Making money on the crypto market is still not as easy as it looks, rug pulls and scams are quite common in the space and any user who is new to the space may fall victim to these. Another major problem is the increased volatility inherent in crypto assets, due to which many novice traders suffer significant losses. Based on the above, today, staking is one of the most common ways of making profits and while the process of locking your crypto assets for a set period of time to support a project while also making some passive income might seem lucrative, it is easy to invest in a risky platform.

In such a scenario, CoinDepo proves to be a reliable platform that looks out for its users and secures their investment. The platform has made it its mission to bring classical financial services to the world of crypto assets without any restrictions or borders. They are doing this by taking existing banking products that everyone knows about and reimagining them with the latest technologies.

What is CoinDepo?

CoinDepo has been operational since 2021 in association with Fireblocks, a leading custodial service for financial institutions. The platform will be the first to soon introduce unique types of loans and microcredit to users who want to borrow stablecoins and cryptocurrencies without a collateral account. They also have an option for a crypto deposit service (Compound Interest Accounts) with high-yield interest rates.

CoinDepo has created an advanced platform for crypto deposits and staking with the best interest rates on the market and flexible deposit plans ranging from a day to a year. They also have 3 regional offices in Singapore, London, and Dubai, managing a global active user base with millions of dollars in crypto assets under management.

Safe Haven for Borrowers and Liquidity Providers

The platform’s unique Borrower Approval Procedure complies with KYC and AML requirements. During this process, the borrowers undergo a comprehensive check and have to get approved by the Board of Independent Auditors and Auditors Guarantors.

Guarantors on the platform are those who provide liquidity to the platform for fees as additional security for loans that are issued by Liquidity Providers through the Loan Overcollateralized Mechanism.

Any user who is a Liquidity Provider on CoinDepo is protected by this Loan Overcollateralization Mechanism that eliminates risks of loss of deposited assets. In case the borrowers commit a default, the Liquidity Providers are reimbursed their investments and earned interest from the Guarantors’ funds held in the CoinDepo Liquidity Reserve Accounts.

CoinDepo stands out from other crypto lending platforms as it enables borrowers to obtain crypto loans without any collateral in CeFi and DeFi Lending Pools. Liquidity Providers can easily track all transactions on the blockchain and earn high-yield interest with zero risk of losing their deposits due to the Loan Overcollateralized Mechanism and the Rebalancing Algorithm of Pools.

CoinDepo Token

The COINDEPO token has a revolutionary fully automated algorithm that parses the entire DeFi sector including Layer 2 Liquidity Pools and staking solutions on different blockchains. This allows CoinDepo users to get the best APR and Compound Interest on major digital assets without the risk of losing their investments.

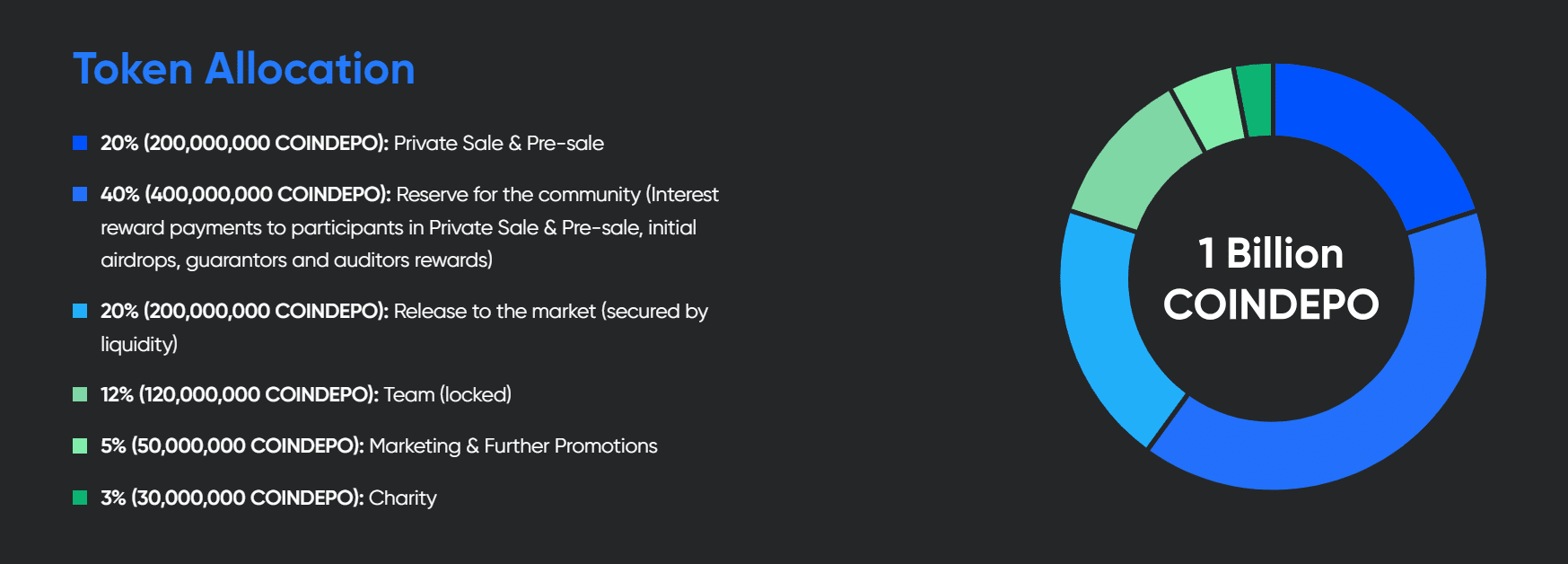

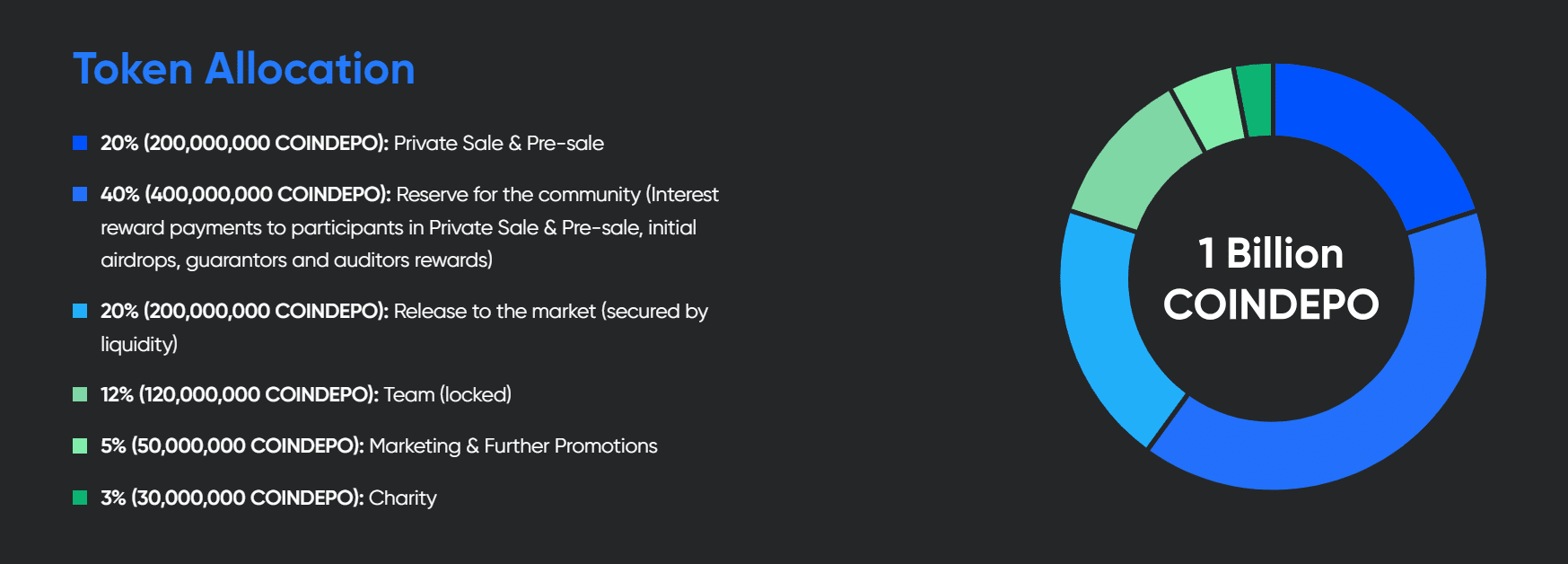

The token will be supported on Ethereum, Tron, Binance Smart Chain, and Solana and has a fixed supply of 1 Billion. Out of this, a 40% share is reserved for the community for interest reward payments to users who participate in the private sale and the pre-sale, initial airdrops, guarantors and auditor rewards. A 20% share is for the private and pre-sale, and another 20% for release to the market (secured by liquidity). 12% is locked for the team, 5% for marketing and further promotions, and the remaining 3% for charity.

The token is automatically staked on the platform immediately after purchase and starts earning 65% per annum. Any user who buys the token now during the Private Sale and Pre-sale can earn up to 600% ROI due to a 75% purchase discount and compound interest on staking which begins to accrue and is paid out daily from the moment the token is purchased during the Private Sale and Pre-sale.

Earn 18% to 24% APR + Compound Interest

Users can earn from 12% to 24% APR and compound interest daily on major cryptos and stablecoins. Funds can be withdrawn at any time and the deposited assets are fully insured. There are zero commissions and no minimum deposits. The interest rates depend on the type of CoinDepo Compound Interest Account. Earned compound interest is paid out in the user’s account daily, weekly, monthly, quarterly, semi-annually, or annually depending on the compounding period of the stablecoin/crypto FD a user chooses. The longer the compounding period selected, the higher the interest rate.

Earning profits is super easy, all you need to do is transfer CoinDepo-supported cryptocurrencies or stablecoins from any external wallet to the CoinDepo account. You can choose from 6 types of CoinDepo Compound Interest Accounts to deposit your assets, with annual interest rates from 12% to 24% + compound interest.

In 2025, CoinDepo also plans to launch a crypto credit card that is useful for crypto and stablecoins with unlimited crypto cashback of up to 8% on every purchase. It will have flexible repayment options and will not require any origination/monthly/annual fees. The card will be accepted worldwide by 90 million+ merchants. Payments can be made in any local currency with metal/plastic and virtual cards.

Final Word

CoinDepo’s future roadmap includes plans to launch its crypto micro-lending service for its customers offering unsecured loans in cryptocurrencies and stablecoins. Apart from this, they are also introducing an Instant Credit Line, where users do not need to open a collateral account (unlike all other existing crypto lending platforms). The crypto assets will continue earning interest on the platform even when someone takes a loan, as all funds will remain in Compound Interest Accounts. Users will be able to spend, without having to sell their crypto assets, using a crypto credit card which is also going to be released soon.

The platform’s main goal is to change the global vision regarding the principles and the future of finance. They are trying to eliminate any difficulties hindering the evolution of the financial system. According to CoinDepo’s vision, innovations in the field of finance are not the invention of something complex and incomprehensible to a normal person but modernization and adaptation of financial products familiar to everyone to the realities of the modern world of digital assets.

For more information on CoinDepo, please check out their official website.

Disclaimer: This is a paid post and should not be treated as news/advice.