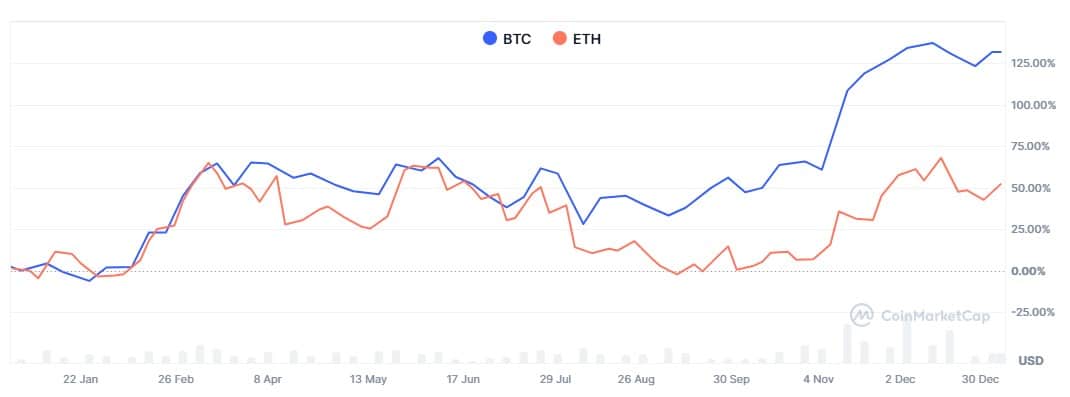

- Ethereum lagged behind Bitcoin with a weaker 2024 performance and tepid ETF demand

- Experts and traders feel differently about Ethereum’s future, with opinions ranging from bullish to cautious

Ethereum’s [ETH] potential in the 2025 bull market is under increasing scrutiny, with many questioning whether it can deliver strong gains. While Ethereum has long been a leader in blockchain, recent trends raise concerns about its ability to outperform in the next cycle.

For example – Markus Thielen, Head of Research at 10x Research, has expressed his own doubts, suggesting that it may lag behind Bitcoin this year. He pointed to a 1% decline in active validators over the past month, highlighting risks such as greater unstaking and weak demand beyond Ethereum’s staking ecosystem.

Thielen’s cautious outlook makes Ethereum a less attractive investment for those eyeing 2025’s rally.

Bitcoin vs Ethereum: The year gone by

Source: Coinmarketcap