- A sharp increase in high-volume transactions, alongside a rise in exchange netflow, indicated a growing lack of confidence

- Traders holding long positions have suffered significant losses, erasing their profits

Dogecoin (DOGE) has been struggling to maintain its bullish momentum in the market, with the memecoin rapidly losing its gains for the month. In fact, the altcoin saw a weekly and daily price drop of 9.63% and 2.54%, respectively, with its monthly gains now reduced to just 4.95%. too.

Recent trends, however, suggest that this decline in DOGE’s value may be driven by a clear drop in traders’ confidence. And, this is likely to continue too.

Volume spikes and higher supply trigger DOGE’s decline

Right now, DOGE is on the end of a downturn, one largely driven by a significant spike in large transaction volumes and an increase in exchange netflow.

When exchange netflow is positive, as with DOGE, it points to a substantial inflow of the cryptocurrency to exchanges, far exceeding the outflow. This position can significantly increase supply, causing the price to drop.

Detailed data from IntoTheBlock revealed that the netflow saw an increment of 135.2 million worth of DOGE over the past week. This indicated that investors have been actively selling.

Source: Coinglass

This sell-off was accompanied by a rise in large transactions, with 1.56 thousand transactions recorded in the last 24 hours alone. In fact, the highest transaction count over the past week reached 1.58 thousand.

Given these market conditions, the probability of DOGE’s price continuing to fall is highly likely.

Market downturn intensifies as DOGE faces steep decline

Additionally, the trading volume for DOGE plummeted by 33.94%, signaling a sharp decline in market interest. Derivative trades have similarly seen a drop in engagement lately.

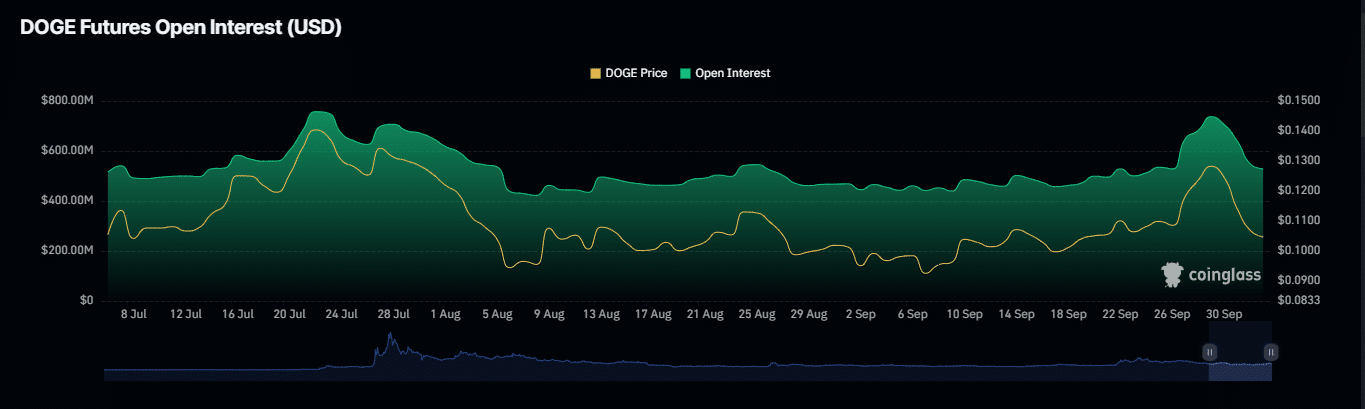

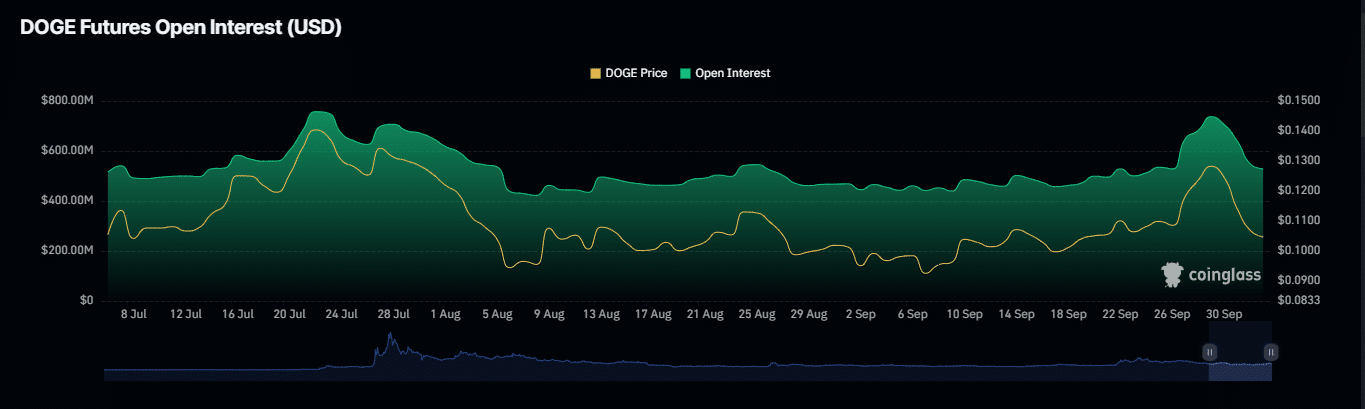

The Open Interest indicator by Coinglass, which measures the appeal of DOGE to traders, mirrored this decrease in value. At the time of writing, Open Interest in the prior 24 hours had fallen by 7.41%, with the same valued at $509.53 million.

Source: Coinglass

Concurrently, this downturn led to the liquidation of over $4.16 million worth of long positions in DOGE. Traders who wagered on DOGE exceeding its previous market levels have faced significant losses.

These metrics collectively depict dwindling interest in the asset, with bears poised to dominate the market. Following these developments, AMBCrypto investigated the potential next positions for DOGE in the market.

Next potential levels for DOGE amid market turbulence

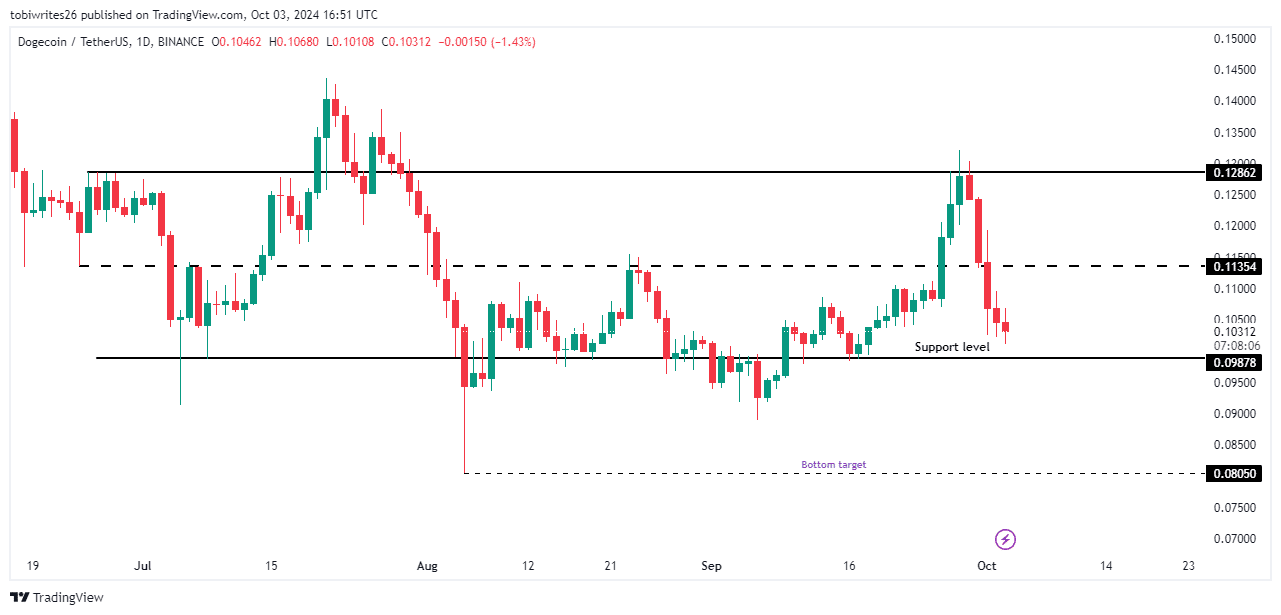

At press time, DOGE seemed to be facing two key price targets on the charts after its inability to break through the resistance at 0.12862 within its consolidation channel.

The immediate likelihood is that DOGE will revert to the channel’s support level at 0.09878. However, there is a high chance that DOGE may break below this support and decline further.

Source: Trading View

Should this occur, the next target for DOGE could be as low as $0.08050. More declines might follow if on-chain metrics continue to support bearish sentiment among traders.