- Cardano has a bullish structure on the daily.

- The range breakout appeared to fail, and bulls needed to act quickly to fix this.

Cardano [ADA] saw swift gains last week. From the 23rd to the 27th of September, ADA made 20% gains and nearly retested the $0.418 resistance level. Its technical indicators were bullish.

A large rally appeared to be brewing, and the increase in active addresses showed that organic demand was likely to surge. The Bitcoin [BTC] dip from the $66k resistance negatively impacted Cardano prices.

The long-term Cardano price prediction was bullish, but the failure to reclaim the nearby retracement level was a worrying development.

Range breakout falters momentarily

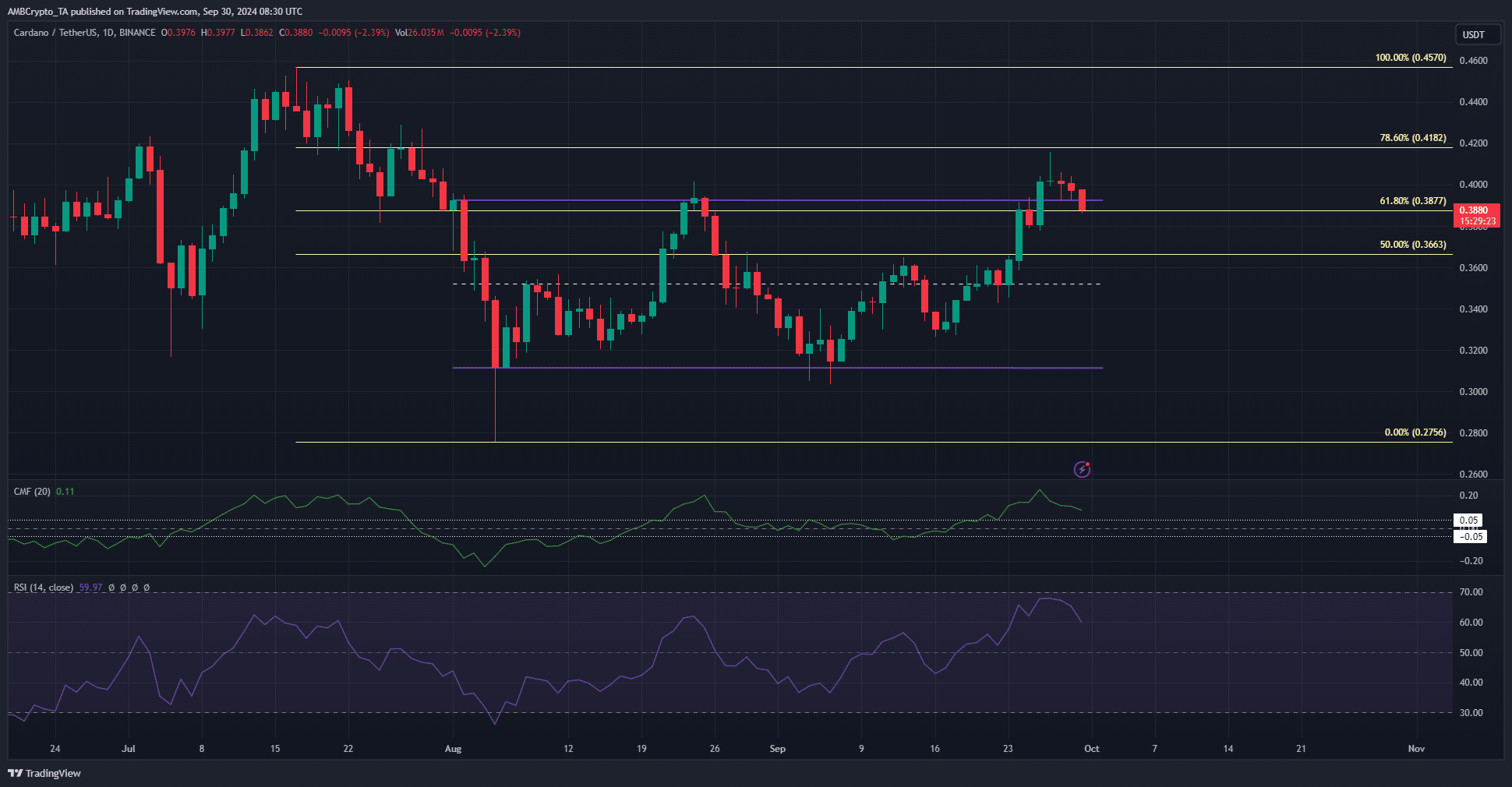

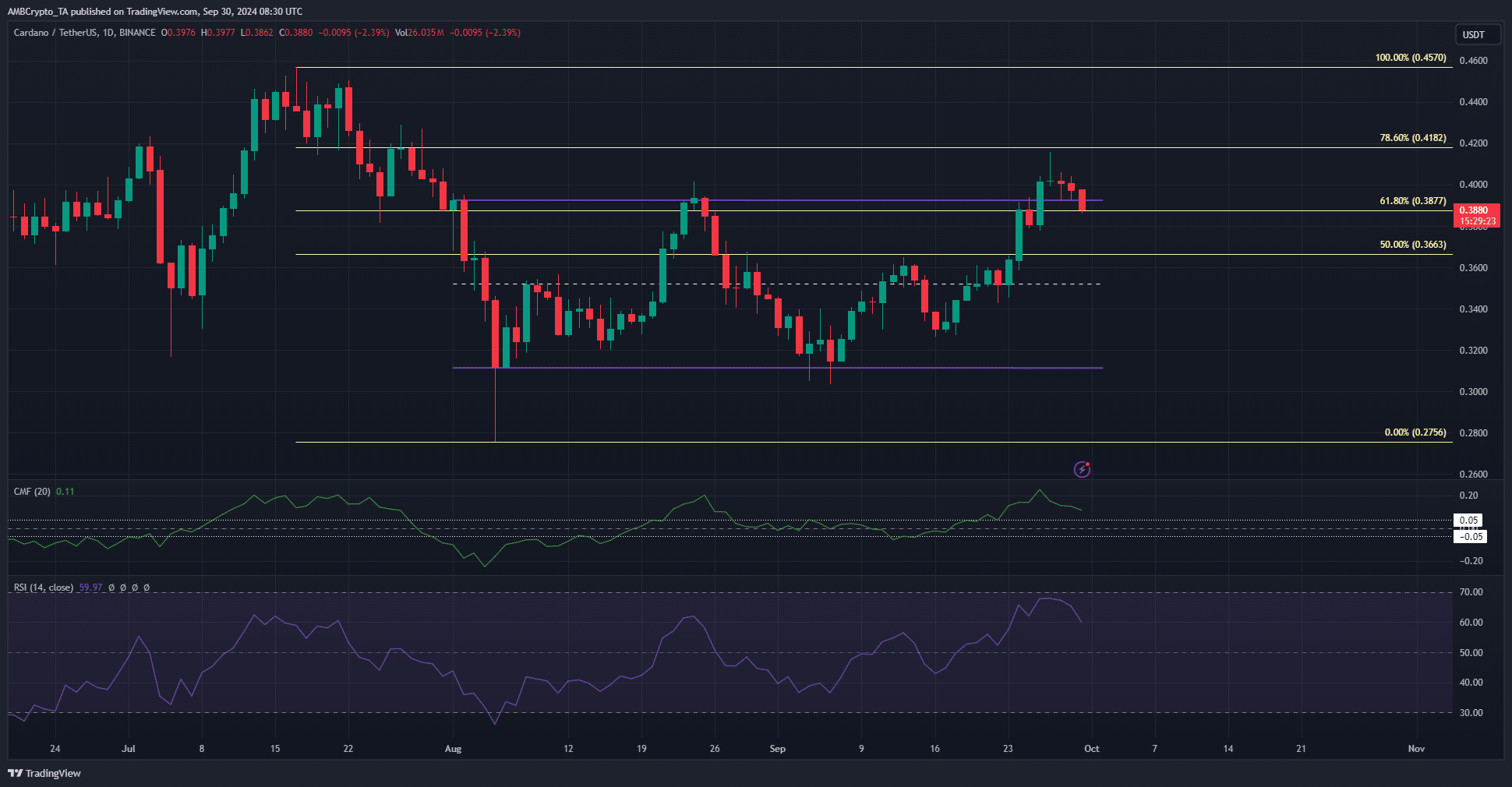

Source: ADA/USDT on TradingView

Based on the downward price move in July and early August, a set of Fibonacci retracement levels were plotted.

It showed that the 78.6% retracement level at $0.418 is key for Cardano bulls to reclaim before the long-term trend can shift bullishly.

In the meantime, a range formation between $0.312 and $0.393 was established in the past two months. The bullish sentiment last week drove ADA above the range highs, but not beyond the Fib retracement level at $0.418.

In the past three days, a 7% price drop has taken place. However, the CMF was still above +0.05 to indicate significant capital flow into the market. The daily RSI also signaled bullish momentum.

Therefore, it is possible that the $0.387 level could serve as short-term support before the next move upward.

Cardano price prediction after $0.39 liquidity

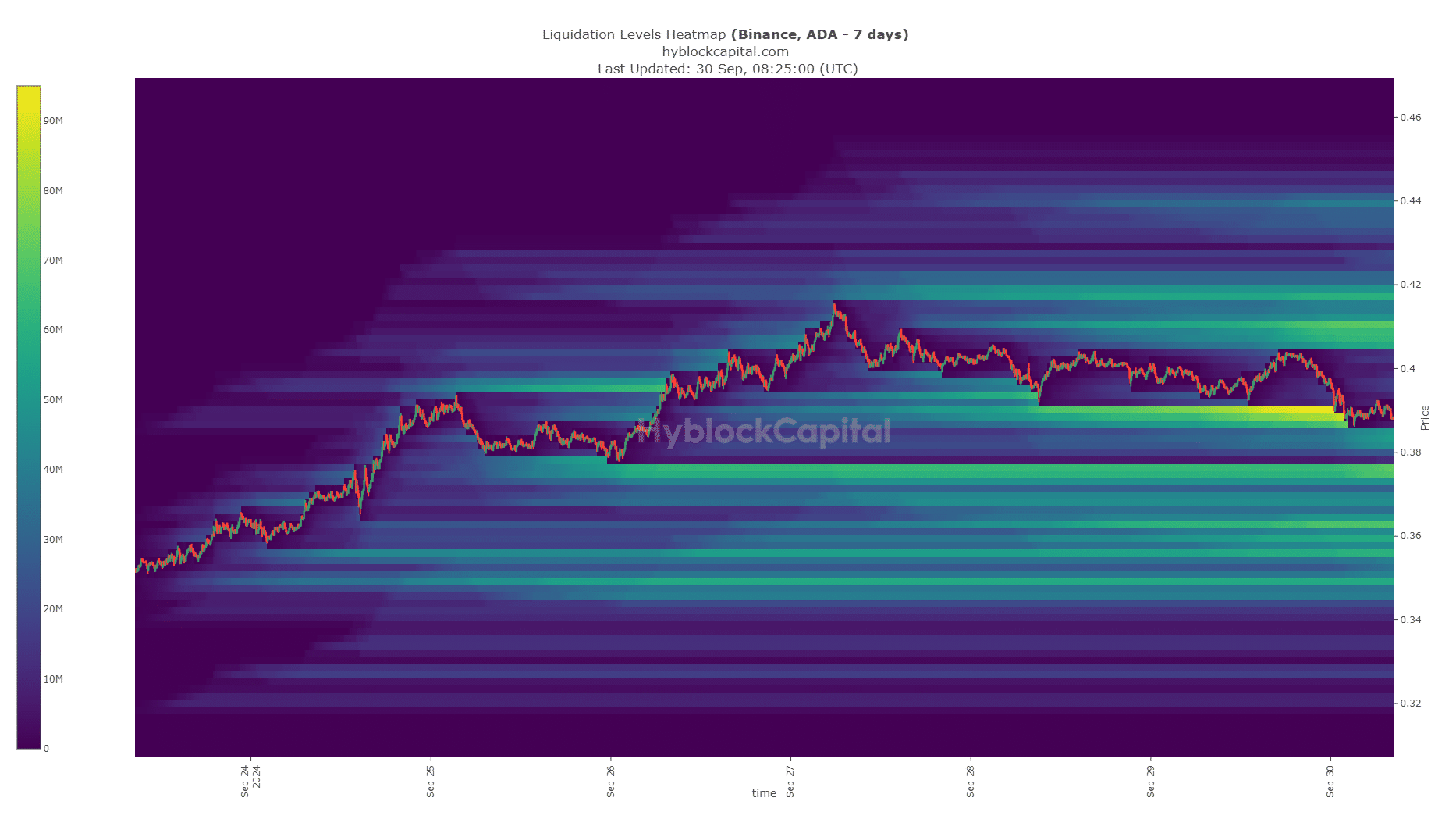

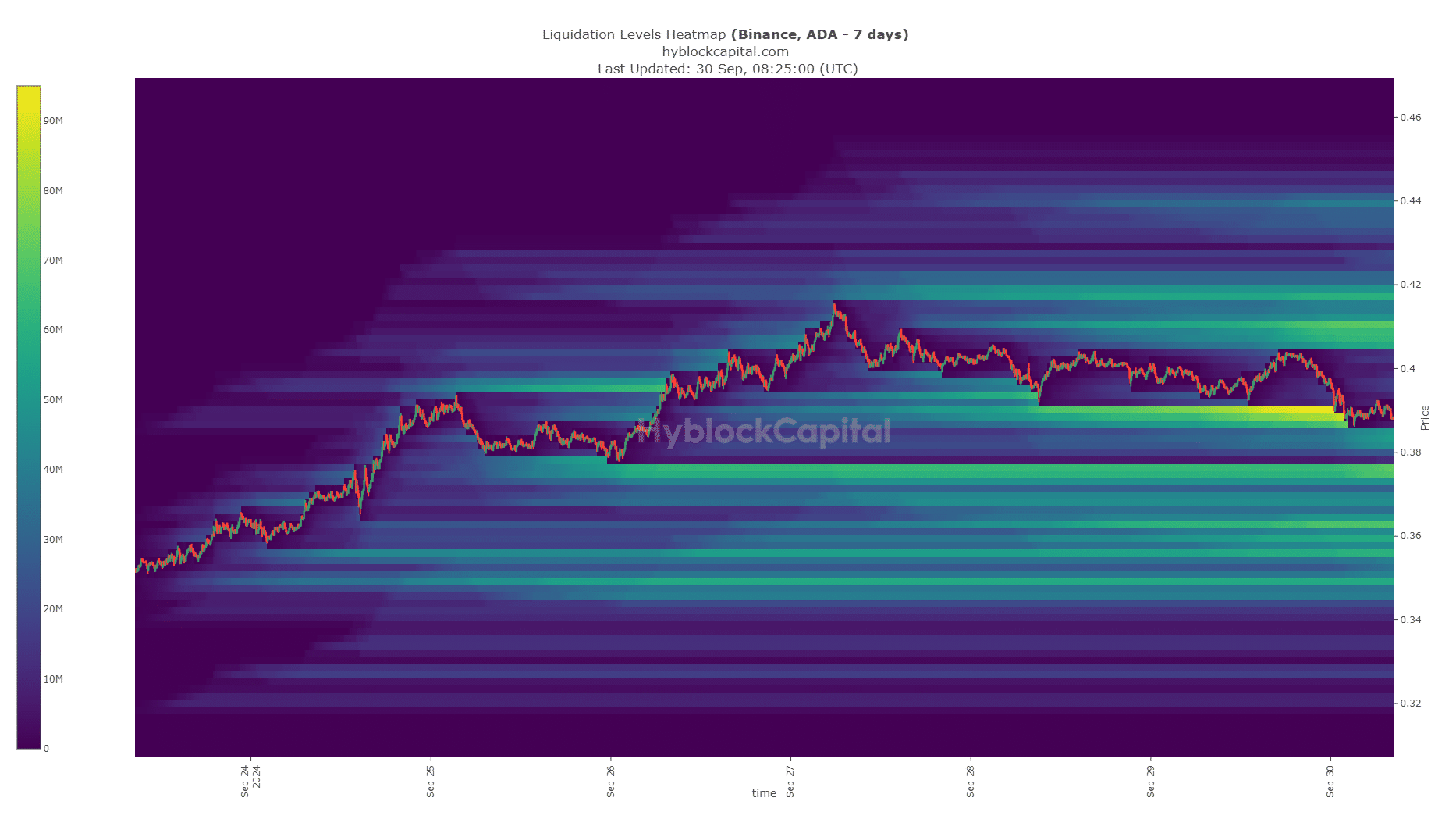

Source: Hyblock

There was a large pool of liquidity around the $0.39 level that Cardano has swept in recent hours of trading. It is likely that the price would reverse bullishly and advance toward the $0.408 zone.

Read Cardano’s [ADA] Price Prediction 2024-25

However, the momentum around BTC was bearish in the short-term, and this could drag Cardano prices downward later this week.

Hence, traders should be cautious and plan around a potential rejection from the range highs.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion