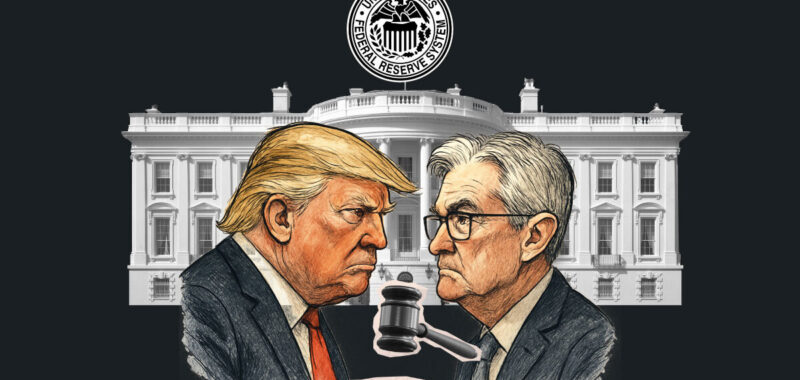

Fed independence at stake

The outcome of the Trump v. Wilcox case has implications for the Federal Reserve, which has long maintained its independence from the executive branch.

The central bank and other federal agencies have been shielded from White House influence since the 1935 Supreme Court decision in Humphrey’s Executor v. United States, which barred President Franklin D. Roosevelt from firing members of the Federal Trade Commission (FTC) for purely political reasons.

According to reporting by The Wall Street Journal, the decision in Trump v. Wilcox could have important ramifications for the Fed and its chair, Jerome Powell.

Trump and Powell have frequently clashed since Powell’s appointment to lead the Fed in 2017 during Trump’s first term — often due to Trump’s desires for lower interest rates. If the Supreme Court were to rule in favor of the government, Trump might not seek to fire Powell at will.

“But granting the president that power would effectively eviscerate the central bank’s independence by making its seven governors, including the chair, at-will appointees of the president, like the Treasury secretary,” the Journal stated.

“Investors would henceforth conclude that monetary policy no longer solely reflects the Fed’s judgment about inflation, employment and financial stability, but also the president’s priorities.”

Another recent action by Trump to fire the two Democratic members of the FTC caused one of the targeted officials, Rebecca Slaughter, to suggest that Powell could be next.

“It’s not just about the FTC, it’s about all of the structures of government that protect market stability,” Slaughter told CNBC last month. “If I can be fired, I don’t know why Jerome Powell can’t be fired. He was actually appointed by President Trump around the same time as me in early 2018. And so, the markets that depend on the stability provided by government institutions should be very concerned.”

Conservative court thinking

The SCOTUSblog, an independent news outlet that covers the court’s decisions, recently interviewed Stephen Vladeck, a Georgetown University law professor who closely watches the court’s emergency docket. Vladeck said that the Humphrey’s Executor case has rarely been challenged by prior presidential administrations, but it has stood up in cases like 2020’s Seila Law vs. Consumer Financial Protection Bureau.

That ruling found that Congress could not protect the head of the CFPB from being removed by the president, because the bureau is led by a single person. That allowed President Joe Biden to remove Kathy Kraninger as the CFPB’s director in 2021 and for Trump to follow suit with Rohit Chopra earlier this year.

But agencies like the Federal Reserve that are led by multi-member commissions have thus far been unaffected by that decision, Vladeck noted.

“Part of why I believe that even this court has been reluctant to overrule Humphrey’s Executor, and it’s had chances, is because I think there is an unspoken but widely shared view that the independence of the Fed (and no other agency) is really important,” he said.

“I don’t think the court has yet been provided with a coherent rationale for a way in which it could overrule Humphrey’s Executor without also undermining the independence of the Fed, and thereby risking yet further harm to the stability of our economic system.”

But the court is strongly conservative and Trump appointed three of them — Neil Gorsuch, Brett Kavanaugh and Amy Coney Barrett. Vladeck said that while the current court has not overruled the Humphrey’s precedent, “it has heavily watered down that understanding.” And he expects a ruling in Trump v. Wilcox before the court goes into recess this summer.