- Ethereum rose above $3,720, signaling bullish momentum toward the $4,000 milestone.

- Key resistance at $3,900 and RSI nearing overbought territory may challenge the breakout.

Ethereum’s [ETH] showing promising signs of a breakout, with its price steadily rising above key resistance levels.

After stabilizing above $3,500, ETH has gained momentum, surpassing key thresholds like $3,650 and $3,720.

As bullish indicators strengthen, Ethereum seems poised for significant price movement. However, the crucial question remains: Will Ethereum bulls push the price above $3,900 and aim for the coveted $4,000 mark, or will market resistance cause a potential reversal?

Breakdown of ETH’s price movements

Ethereum’s recent price trajectory highlights its resilience amid fluctuating market conditions. After stabilizing above $3,500, ETH demonstrated a consistent bullish structure, marked by a series of higher lows and higher highs.

The price action formed a clear upward channel, with ETH crossing key thresholds like $3,650 and $3,720.

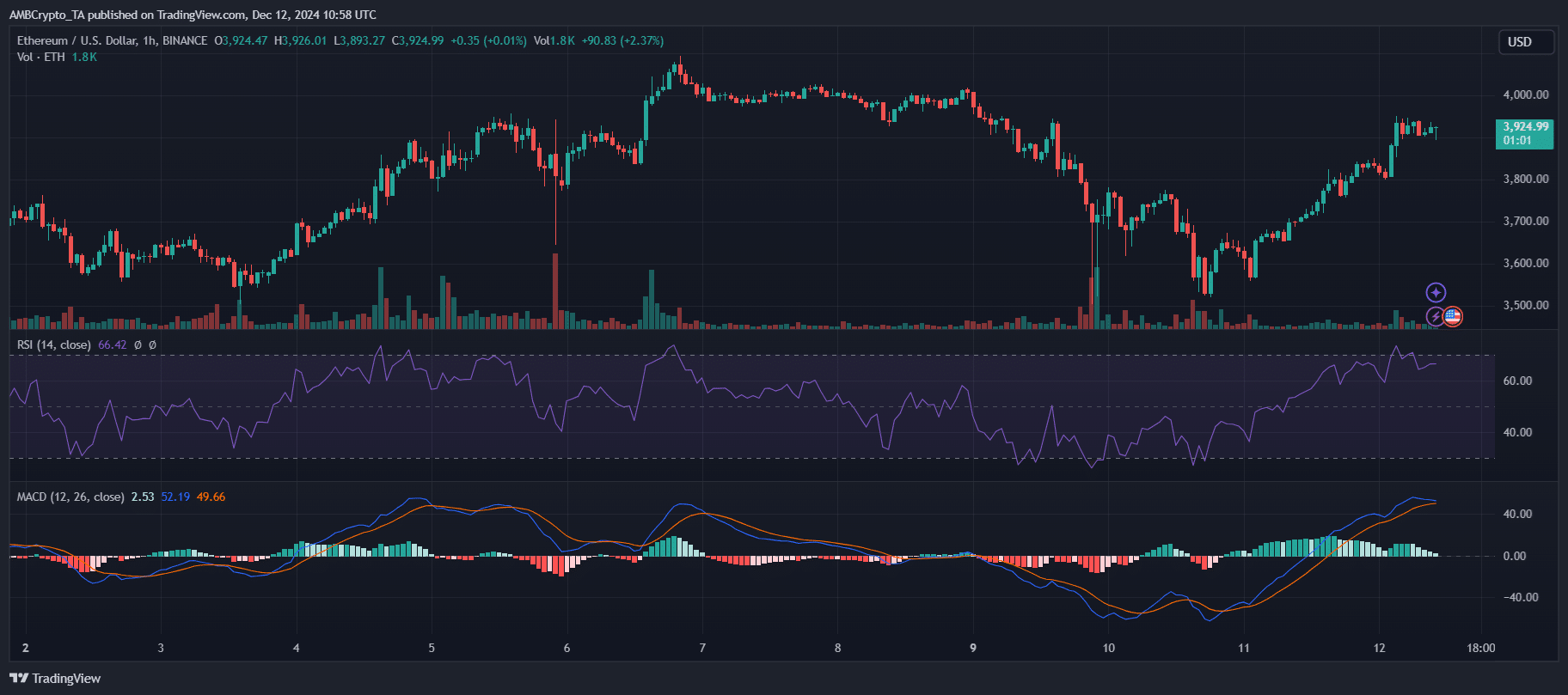

Source: TradingView

Notably, the volume surge during key breakouts confirms strong buyer participation. The RSI also breached the midline, moving into bullish territory, which further solidified the uptrend.

As the chart reveals, Ethereum recently tested the $3,900 resistance zone, reflecting the increasing strength of market bulls. However, minor pullbacks within this rally indicate potential hesitation among buyers.

This consolidation phase may define whether ETH secures the next leg toward $4,000 or faces a temporary setback.

The key to ETH’s breakout

Ethereum’s breakout hinges on critical support levels that underpin its bullish momentum. The $3,650-$3,720 zone has acted as a reliable support floor, absorbing selling pressure and fueling upward momentum.

RSI levels around 65 suggest ETH is nearing overbought territory, but still has room for further gains. Meanwhile, the MACD histogram shows bullish crossover signals, with the MACD line staying above the signal line; a hallmark of sustained upward momentum.

However, as ETH approaches the psychological $4,000 mark, traders should monitor diminishing buying volumes and weakening bullish momentum on lower timeframes.

Any failure to hold above the $3,720 support could lead to a deeper retracement, potentially revisiting $3,500. Conversely, a decisive push above $3,900 with robust volume could set the stage for a breakout beyond $4,000; failing which a short-term price correction is possible.

Read Ethereum [ETH] Price Prediction 2024-2025

Breakout or reversal for ETH?

A breakout requires strong volume confirmation and sustained bullish momentum, especially with the MACD maintaining its upward slope.

However, the RSI levels signal caution, as a rejection of this resistance could trigger a pullback. Bears may capitalize on fading momentum if buying pressure weakens. For bulls to claim $4,000, ETH must sustain higher lows while preserving critical support levels.