The current status of tariffs seems to change on a daily basis, and federal layoffs have forced some to change plans. But the uncertainty alone is affecting the price of things related to housing and impacting the behavior of buyers and sellers.

“It’s terrifying,” said Compass Chicago luxury agent Joanne Nemerovski. “People don’t know if [the tariffs] are coming or going. It’s really hard emotionally for people. It’s a global economy now and a lot of the products that go into home building and later in ownership are made abroad and all over the world.”

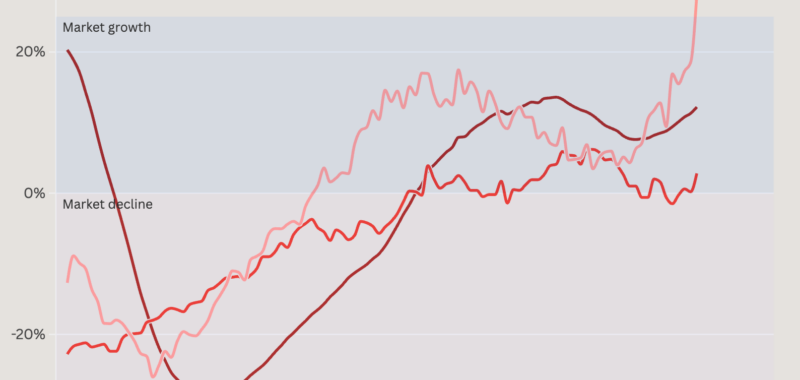

Like a lot of markets, Chicago suffered a downturn following the pandemic housing boom that began in 2020 and ended in 2022. Through much of 2023, inventory, new listings and home sales in Chicago crashed year over year in the range of 15% to 30%.

But the Chicago market began to rebound in the summer of 2024 and has been humming since. Inventory (12.2%), pending new home sales (2.8%) and new listings (28.1%) are up year over year by healthy margins.

“The market is strong,” said agent Tricia Marchert. “Right-priced homes are going that first weekend [after listing] just like they were two and three years ago. You price it too high, those will sit and then you’ll see a price reduction in a week or two. The sellers get very nervous if their house doesn’t sell within a week, which is kind of crazy.”

However, the strong market is now colliding with economic volatility, particularly around tariffs. Trump has twice paused a 25% tariff on both Canada and Mexico, and the official status of those two pauses has gotten lost in the confusion over the last week, though they appear to still be in place.

After weeks of signaling a reciprocal tariff on every country in the world, Trump’s new global tariffs announced last were anything but reciprocal. Instead, he placed huge tariffs on even allies, some of whom were slapped with rates that far exceeded the ones they have on the United States.

The magnitude of the new tariffs shocked markets and led to a multi-trillion dollar selloff, prompting criticism from even reliable Trump allies in Congress and the private sector. That was enough to prompt Trump to pause all of them, except the one on China, which he raised to a stunning 125%. A blanket 10% tariff on all imports also remains in effect.

Apparently the back-and-forth has alarmed home sellers as well. The “lock-in effect” caused by high mortgage rates appears to have dissipated as the trade war has escalated, suggesting people want to get out ahead of any negative impacts from the tariffs.

“This is really the first time where outside economic and political forces are really causing a significant number of people to rethink their plans, whether it’s timing or budget or how they’re funding a transaction,” said Redfin Chicago agent Daniel Close. “I’ve really never seen anything quite like it in my 15 years in real estate.”