- Buterin’s Ethereum holdings dropped from 325,000 ETH to 240,000 ETH over three years.

- His recent transfer of 800 ETH sparked concerns about a potential selloff.

Ethereum [ETH] co-founder Vitalik Buterin has made significant moves in the crypto market. This move has caught the attention of investors and traders alike.

Recently, Buterin’s Ethereum holdings have seen a notable reduction, which has had a ripple effect on its price movements.

According to the recent tweet from a renown analyst, Buterin made a move of 800 ether worth more than $2.1 million to a multi-signature wallet, fueling rumors of a potential for a more massive selloff.

Notably, this is not the first time his actions have impacted the market.

In May 2021, for instance, there was a sharp decline of the price of Ethereum in relation to the time part of his $1 billion donation to the India COVID-19 Relief Fund was made.

These activities highlight the correlation and significance of Ethereum transactions from Buterin to the price movements.

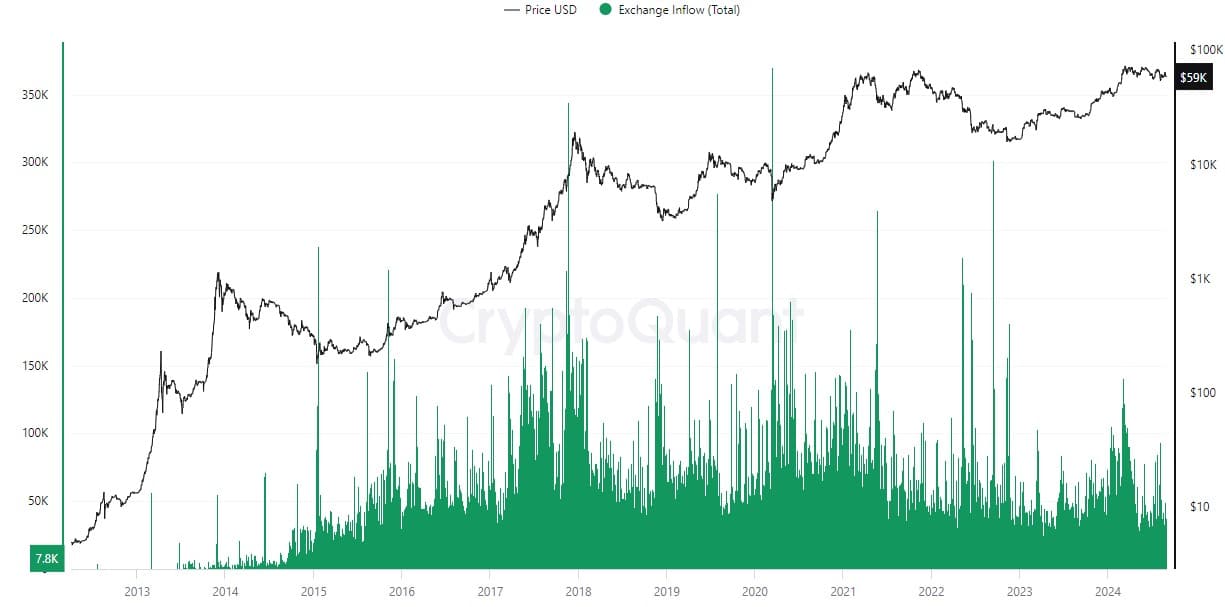

Inflows grow as investors go with the flow

Following Buterin’s latest transfer, ETH saw a 5% dip, raising concerns among market participants.

Interestingly, on-chain data sourced from Cryptoquant indicates an uptrend in exchange inflows, suggesting that significant players are positioning themselves for potential market shifts.

Source: Cryptoquant

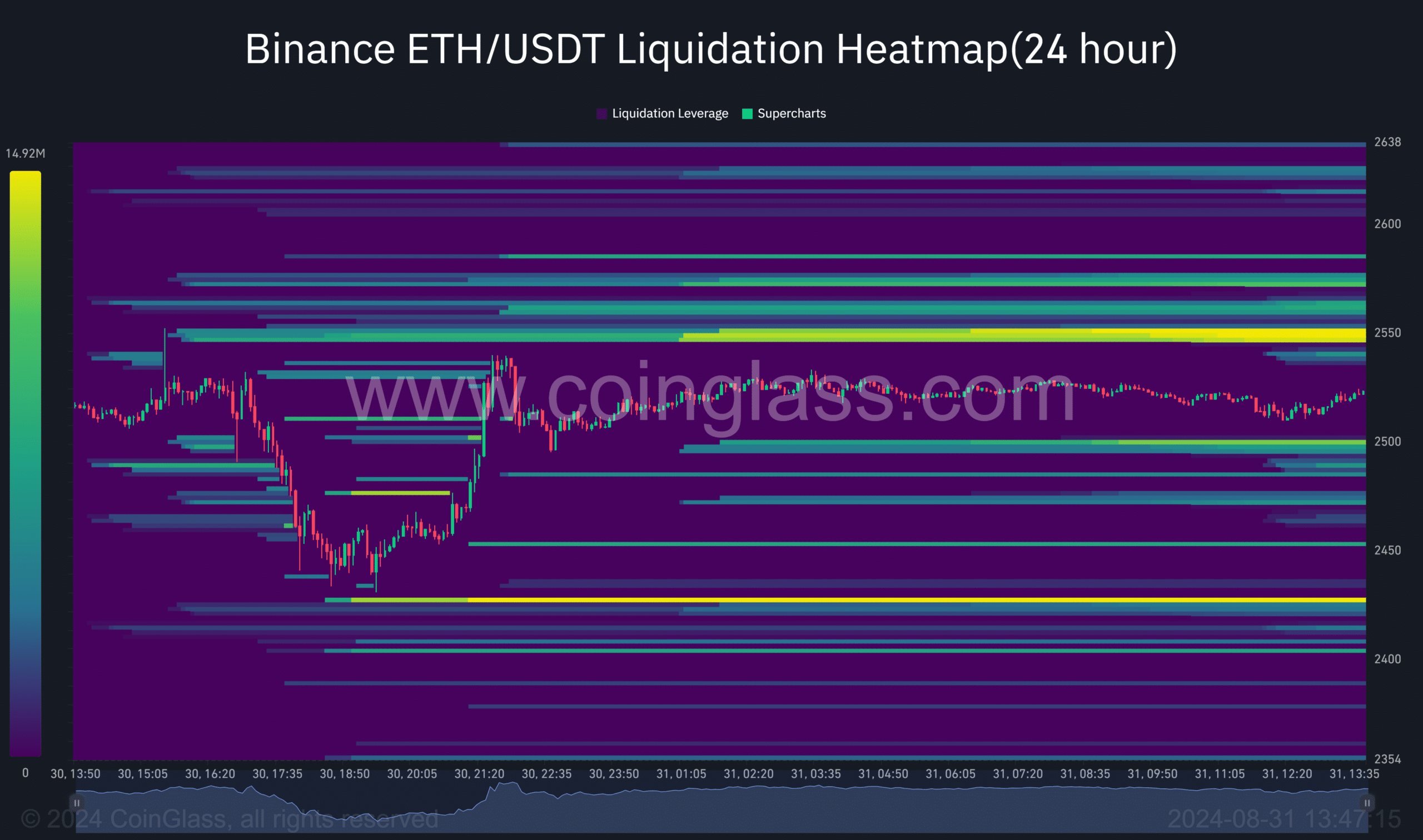

Liquidity heatmap insights

The current liquidity heatmap data from Coinglass indicates a bullish bias for Ethereum.

There is a notable liquidation pool of 13.11 million worth of ETH at the $2,550 psychological level.

This suggests that a substantial number of positions could be liquidated if Ethereum reaches this price point, potentially leading to a surge in market activity.

Source: Coinglass

Read Ethereum (ETH) Price Prediction 2024-25

As Ethereum’s core developers pocket future network upgrades, the market remains sensitive to movements by influential figures like Vitalik Buterin.

The Ethereum price may continue to experience volatility, especially as the broader crypto market reacts to economic shifts.