- Conflux had a bullish daily structure since Monday

- The heightened volume could see the breakout reach May’s resistance levels

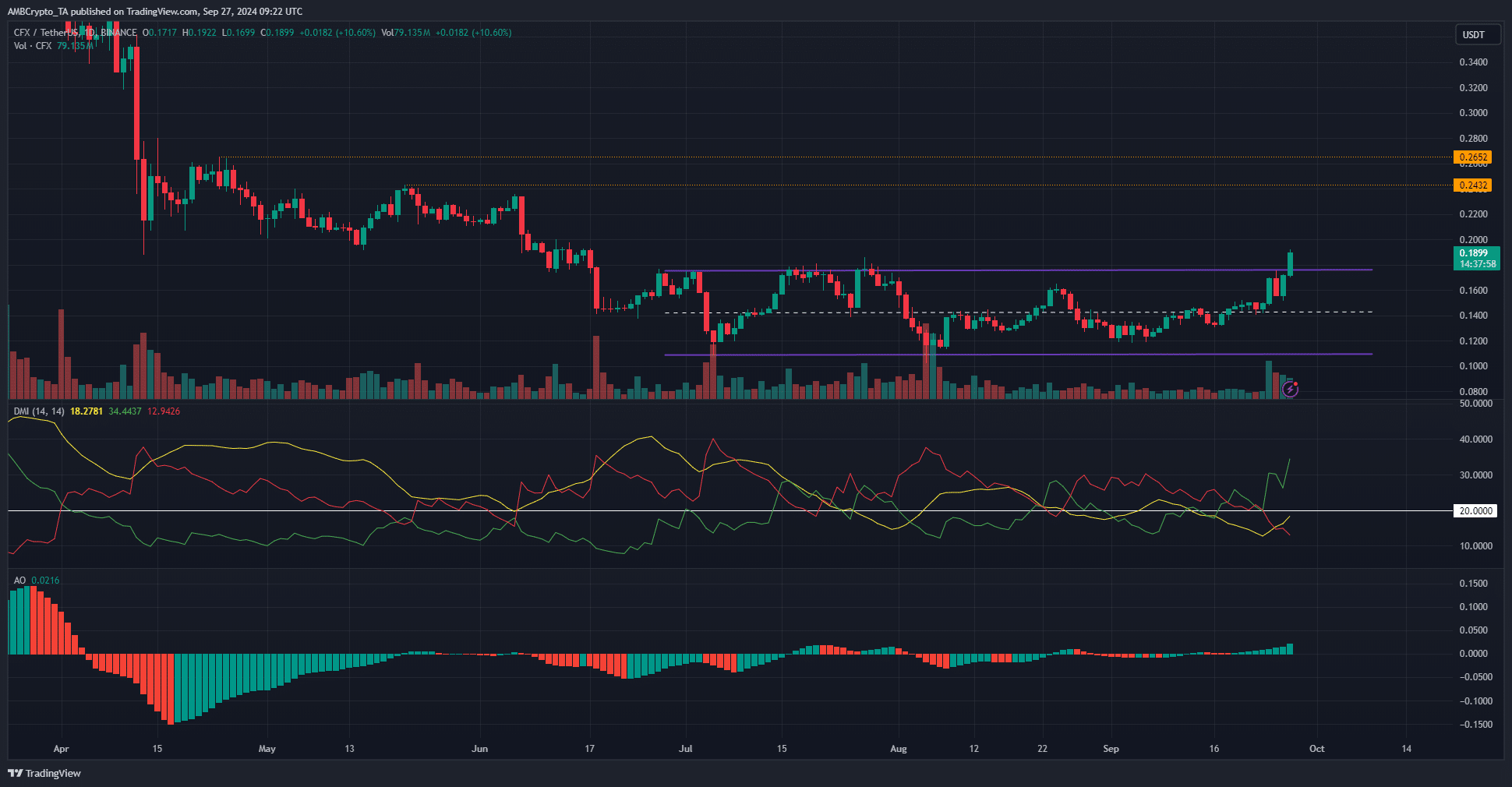

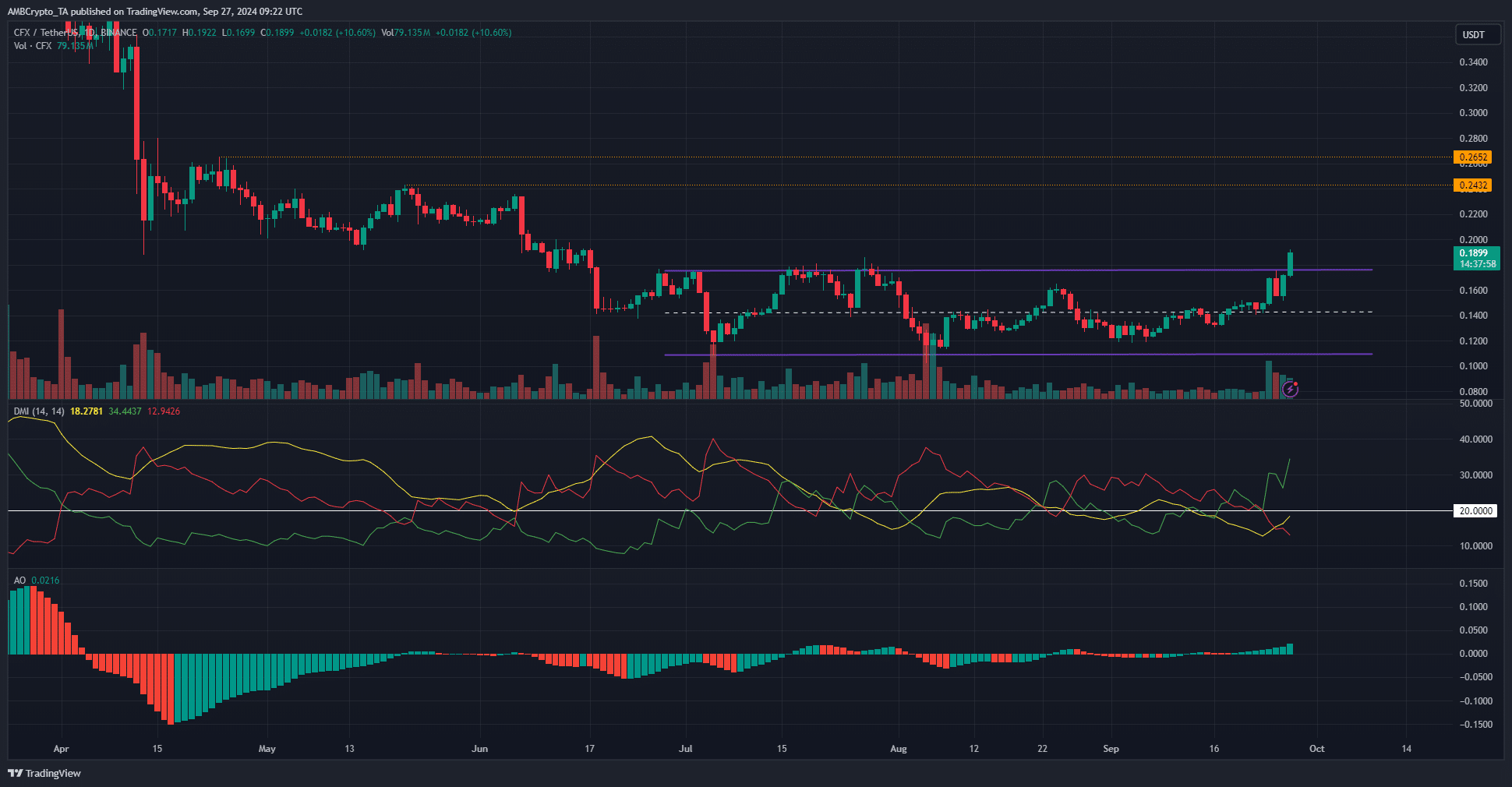

Conflux [CFX] had been trading within a range since late June. After threatening to fall out of the range in early July and August, the bulls have battled hard and made a comeback, making 33% gains in four days.

The breakout past the three-month resistance at $0.176 meant that a move beyond $0.2 is imminent. The sideways trend was shaken off, and bulls targeted a 40% move upward.

Targets for the range breakout

Source: CFX/USDT on TradingView

In general, a multi-month consolidation phase after a downtrend is typical for assets after a bear market. Such a range formation presented long-term investors with buying opportunities, although it also required high conviction from them to hold on despite short-term volatility.

The breakout past $0.176 was on relatively high volume. The DMI showed that a strong uptrend was shaping up, with the +DI well above 20, and once the ADX pushes higher, it would be a good sign for the buyers.

The Awesome Oscillator was also above neutral zero. Such a range formation usually rallies at least the width of the range. This meant that a conservative target for CFX bulls was the $0.242 level.

This target lines up with the resistance from May. Further north, the $0.265 is also a substantial resistance level from April.

Short-term bullish belief

Source: Coinalyze

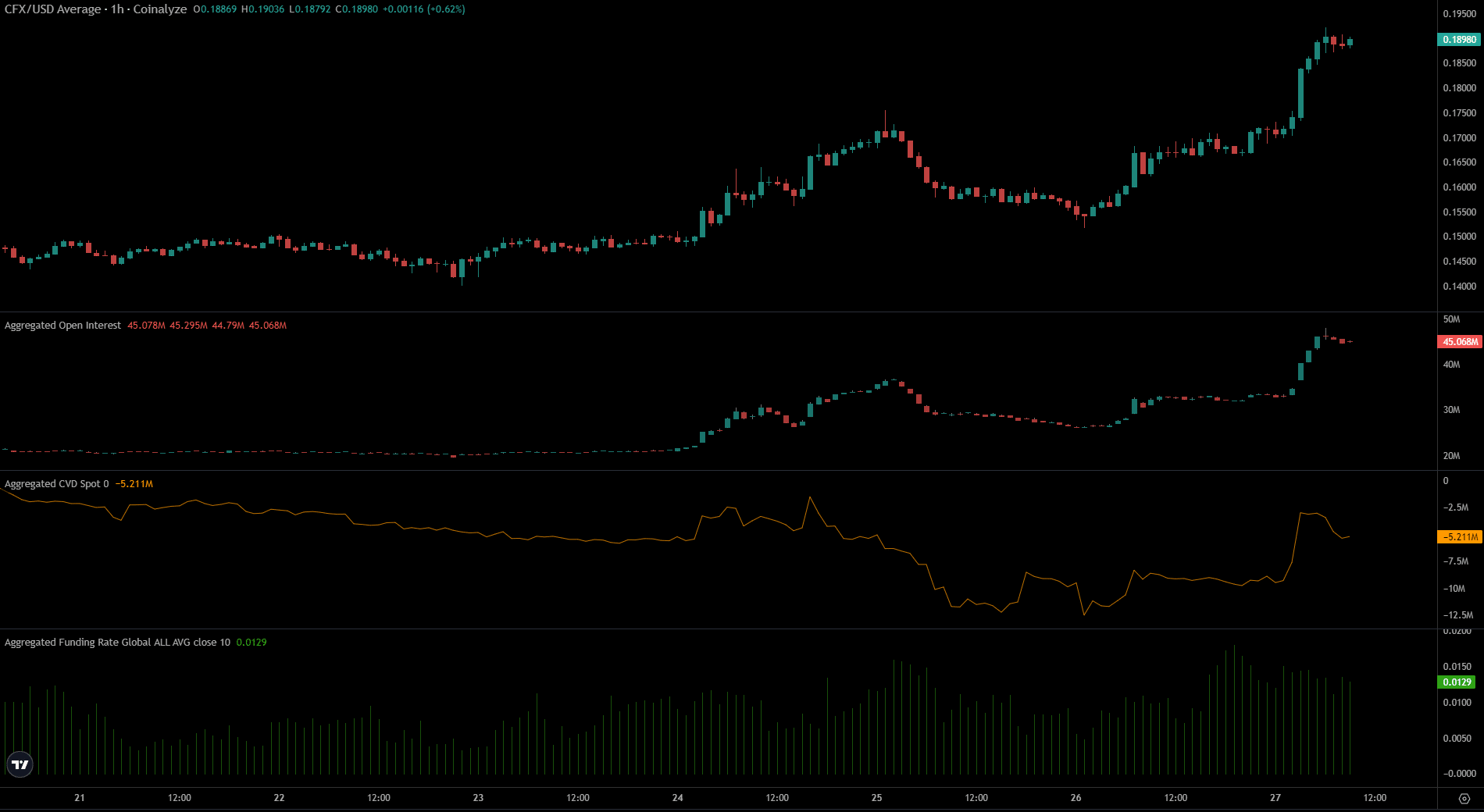

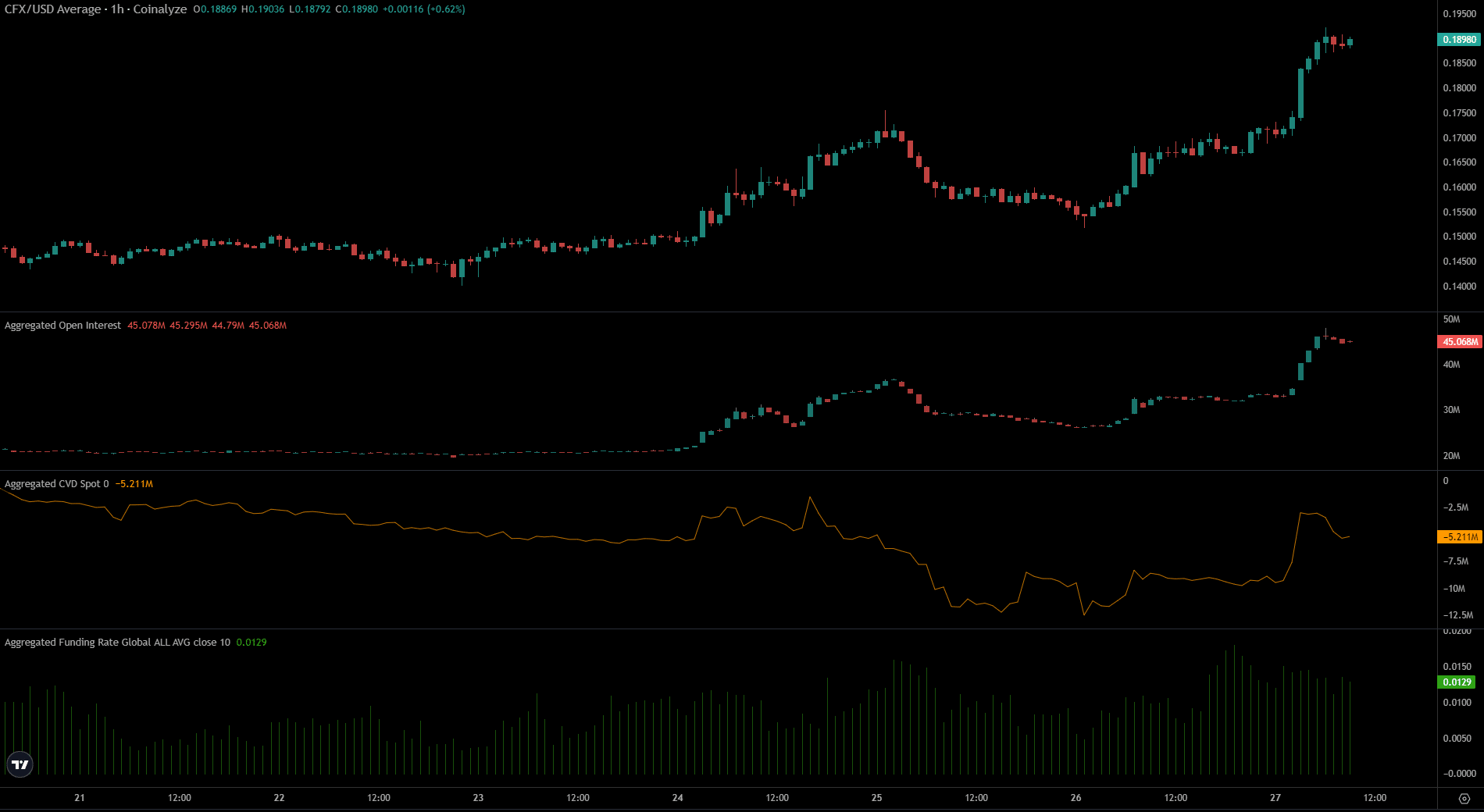

On the 23rd of September, the Open Interest on CFX contracts measured $20.9 million at the highest. Over the past four days, it has surged to $45 million.

The spot CVD declined massively a couple of days ago, but has recovered since then, cheering up some worried bulls.

Realistic or not, here’s CFX’s market cap in BTC’s terms

The funding rate was also high. Together, they signaled that the short-term outlook for Conflux was bullish. Another 30%-40% move higher appears likely.

Beyond that, it could get tricky and buyers might need more time to make the move happen.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion