- Floki was nearing a breakout, with $0.00028980 as the critical resistance for bullish momentum.

- Market metrics showed optimism, with a 112.57% price-DAA Divergence supporting potential upside.

Floki [FLOKI]is gaining attention as it edged closer to breaking out of its long-term descending channel. At press time, Floki was trading at $0.0002417, down by 0.09%, in the last 24 hours.

The price is consolidating above the $0.00021129 support level, with key resistance at $0.00024862, as shown by the 0.786 Fibonacci retracement level.

If Floki clears this resistance, it could challenge $0.00028980 and rally toward the next target at $0.00034883. Traders are closely watching for a decisive move to confirm bullish momentum.

Source: TradingView

Technical indicators suggest a potential for a rally

Fibonacci retracement levels show $0.00024862 as the immediate barrier Floki must overcome. A breakout here could lead to testing $0.00028980, a critical resistance point. Additionally, the Relative Strength Index (RSI) was at 56.21, indicating the market remains in a neutral zone.

This suggests there is room for upward movement if buying pressure intensifies. Moreover, the consolidation near the resistance zone indicates traders are positioning for a breakout, adding to the anticipation.

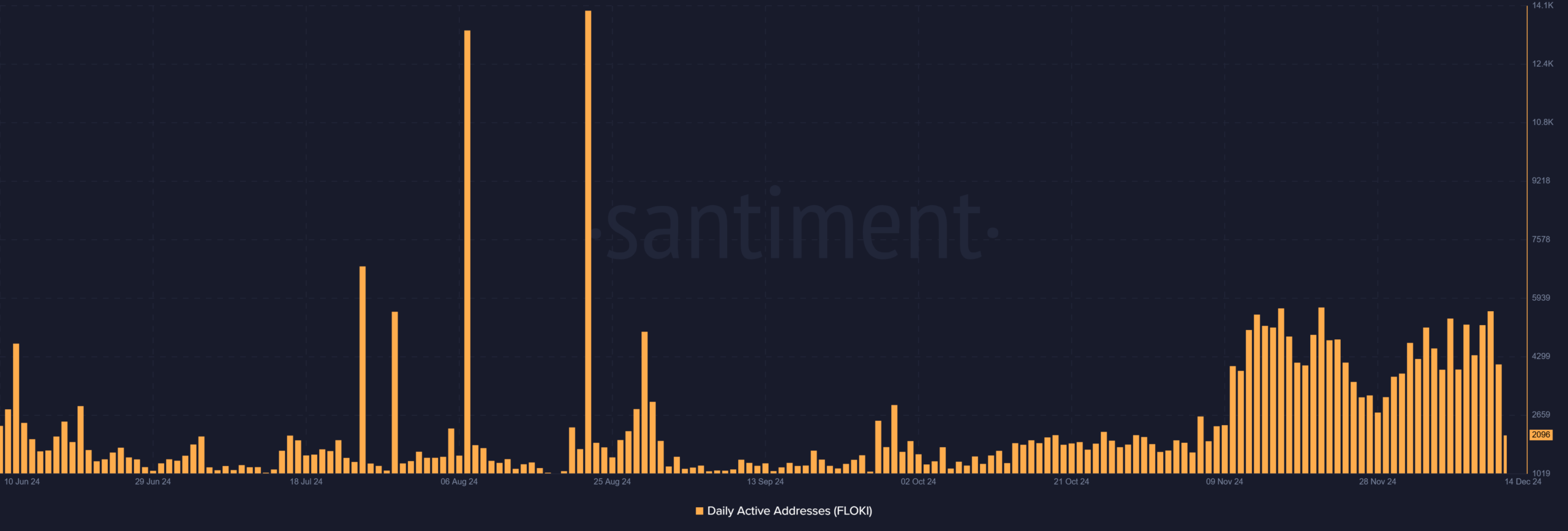

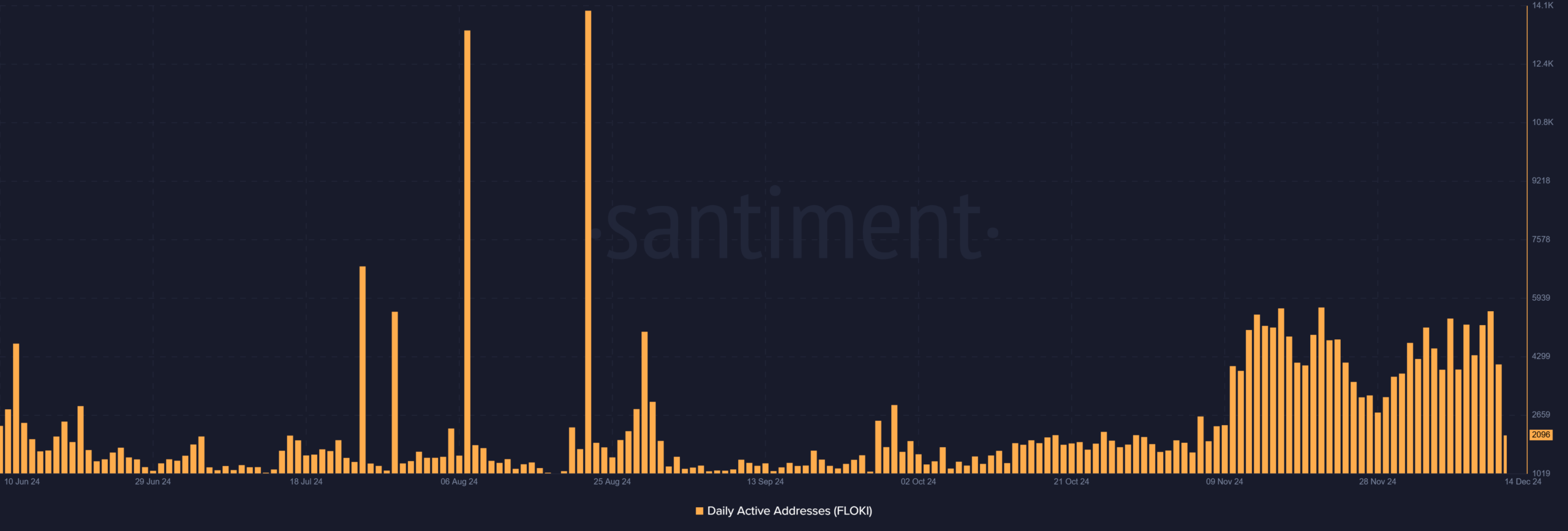

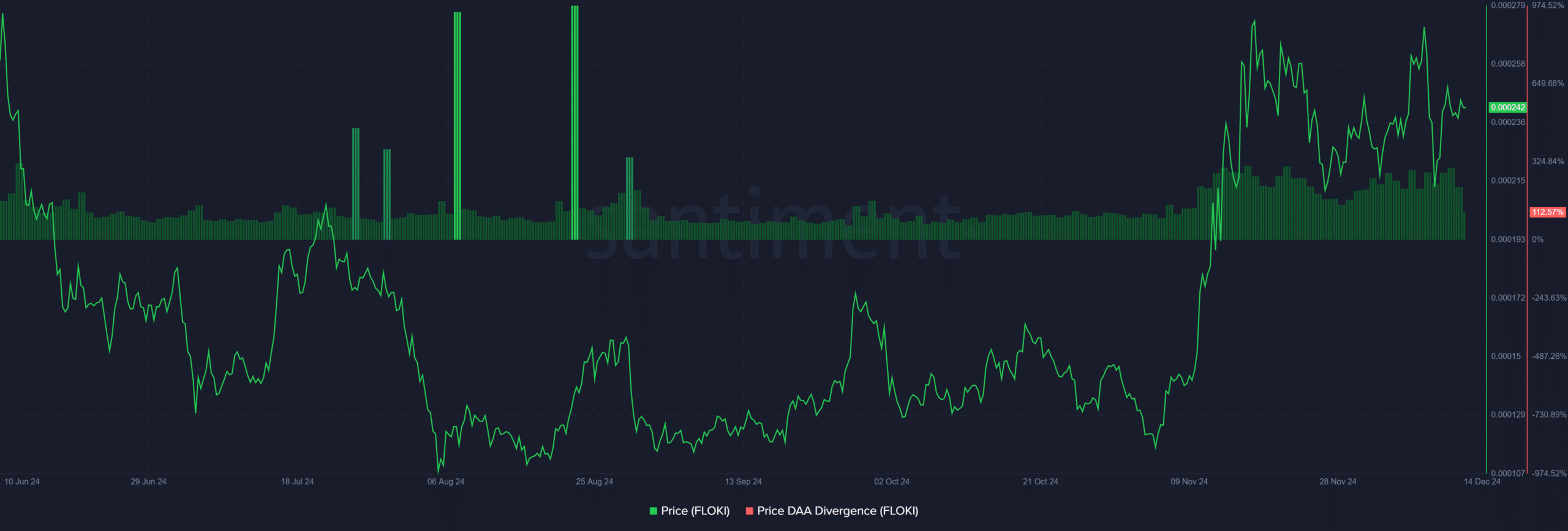

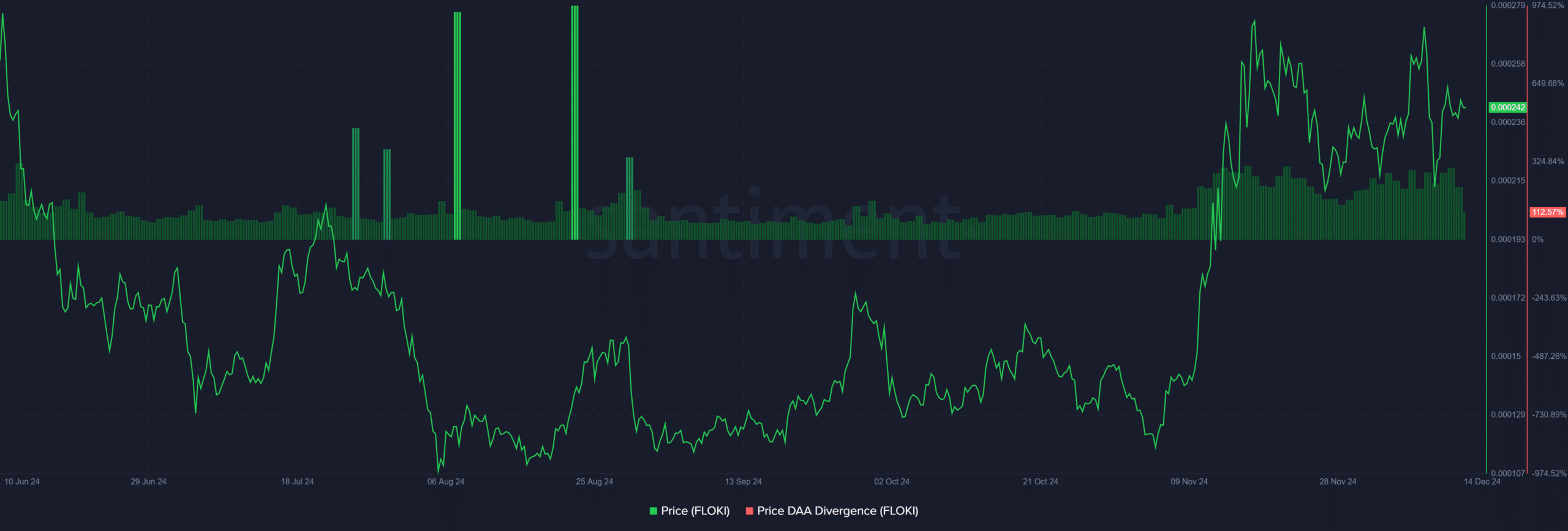

Daily active addresses show a decline

Floki’s daily active addresses have dropped significantly to 2,096 from 4,085 the previous day. This sharp decline reflects reduced short-term network activity, possibly due to traders waiting for a clear breakout signal.

However, this decrease does not necessarily indicate a lack of interest. Instead, it may suggest caution among market participants as Floki nears a critical point in its price action.

Source: Santiment

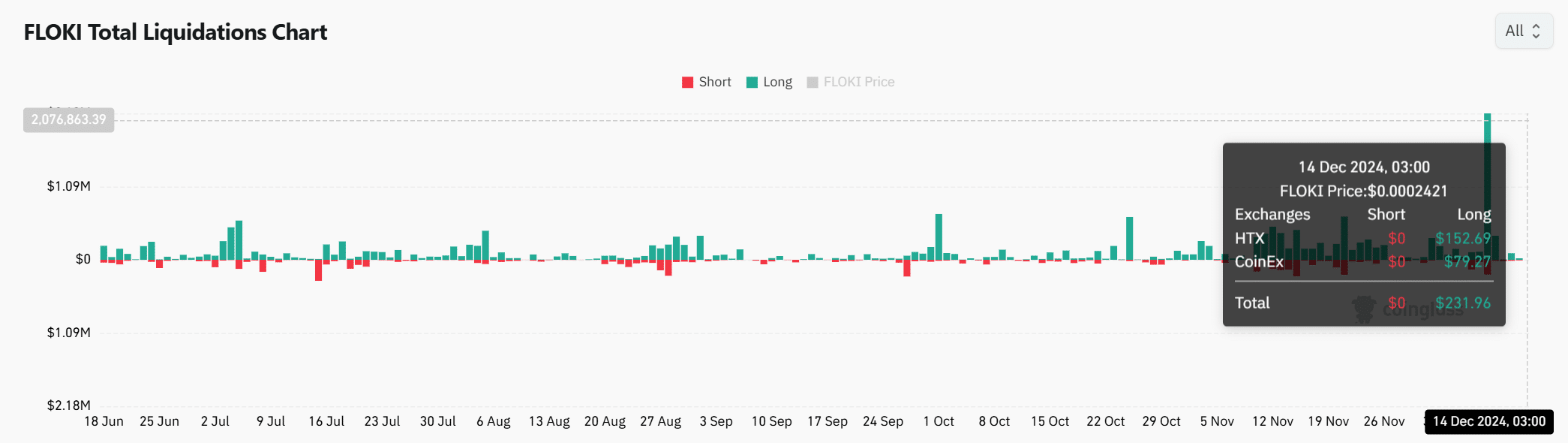

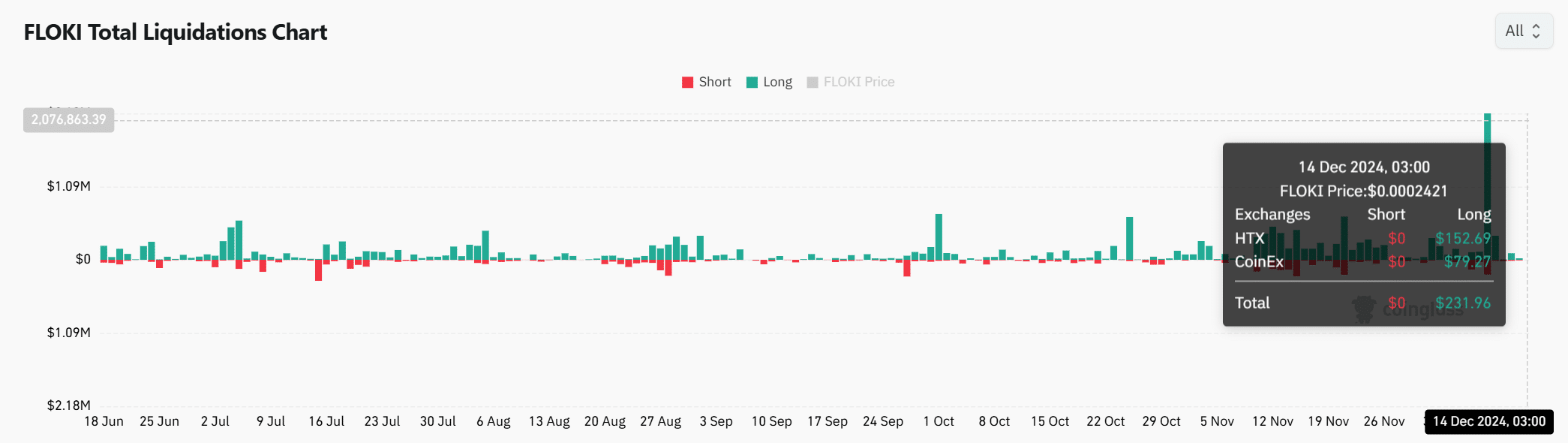

FLOKI liquidations remain low

Interestingly, liquidation data shows $231.96 in liquidated longs, while shorts remain at $0. This suggests that bulls have taken higher risks ahead of the potential breakout, while bears stay on the sidelines.

Thus, the muted liquidation activity reflects market caution as traders await a decisive move. If Floki breaks resistance, liquidation volumes are expected to rise sharply, potentially amplifying volatility.

Source: Coinglass

Price-DAA divergence signals optimism

Floki’s price-DAA divergence climbed to an impressive 112.57%. This sharp increase suggests underlying confidence from long-term holders, even as daily active addresses decline.

Therefore, the divergence highlights optimism for sustained upward momentum, especially if key resistance levels are breached.

Source: Santiment

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

Can FLOKI confirm the breakout?

FLOKI is at a critical juncture in its price action. With strong price-DAA divergence and a stable RSI, the token is technically positioned to challenge its resistance levels.

A confirmed breakout above $0.00028980 could spark a rally towards $0.00034883. However, caution is warranted as on-chain activity shows reduced engagement. The next move will determine if FLOKI can seize the momentum and solidify its upward trend.