- HBAR peaked at over 6-month highs.

- The market’s mixed signals left room for further highs and dips.

Hedera Hashgraph [HBAR] surged to its highest price since late April, following speculation that a member of Hedera’s board could be in line to become the next Chair of the U.S. Securities and Exchange Commission (SEC).

Previously, AMBCrypto had reported on Donald Trump’s alleged plans to replace Gary Gensler. Now, Brian Brooks, the former CEO of Binance.US, has been named among the potential candidates to succeed Gensler.

Race heats up for the next SEC chair

FOX Business journalist Eleanor Terrett broke the news on X (formerly Twitter). She revealed that Brooks was being considered for “various financial agency roles.”

Beyond the Commodity Futures Trading Commission (CFTC), he was vetted for positions at the SEC, the Federal Deposit Insurance Corporation (FDIC), and the Office of the Comptroller of the Currency (OCC). He was also considered for roles at the Financial Stability Oversight Council (FSOC), the Financial Industry Regulatory Authority (FINRA), and the Federal Reserve.

Brooks’ nomination would mark a significant shift for the SEC, particularly for the cryptocurrency sector. As former OCC Acting Director under the Republican administration, Brooks championed blockchain innovation, stablecoin regulations, and encouraged banks to explore blockchain technologies.

Now, this latest information has sparked optimism among blockchain enthusiasts about a potentially favorable regulatory landscape under his leadership.

HBAR’s market state

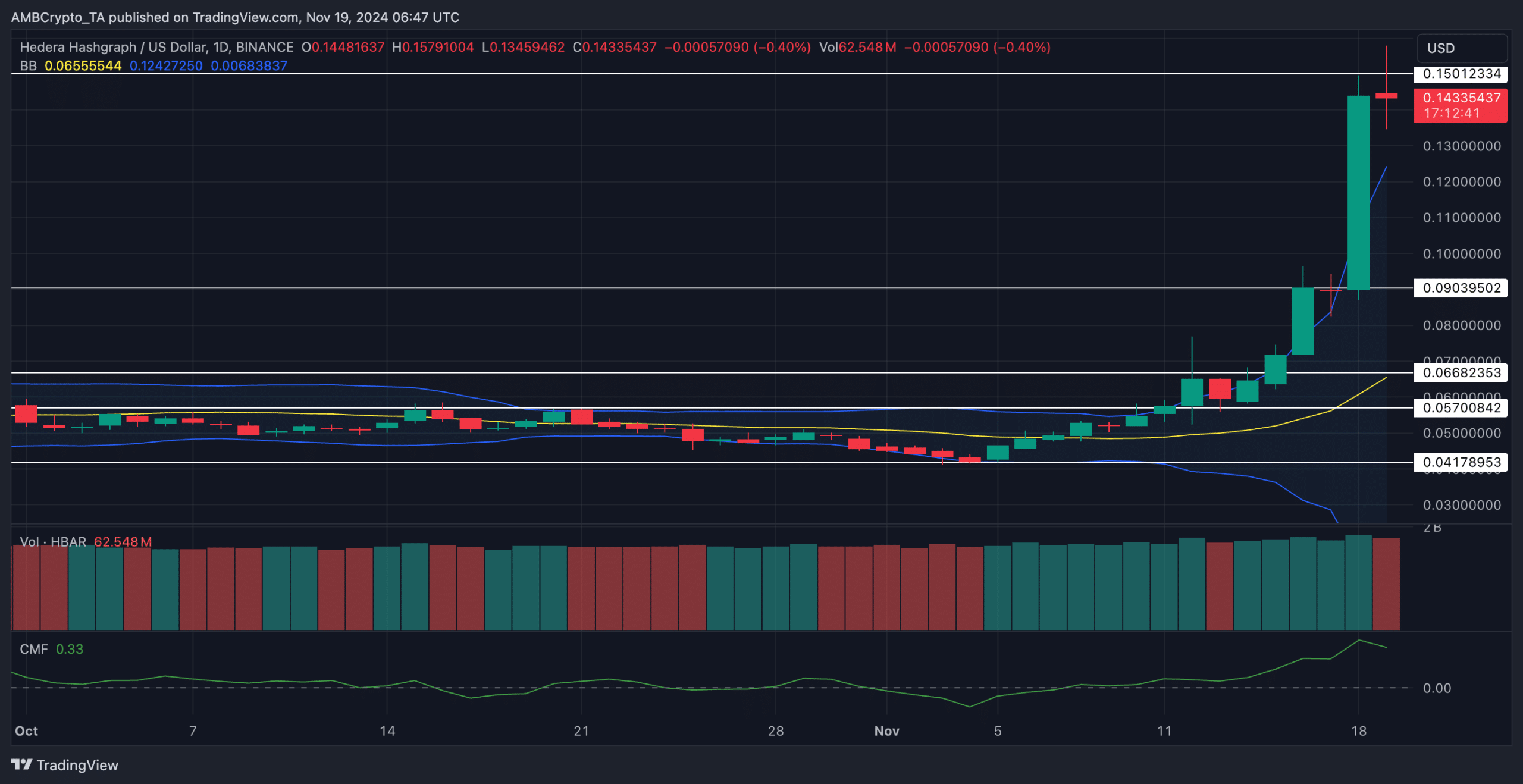

Notably, the market responded strongly to the news. HBAR’s price spiked to $0.15—its highest level in over six months. At press time, it adjusted to $0.14.

The token secured the third spot among both daily and weekly gainers, with a 16% increase over 24 hours and a staggering 148% rise over the past seven days, as per CoinMarketCap data.

Nonetheless, AMBCrypto’s analysis revealed that HBAR was overbought on the daily chart. The price candles stood above the expanded Bollinger Bands. This indicated heightened volatility and raised the likelihood of a near-term correction.

Source: TradingView

Additionally, the CMF registered a minor downtick to 0.33. This signaled reduced buying pressure, further supporting the potential for a pullback.

If a correction occurs, $0.09 can likely act as a cushion for the price. A drop below it could see the price go as low as $0.06.

Failure to hold this level could signal a trend reversal. Additionally, if bearish momentum intensifies further downside targets at $0.05 and $0.04 could be tested.

Despite the risks of a short-term correction, other market indicators suggested a bullish outlook.

According to prior AMBCrypto analysis, rising Open Interest(OI) and DeFi Total Value Locked (TVL) supported the possibility of price growth for HBAR.

A new era for crypto

Amid the latest developments, Brooks shared his thoughts on X, highlighting the significance of groundwork laid for the new SEC chair:

“Whoever @realDonaldTrump appoints as SEC chair won’t be starting from scratch. In his last administration, President Trump built the infrastructure for two ATH cycles.”

As speculation builds, both the cryptocurrency market and regulatory circles await confirmation of the next SEC Chair, with Brooks at the center of attention.