- INJ stakeholders lost significant gains made during the September rally.

- Now, the hope for a breakout hinges on a key factor.

Injective [INJ] defied September’s bearish trend, surging over 40% to hit $23 last week. However, a price correction in October erased much of those gains, pulling INJ back to earlier levels.

Recently, the Injective network announced key milestones, sparking a notable increase in its userbase and a 6% rise in INJ’s value.

Despite this brief uptick, the rally was cut short by a bearish MACD crossover on the daily chart. Following this, AMBCrypto investigated if this retracement could catalyze a breakout, as many analysts anticipate.

INJ in short supply

Injective’s innovative burn auction, introduced with INJ 2.0 in 2023, has simplified the token burning process.

For context, it enables individual users to contribute directly to the Auction Fund; the INJ network has made token burning more accessible.

Recently, the network announced the burning of an additional 200K INJ tokens, a move expected to positively impact INJ’s price action over the long term.

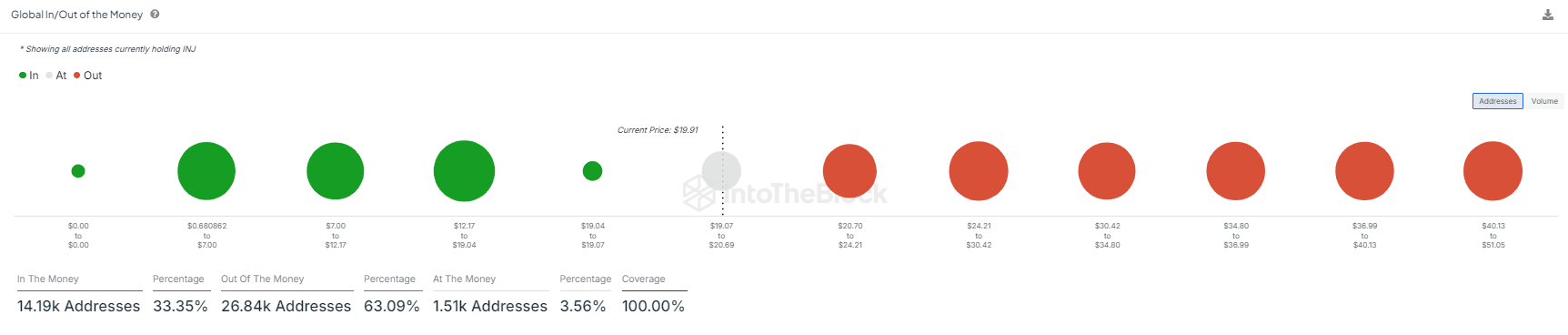

However, as AMBCrypto pointed out, the recent price retracement has pushed many INJ holders into a loss position. A significant portion of these investors accounts for 1.66 million INJs, acquired at an average price of $22, which is lower than the current trading price.

Source : IntoTheBlock

If other holders see the current price as a market bottom and decide to buy the dip, these investors may have an incentive to hold off on breaking even, in addition to the network achievements previously mentioned.

If this trend holds, the next big test for Injective will be turning the previous $23 resistance into support, if they succeed, then the next resistance might hit around $30.

Whales are supporting this idea

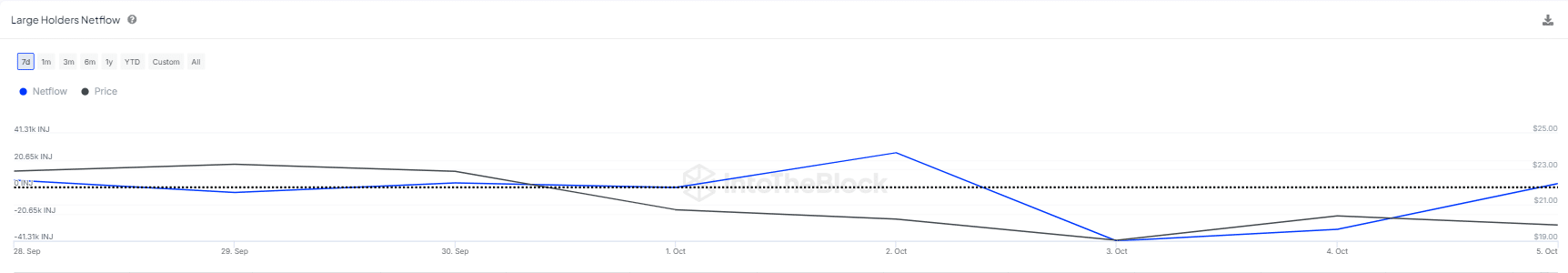

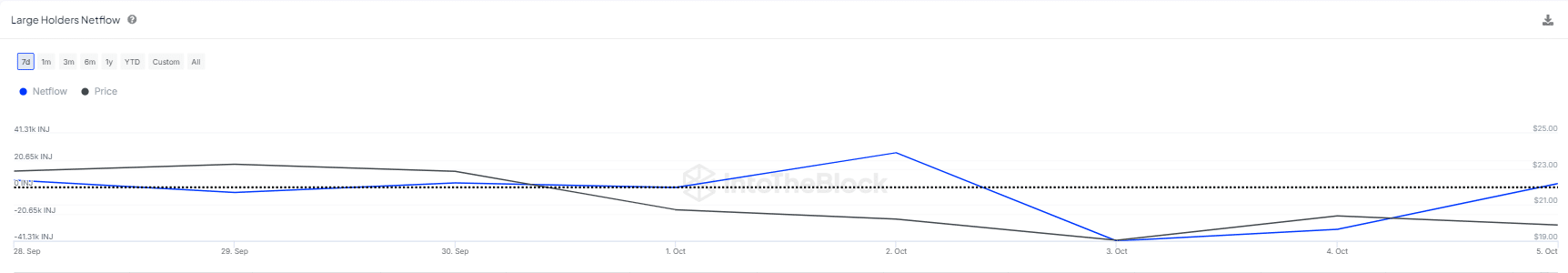

This week, large whale cohorts intervened to prevent INJ from a deeper pullback that could have dropped the price to $18. Their efforts led to a notable 7% gain, pushing INJ back up to $20.

The chart below shows that approximately 45K INJ tokens flowed from exchanges into whale wallets, accumulating during the dip and successfully flipping the $18 level into support.

Source : IntoTheBlock

While this is a bullish sign, a decline in whale holdings could pose a challenge for bulls trying to maintain the $23 level.

In summary, this accumulation suggests a potential market bottom, encouraging loss-position holders to maintain their holdings while drawing in profit holders through FOMO, which is crucial for establishing the $23 support.

Read Injective’s [INJ] Price Prediction 2024–2025

However, if whales retreat, major players may lose confidence in a recovery, possibly driving INJ back to $18.

Therefore, tracking whale activity is essential for a breakout. If whales remain committed long-term, their confidence could help bulls hold onto the $23 support, setting the stage for the next resistance at $30.