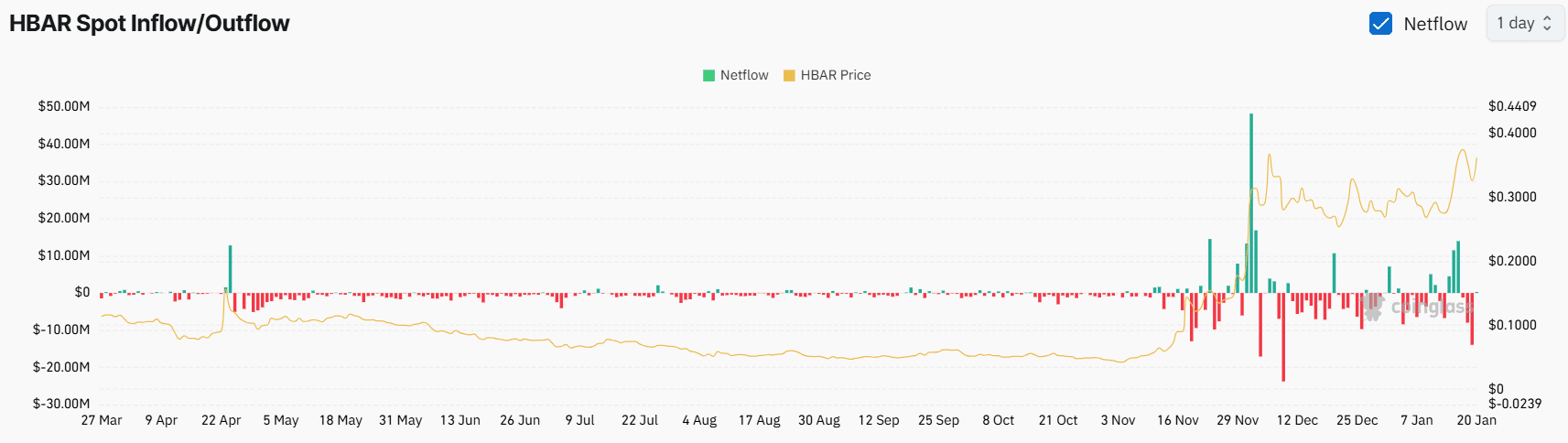

- Exchanges have witnessed an outflow of $13.9 million worth of HBAR.

- HBAR’s Long/Short stood at 0.89, indicating bearish sentiment among traders.

The overall sentiment in the cryptocurrency market seems to be recovering impressively. Amid this, Hedera [HBAR] appears poised for a 22% gain as well.

As of press time, HBAR had surged over 8% in price, attracting significant attention from traders and investors.

$14 million HBAR outflows

Data from the on-chain analytics firm Coinglass’s Spot Inflow/Outflow revealed that exchanges have witnessed a massive outflow of $13.9 million worth of HBAR in the past 24 hours.

This indicated strong bullish sentiment among long-term holders, who appeared to be betting on the asset.

Source: Coinglass

The outflow indicated potential accumulation by long-term holders moving assets from exchanges to their wallets. Additionally, it signaled potential buying pressure and significant upside momentum.

Intraday traders’ bearish outlook

On the other hand, traders appeared to be betting on the short side. HBAR’s Long/Short Ratio was 0.89 at press time, indicating bearish sentiment among traders.

However, the data revealed that 53% of top traders held short positions, while 47.2% held long positions. Thus, it appears that investors were bullish, while traders seemed slightly bearish.

HBAR price prediction and current momentum

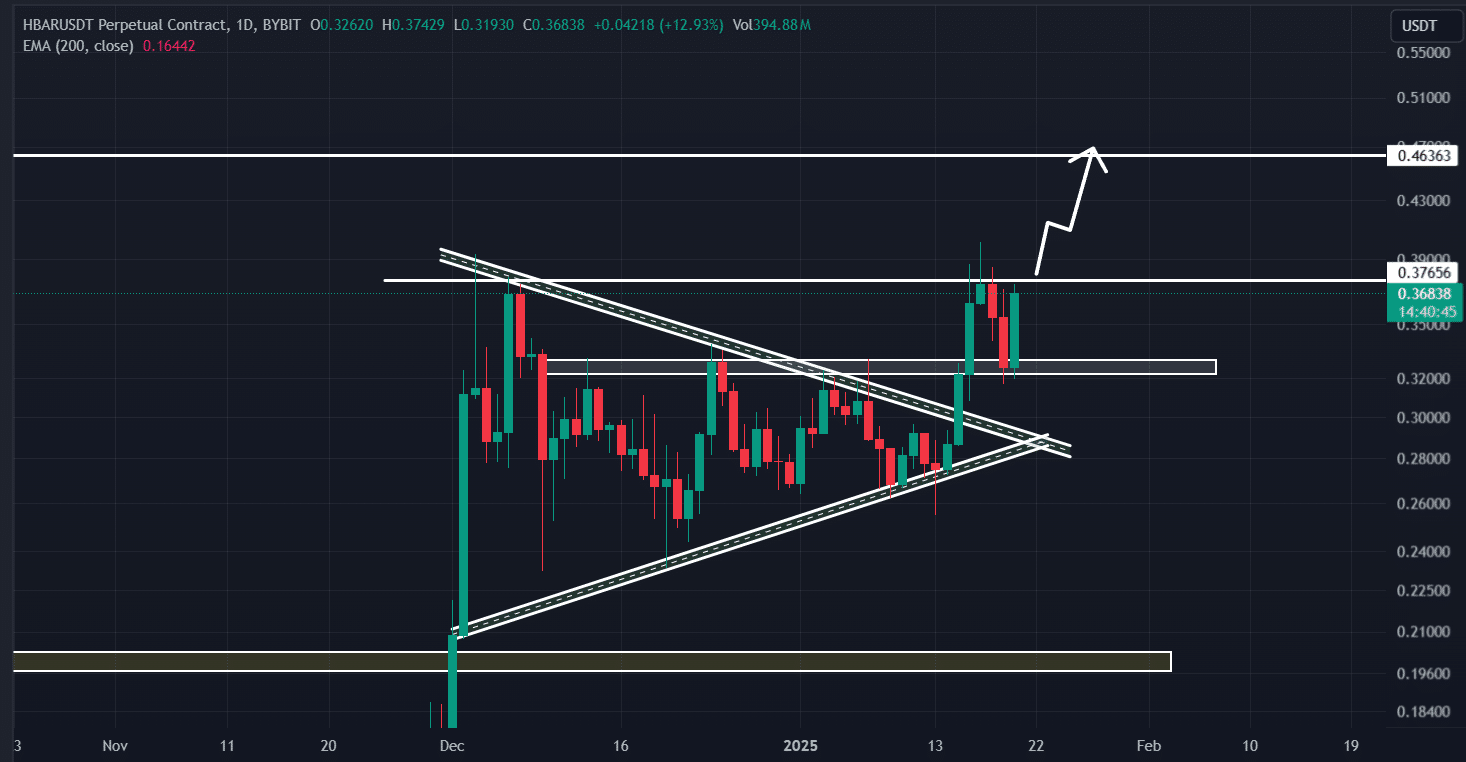

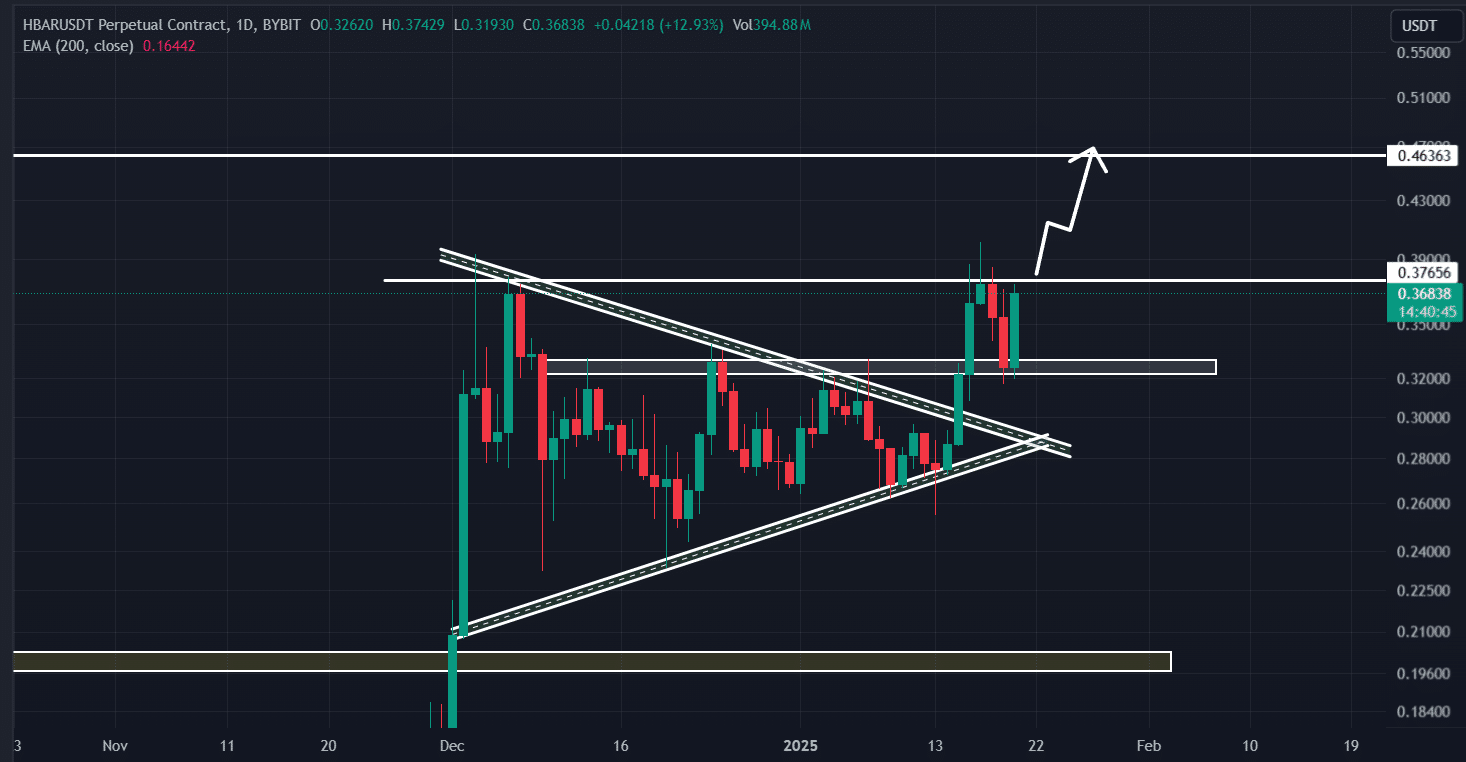

At press time, HBAR was trading near $0.364, having surged over 8.50% in the past 24 hours. Strong interest from traders and investors has led to a 60% increase in its trading volume during this period.

HBAR witnessed this impressive participation after successfully retesting the breakout of a bullish symmetrical triangle price action pattern.

Read Hedera’s [HBAR] Price Prediction 2025–2026

The altcoin was facing mild resistance near $0.378 on the daily chart but has also formed a large green candle and a bullish engulfing pattern, indicating strong bullish momentum for continued upside potential.

Source: TradingView

Based on historical price momentum, if HBAR breaches the resistance and closes a daily candle above the $0.378 level, there is a strong possibility it could rally by 22% to reach its all-time high of $0.465 in the near future.