- BTC saw a massive sell-off amid Israel-Iran tensions.

- BTC showed strong sensitivity to U.S. equities, making it susceptible to geopolitical tensions.

After defying negative seasonality expectations in September with decent gains, Bitcoin [BTC] and crypto markets are off to a rough start in ‘Uptober.’

BTC, the world’s largest crypto asset, declined nearly 4% on the 1st of October, bringing its weekly losses to about 10%.

It dropped from the peak of $65K to a low of $60.1K amid Israel-Iran escalations.

The BTC plunge triggered a wild crypto market sell-off, turning the whole sector red in the past 48 hours.

Source: CoinMarketCap

Israel-Iran tensions

Israel-Iran tensions have been going on for years, although through proxies like Hezbollah and Yemen-based Houthis.

But the adversaries have since opted for a direct face-off, which hit fever pitch on the 1st of October as Iran reportedly launched a barrage of missiles at Israel. This was retaliation to Israel’s ground offensive in Lebanon.

Investors quickly adopted risk-off mode, perhaps fearing that the escalations could morph into a devastating regional war.

The U.S. equities, led by tech stocks, triggered a massive sell-off. The tech-heavy Nasdaq Composite declined 1.5%, while the S&P 500 Index shed 0.93%.

BTC followed suit with a nearly 4% plunge, dragging it to range-low levels near $60K.

Ethereum [ETH] saw the most sell-off amongst major crypto assets at press time. It was down 6% on the daily charts, followed by Solana’s [SOL] 5.8% drop.

On the 1st of October, the U.S. spot BTC ETFs also recorded $242.5 million in daily outflows, the highest since early September.

This further underscored crypto investors’ risk-off approach as most switched to gold.

The sell-off wasn’t surprising given BTC’s risk-on status and recent strong positive correlation with U.S. stocks.

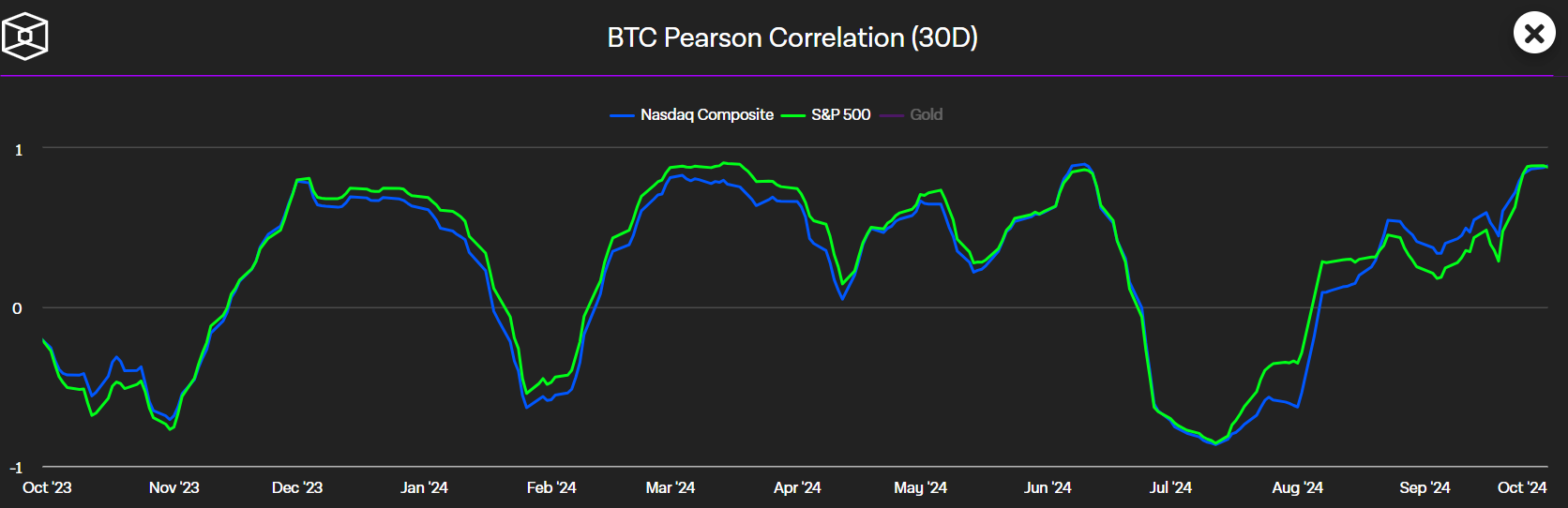

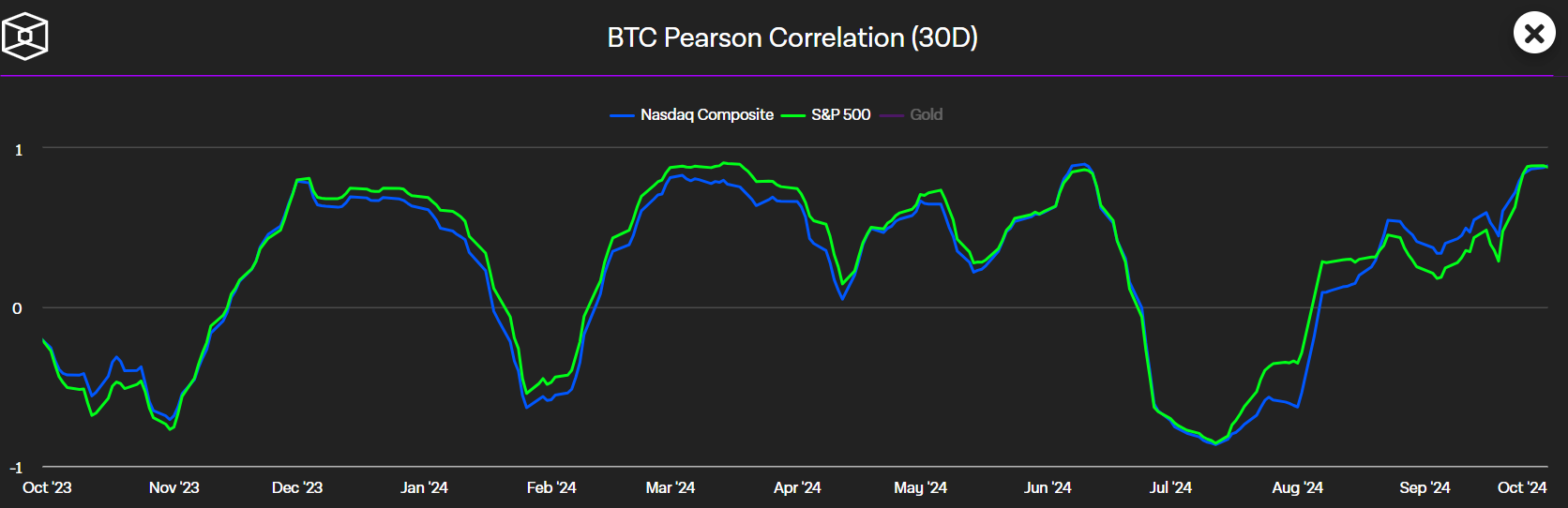

Per BTC Pearson Correlation, BTC has shown increasing sensitivity to US stocks since July.

Source: The Block

That said, Quinn Thompson, founder of macro-focused crypto hedge fund Lekker Capital, claimed that the escalation was a complex play that could influence US elections. Nonetheless, he believed the tensions would taper off in the short term.

“But if I had to bet on it, I would guess that today’s situation blows over in the near term with lots of saber rattling and barking similar to recent months.”

QCP Capital echoed a similar short-term potential impact of the tensions. It said,

“Middle East geopolitics will steal the limelight for now, but the shallow sell-off suggests that the market remains well bid for risk assets.”

If Thompson’s projection plays out, BTC and the overall market could rebound soon.

In the meantime, $58K was a key level to track if the sell-off compounded and BTC broke below $60K.

Source: BTC/USDT, TradingView