- Bitcoin shows a slight recovery after a significant drop, influencing correlated altcoins like Cardano.

- Analysts suggest monitoring the positive correlation between Bitcoin and altcoins for potential market shifts.

Bitcoin [BTC], after experiencing a sharp decline earlier this week as it dropped by more than 10% within just two days, has shown a slight rebound over the past 24 hours. During this period, Bitcoin’s price has increased by 0.5%, approaching the $60,000 mark.

Despite this minor recovery, the asset remains down by 2.3% over the past week, reflecting a market still in flux. This price movement has sparked discussions among analysts, with particular focus on the correlation between Bitcoin and various altcoins.

Correlation between Bitcoin and altcoins

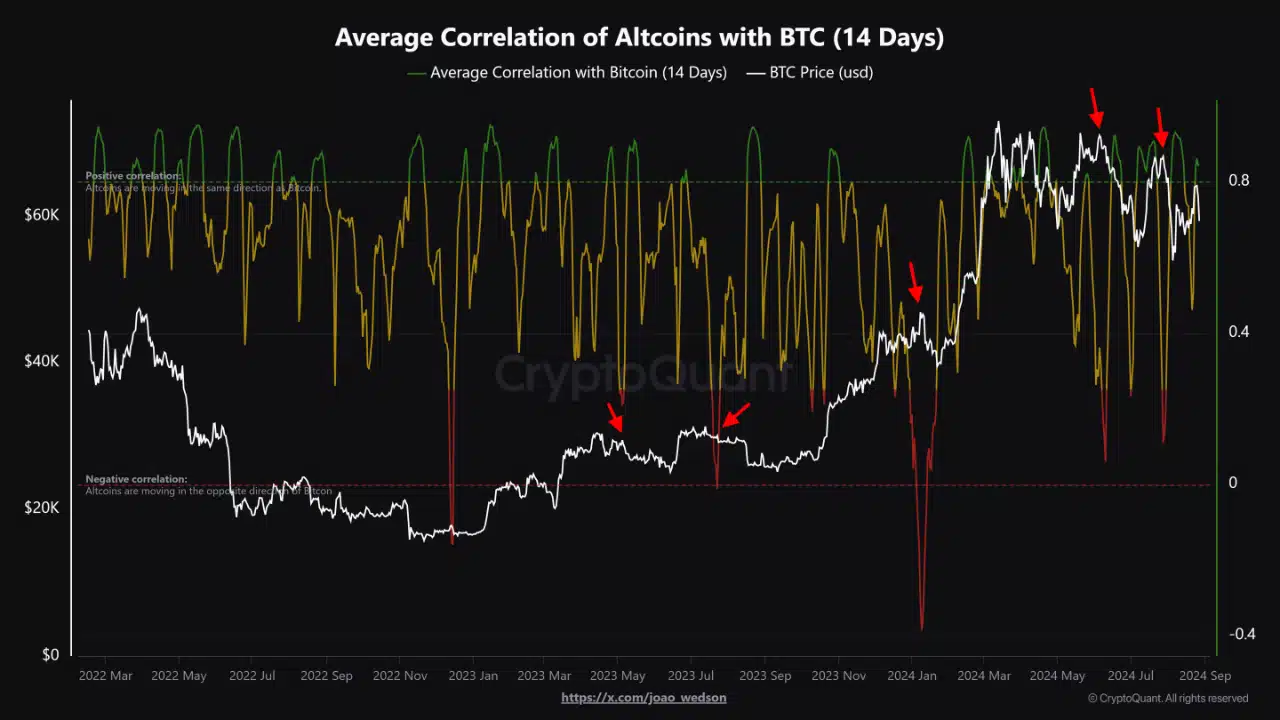

Amidst Bitcoin’s fluctuating performance, a report from CryptoQuant analyst Joao Wedson highlighted the significant correlation between Bitcoin and altcoins.

According to Wedson, the current positive correlation suggests that altcoins are closely following Bitcoin’s price movements, indicating an alignment in the broader crypto market.

Source: CryptoQuant

This behavior reflects investor confidence, as the synchronized movement suggests a level of stability in the market. However, the report warns that a shift to a negative correlation could serve as a red flag for Bitcoin and the market at large.

Historically, a negative correlation occurs when altcoins significantly outperform Bitcoin, often leading to a subsequent drop in BTC’s price.

This pattern was evident in January, June, and July of 2024, where altcoins outpaced Bitcoin, only for the market to experience a significant downturn shortly afterward.

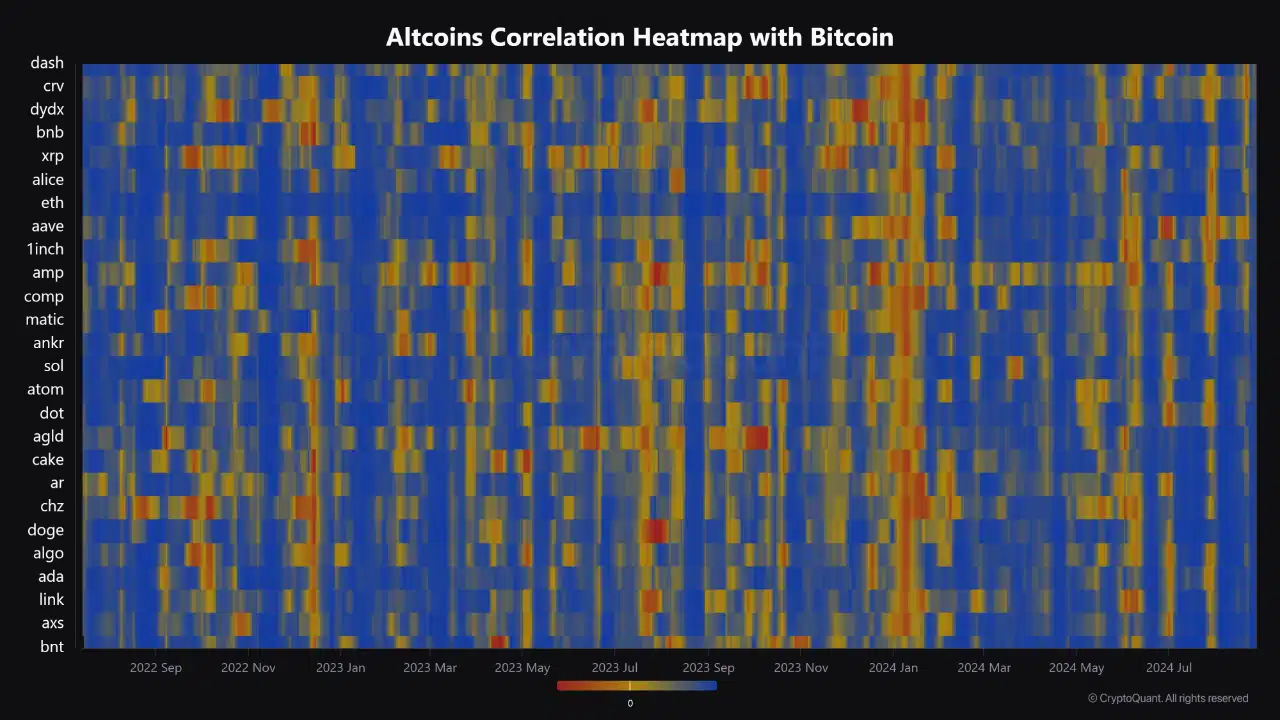

Currently, altcoins such as Bancor (BNT), Axie Infinity (AXS), Chainlink (LINK), Algorand (ALGO), and Cardano (ADA) exhibit the highest correlation with Bitcoin, meaning their prices are moving in tandem with BTC.

In contrast, altcoins like Dash (DASH), Curve (CRV), dYdX (DYDX), Binance Coin (BNB), and MyNeighborAlice (ALICE) show lower correlation levels, indicating a more independent price movement.

Source: CryptoQuant

Despite these variations, the overall positive correlation across altcoins suggests a market moving in unison with Bitcoin, signaling potential short-term stability. However, continuous monitoring is essential to detect any deviations that might signal increased risk.

Cardano: A case study in correlation and market trends

Taking Cardano [ADA] as a case study, we observe that ADA’s price has mirrored Bitcoin’s trajectory, experiencing a significant drop earlier this week to as low as $0.34.

However, in the past 24 hours, ADA has shown signs of recovery, with its price rising by 2.8%. This recovery aligns with the broader market’s trend of slight rebounds following initial sharp declines.

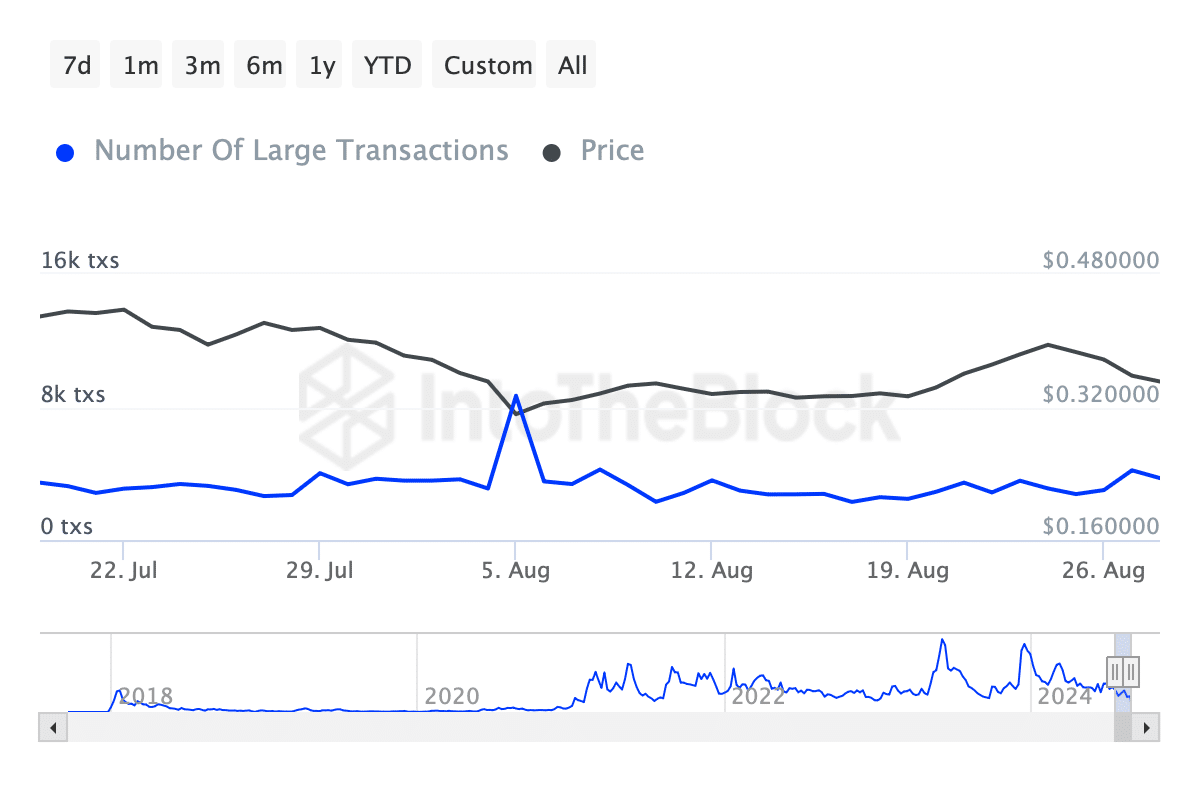

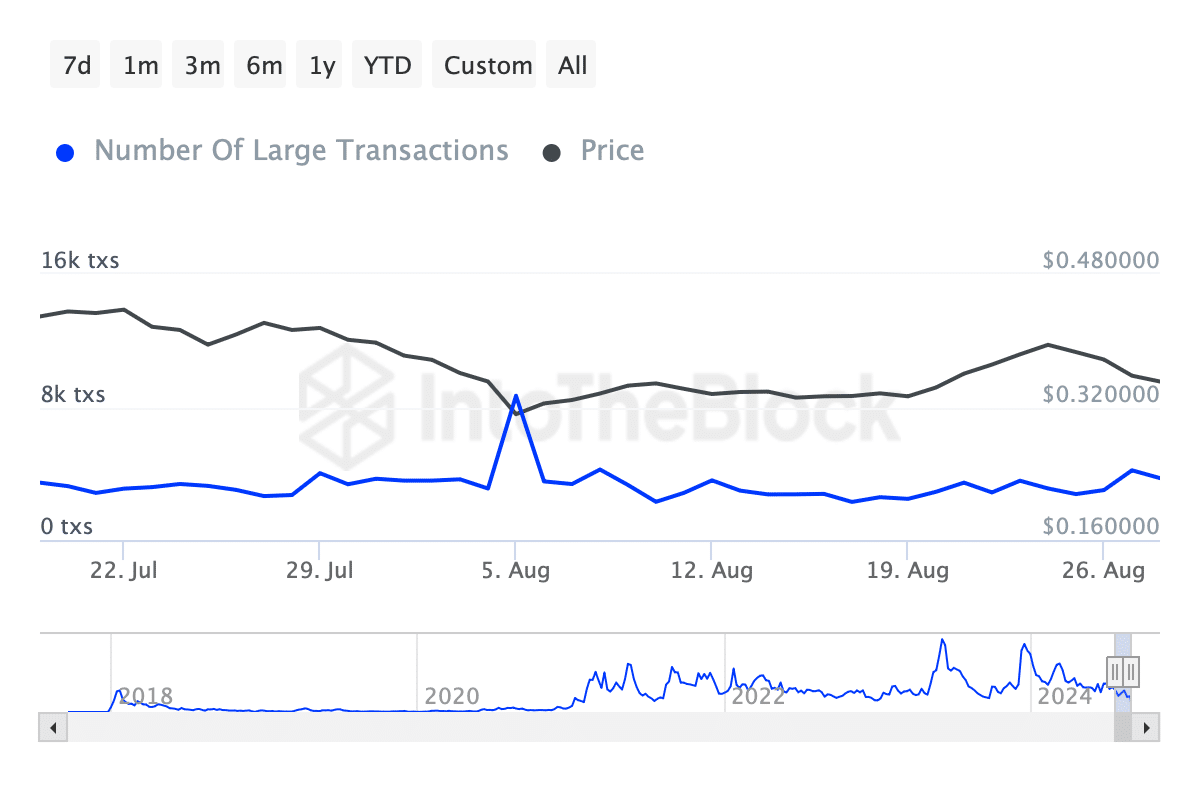

Interestingly, despite ADA’s price drop, its fundamentals indicate growing whale interest.

Data from IntoTheBlock reveals a surge in large transactions—those greater than $100k—reaching nearly 4,000 as of today, a sharp increase from below 3k transactions recorded last week.

This suggests that larger investors are taking advantage of the lower prices to accumulate ADA.

Source: IntoTheBlock

Read Cardano’s [ADA] Price Prediction 2024-25

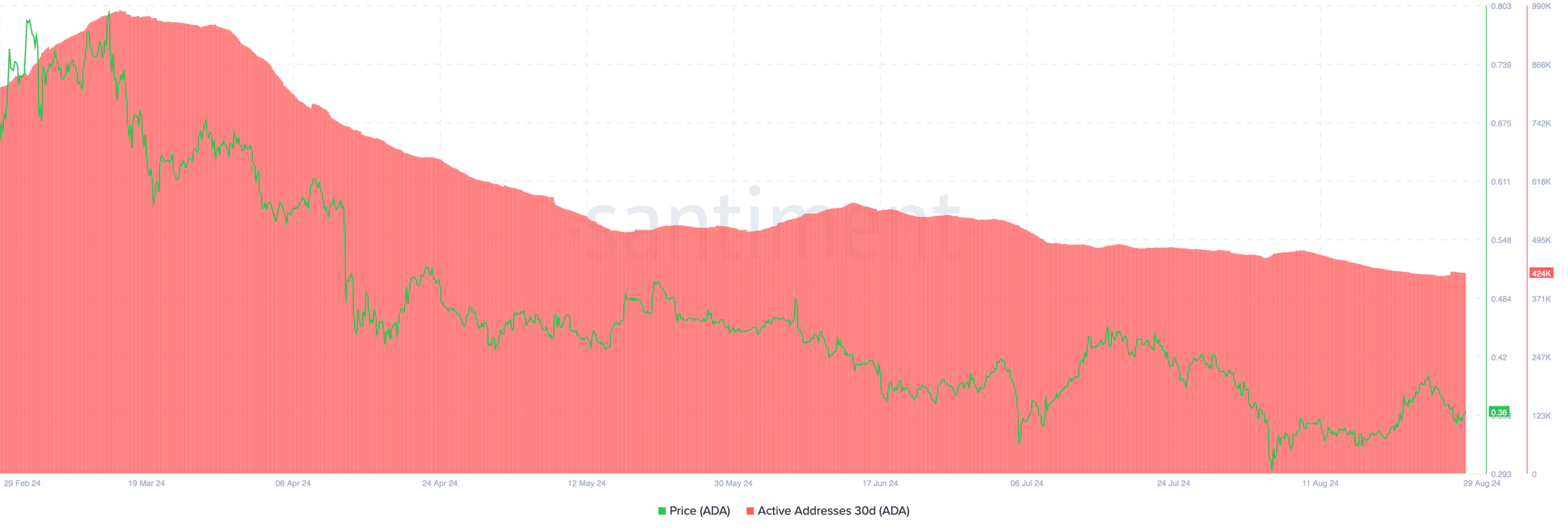

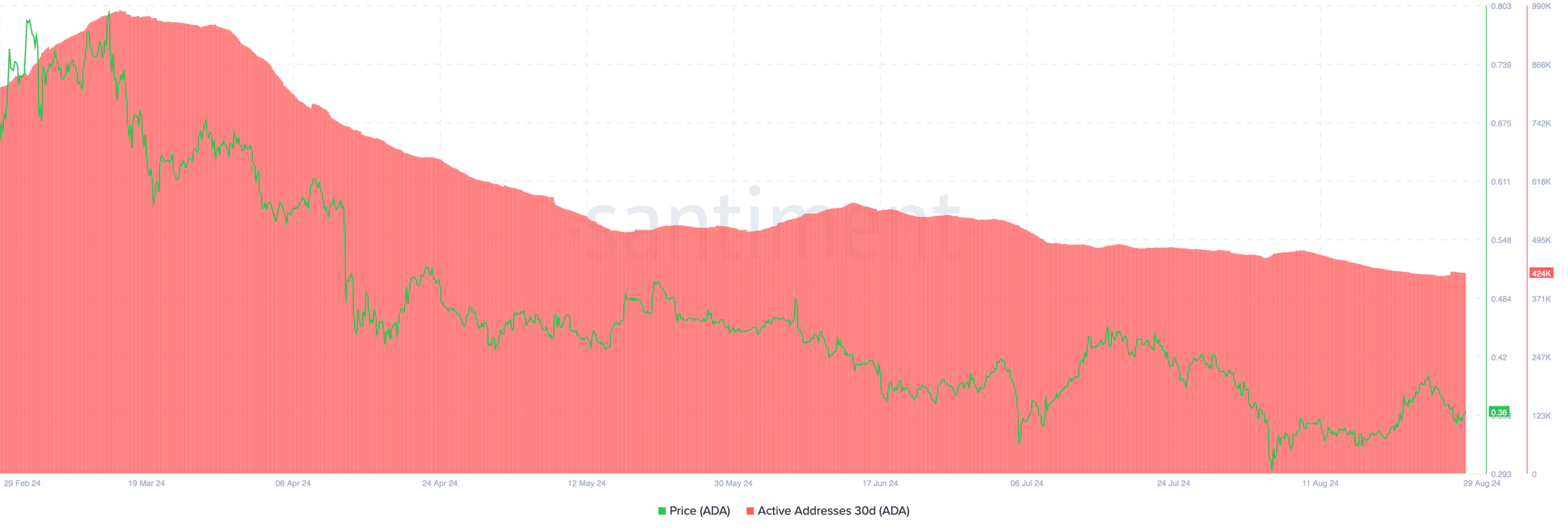

On the other hand, data from Santiment shows a decline in ADA’s number of active addresses over the past month, dropping to below 500k—a significant decrease from nearly 1 million addresses in March.

This decline in active addresses could reflect reduced retail investor activity, even as whales continue to engage with the asset.

Source: Santiment