- Near Protocol’s consolidation phase suggested a probable decline.

- However, a rebound could allow NEAR to continue trading within its consolidation channel.

Near Protocol’s [NEAR] bearish trend is evident across all timeframes, with a 6.00% decline over the past month and a 7.85% drop weekly.

It has entered another downward phase, recording a 1.82% decrease in the last 24 hours.

While a minor rebound may enable NEAR to maintain its position within the consolidation phase, the prospect of a significant upward trend from its current price remains uncertain.

NEAR faces imminent decline

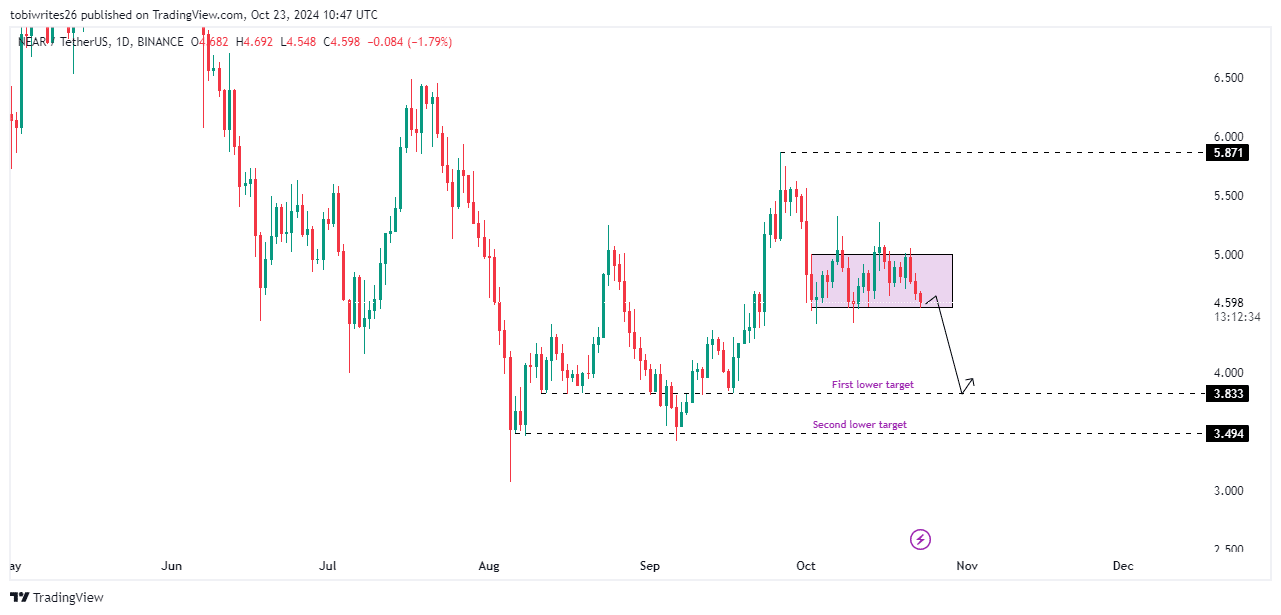

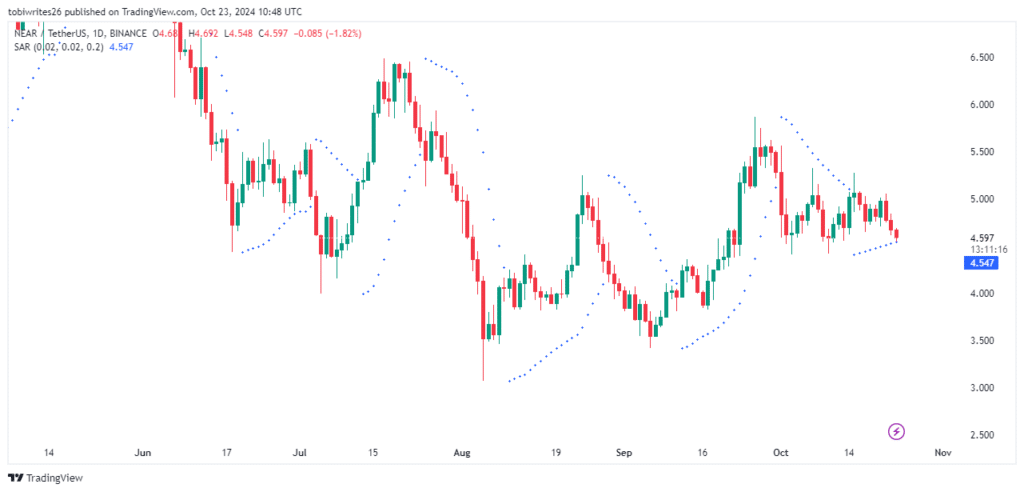

NEAR has been trading within a consolidation phase between $5.005 and $4.561 since the 2nd of October. While this phase typically indicates accumulation, in NEAR’s case, it suggests an impending distribution.

If this distribution occurs, NEAR could target two potential price levels: the first at $3.833, and if selling pressure continues, a further decline to $3.494.

Source: TradingView

If the anticipated distribution does not materialize, NEAR will likely remain within its current trading range. Thus, AMBCrypto has reviewed other onchain metrics to determine NEAR’s next move.

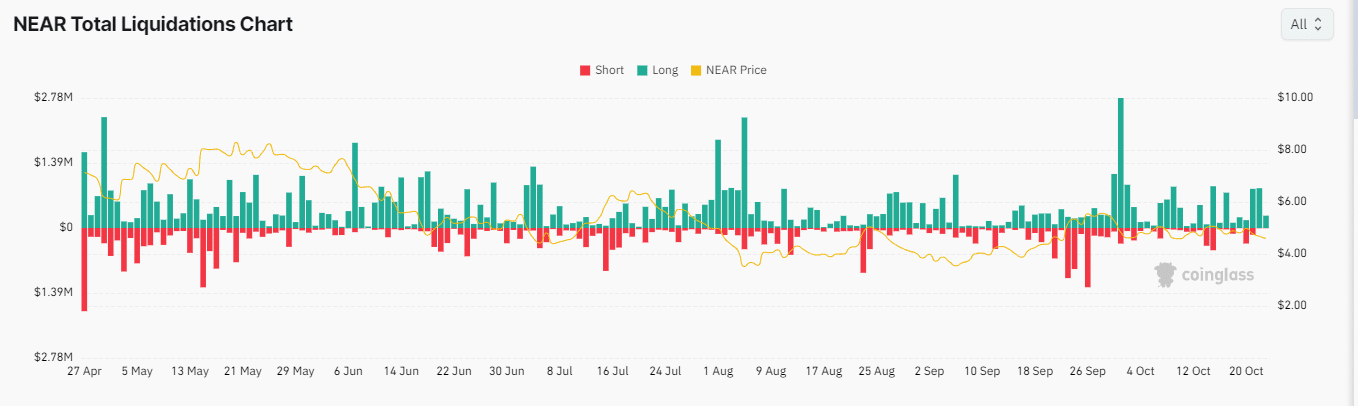

Trader loss imbalance signals active sellers

According to Coinglass, a significant imbalance has emerged between short and long liquidations over the past 24 hours.

Of the $388.22k worth of NEAR liquidated from the market, a substantial $377.36 thousand came from long positions, while only $10.86 thousand was attributed to short positions.

This imbalance indicates that the market is likely trending downward, as the side with the lower liquidation amount—in this case, short traders—tends to dominate market direction.

Source: TradingView

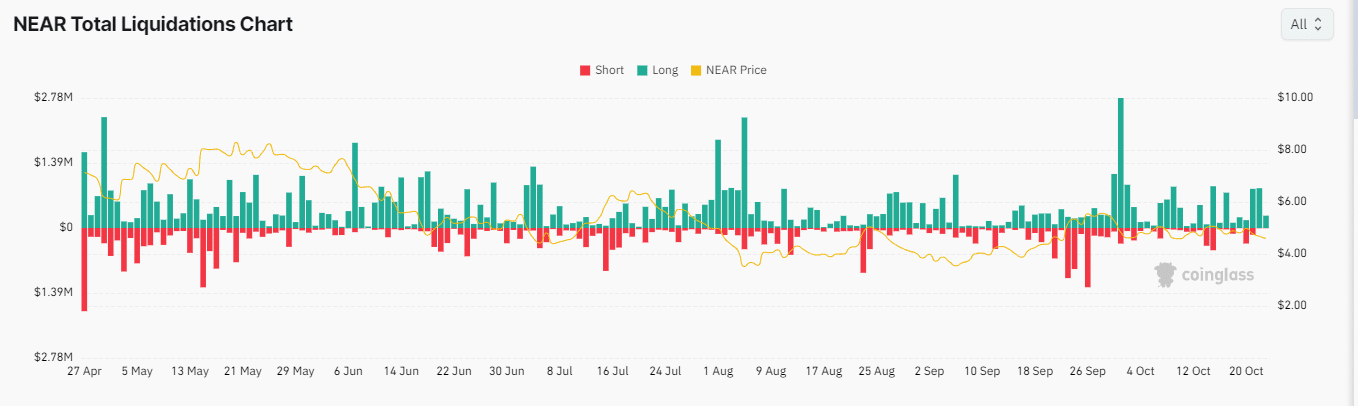

Additionally, the Weighted Funding Rate has considerably declined, signaling that short positions are paying long positions amid a prevailing bearish sentiment.

The Weighted Funding Rate represents the average funding rate across exchanges, adjusted for the size of Open Interest, which reflects the cost of holding long or short positions in perpetual futures contracts.

If the liquidation imbalance favors bearish traders and the Weighted Funding Rate continues to fall, NEAR may face further declines from its current trading range.

Faint signs of a rebound

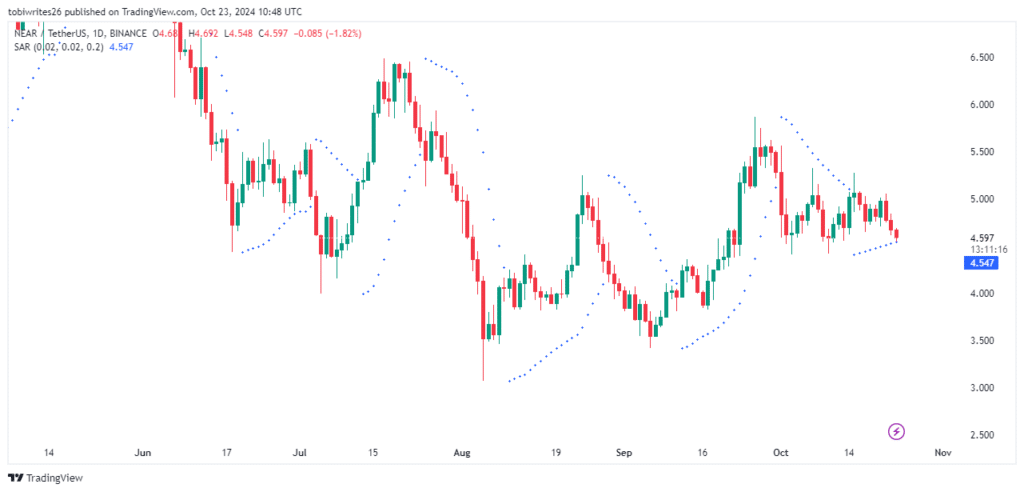

Amidst persistent bearish sentiment in the market, there is a possibility for a rebound from the support level of the consolidation channel, allowing NEAR to extend its trading range within this channel.

This potential recovery is indicated by the Parabolic SAR (Stop and Reverse), which has formed dots below NEAR’s price, suggesting that the market retains a bullish outlook.

Read NEAR Protocol’s [NEAR] Price Prediction 2024–2025

This signals that some traders are actively buying NEAR at current levels.

Source: Trading View

If these dots continue to form, NEAR could sustain its position within the consolidation phase and possibly break out beyond it if market sentiment shifts positively.