- Aave and Tethere Gold were the gainers of the past week.

- Dogwifhat, Ethena, and Pyth Network were the biggest losers of the week.

The week has been particularly harsh for the cryptocurrency market, with nearly all crypto assets experiencing significant losses. Unlike the previous week, assets such as Dogwifhat and other memecoins fell into the loser category.

According to the tracked data, only two assets managed to avoid this downward trend.

Biggest winners

Aave (AAVE)

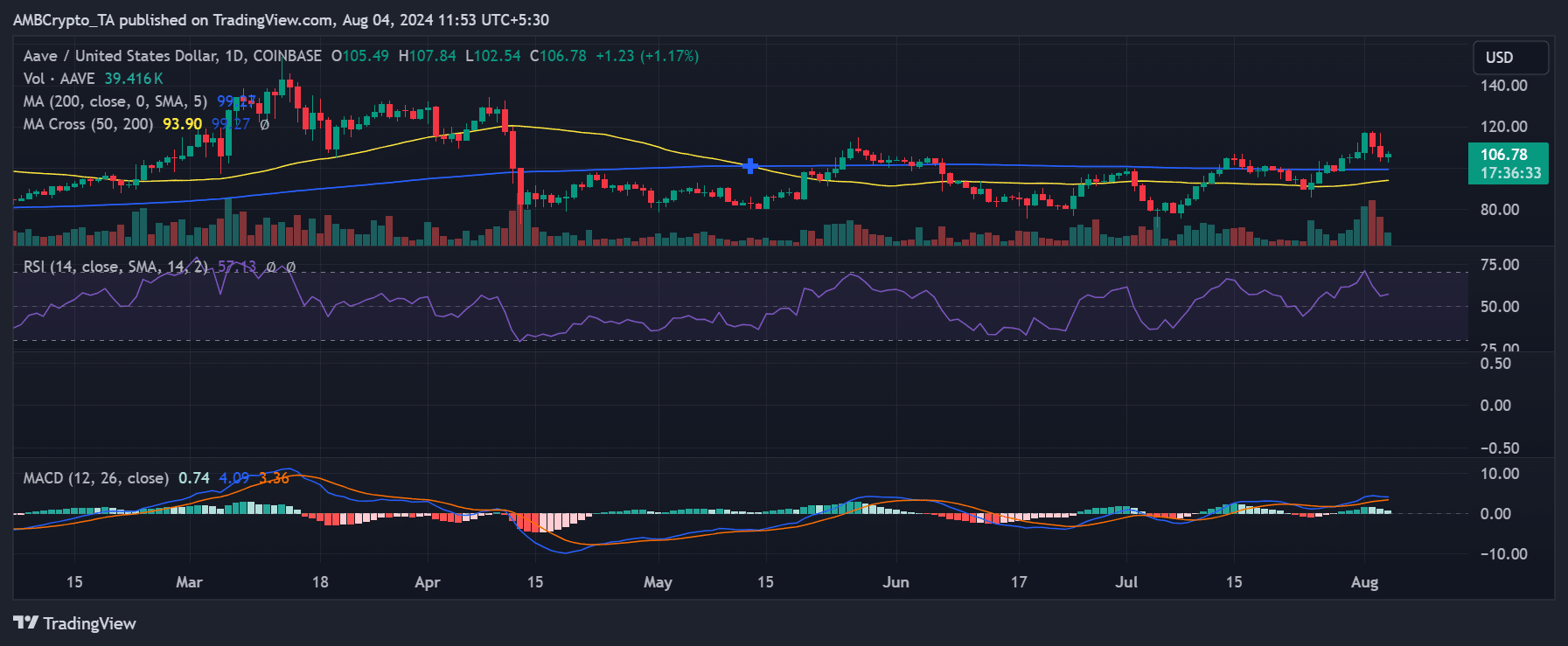

An analysis of Aave (AAVE) on a daily timeframe revealed a volatile week. It began with a decline of over 2%, dropping from around $101 to approximately $98.6.

However, AAVE experienced a strong uptrend afterward, culminating in an 8.61% increase on 1st August, which pushed its price above $116.

By the end of the week, though, AAVE saw a significant drop of over 4%, settling at around $105. This followed a prior day’s decline of over 5%, which had brought the price to about $110.

Source: TradingView

Despite these fluctuations, data from CoinMarketCap indicated that AAVE was the highest gainer of the week, with an overall increase of 8.25%.

As of the latest data, AAVE’s market capitalization stood at nearly $1.6 billion, with a trading volume exceeding $265 million.

Tether Gold (XAUT)

The only other asset on the gainers’ list this past week was Tether Gold (XAUT), which recorded a 2.42% gain. Tether Gold started the week at approximately $2,387 and experienced a price rise during the week, reaching around $2,474.

Similar to AAVE, XAUT’s price then declined, stabilized, and ended the week at around $2,445. As of this writing, Tether Gold’s market capitalization is approximately $602 million, with a trading volume of around $6 million.

Biggest losers

Dogwifhat (WIF)

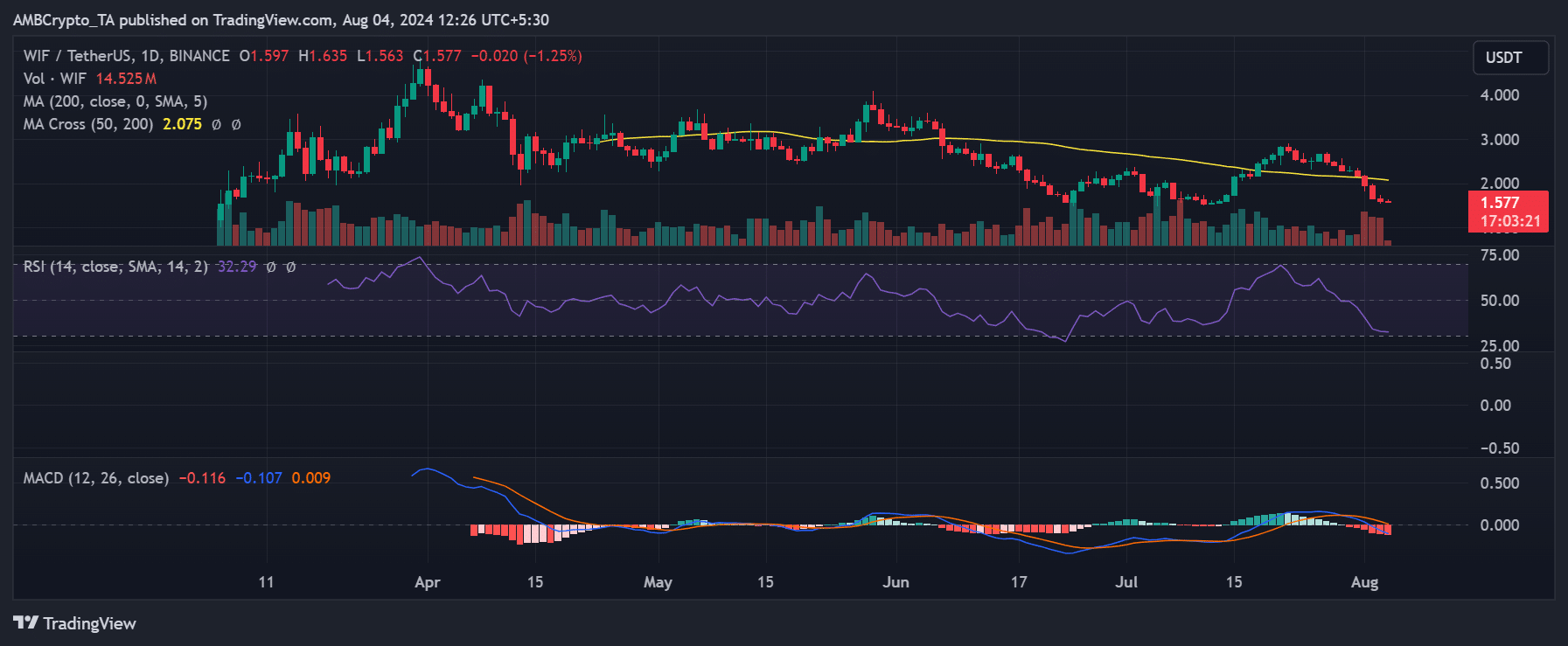

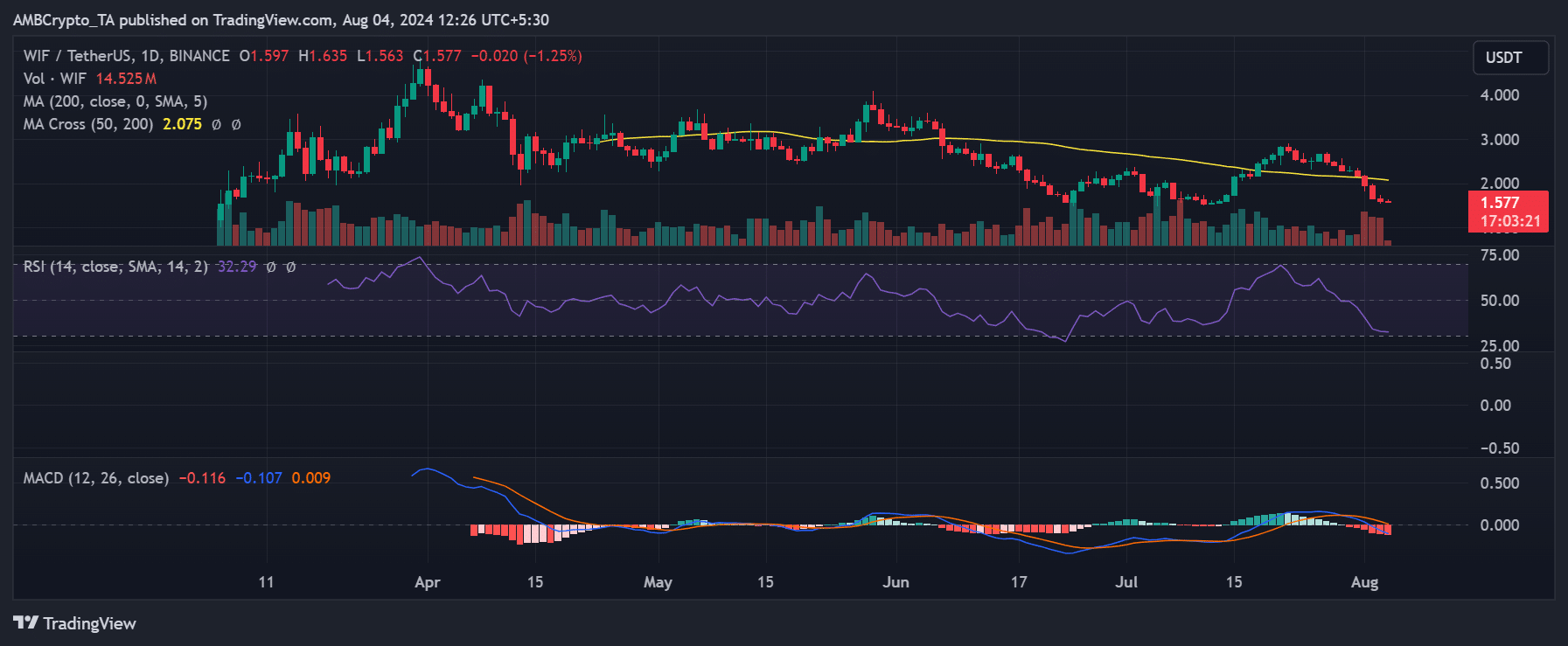

Dogwifhat (WIF) emerged as the week’s biggest loser, with its daily timeframe chart analysis revealing a consistent downtrend.

According to AMBCrypto’s analysis, WIF declined for six of the seven days in the past week. The week began with a 2.9% drop, reducing its price from around $2.48 to $2.41. ‘

Subsequent declines followed, with only a brief increase of less than 1% on 30th July marking the sole uptrend.

The most significant decline occurred on 2nd August when the price plummeted by over 15%. By the end of the week, WIF’s price had fallen to approximately $1.60.

Data from CoinMarketCap indicated that WIF’s overall decline for the week was 35.75%.

Source: TradingView

The Relative Strength Index (RSI) for WIF was close to 30, suggesting a strong bearish trend and indicating that the asset was oversold. As of this writing, WIF’s market capitalization was over $1.5 billion, with a trading volume exceeding $360 million.

Ethena (ENA)

Ethena (ENA) emerged as the second biggest loser of the week. Analyzing its price trend, ENA started the week trading at approximately $0.45.

However, it experienced consecutive declines throughout the week, ultimately falling to around $0.31. Data from CoinMarketCap indicates that ENA suffered a 28.58% decline over the past week.

As of this writing, Ethena’s market capitalization stands at around $583 million, with a trading volume of about $58.6 million.

Pyth Network (PYTH)

Pyth emerged as the third-biggest loser of the week with a 27.24% decline, narrowly surpassing Pepe, which had a 27.17% decline.

Analyzing Pyth’s price trend, it started the week trading at approximately $0.39. However, it experienced consecutive declines throughout the week, ending at around $0.28.

Despite this drop, Pyth’s market capitalization remains over $1 billion, with a trading volume of around $50.4 million as of this writing.

Conclusion

Here’s the weekly recap of the biggest gainers and losers. It’s crucial to bear in mind the volatile nature of the market, where prices can shift rapidly.

Thus, doing your own research (DYOR) before making any investment decisions is best.