The mortgage industry has complained loudly and often that government regulation and investor requirements are contributing to spiraling costs that get passed on to consumers. And Rohit Chopra, the hard-charging director of the Consumer Financial Protection Bureau, who is often the target of such complaints, apparently agrees. At least when it comes to redundancies with refinancings, that is.

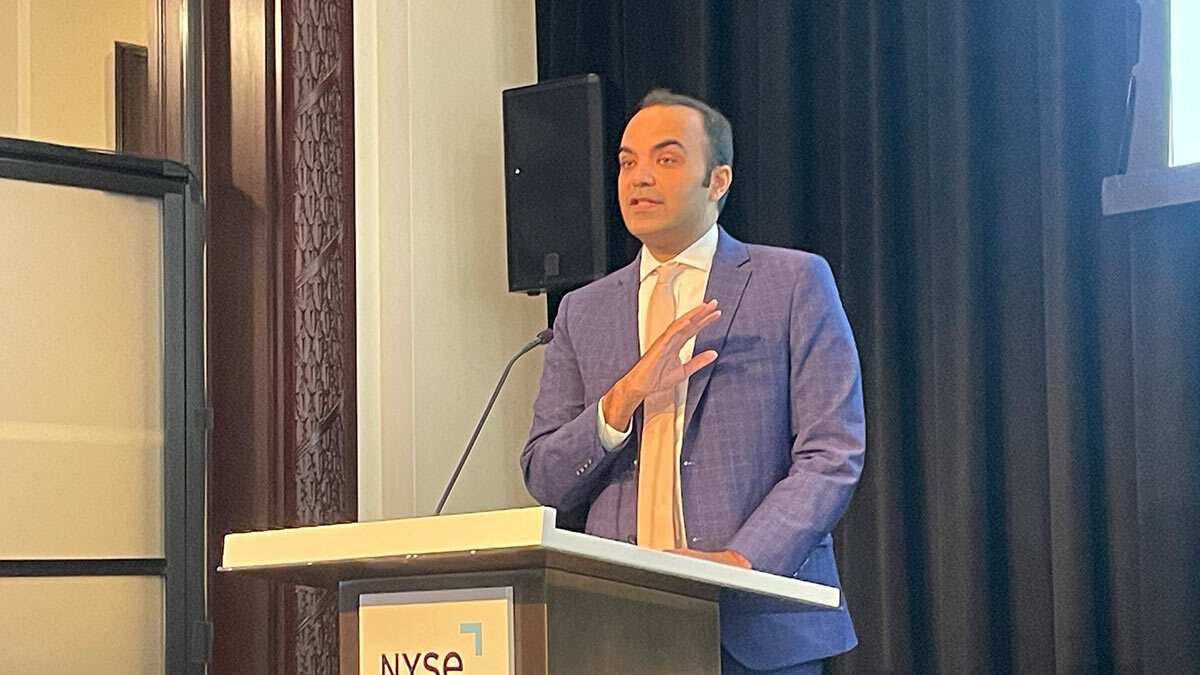

“We really think closing costs can be a significant obstacle to refinancing,” Chopra said at an AI and technology conference jointly hosted by ICE Mortgage Technology and the National Housing Conference at the New York Stock Exchange on Monday. “They can add up to several percentage points of the total mortgage amount. This means it won’t make sense for borrowers to refinance unless the offer interest rate is substantially lower than their current rate.”

In his keynote address, Chopra pointed to the closing costs that borrowers can’t shop as culprits — credit reports, FICO scores, employment verification and lender’s title policy. But he also remarked that certain redundancies are under the microscope.

“We’re exploring whether we should make certain changes to the existing mortgage regulations to streamline the process and to reduce closing costs,” he said. “When an existing or competing lender is seeking to refinance a mortgage with a much lower rate or a substantially similar quote, it may not be worthwhile for the lender to repeat many of the steps that were taken during the purchase process.”

He continued: “We’re especially interested in the costs and time taken to refinance a mortgage that are exclusively related to complying with federal mortgage law, rather than steps that may be demanded by investors for other reasons. We’re also looking at identifying ways to jumpstart competition in certain closing cost categories, which can also help spur more activity. Third, we’re pursuing rules to accelerate the shift to open banking with mortgages in mind.”

The CFPB will be watching closely the implementation of new mortgage technology, including applications being marketed as utilizing artificial intelligence, he said. There are some novel uses of data, including generative AI in so many stages of the mortgage process, and many could represent leaps that benefit lenders and consumers. But poor implementation could exacerbate existing disparities and create new ones, Chopra said.

Chopra noted that the CFPB in recent years has hired many technologists to identify areas ripe for innovation, but also to prosecute violations of the law.