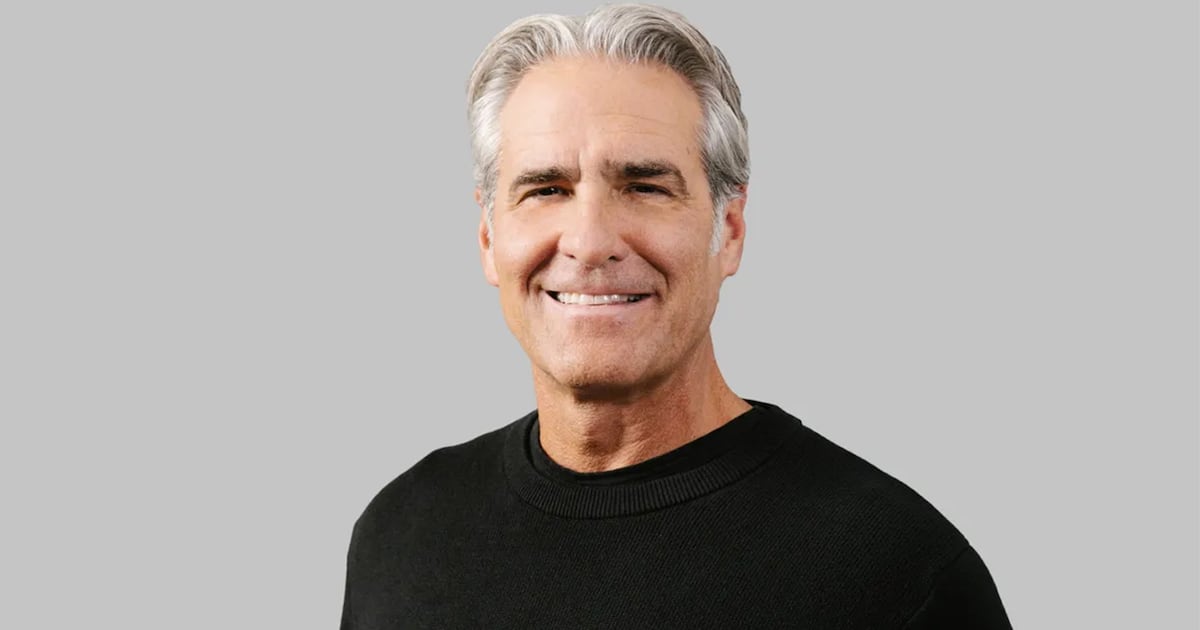

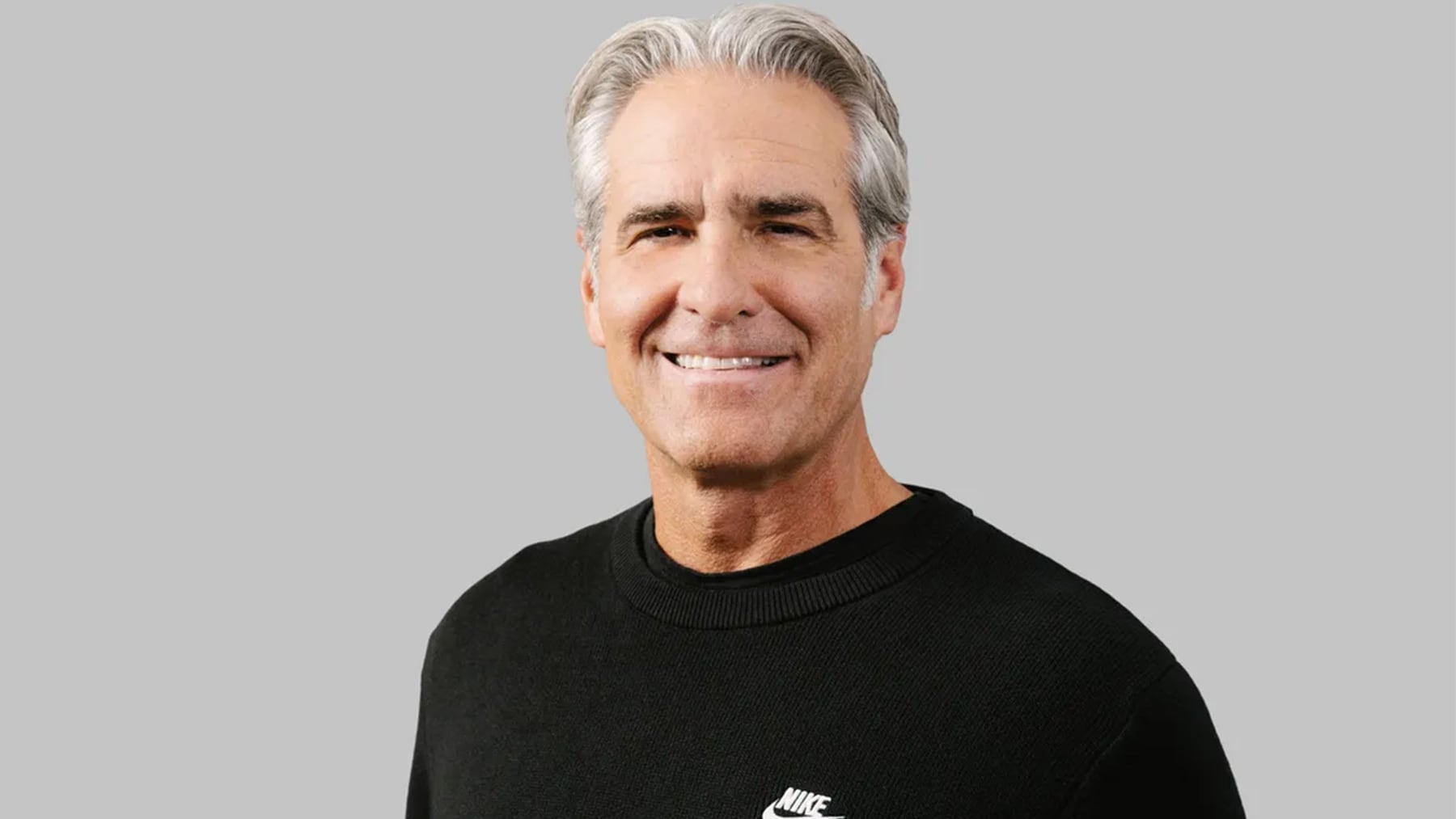

Elliott Hill, the newly named chief executive officer of Nike Inc., came out of retirement last week to help the beleaguered brand regain its footing. He previously spent 31 years at the sneaker and sports apparel company, climbing the ranks from sales intern in 1988 to consumer division president before retiring in 2020.

Hillâs return is part of a rich history of big companies â Starbucks Corp. and UBS Group AG among them â calling on veteran executives to reestablish equilibrium in times of crisis. The most famous example is Steve Jobs, who returned to Apple Inc. 12 years after he was ousted as CEO in 1985. His return laid the groundwork for the formerly flagging tech brand to become one of the worldâs most valuable companies.

Jobsâ wildly successful encore run at Apple set a tantalising precedent for businesses at a leadership crossroads. In the years since, Procter & Gamble, JCPenney Co., Twitter Inc., and Walt Disney Co. all reinstalled proven CEOs when their successors struggled. However, most boomerang executives donât bring blockbuster results.

A 2019 study examining 25 years of public company data found that annual stock performance was 10 percent worse under returning CEOs than their non-repeat counterparts. The findings were consistent even when comparing the boomerangers to first-time CEOs hired into crisis situations.

The weak results mostly come down to company veterans having calcified ideas of how the business should run, said Christopher Bingham, a professor at the University of North Carolinaâs Kenan-Flagler Business School and lead author of the study. Examples Bingham cites include Dell Inc., which continued to struggle after Michael Dell returned in 2007 following a three-year hiatus from the C-suite.

Unlike Dell, or Jobs for that matter, Hill isnât a company founder. This sets him apart from other high-profile returnees like Jack Dorsey (who was twice the CEO of Twitter Inc.), M. Steven Ells (Chipotle Mexican Grill Inc.), Leonard Riggio (Barnes & Noble), Kevin Plank (Under Armour Inc.), and Steve Huffman (Reddit Inc.).

Of course, itâs not only founders who get reinstalled in top roles. Sergio Ermotti at UBS Group AG, A.G. Lafley at Procter & Gamble, and Myron Ullman at JCPenney Co. all were company outsiders before they returned for a second stint as insiders.

Hill differs from these leaders, too, in that he was never CEO before. Though he spent 20 years as an executive at Nike, Hill retired without having held the top job during his initial tenure.

But Kenan-Flaglerâs Bingham said Hill will still be subject to some of the same limitations that have plagued returning CEOs, namely an ingrained âmental modelâ of how the business should work. That could be especially problematic given how fickle consumer tastes are and how fast Nikeâs industry is evolving, he said.

âThe challenge with bringing someone back is you need someone to do something youâve never done before,â Bingham said. Reinstalling a veteran executive is ânot innovation, thatâs business as usual.â

Hill has his work cut out for him after former CEO John Donahoeâs stint led to a loss of market share and an outflow of designer talent.

As Harvard Business School professor Jay Lorsch told Bloomberg back when Lafley returned to P&G: âItâs always an emergency when this happens. You donât go back to the old guy unless you made a mistake and it means you didnât have another candidate ready to go.â That was 11 years ago. The observation is no less relevant today.

Here are some of the returning executives Hill might find himself measured against in his second go-around at Nike.

Michael Kowalski, Tiffany & Co.

- First CEO run: 1999-2015

- Second CEO run: February 2017-October 2017

Kowalski came out of retirement to lead Tiffany briefly in 2017 after his successor, Frederic Cumenal, was ousted following disappointing sales. Fashion executive Alessandro Bogliolo took over in October 2017 and led the company until LVMHâs $16 billion acquisition of the brand was completed in 2021.

Jack Dorsey, Twitter

- First CEO run: 2007-2008

- Second CEO run: 2015-2021

Dorsey returned to Twitter in 2015 after his ouster in 2008. Dorseyâs second run as CEO was tumultuous: the business became profitable while also drawing fire from politicians and activist investors. His resignation in 2021 made room for Parag Agrawal to be promoted from chief technology officer to CEO. Agrawal was forced out the following year after Elon Musk took over the company.

Katrina Lake, Stitch Fix

- First CEO run: 2011-2021

- Second CEO run: January 2023-June 2023

Lake founded Stitch Fix Inc. and took the company public in 2017. Under her leadership, the online clothing brand saw blockbuster growth, pulling in $1.7 billion in revenue in 2020. Former Bain & Co. partner Elizabeth Spaulding became CEO in 2021, before Lake took back the top job in 2023 after the brand struggled to maintain pandemic-era profits. The company hired Matt Baer, a former Macyâs Inc. executive, last year to lead the company.

Howard Schultz, Starbucks

- First CEO run: 1987-2000

- Second CEO run: 2008-2017

- Third CEO run: 2022-2023

Schultz has cycled in and out of the CEO seat at Starbucks three times over five decades. Most recently he came out of retirement to serve as interim CEO in 2022, spending a year in the role before handing over the keys to Laxman Narasimhan. But Narasimhan was booted in August after just 16 months on the job following two quarters of slowing sales. In August, the coffee chain hired Brian Niccol away from Chipotle Mexican Grill Inc. to inject new energy into the brand.

Bob Iger, Walt Disney

- First CEO run: 2005-2020

- Second CEO run: 2022-present

And then thereâs longtime Walt Disney Co. CEO Bob Iger, who took the reins back from Bob Chapek, his hand-picked successor, in 2022 after less than three years. This summer, the company extended Igerâs two-year contract through 2026. Succession planning is still ongoing. While Iger successfully warded off a cadre of activist investors and settled a political spat with Florida Governor Ron DeSantis this spring, the companyâs financial results have been mixed. Lower-than-expected revenue last quarter at its theme parks offset the success of its newly profitable streaming business.

By Jo Constantz