- Grayscale joins firms applying for a spot SOL ETF.

- It currently has over $120 million AUM from its GSOL.

Grayscale Investments is ramping up efforts to expand its product offerings in the cryptocurrency space by filing a proposal with the U.S. Securities and Exchange Commission (SEC) to convert its Grayscale Solana Trust (GSOL) into a spot exchange-traded fund (ETF). If approved, the fund would trade on NYSE Arca, joining a wave of similar applications by other firms.

Current Grayscale offering: Solana Trust

The Grayscale Solana Trust, currently structured as a private investment vehicle, provides accredited investors with exposure to Solana (SOL) without the complexities of direct asset management.

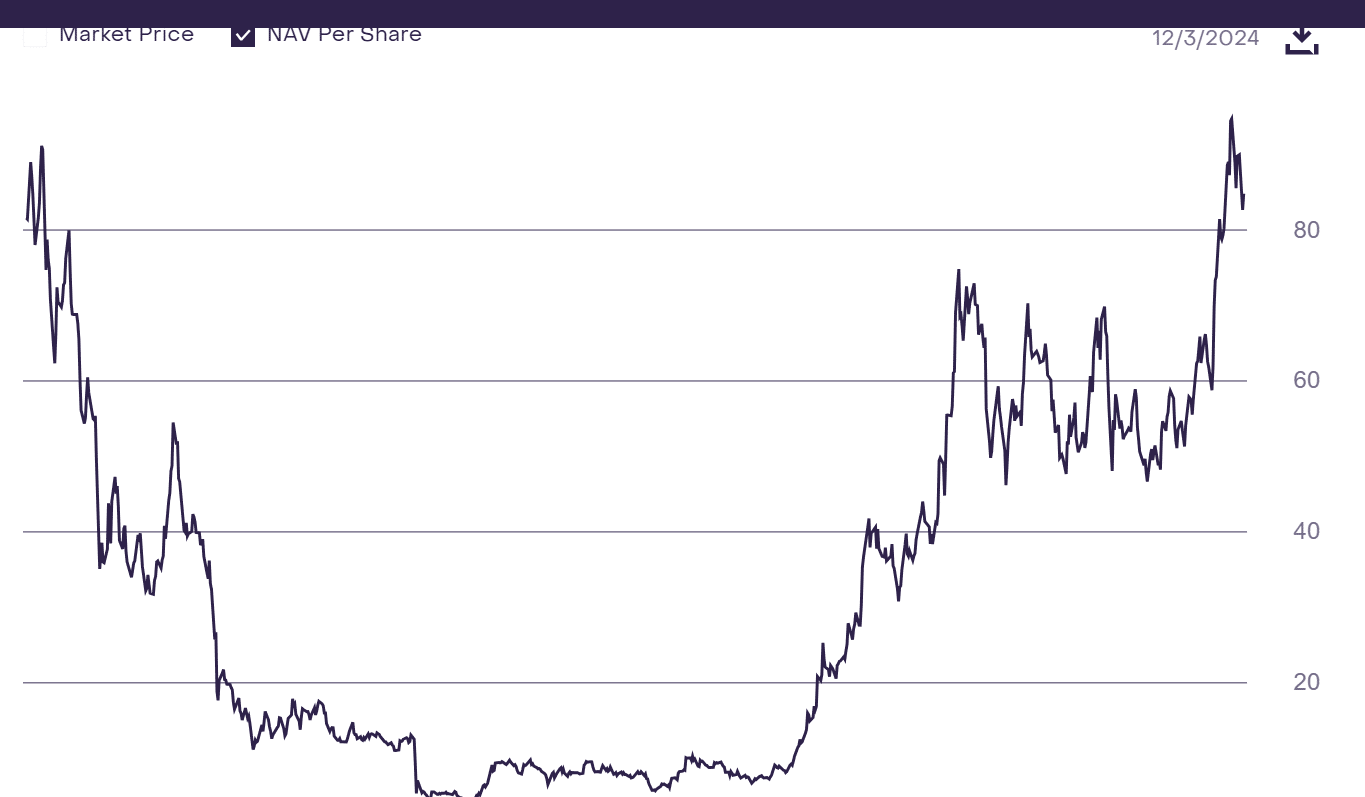

Source: Grayscale

According to recent data, the trust holds an AUM of $120,140,670.86 with a net asset value (NAV) per share of $84.82. Historically, the NAV has displayed substantial growth, reflecting the increasing institutional appetite for Solana.

Grayscale’s strategy to transition the trust into a spot ETF aims to enhance liquidity and accessibility, aligning with market trends favoring such offerings.

Analyzing the Solana market trends

Solana’s market activity has been robust, as reflected in its price chart. SOL is trading at $235.70, supported by the 50-day moving average of $202.37 and the 200-day moving average of $163.23.

The Relative Strength Index (RSI) stands at 55.86, indicating neutral market sentiment with room for further upside. Recent price movements suggest positive trends amidst broader market volatility, strengthening the case for increased institutional engagement.

Source: TradingView

The NAV per share chart for GSOL mirrors Solana’s price trajectory, highlighting growing investor confidence in the asset. The upward trend in NAV signifies a maturing market with rising demand for professionally managed investment products tied to Solana.

Industry-wide context: Solana ETF momentum

Grayscale’s filing follows a slew of applications for spot Solana ETFs in 2024.

VanEck and 21Shares submitted proposals last summer, targeting the burgeoning Solana ecosystem. Canary Capital joined the race with its application in October, while Bitwise Asset Management recently entered the fray.

This flurry of activity indicates strong market anticipation for Solana ETFs.

Is your portfolio green? Check out the Solana Profit Calculator

Grayscale’s move to convert its Solana Trust into a spot ETF is a bullish move from the asset manager and underscores the growing institutional appetite for crypto exposure.

Whether the SEC will approve these applications remains to be seen, but the momentum surrounding Solana ETFs marks a pivotal moment for the cryptocurrency market.