- INJ has surged by 10.99% over the past 24 hours.

- Injective is experiencing strong positive market sentiment, signaling further gains.

Since Fed rate cuts a week ago, crypto markets have recorded significant gains. With the market reawakening, Bitcoin [BTC] has led the way.

Usually, Bitcoin’s recovery means gains for the altcoins. Therefore, altcoins have made considerable gains, with AI-themed coins experiencing a massive upsurge.

Amidst this AI coins resurgence, Injective [INJ] has shown massive resilience.

In fact, as of this writing, INJ was trading at $23.23. This marked a 10.99% increase over the past day.

Over the same period, Injective’s trading volume has soared by 45.27% to $174.4 million. Also, the altcoin’s market cap has increased by 10.74% to $2.3 billion.

This trend has been sustained throughout the month. As such, over the past week, INJ has increased by 13.55% completing a long-month uptrend, hiking by 13.14% on monthly charts.

What INJ’s chart says

According to AMBCrypto’s analysis, INJ was experiencing a sustained upward momentum at press time.

Since hitting a monthly local low of $15.56, Injective has alerted to break free from a months-long consolidation. This uptrend shows a sustained change in market sentiment and investor preference.

Thus, these prevailing market conditions could set INJ to make further gains on its price charts.

Source: TradingView

For instance, Injective’s Relative Strength Index (RSI) has seen a sustained for the last two weeks, rising from 47 to 68 at press time.

This shows increased demand for the altcoin, which is further by an earlier observed surge in trading volume. Thus, INJ was experiencing stronger buying pressure than selling.

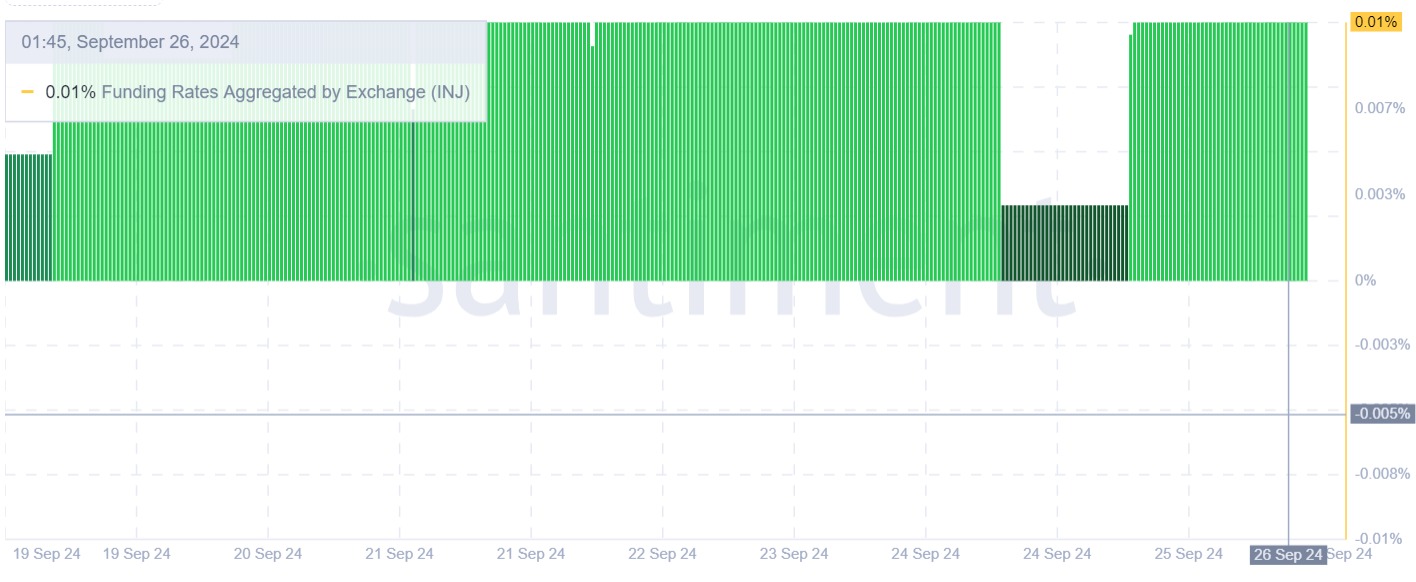

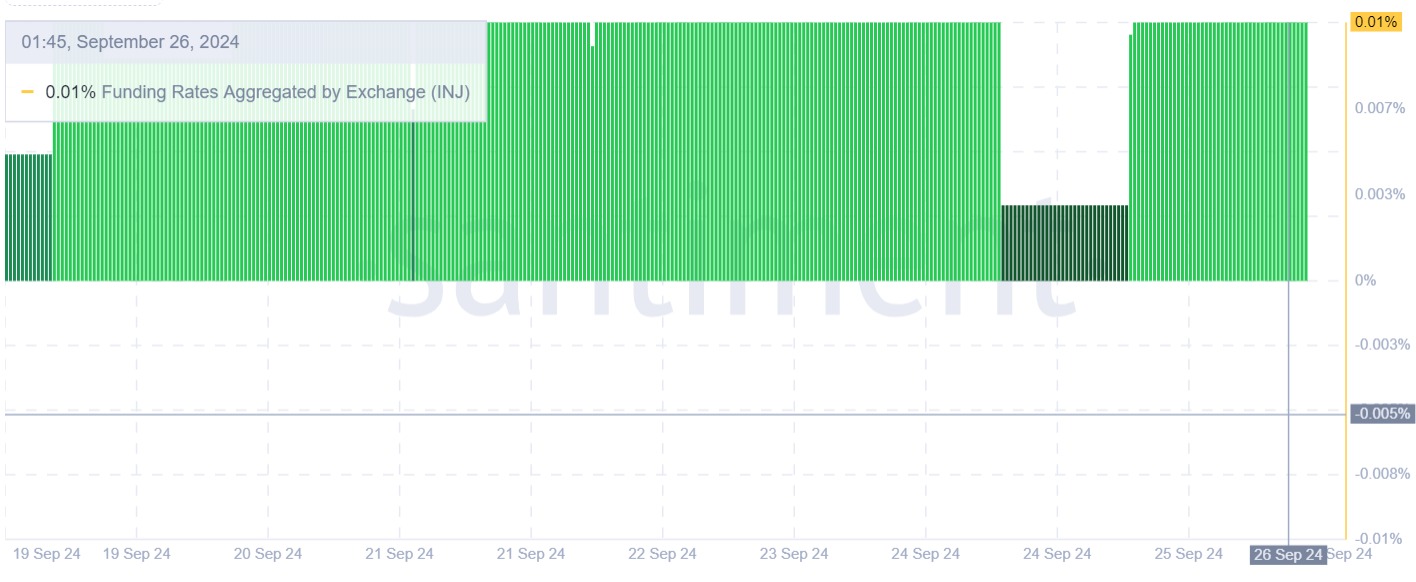

Source: Santiment

Additionally, Injective’s Funding Rate Aggregated by Exchange has remained positive over the past week.

Usually, a positive Funding Rate aggregated by exchange suggests that long positions are paying short positions. This indicates that most investors are bullish and expect prices to increase.

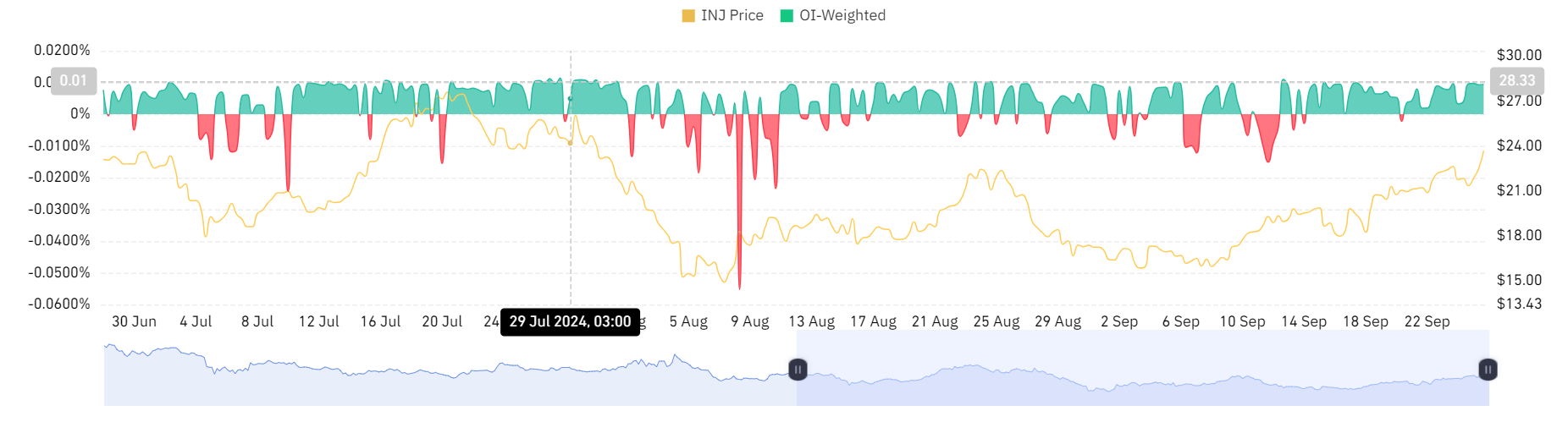

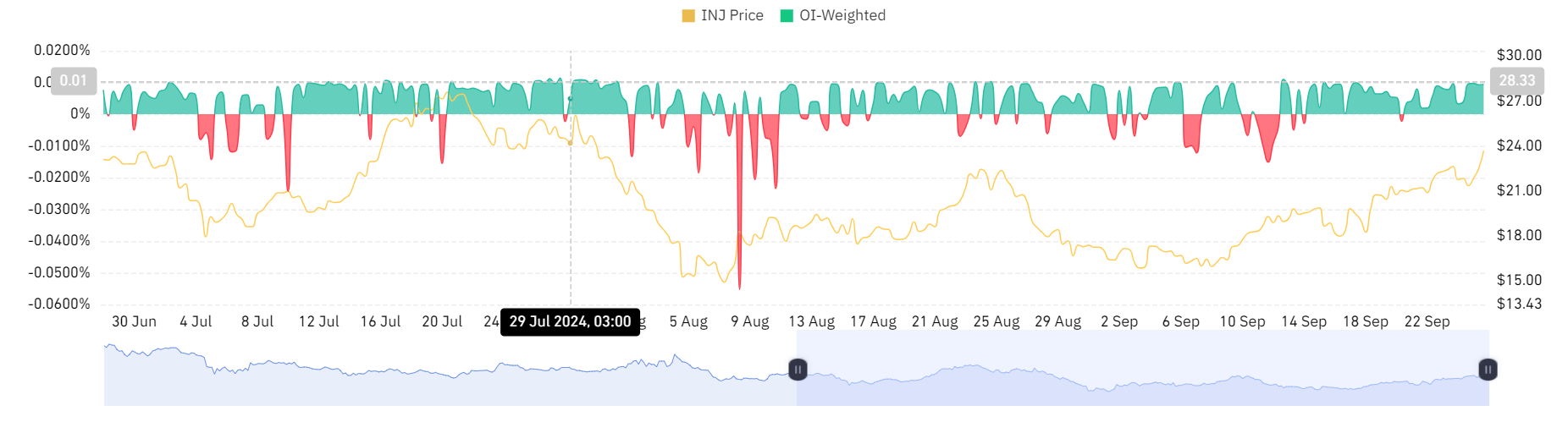

Source: Santiment

Looking further, Open Interest in USD per Exchange has seen a sustained uptrend over the past week. As such, it has increased from $33.4 million to $41.18 million.

With the price rising as Open Interest increases, it usually confirms the strength of an uptrend. This means that traders are taking positions in the direction of the price movement, confirming the trend’s credibility.

Source: Coinglass

Finally, the demand for long positions is further strengthened by a positive OI-Weighted Funding Rate. This suggests that long position holders are bullish that they pay a fee to hold their positions.

Read Injective’s [INJ] Price Prediction 2024–2025

Simply put, Injective is currently experiencing an upward momentum. With positive market sentiment, INJ is well-positioned for further gains.

Thus, if the prevailing market conditions hold, INJ will break out from the next significant resistance level at $25.8. A breakout from this level will see Injective reach $29.3.