- Long-term holders added 297K BTC in nine days, showing increased confidence.

- Continued Bitcoin accumulation could push BTC past $88K, possibly testing $90K soon.

Since recovering from the recent market crash, Bitcoin [BTC] has witnessed a significant surge in demand, with investors returning to the market. Naturally, this resurgence has sparked increased accumulation activity across the board.

According to Glassnode, Bitcoin’s Accumulation Trend Score has surged to a year-to-date high. At press time, the score sat at 0.43, signaling growing demand for the crypto.

Source: Glassnode

A rising accumulation score suggests that wallets are re-entering accumulation on a broader scale.

Despite recent price hesitation, large investor groups have cautiously resumed stacking, with long-term holders (LTHs) leading the charge. Over the past nine days, LTH supply has increased by 297,000 BTC, signaling growing confidence among seasoned investors.

Further reinforcing this trend, LTH Binary Spent has dropped to 0.3 in the past week, indicating that fewer long-term holders are selling Bitcoin – a strong bullish signal.

Source: Checkonchain

With LTH reducing selling activities, other market participants have followed suit. Inasmuch, unspent outputs have sustainably grown through 2025, hitting 3.03 million.

Although it’s a drop from 5.2 million in 2024, current levels remain relatively high, implying that BTC holders remain bullish and anticipate better returns and market conditions in the near term.

Source: BitBo

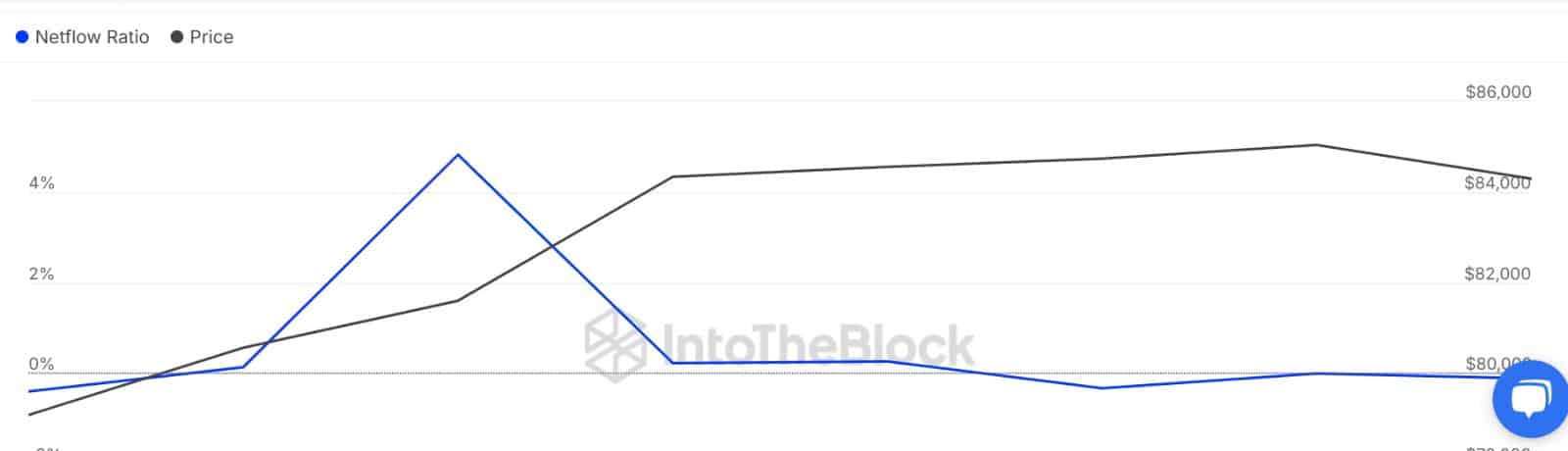

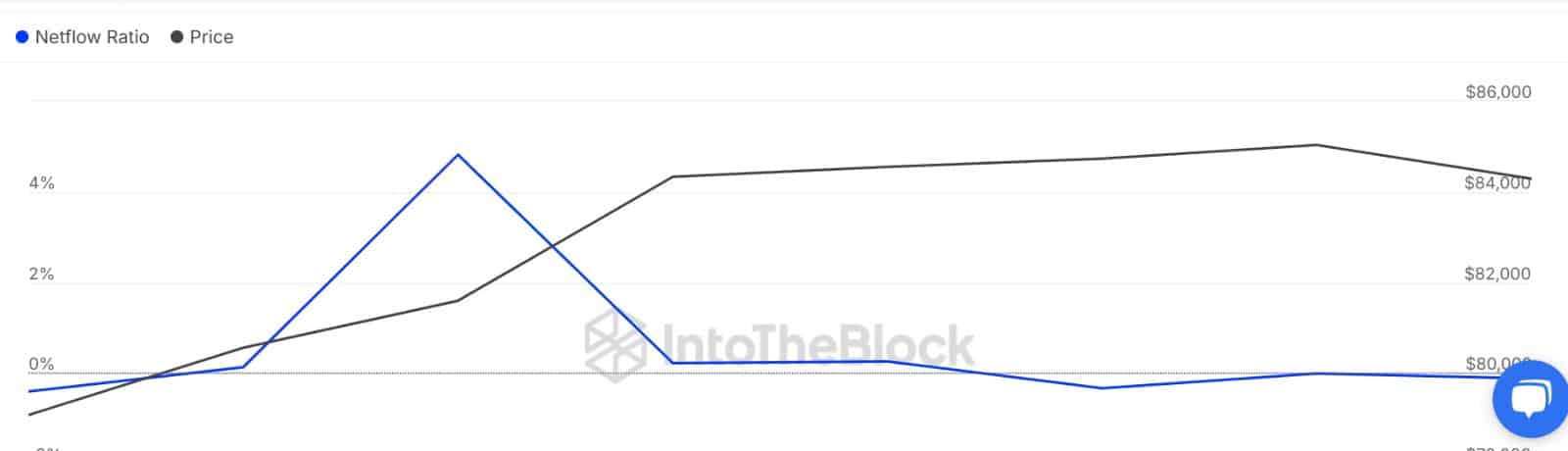

On top of that, whale activity has further reinforced the ongoing accumulation narrative.

For the past three consecutive days, Exchange Flow from large holders remained negative, indicating that more BTC was being withdrawn than deposited.

Simply put, whales are stockpiling—a classic signal of a potential bullish shift.

Source: IntoTheBlock

What does it mean for BTC?

With long-term holders (LTHs) and large investors accumulating, Bitcoin’s market stability appears strong as big players bet on improved performance.

This optimistic sentiment among market participants often drives higher prices.

If the current accumulation trend continues, Bitcoin could see a reversal in fortunes, fueled primarily by organic demand.

An upward move from here could lead to a breakout from consolidation, with BTC surpassing $86,700. If momentum holds, Bitcoin could reclaim $88K and push toward the psychological $90K level.

Conversely, if short-term holders (STHs) take profits from recent gains, Bitcoin might correct downward, potentially dropping to $82,696.

Monitoring accumulation trends and investor activity will be crucial in determining BTC’s next direction.