- FET could soar by 26% to the $1.95 level or even higher if it closes a daily candle above the $1.5 level.

- FET’s Future Open Interest has skyrocketed by 25% in the last 24 hours.

Artificial Superintelligence [FET] is poised for a significant price surge, driven by its bullish on-chain metrics and potential breakout.

Despite the current bearish market sentiment, FET has surged by over 28% in the past four days, outperforming major cryptocurrencies like Bitcoin [BTC], Ethereum [ETH], and Solana [SOL].

Will FET remain bullish?

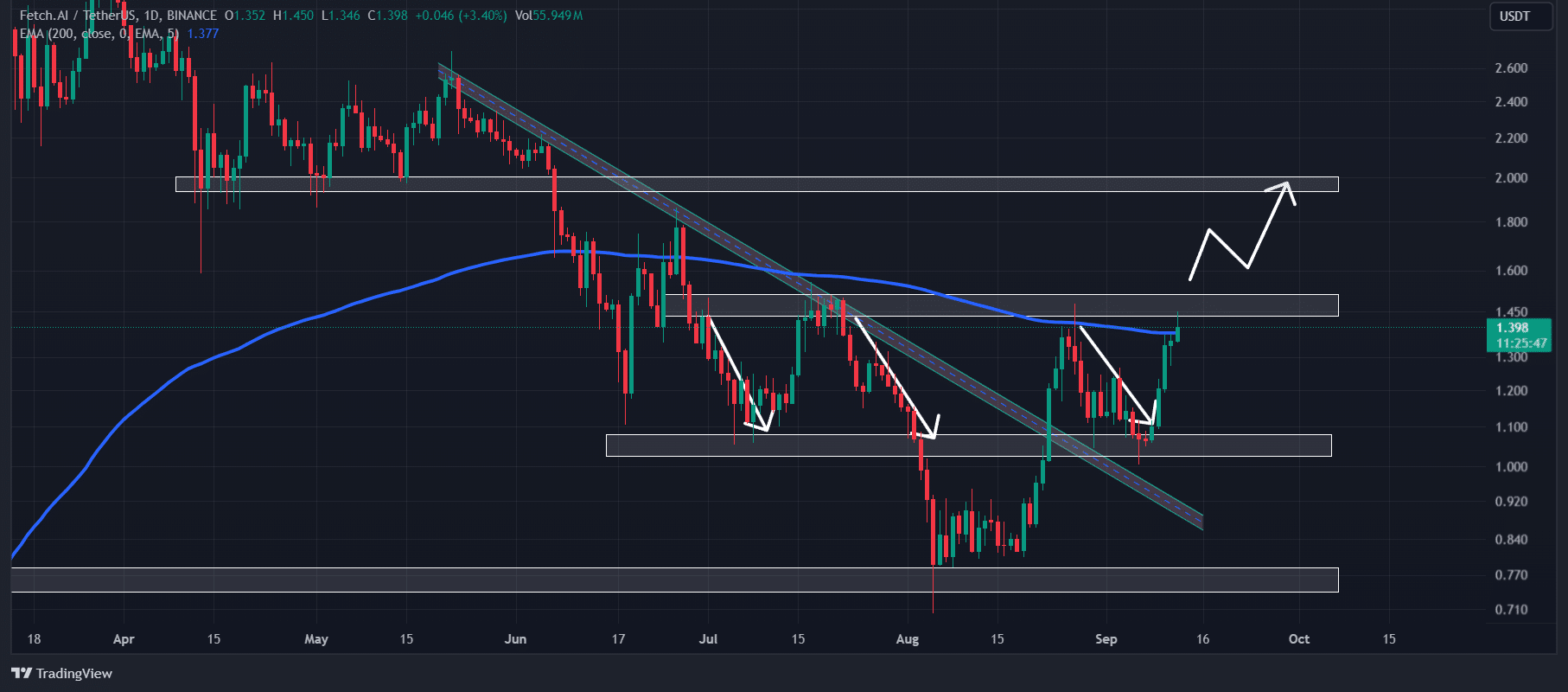

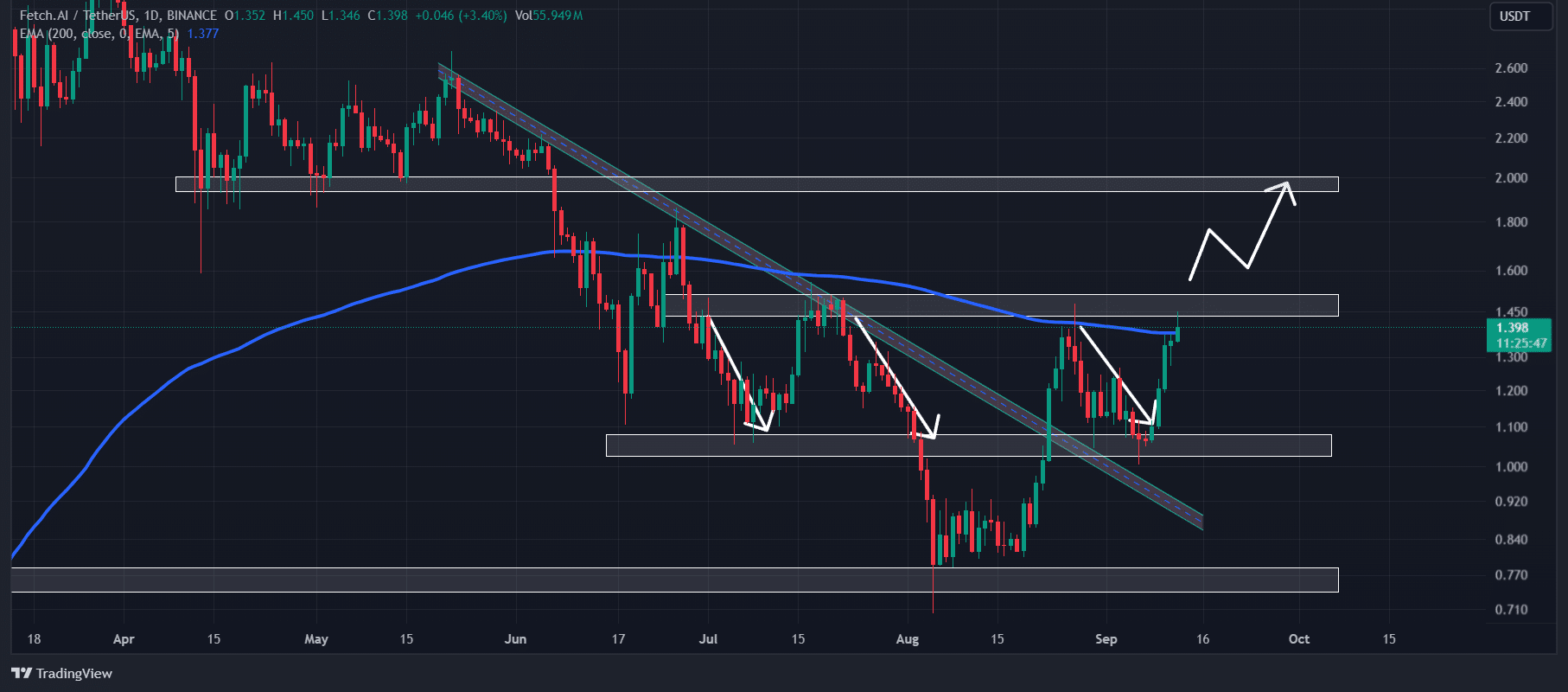

AMBCrypto’s look at TradingView revealed that FET’s fortunes appeared bullish at press time, as it was trading above the 200 Exponential Moving Average (EMA) on a daily time frame.

Investors and traders often use this indicator to determine whether an asset is in an uptrend or a downtrend.

In addition to this, FET was also facing strong resistance near the $1.5 level.

Source: TradingView

Since July 2024, whenever FET has reached this level, it has experienced selling pressure. However, the current sentiment around FET seemed different, as investor interest looked to be continuously increasing.

Thus, based on the historical price momentum, if FET closes a daily candle above the $1.5 level, there is a high possibility it could soar by 26% to the $1.95 level or even higher.

On-chain data

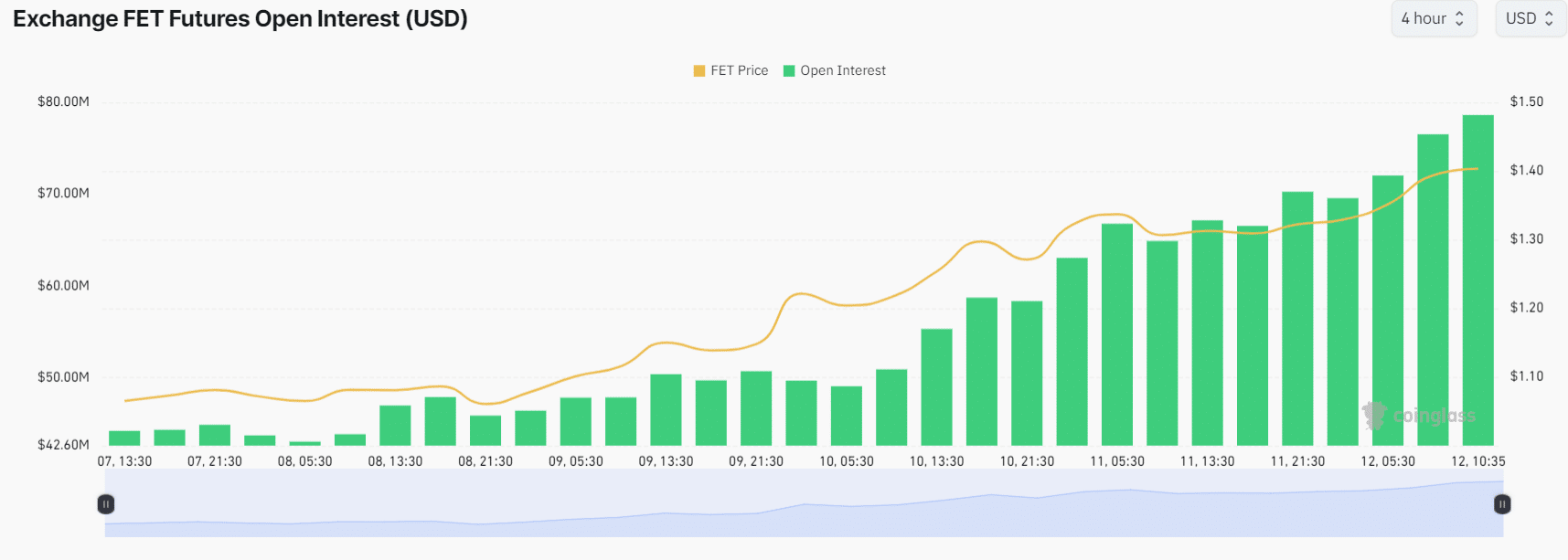

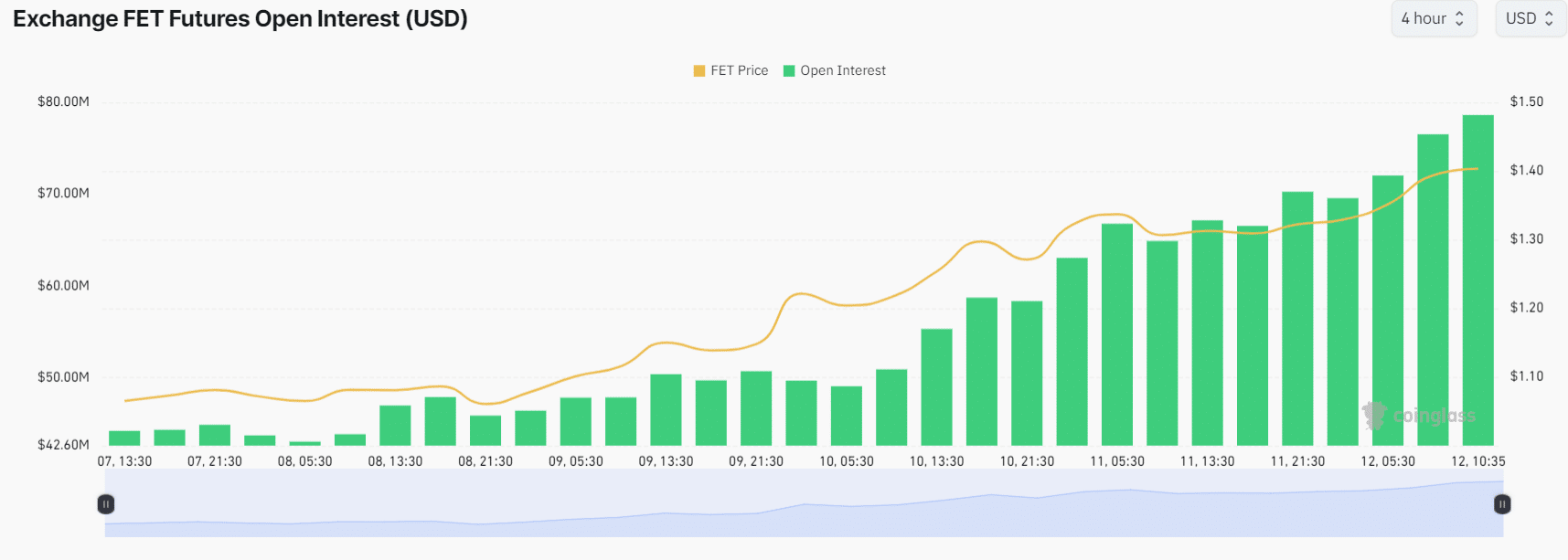

FET’s bullish outlook was further supported by on-chain metrics. Coinglass’ FET Long/Short ratio was 1.03 at press time, indicating bullish market sentiment. A value above 1 means more traders are betting on FET’s price rise.

Meanwhile, its Futures Open Interest skyrocketed 25% in the last 24 hours, and has been continuously increasing since the 6th of September.

Source: Coinglass

This combination of rising Futures Open Interest and a Long/Short Ratio above 1 presented a potential buying opportunity. Traders and investors often use this setup to build their long or short positions.

Read Artificial Superintelligence Alliance’s [FET] Price Prediction 2024–2025

At press time, FET was trading near the $1.40 level, after a price surge of over 8% in the last 24 hours.

Its trading volume has skyrocketed by 40% during the same period, indicating higher participation from traders amid the ongoing price recovery.