- FLOKI mirrors PEPE’s price pattern of January to mid-year of 2024.

- Key on-chain metrics point to a bullish outlook amid memecoin resurgence.

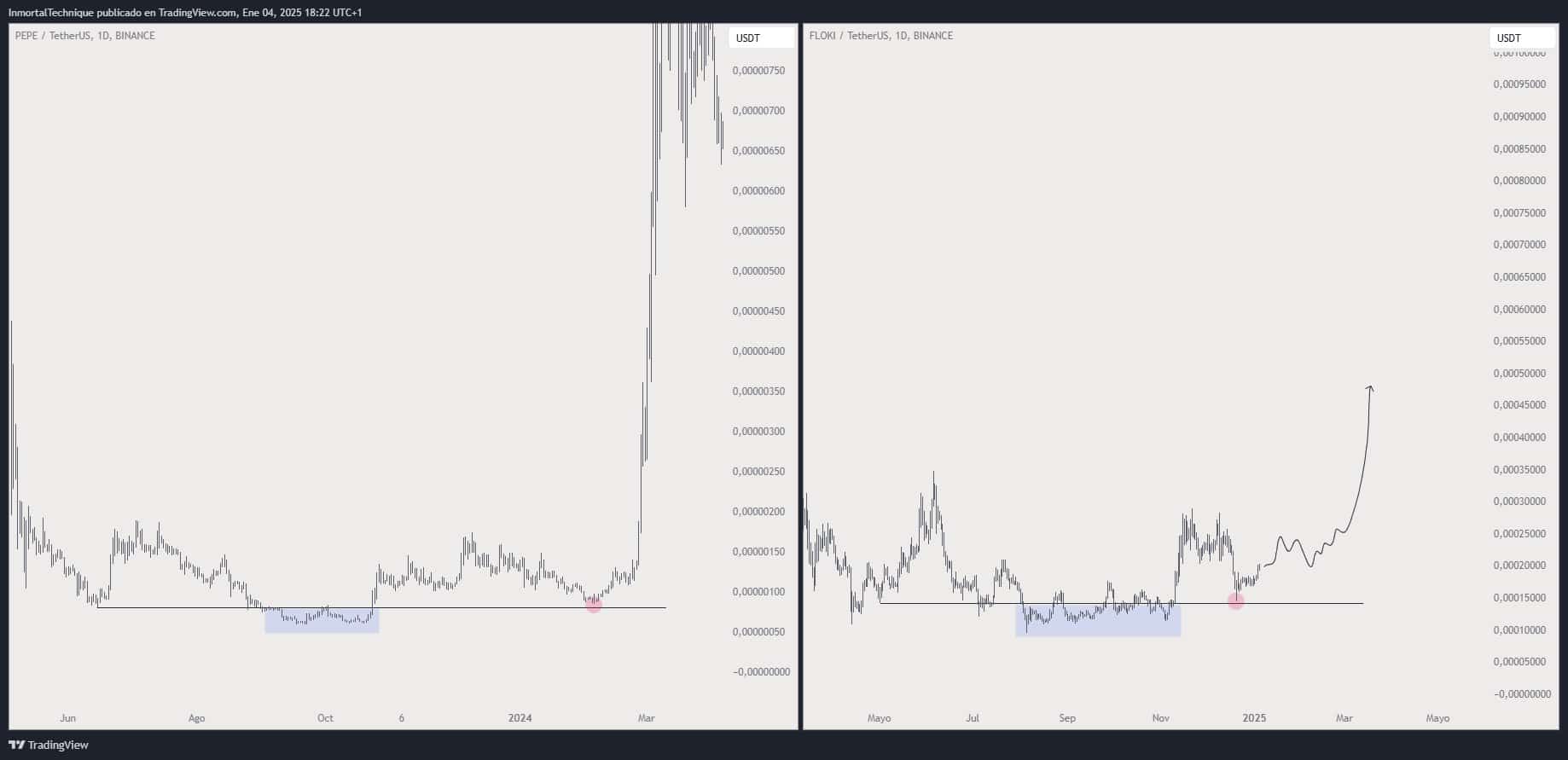

The charts saw two distinct movements for Pepe [PEPE] and Floki Inu [FLOKI] tokens throughout 2024 into early 2025, reflecting mirrored price patterns.

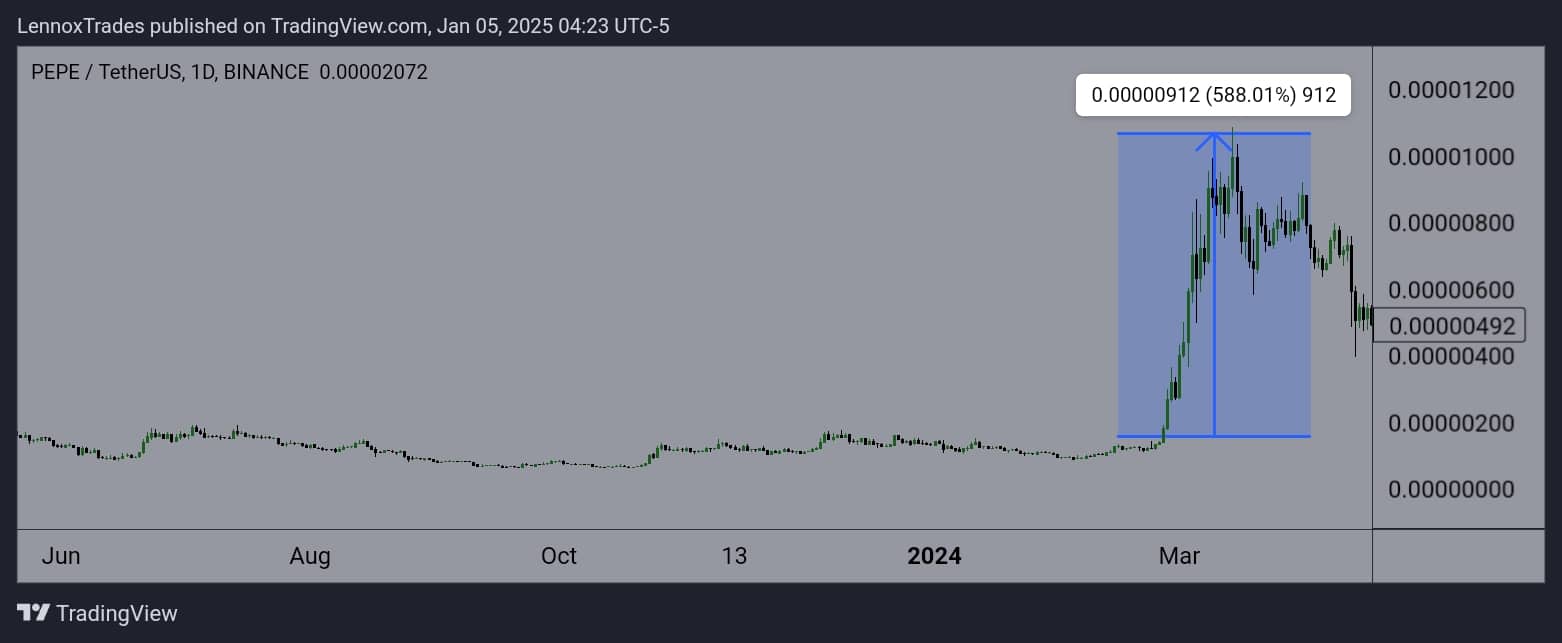

PEPE saw a steep uptick in early January, followed by consolidation and a subsequent spike around March 2024. PEPE made returns of more than 588% by mid-year.

Source: Trading View

Similarly, FLOKI saw the same pattern through late 2024 with a notable surge starting now, indicating a potential catch-up to PEPE’s earlier gains.

These movements suggest that FLOKI’s price action was closely aping PEPE’s, with initial stability followed by a sharp increase, highlighting a pattern replication.

FLOKI began to significantly rise in early 2025, mirroring Pepe’s earlier price trajectory, which suggests a delayed but similar market reaction.

Source: TradingView

This pattern could imply that as PEPE led with 588% gains, FLOKI might follow suit, attracting similar interest and speculative trading based on historical movements of PEPE.

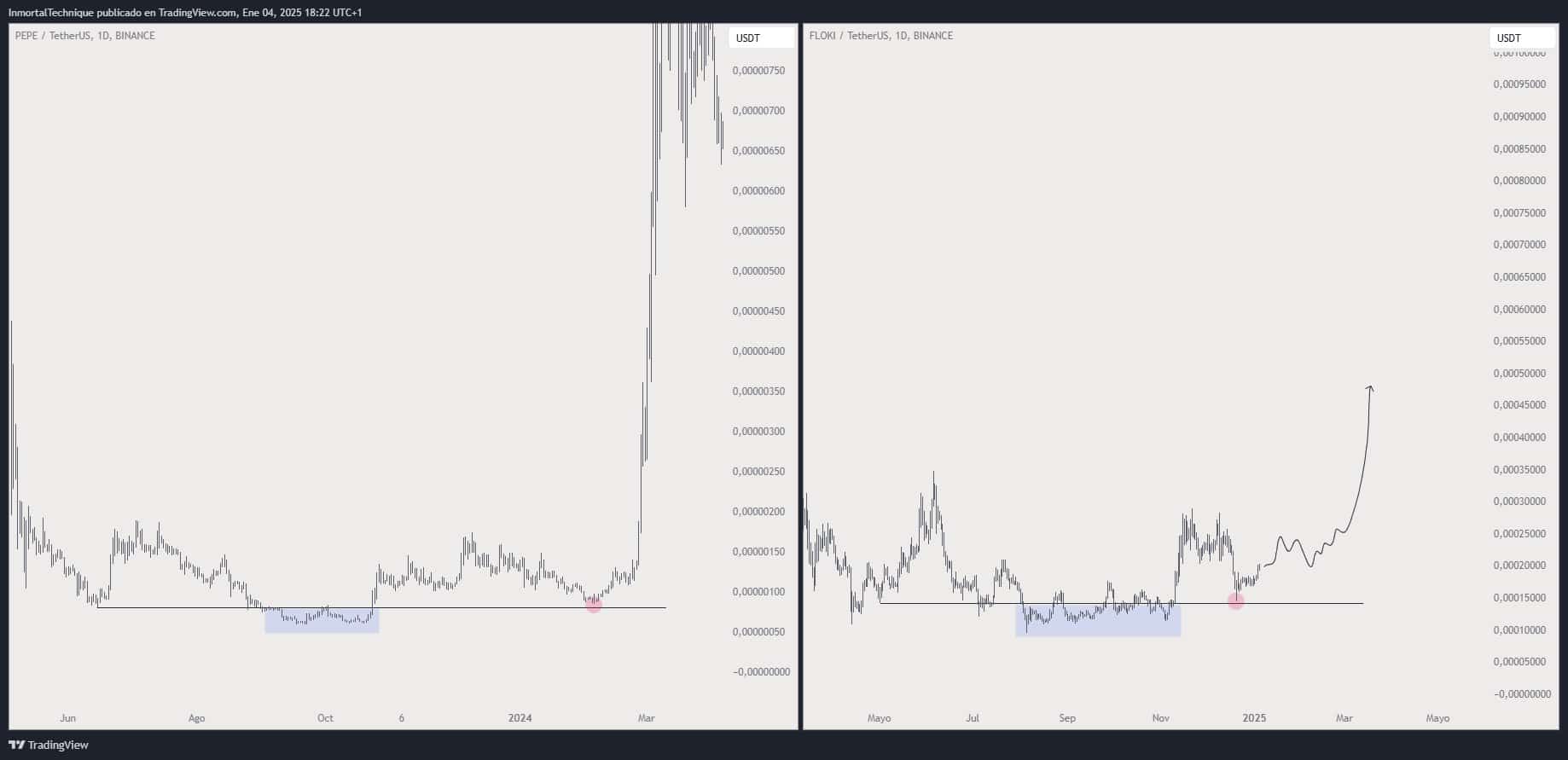

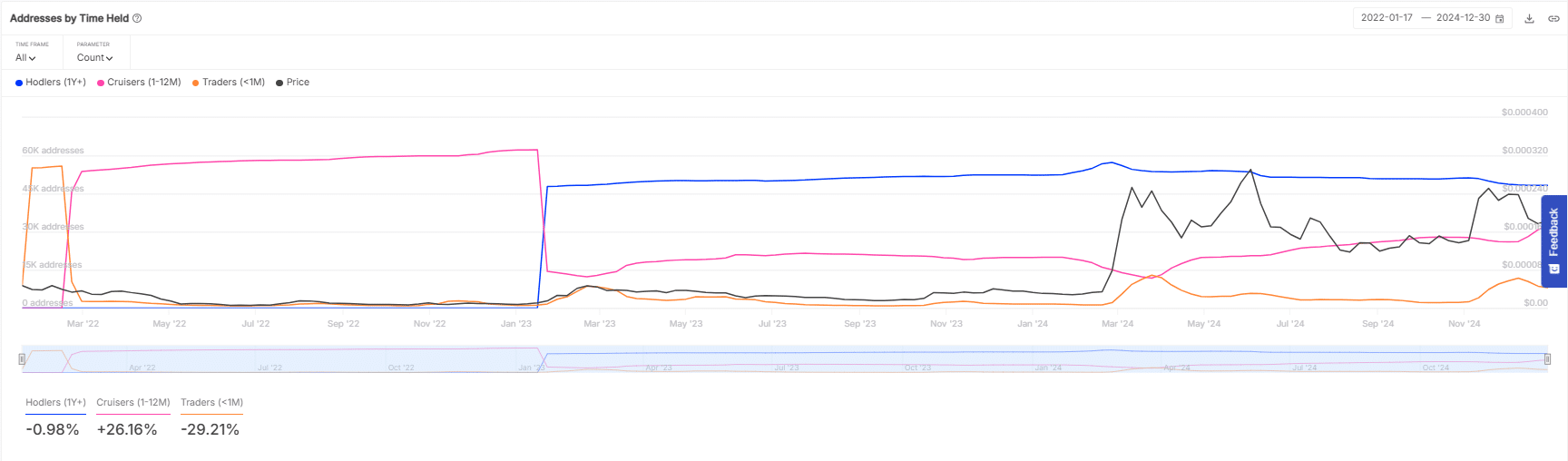

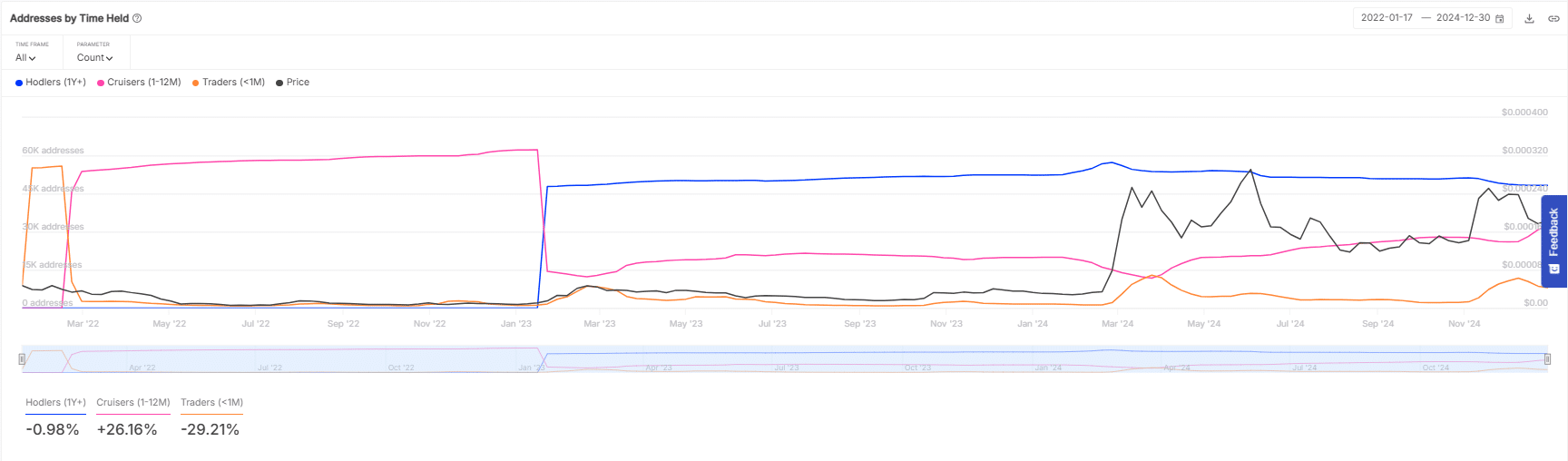

FLOKI addresses by time held and profitability

FLOKI’s address composition by time held revealed significant shifts, as holders with less than one month dropped sharply by 29.21%, while mid-term cruisers surged by 26.16%.

Long-term holders over a year barely decreased, showing a minor change of -0.98%.

This composition indicated a transfer from very short-term to more committed mid-term speculation, suggesting a potential stabilization in FLOKI’s price as traders who might typically sell quickly have either exited or transitioned to holding longer.

Source: IntoTheBlock

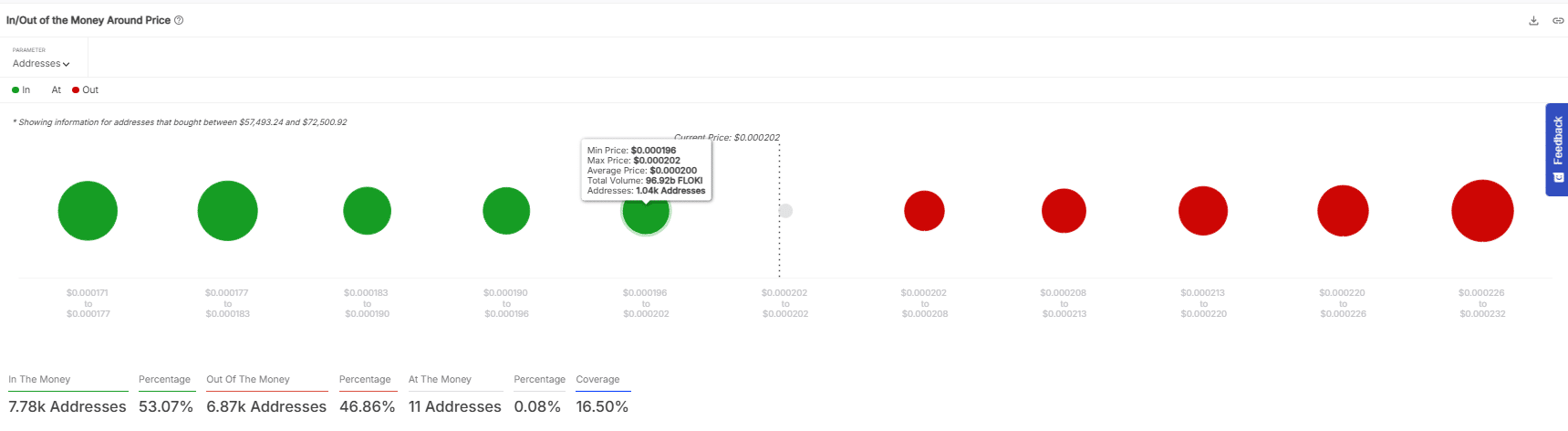

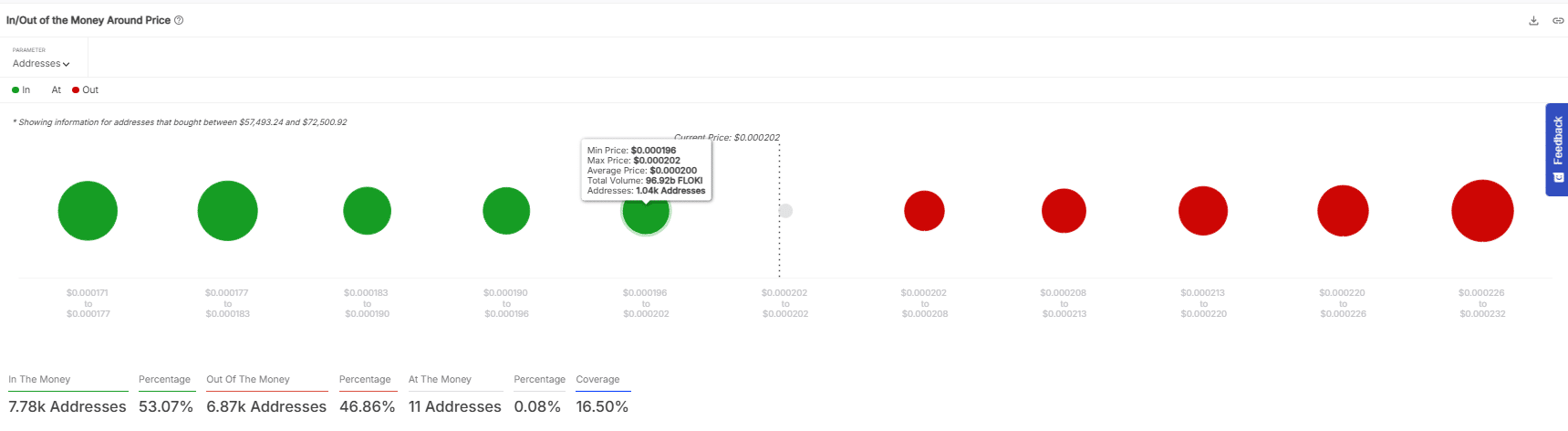

At press time, 53.07% of addresses were in the money, demonstrating a potential support zone, particularly strong between $0.000196 and $0.000202.

Conversely, 46.86% are out of the money, highlighting recent price declines. This could suggest a stabilization phase if buyers enter at these levels, potentially pushing prices upward.

Source: IntoTheBlock

The minor 0.08% at the money reflected immediate price sensitivity. This balance indicated that FLOKI could witness price resilience or even an uptick, fostering a cautiously optimistic outlook for its near-term valuation trajectory.

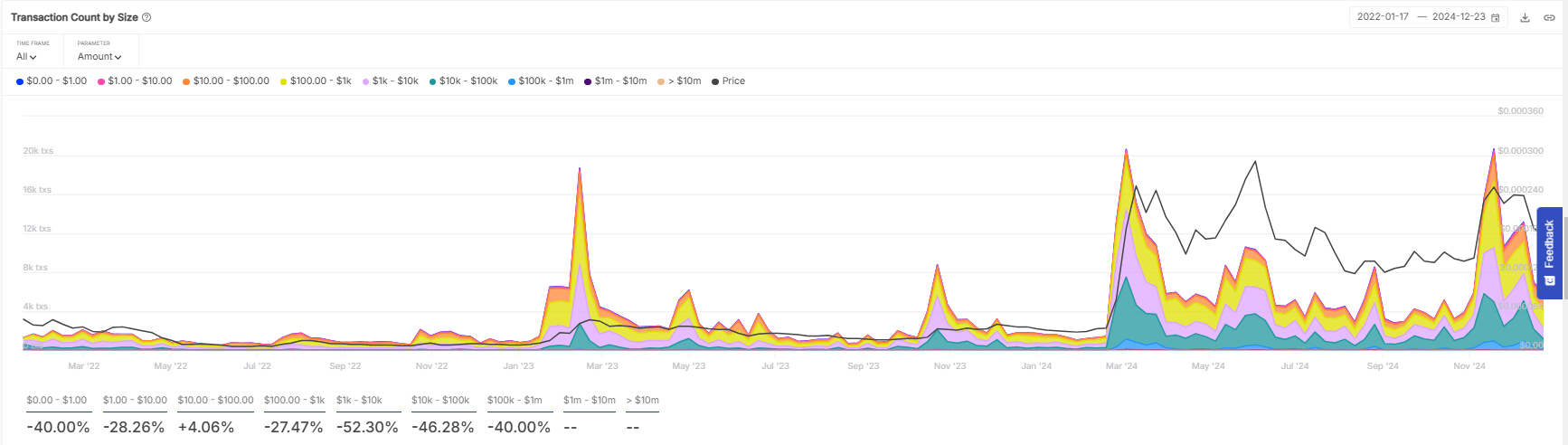

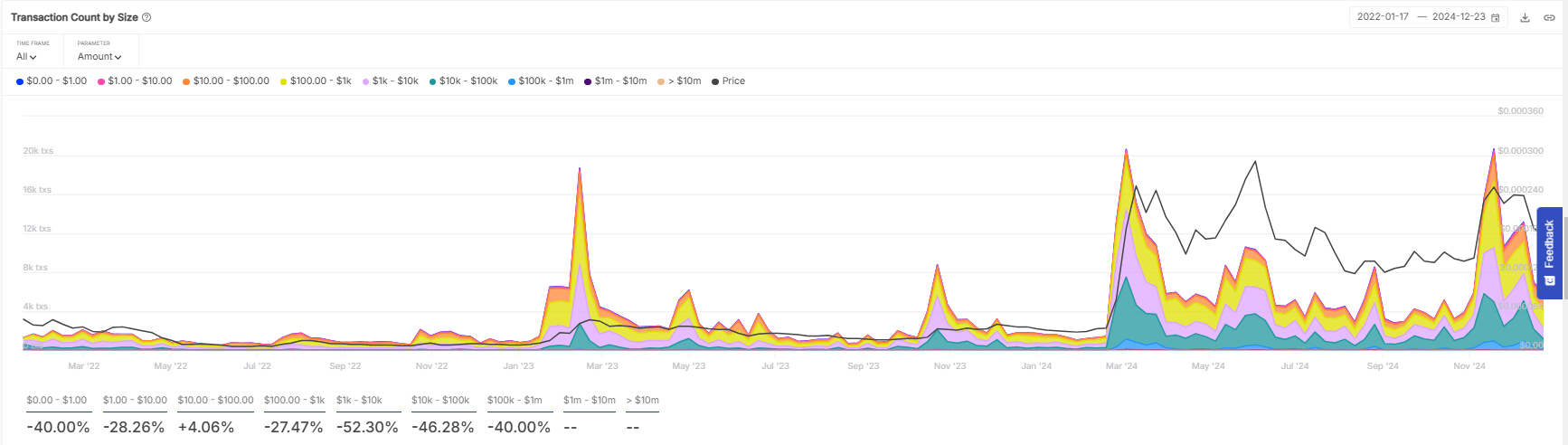

Transactions Volume in USD and count by size

FLOKI saw peaks in transaction volume between $1-$10 and $100-$1k, indicating surges in activity that tapered off, stabilizing at lower levels throughout the year.

The percentage changes were substantial: transactions below $1 and from $10 to $100 saw declines of 26.48% and 29.43%, respectively, while the $1k to $10k range increased by 4.97%.

FLOKI transaction count by size saw a sharp peak in transaction counts for smaller amounts, indicating a surge in retail participation.

This spike contrasts starkly with the declines across larger transaction sizes, particularly those over $100, which experienced a 52.30% drop.

Source: IntoTheBlock

These movements suggested that while retail interest in FLOKI remained strong, larger investors might be pulling back.

Realistic or not, here’s FLOKI’s market cap in PEPE’s terms

This dynamic could suggest that FLOKI’s future price might be influenced by retail speculation rather than institutional investment, leading to potential volatility.

The retail-driven market might push prices up short-term, but the lack of substantial institutional support could pose risks for long-term stability.