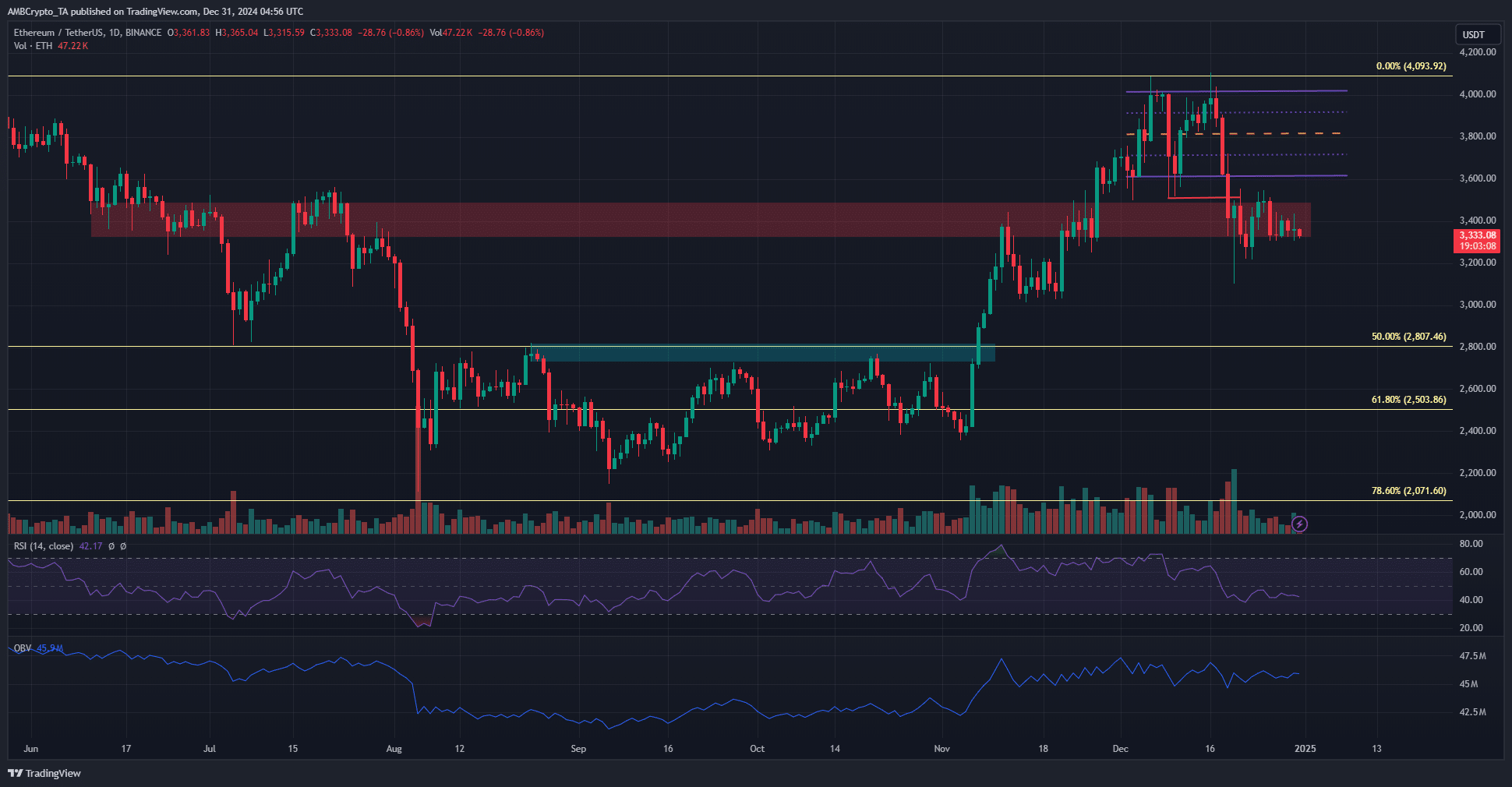

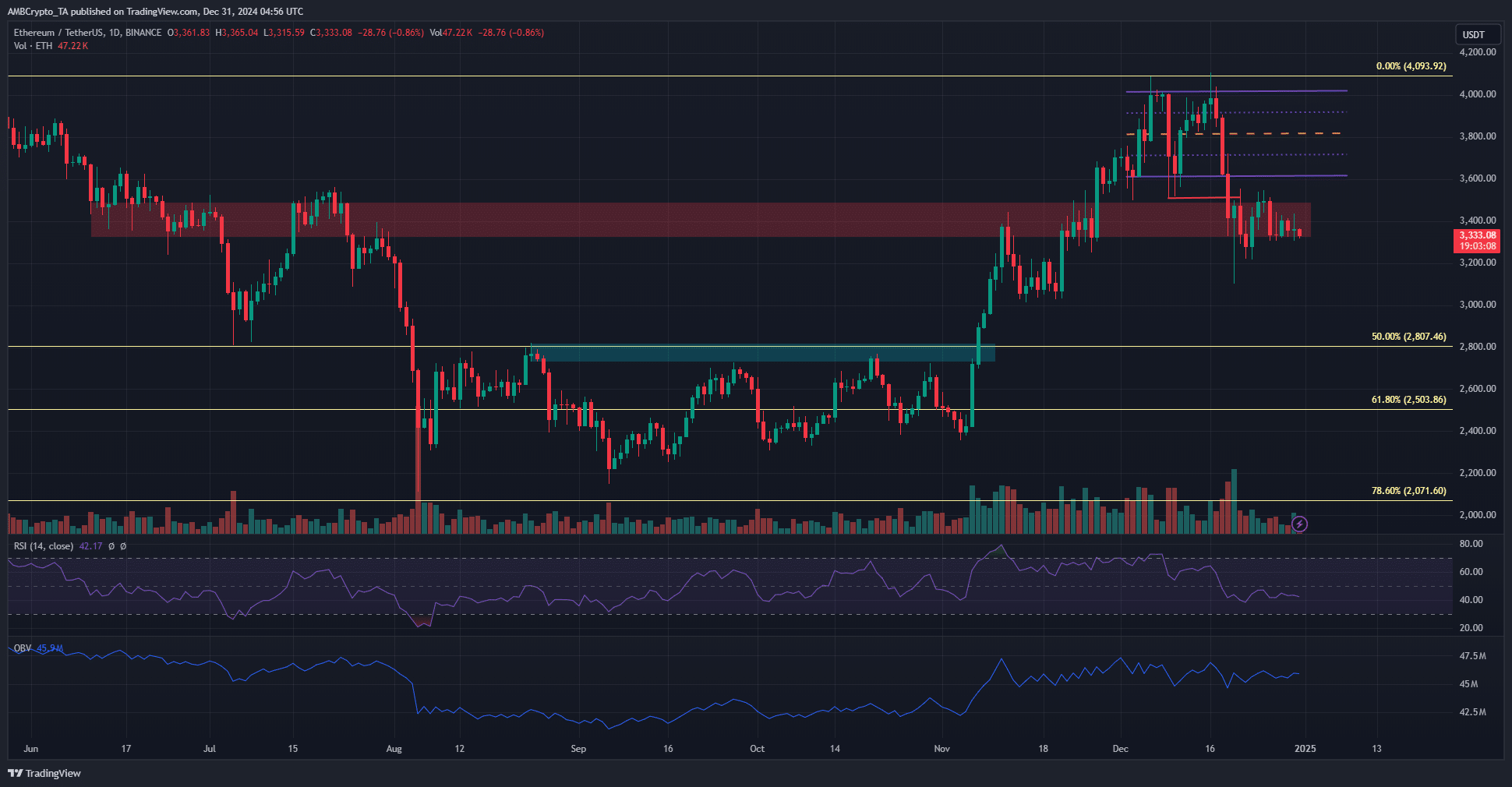

- The structure and momentum of ETH were bearish on the daily chart.

- The lack of buying pressure over the past month was a concerning sight.

Ethereum [ETH] has formed an inverse head and shoulder pattern in the 2-week timeframe. This was a strongly bullish sign for the higher timeframes. If the pattern witnesses a bullish breakout, it could take the Ethereum price to $12,000.

The daily timeframe and lower showed that sentiment was strongly bearish. The price has lost the short-term range and fallen below the $3.4k support zone. Based on the momentum, more losses appeared likely.

Bearish structure and support failure

Source: ETH/USDT on TradingView

The drop in the price below $3,509 on the 19th of December signaled a bearish market shift on the daily charts. This was accompanied by an RSI drop below the neutral 50 mark. Meanwhile, the OBV has been ranging over the past two months.

These findings support the idea that more losses are imminent. The $3.4k former support zone has flipped to resistance. Additionally, the OBV did not show significant gains in the second half of November.

The OBV formed a range from the 14th of November to the 19th of December. During this period, Ethereum’s price tested the $4k resistance from $3k and faced rejection, retracing to $3.3k. This indicates a bearish trend and a lack of buying pressure.

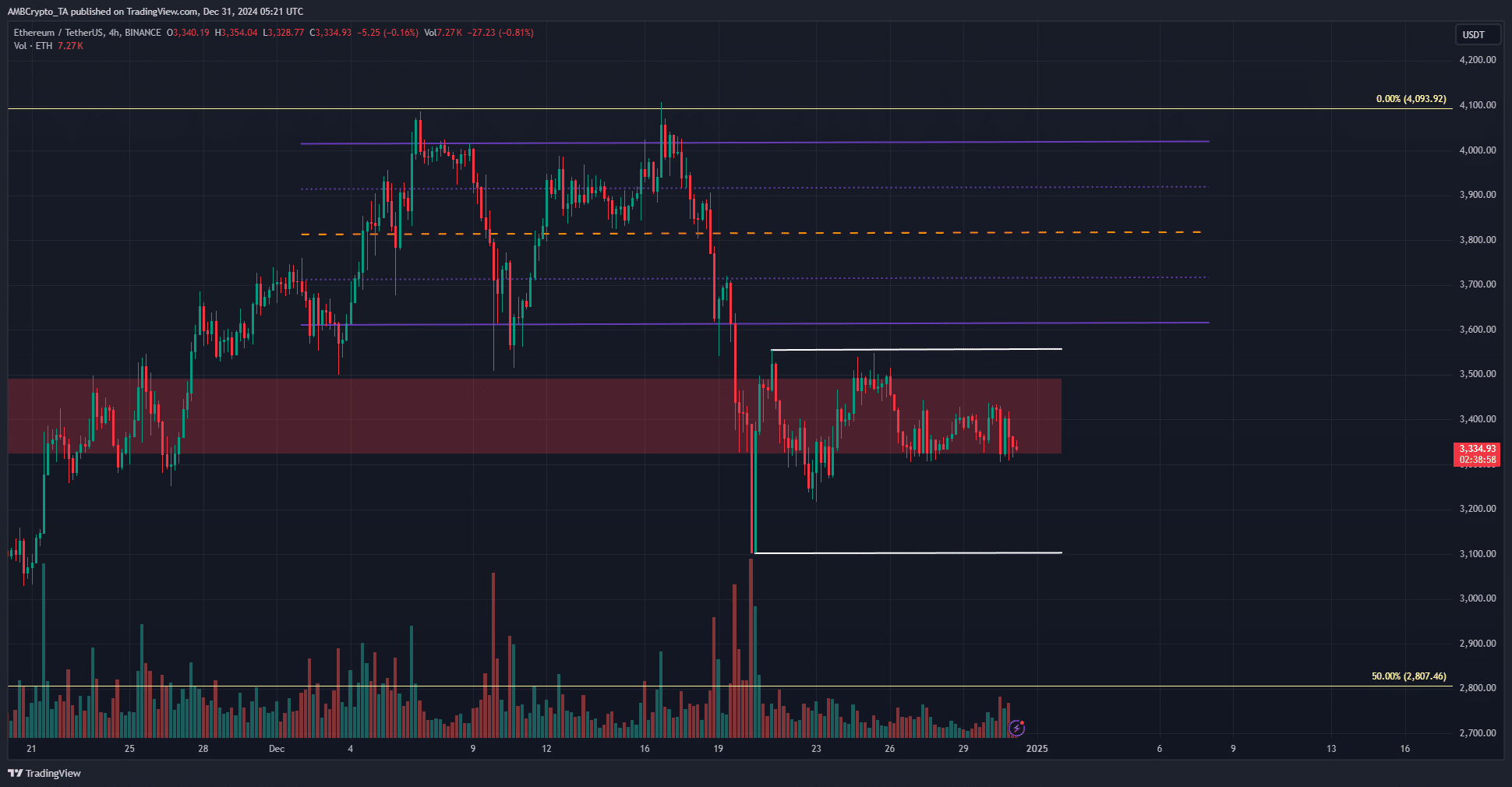

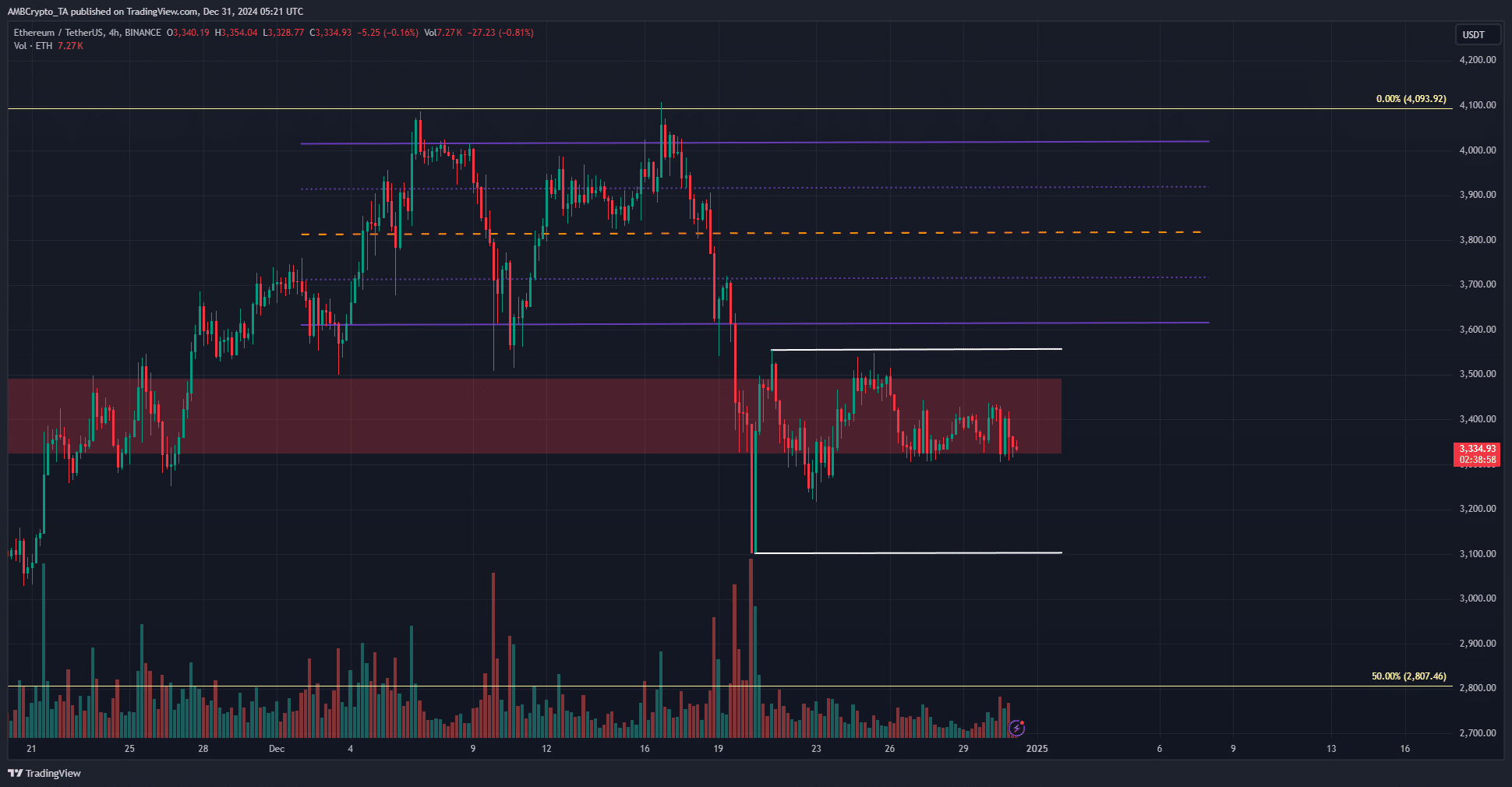

The 4-hour chart marks key levels for the Ethereum price

Source: ETH/USDT on TradingView

Highlighted in white were the two immediate levels of support and resistance that ETH market participants need to be wary of. The $3,555 and $3,101 would dictate the next price move’s direction.

Read Ethereum’s [ETH] Price Prediction 2024-25

In the lower timeframes, the $3,314 level served as support and could see a 3.4%-5.8% price bounce. However, this might not turn the daily timeframe bias bullish. An influx of buying pressure, absent in the past month, is needed to revive bullish hopes.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion