- MicroStrategy sees $22m in volume on launch day as Bitcoin’s historical pattern is set for repetition.

- Bitcoin ETFs net flow turned positive again after one day of outflows despite market sentiment being fearful.

MicroStrategy, a major Bitcoin [BTC] player, achieved $22 million in volume on the first day of the ETF, possibly setting a record for leveraged ETFs, as first shared by Bloomberg’s ETF Analyst Eric Balchunas on X (formerly Twitter).

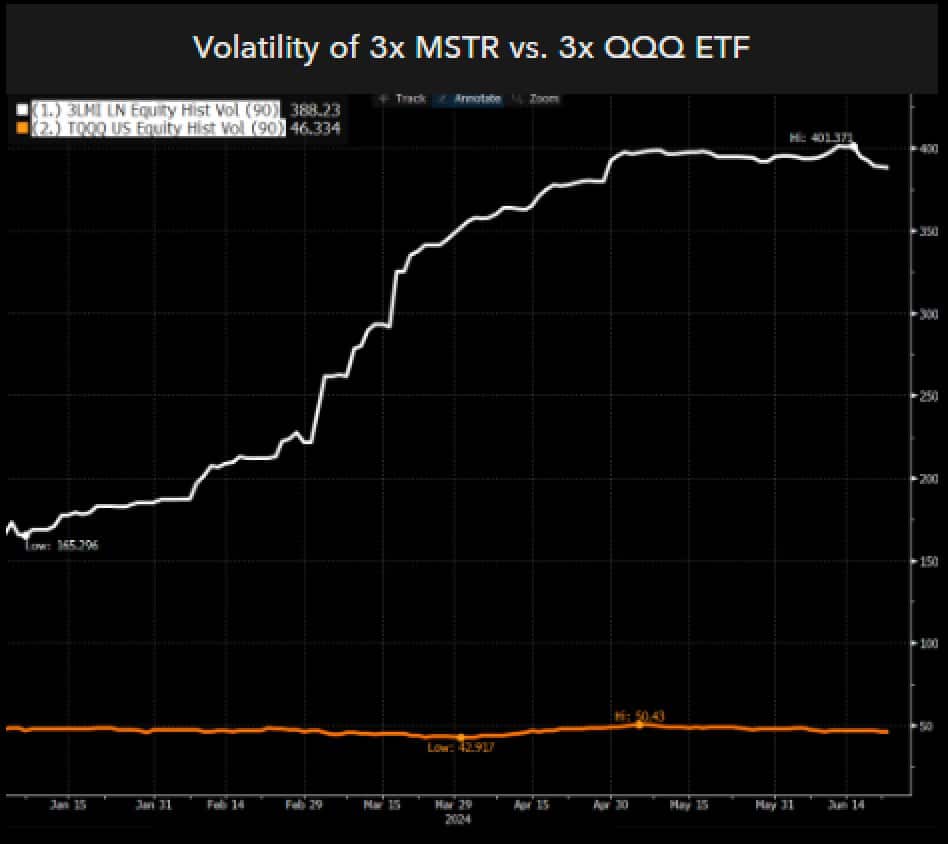

This ETF is expected to lead in volatility among the U.S. ETFs, based on the 90-day volatility indicator. However, its volatility may increase further as issuers push the limits to attract investors.

Despite $MSTX’s high volatility in the US, it’ll still be less extreme compared to Europe’s $3LMI LN, which has a 90-day volatility of over 350%.

Source: Eric Balchunas/X

The volatility and trading volume of $MSTX suggest it could become a major player in the ETF market, thus impacting the future price of Bitcoin.

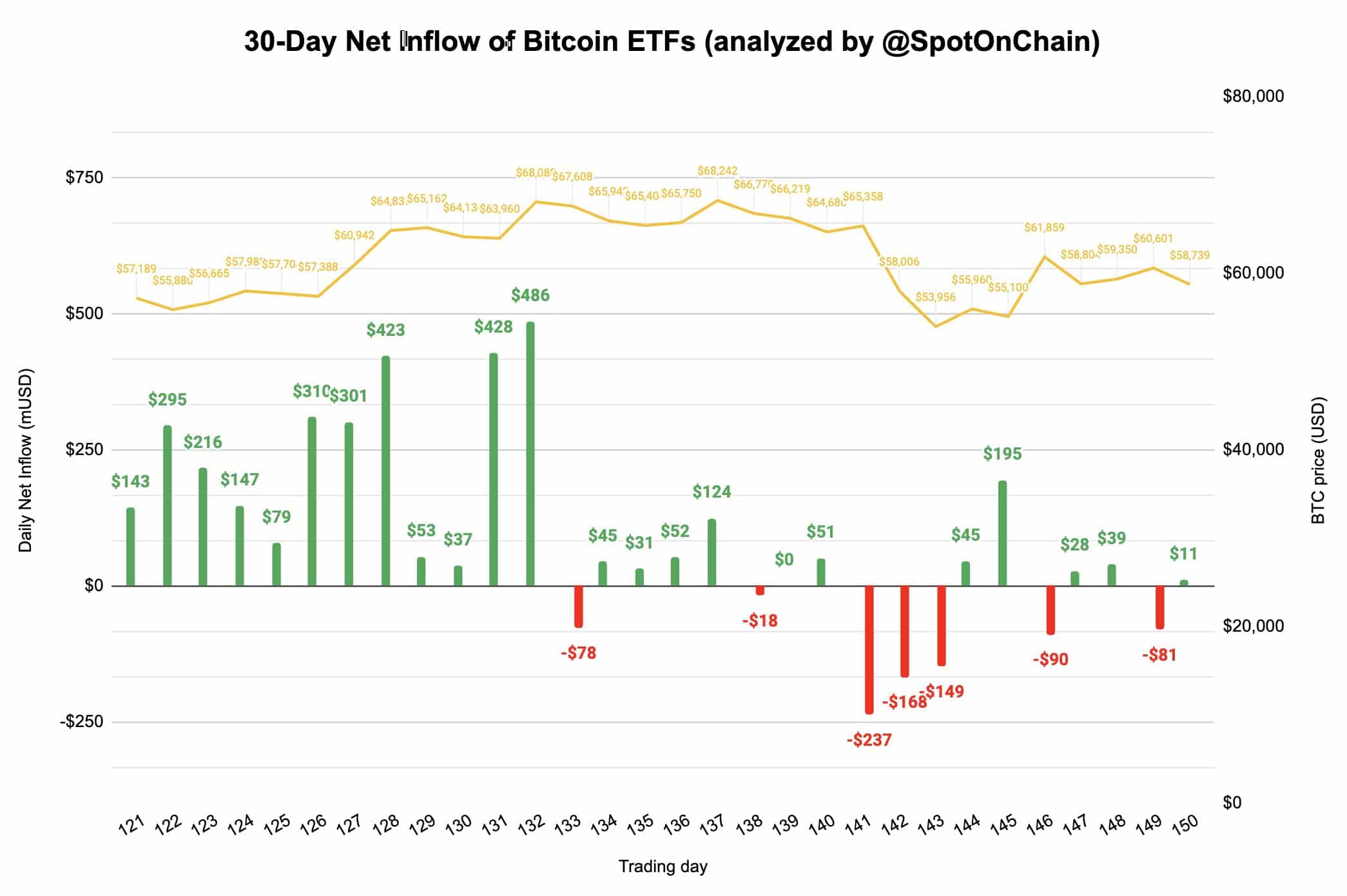

This has possibly led to Bitcoin ETFs seeing a positive shift, with $11 million deposited, reversing a brief outflow as Spot On Chain shared on X.

Source: Spot On Chain

Among the top U.S. Bitcoin ETFs, only BlackRock’s IBIT didn’t see a significant increase in net flow, while Fidelity, Grayscale, and Bitwise experienced notable inflows.

The ETF market is poised for continued growth, bolstered by the MicroStrategy ETF’s record trading volume.

Given MicroStrategy’s substantial Bitcoin holdings, its influence suggests that Bitcoin prices are likely to rise.

BTC current cycle mirrors ‘Blue Years’

Bitcoin’s current cycle mirrors past “Blue Years,” marked by consistent patterns of two major highs and two sideways periods.

This cycle has seen a powerful move from January to March, followed by a prolonged correction. Unlike previous cycles, this one hasn’t yet reached new all-time highs, extending the correction.

Source: CryptoCon, TradingView

Historically, similar cycles have found every second early top (light blue circle) bottoms around August, suggesting the recent drop is typical before a push into new highs the following year.

Despite some differences, the Halving Cycles Theory indicates that a top in late 2025 remains on track. New highs appear likely as the cycle progresses.

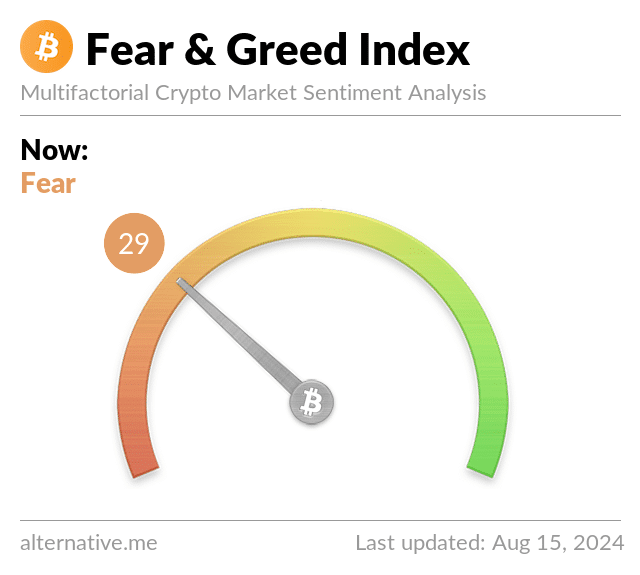

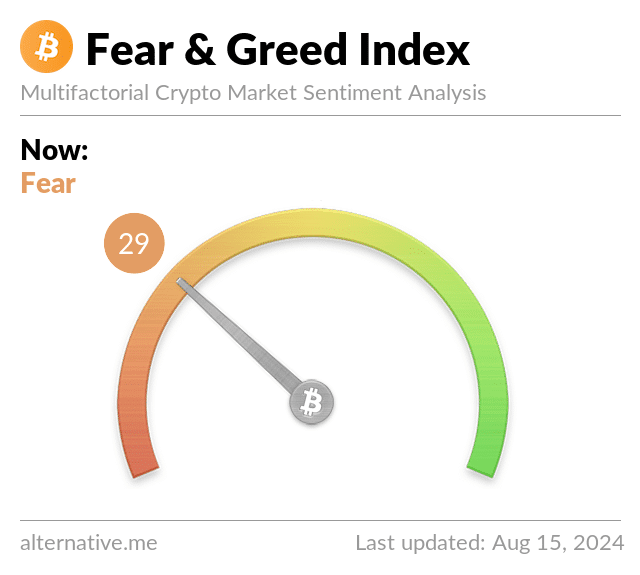

Additionally, major banks and large financial institutions globally are increasing their Bitcoin holdings, despite the current fearful market sentiment.

Source: Alternative.me

It’s wise to follow the lead of these influential investors. With strong buying activity and positive market metrics, traders and investors can anticipate a potential upward movement in Bitcoin’s price.