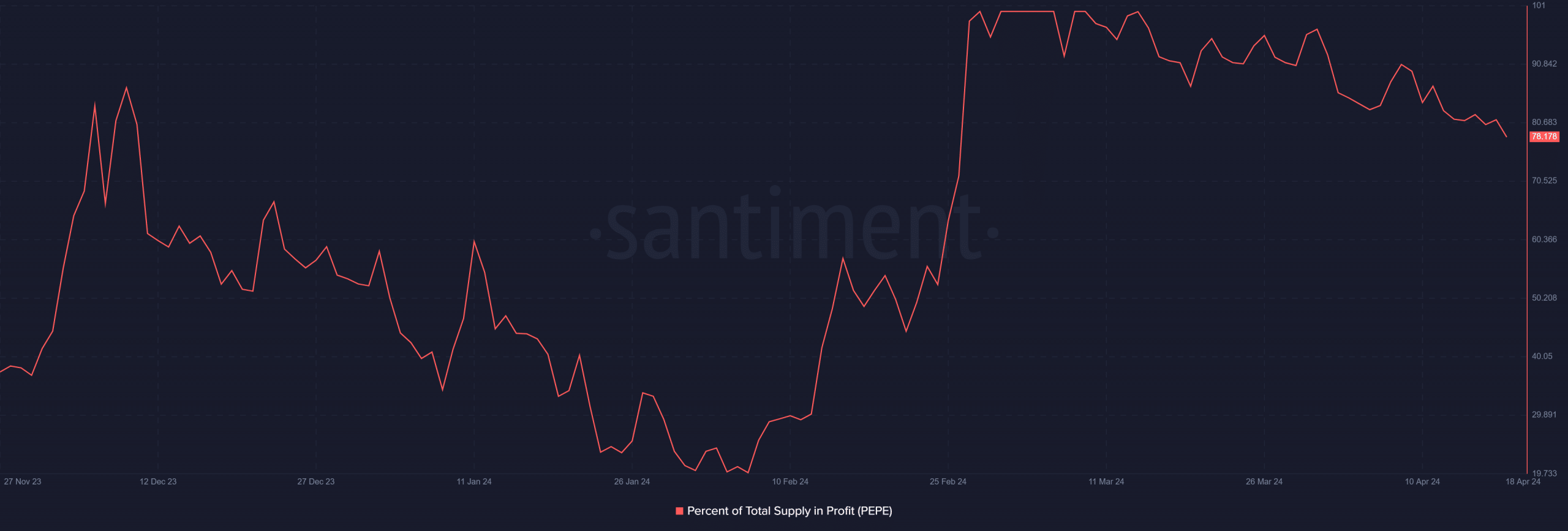

Analysis of Pepe’s supply in profit showed a significant surge in February, increasing from around 19% to 100%. This led to the supply in profit rising from approximately 84 trillion to over 420 trillion.

However, from March onwards, the supply in profit began to decline, reaching around 96% by the end of March, equivalent to 409 trillion.

Source: Santiment

This decline has persisted, with the number of PEPE supply in profit decreasing. At the time of this writing, the supply in profit was around 78%, approximately 330 trillion.

Enough volume and active addresses for PEPE?

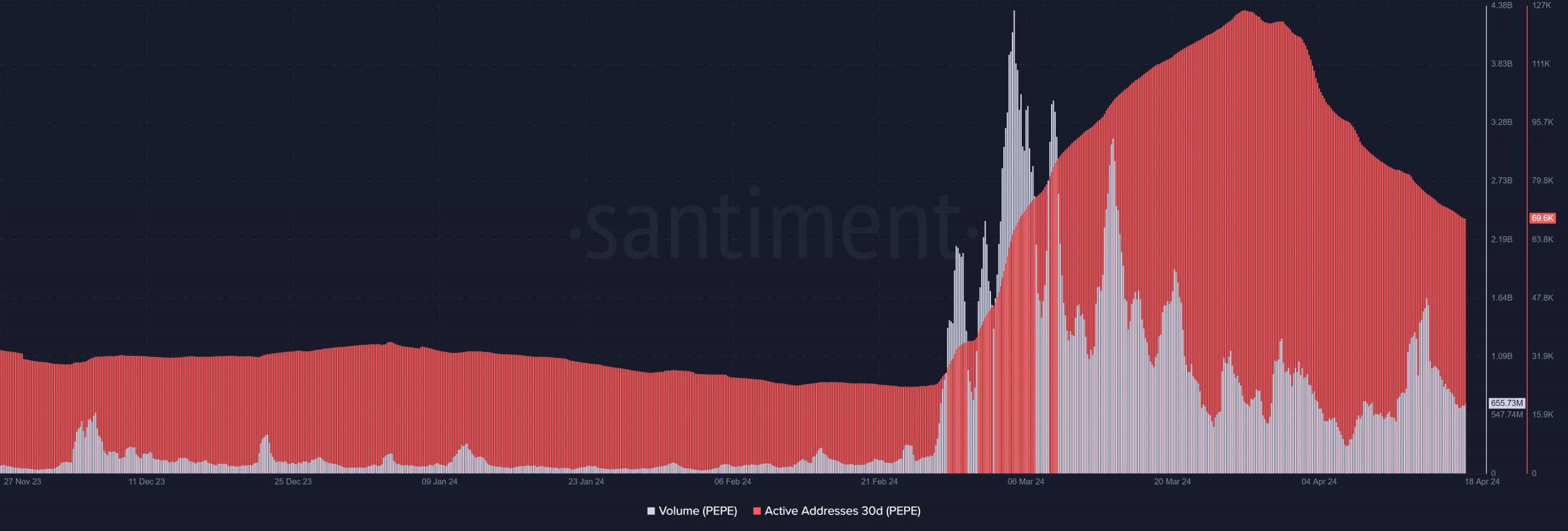

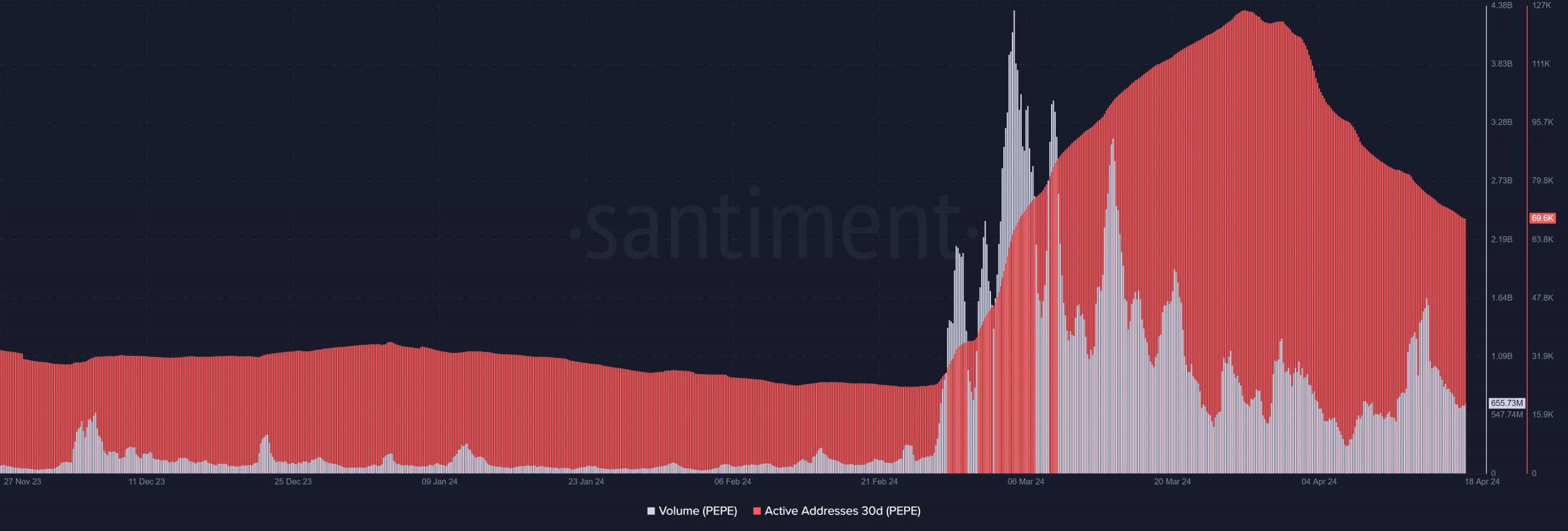

An analysis of Pepe’s 30-day active addresses revealed a significant increase several weeks ago, with the number rising to over 126,000 from around 24,000.

It managed to sustain above the 10,000 threshold until the first week of April, after which a decline began.

This decline has been notable from the beginning of April until press time, with the number of active addresses at approximately 69,000.

Source: Santiment

Additionally, Pepe’s volume saw a significant decrease in recent weeks.

While it experienced its peak volume trend between the 28th of February and the 15th of March, with the volume surpassing $1 billion between the 13th and the 14th of April, it has since dropped.

At the time of this writing, the volume was around $650 million. The analysis suggests that there needs to be more activity to drive up the price.

Consequently, the supply in profit is likely to continue dropping, at least for now.

Read Pepe’s [PEPE] Price Prediction 2024-25

PEPE close to flipping support

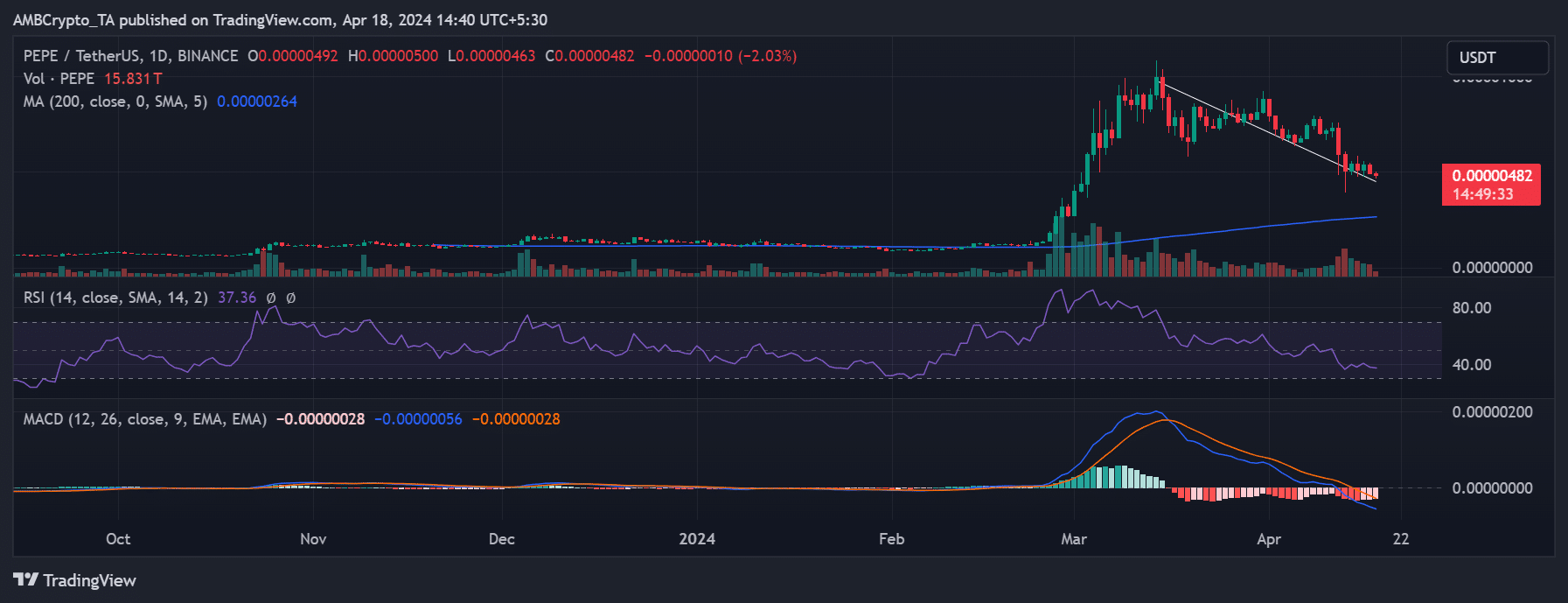

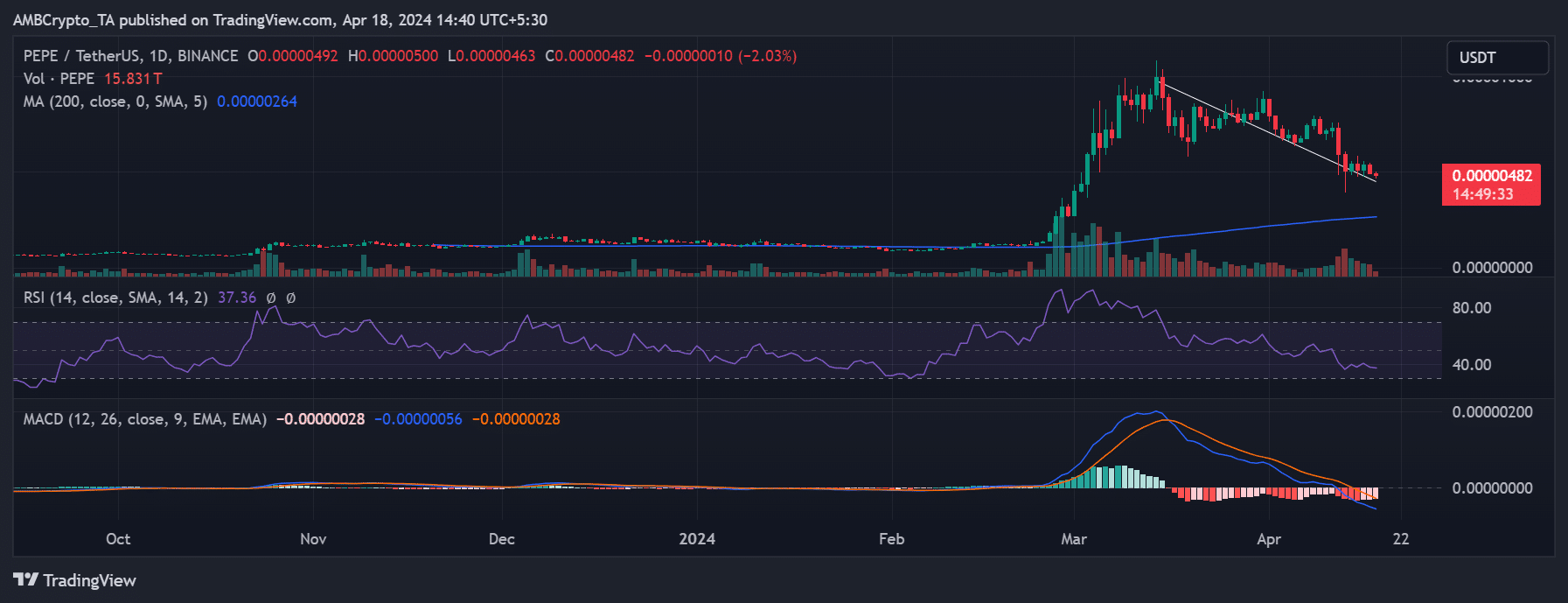

The daily timeframe chart of Pepe indicates significant price declines over the past seven days. Analysis showed that by the end of trading on the 17th of April, it had decreased by over 8%.

The chart illustrates that the trend line has shifted to serve as support as the decline persists. At the time of writing, Pepe was trading with a decline of over 1.6%, priced around $0.0000048.

Source: TradingView